Global Electromyography Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.11 Billion

USD

4.70 Billion

2024

2032

USD

2.11 Billion

USD

4.70 Billion

2024

2032

| 2025 –2032 | |

| USD 2.11 Billion | |

| USD 4.70 Billion | |

|

|

|

|

Electromyography Devices Market Size

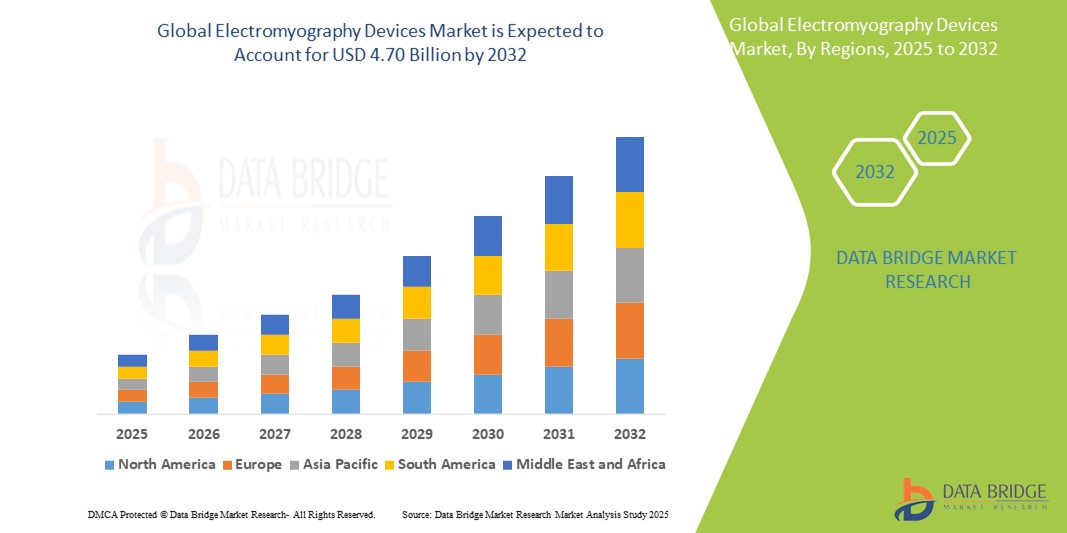

- The global electromyography device market was valued at USD 2.11 billion in 2024 and is expected to reach USD 4.70 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.56%, primarily driven by the increasing prevalence of neuromuscular disorders and the growing demand for accurate diagnostic tools

- This growth is driven by factors such as increase in conditions such as peripheral neuropathy, carpal tunnel syndrome, and muscular dystrophy

Electromyography Devices Market Analysis

- The electromyography (EMG) device market involves the development, production, and sale of medical equipment used to measure the electrical activity of muscles for diagnosing neuromuscular disorders

- One prominent trend in the global electromyography (EMG) devices market is the increasing demand for these devices, driven by the rising prevalence of neuromuscular disorders and the need for accurate diagnostic tools

- Electromyography devices provide critical insights into muscle and nerve function, playing a vital role in diagnosing conditions such as peripheral neuropathy, carpal tunnel syndrome, and muscular dystrophy

- For instance, the growing number of patients with age-related neuromuscular conditions and sports injuries significantly contributes to the demand for EMG devices, especially in regions with aging populations or high athletic participation

- The North American market leads the way, driven by its advanced healthcare infrastructure, high adoption of cutting-edge technologies, and increasing focus on early diagnosis and personalized treatment plans

- Electromyography devices are considered essential tools in both clinical and research settings, ensuring accurate diagnosis and effective management of neuromuscular conditions globally

Report Scope and Electromyography Devices Market Segmentation

|

Attributes |

Electromyography Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electromyography Devices Market Trends

“Growing Digital Integration in Electromyography Devices”

- One prominent trend in the global electromyography (EMG) devices market is the growing adoption of digital integration and advanced data analytics

- These technological advancements enhance the precision and efficiency of EMG diagnostics by providing real-time, high-resolution data on muscle and nerve activity

- For instance, digital integration allows for better data storage and analysis, offering clinicians detailed insights into muscle function, which is crucial for diagnosing conditions like carpal tunnel syndrome, muscular dystrophy, and other neuromuscular disorders

- Additionally, digital platforms enable seamless integration with electronic health records (EHRs), improving the overall workflow in clinical settings and facilitating better patient management

- This trend is transforming the way neuromuscular conditions are diagnosed and managed, improving diagnostic accuracy and driving the demand for technologically advanced EMG devices in the market

Electromyography Devices Market Dynamics

Driver

“Advancements in Digital Integration and Data Analytics”

- The growing digital integration in electromyography (EMG) devices is driven by the increasing demand for precise and efficient diagnostics in neuromuscular conditions

- As the healthcare sector focuses on improving diagnostic accuracy, the integration of digital technologies enables real-time data analysis and streamlined communication between clinicians and patients

- Digital platforms offer features such as high-resolution muscle activity visualization, automated reporting, and seamless connection to electronic health records (EHRs), all of which enhance the diagnostic process

- The shift towards digital integration is also supported by advancements in cloud-based data storage and artificial intelligence, which help in the faster detection and treatment of neuromuscular disorders

- This trend significantly contributes to the growing adoption of EMG devices, improving clinical outcomes and patient care across global healthcare settings

For instance,

- In 2023, a study published in the Journal of Clinical Neurophysiology highlighted the increasing use of digital EMG devices in neurology clinics, pointing out how real-time data analysis supports quicker, more accurate diagnoses of conditions like muscular dystrophy and peripheral neuropathy

- As digital integration improves, the demand for EMG devices is expected to rise, particularly in regions with aging populations and higher rates of neuromuscular disorders

- The continuous advancement of digital capabilities in EMG devices is making these tools more efficient and accessible, driving market growth and improving diagnostic precision

Opportunity

“AI Integration in Electromyography Devices Opportunities”

- The integration of artificial intelligence (AI) in electromyography (EMG) devices presents a significant opportunity to enhance diagnostic accuracy, improve efficiency, and accelerate treatment decisions for neuromuscular conditions

- AI algorithms can analyze real-time EMG data to detect abnormalities in muscle and nerve function, offering instant feedback to clinicians and enabling more informed decision-making

- In addition, AI-powered EMG systems can assist in pattern recognition, helping to identify specific neuromuscular disorders such as carpal tunnel syndrome or muscular dystrophy with greater precision

For instance,

- In 2024, a study published in Neurology AI demonstrated how AI integration in EMG devices can accurately detect early signs of peripheral neuropathy by analyzing subtle changes in muscle activity, leading to earlier intervention and improved patient outcomes

- In 2023, the Journal of Clinical Neurophysiology highlighted AI’s role in automating the analysis of complex EMG data, reducing the time needed for diagnosis and enhancing the speed of treatment decisions

- The use of AI in EMG devices not only streamlines the diagnostic process but also enables personalized treatment plans by offering predictive insights into disease progression, ultimately improving patient care and outcomes

Restraint/Challenge

“High Equipment Costs Limiting Electromyography Device Adoption”

- The high cost of electromyography (EMG) devices presents a significant challenge for the market, especially in developing regions where healthcare budgets are limited

- These devices, which are crucial for diagnosing neuromuscular conditions, can range from several thousand to tens of thousands of dollars, making them financially inaccessible for smaller clinics and healthcare facilities

- This financial barrier can prevent healthcare providers from upgrading their equipment or investing in newer, more advanced EMG technologies, resulting in reliance on outdated or less efficient diagnostic tools

For instance,

- In December 2024, according to an article published by the Journal of Neurological Diagnostics, the high cost of EMG devices significantly limits access to advanced diagnostic tools in low-resource settings, potentially leading to delayed diagnoses and suboptimal patient care

- As a result, the high costs contribute to disparities in access to quality neuromuscular diagnostics, ultimately slowing the growth of the EMG devices market and hindering broader adoption

Electromyography Device Market Scope

The market is segmented on the basis of product mobility, study type and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product mobility |

|

|

By Study Type |

|

|

By End User |

|

Electromyography Device Market Regional Analysis

“North America is the Dominant Region in the Electromyography Device Market”

- North America leads the electromyography (EMG) device market, driven by advanced healthcare infrastructure, high adoption of innovative medical technologies, and the strong presence of key market players

- The U.S. holds a significant share due to the increasing demand for accurate diagnostics of neuromuscular disorders, rising prevalence of conditions like muscular dystrophy and carpal tunnel syndrome, and continuous advancements in EMG technology

- Well-established reimbursement policies, increasing healthcare investments, and a focus on early diagnosis further strengthen the market in North America

- In addition, the rising number of neurology clinics, outpatient centers, and hospitals adopting EMG devices is fuelling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the EMG device market, driven by rapid improvements in healthcare infrastructure, growing awareness of neuromuscular disorders, and rising surgical and diagnostic volumes

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, increasing healthcare investments, and a growing number of cases involving neuromuscular diseases

- Japan, with its advanced medical technologies and increasing number of neurology specialists, remains a significant market for EMG devices. The country continues to lead in adopting cutting-edge diagnostic equipment to improve accuracy and patient outcomes

- China and India, with their vast populations and rising awareness about health conditions like peripheral neuropathy, are witnessing growing demand for EMG devices, with both government and private sector investments improving accessibility to modern healthcare and diagnostics

Electromyography Device Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Natus Medical Incorporated (U.S.)

- ADInstruments NZ Limited (New Zealand)

- iWorx (U.S.)

- Delsys Incorporated (U.S.)

- Ambu A/S (Denmark)

- Compumedics Limited (Australia)

- Magstim EGI (U.S.)

- NeuroWave Systems Inc. (U.S.)

- Noraxon (U.S.)

- Cadwell Laboratories Inc. (U.S.)

- Nihon Kohden Corporation (Japan)

- Medtronic (Ireland)

- GE HealthCare (U.S.)

- Masimo (U.S.)

Latest Developments in Global Electromyography Market

- In January 2025, Natus Medical Incorporated, a global leader in neurology diagnostics, announced the launch of its new portable EMG system, designed for on-the-go diagnostics. The system features advanced software that offers real-time muscle activity monitoring and integration with electronic health records (EHRs), improving the efficiency and accuracy of neuromuscular assessments. This new product aims to enhance the accessibility and convenience of EMG testing, especially in outpatient and remote settings

- In December 2024, Delsys Incorporated unveiled its latest wearable EMG technology at the IEEE EMBS Conference. The system integrates AI algorithms for muscle fatigue analysis and performance tracking in athletes. This advancement focuses on providing real-time data for rehabilitation specialists, helping to monitor and optimize recovery for patients with musculoskeletal disorders

- In October 2024, Compumedics Limited announced the launch of an upgraded version of its NICOlet EMG system. The new model includes enhanced software for real-time neuromuscular mapping and increased sensitivity to detect early-stage muscle dysfunction. The updated system is designed for use in both clinical and research settings, offering more precise diagnostics and improved workflow for neurology departments

- In September 2024, Noraxon U.S.A. Inc. revealed the launch of its new MyoResearch EMG software suite, designed for advanced musculoskeletal research and rehabilitation. The software suite incorporates artificial intelligence to automatically analyze muscle signals, improving the diagnostic process for conditions like carpal tunnel syndrome and peripheral neuropathy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ELECTROMYOGRAPHY DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ELECTROMYOGRAPHY DEVICES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ELECTROMYOGRAPHY DEVICES MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

5.3 STRATEGIC INITIATIVES

5.4 PIPELINE ANALYSIS

5.5 PATENT ANALYSIS

6. REGULATORY FRAMWORK

7. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET , BY PRODUCT

7.1 OVERVIEW

7.2 STATIONARY EMG SYSTEMS

7.2.1 SINGLE CHANNEL

7.2.2 MULTIPLE CHANNEL

7.3 PORTABLE EMG SYSTEMS

7.3.1 SINGLE CHANNEL

7.3.2 MULTIPLE CHANNEL

8. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE CHANNEL

8.3 MULTIPLE CHANNEL

9. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET, BY CONNECTIVITY

9.1 OVERVIEW

9.2 WIRELESS

9.3 WIRED

10. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET, BY STUDY TYPE

10.1 OVERVIEW

10.2 NERVE CONDUCTION

10.2.1 SENSORY NERVE CONDUCTION STUDIES

10.2.2 MOTOR NERVE CONDUCTION STUDIES

10.2.3 F-WAVE STUDIES

10.2.4 H-REFLEX STUDIES

10.2.5 OTHERS

10.3 EVOKED POTENTIAL

10.3.1 SOMATOSENSORY EVOKED POTENTIALS

10.3.2 MOTOR EVOKED POTENTIALS (MEPS)

10.3.3 VISUAL EVOKED POTENTIALS (VEPS)

11. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CLINCIAL

11.2.1 STATIONARY EMG SYSTEMS

11.2.1.1. SINGLE CHANNEL

11.2.1.2. MULTIPLE CHANNEL

11.2.2 PORTABLE EMG SYSTEMS

11.2.2.1. SINGLE CHANNEL

11.2.2.2. MULTIPLE CHANNEL

11.3 RESEARCH

11.3.1 STATIONARY EMG SYSTEMS

11.3.1.1. SINGLE CHANNEL

11.3.1.2. MULTIPLE CHANNEL

11.3.2 PORTABLE EMG SYSTEMS

11.3.2.1. SINGLE CHANNEL

11.3.3 MULTIPLE CHANNEL

12. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PRIVATE

12.2.2 PUBLIC

12.3 CLINICS

12.4 REHABILITATION CENTERS

12.5 HOMECARE SETTINGS

12.6 RESEARCH AND ACADEMIC INSTITUTE

12.7 OTHERS

13. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAIL SALES

13.4 ONLINE SALES

13.5 OTHERS

14. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET , BY REGION

GLOBAL ELECTROMYOGRAPHY DEVICES MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 U.K.

14.2.3 ITALY

14.2.4 FRANCE

14.2.5 SPAIN

14.2.6 RUSSIA

14.2.7 SWITZERLAND

14.2.8 TURKEY

14.2.9 BELGIUM

14.2.10 NETHERLANDS

14.2.11 DENMARK

14.2.12 SWEDEN

14.2.13 POLAND

14.2.14 NORWAY

14.2.15 FINLAND

14.2.16 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 SINGAPORE

14.3.6 THAILAND

14.3.7 INDONESIA

14.3.8 MALAYSIA

14.3.9 PHILIPPINES

14.3.10 AUSTRALIA

14.3.11 NEW ZEALAND

14.3.12 VIETNAM

14.3.13 TAIWAN

14.3.14 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 BAHRAIN

14.5.4 UNITED ARAB EMIRATES

14.5.5 KUWAIT

14.5.6 OMAN

14.5.7 QATAR

14.5.8 SAUDI ARABIA

14.5.9 REST OF MEA

14.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET , SWOT AND DBMR ANALYSIS

16. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET , COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17. GLOBAL ELECTROMYOGRAPHY DEVICES MARKET , COMPANY PROFILE

17.1 NATUS MEDICAL INCORPORATED

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 NORAXON

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 DELSYS INCORPORATED

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 COMPUMEDICS LIMITED

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 NEUROSOFT

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 CADWELL INDUSTRIES INC

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 INOMED MEDIZINTECHNIK GMBH

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 THOUGHT TECHNOLOGY LTD

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 MEDTRONIC

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.10 NIHON KOHDEN CORPORATION

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 NEUROWAVE SYSTEMS INC

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 NEUROSTYLE PTD. LTD

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 INTRONIXTECH TECHNOLOGY

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 ADINSTRUMENTS

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 CONTEC MEDICAL SYSTEMS CO.,LTD

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 BIOMETRICS LTD

17.16.1 COMPANY OVERVIEW

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 CLARITY MEDICAL

17.17.1 COMPANY OVERVIEW

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 COMETA SRL

17.18.1 COMPANY OVERVIEW

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 IWORX

17.19.1 COMPANY OVERVIEW

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18. RELATED REPORTS

19. CONCLUSION

20. QUESTIONNAIRE

21. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.