Global Electronic Adhesives Market

Market Size in USD Billion

CAGR :

%

USD

5.19 Billion

USD

9.18 Billion

2024

2032

USD

5.19 Billion

USD

9.18 Billion

2024

2032

| 2025 –2032 | |

| USD 5.19 Billion | |

| USD 9.18 Billion | |

|

|

|

|

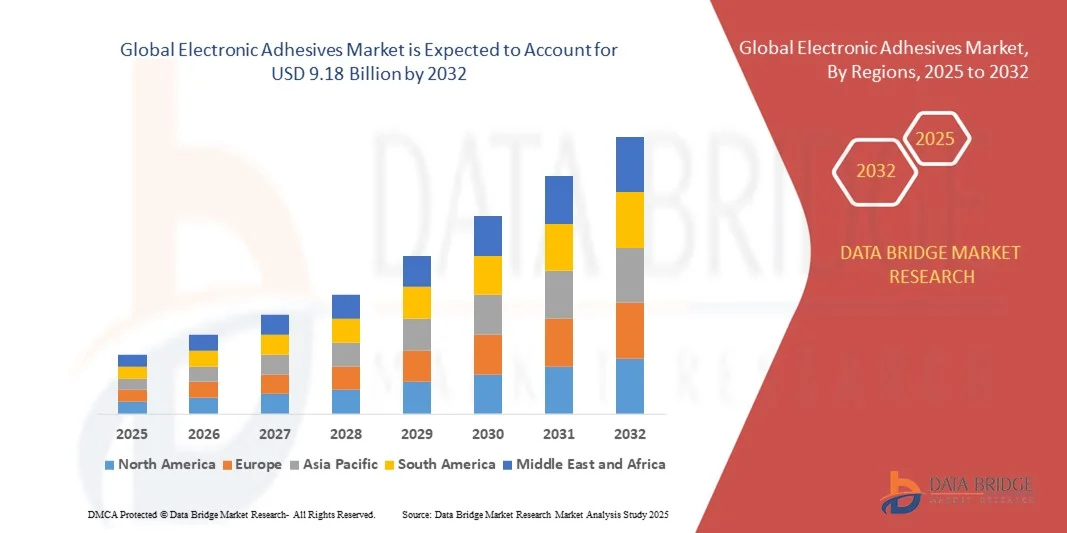

What is the Global Electronic Adhesives Market Size and Growth Rate?

- The global electronic adhesives market size was valued at USD 5.19 billion in 2024 and is expected to reach USD 9.18 billion by 2032, at a CAGR of 7.4% during the forecast period

- Major factors that are expected to boost the growth of the electronic adhesives market in the forecast period are the rise in the infrastructural investments for energy transformers

- Furthermore, the increasing need for electronic equipment from end-users including computers, laptops, household appliances is further anticipated to propel the growth of the electronic adhesives market

- Moreover, the development in the technologies in industrial and consumer application is further estimated to cushion the growth of the electronic adhesives market

What are the Major Takeaways of Electronic Adhesives Market?

- The growing product cost and the high installation cost for laminating is further projected to impede the growth of the electronic adhesives market in the timeline period

- In addition, the investments in the research and development activities from manufacturers for the use of microelectrionic devices will further provide potential opportunities for the growth of the electronic adhesives market in the coming years

- Asia-Pacific dominated the electronic adhesives market with the largest revenue share of 36.58% in 2024, driven by increasing industrialization, urbanization, and technological adoption across countries such as China, Japan, and India

- The North America electronic adhesives market is poised to grow at the fastest CAGR of 10.58% during the forecast period of 2025 to 2032, driven by increasing demand for consumer electronics, EVs, and advanced industrial automation

- The liquid segment dominated the market with a 46% revenue share in 2024, driven by its versatile application across electronics assembly, strong bonding properties, and ease of automation in production lines

Report Scope and Electronic Adhesives Market Segmentation

|

Attributes |

Electronic Adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electronic Adhesives Market?

Integration of Smart Technologies and IoT-enabled Adhesives

- A key and growing trend in the global electronic adhesives market is the adoption of smart technologies and IoT-enabled solutions, allowing adhesives to integrate with advanced monitoring and automation systems. This integration enhances process efficiency, reliability, and predictive maintenance in electronics manufacturing

- For instance, some smart dispensing systems with electronic adhesives can be remotely monitored and controlled through cloud platforms, enabling real-time adjustments to curing or bonding parameters. This reduces waste and improves quality consistency

- IoT-enabled adhesives offer features such as self-monitoring for curing temperature, humidity, or viscosity, alerting operators to deviations that could affect product performance. This predictive capability minimizes defects and enhances operational efficiency

- The integration with digital platforms facilitates centralized monitoring of production lines, allowing seamless coordination with other automated processes and smart equipment, creating a more connected and efficient electronics manufacturing environment

- This trend is driving demand for intelligent adhesive solutions that provide both functional performance and digital compatibility. Companies such as 3M and Henkel are investing in smart adhesives that can interface with automated dispensing systems, ensuring higher precision and process control

- The increasing adoption of connected, data-driven manufacturing is propelling demand for electronic adhesives that are both high-performance and digitally compatible, across consumer electronics, automotive, and industrial sectors

What are the Key Drivers of Electronic Adhesives Market?

- Rising demand for miniaturized and high-performance electronic devices is driving the need for advanced adhesives that provide strong, reliable, and thermally stable bonds

- Increasing adoption of automated manufacturing and IoT-enabled processes in electronics production requires adhesives compatible with smart dispensing systems and real-time monitoring

- Companies are developing adhesives with multifunctional capabilities, including thermal management, electrical conductivity, and moisture resistance, addressing the performance requirements of modern electronics

- The trend towards wearable devices, flexible electronics, and electric vehicles is increasing demand for specialty adhesives that can withstand mechanical stress, temperature fluctuations, and environmental exposure

- Key factors such as reduced production defects, enhanced device durability, and improved energy efficiency are boosting adoption, while investments in R&D for innovative adhesives continue to expand market potential

Which Factor is Challenging the Growth of the Electronic Adhesives Market?

- The high cost of specialty electronic adhesives, particularly those with multifunctional or IoT-enabled features, can limit adoption in cost-sensitive regions or among smaller manufacturers

- Concerns about material compatibility, curing conditions, and long-term reliability pose challenges for integrating advanced adhesives into complex electronics assemblies

- The need for specialized equipment for dispensing, curing, and quality control increases the initial investment for manufacturers, acting as a barrier to entry

- Supply chain constraints and fluctuations in raw material prices, particularly for specialty polymers and conductive fillers, can disrupt production and affect pricing

- Addressing these challenges through cost optimization, standardization of application processes, and development of more user-friendly adhesive solutions is critical for sustained market growth

How is the Electronic Adhesives Market Segmented?

The electronic adhesives market is segmented on the basis of form, product, resin type, application, and end user industry.

- By Form

On the basis of form, the electronic adhesives market is segmented into liquid, solid, and paste. The liquid segment dominated the market with a 46% revenue share in 2024, driven by its versatile application across electronics assembly, strong bonding properties, and ease of automation in production lines. Liquid adhesives offer advantages such as uniform coating, fast curing, and suitability for intricate assemblies, making them widely preferred in high-volume electronics manufacturing.

The paste segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its growing adoption in semiconductor packaging, precision bonding, and microelectronics applications. The paste form provides controlled dispensing, high thermal conductivity, and precise application, which is essential for miniaturized electronic components. Increasing demand for advanced circuit boards, wearables, and automotive electronics is further propelling the adoption of paste adhesives across various end-use sectors.

- By Product

On the basis of product, the market is segmented into thermally conductive adhesives, electrically conductive adhesives, and others. The thermally conductive adhesives segment held the largest market share of 52% in 2024, driven by the rising need for heat dissipation in high-performance electronics and LED assemblies. These adhesives ensure efficient thermal management in compact devices, improving reliability and lifespan.

The electrically conductive adhesives segment is projected to grow at the fastest CAGR from 2025 to 2032, owing to the expanding applications in flexible electronics, sensors, and EMI shielding. Electrically conductive adhesives are critical for replacing traditional soldering methods, offering environmentally friendly and low-temperature bonding solutions. Growing consumer electronics, EVs, and miniaturized devices are expected to boost the adoption of electrically conductive adhesives globally.

- By Resin Type

On the basis of resin type, the Electronic Adhesives market is segmented into silicon, epoxy, polyurethane (PU), acrylic, and others. The epoxy segment dominated the market with 48% revenue share in 2024, attributed to its high mechanical strength, chemical resistance, and excellent adhesion properties across multiple substrates. Epoxy adhesives are widely used in circuit boards, automotive electronics, and industrial assemblies.

The silicon segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for flexible electronics, wearable devices, and high-temperature applications. Silicon adhesives offer superior thermal stability, elasticity, and environmental resistance, meeting the growing requirements of advanced electronic systems. The trend toward miniaturized, high-performance electronics is expected to further propel silicon resin adoption.

- By Application

On the basis of application, the market is segmented into circuit boards, wire cabling, potting and encapsulation, wire coatings, audio component assembling, and others. The circuit boards segment dominated the market with a 45% revenue share in 2024, due to the rising production of PCBs in consumer electronics, telecommunications, and industrial applications. Circuit boards require precise and reliable adhesive bonding for thermal management, electrical conductivity, and mechanical stability.

The potting and encapsulation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the demand for protective coatings in automotive electronics, LED assemblies, and industrial equipment. Potting provides superior protection against moisture, vibration, and thermal stress, making it essential for high-reliability electronics.

- By End-User Industry

On the basis of end-user industry, the market is segmented into computers & servers, communications, consumer electronics, industrial, medical, automotive, commercial aviation, defense, and other transportation. The consumer electronics segment held the largest market share of 50% in 2024, fueled by the growing demand for smartphones, tablets, wearable devices, and IoT gadgets requiring advanced adhesive solutions.

The automotive segment is projected to register the fastest CAGR from 2025 to 2032, driven by the rapid adoption of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and connected car technologies. Electronic adhesives in automotive applications provide thermal management, vibration resistance, and insulation for critical components, aligning with the increasing focus on EV efficiency and reliability.

Which Region Holds the Largest Share of the Electronic Adhesives Market?

- Asia-Pacific dominated the electronic adhesives market with the largest revenue share of 36.58% in 2024, driven by increasing industrialization, urbanization, and technological adoption across countries such as China, Japan, and India

- Consumers and manufacturers in the region highly value the efficiency, reliability, and advanced performance offered by Electronic Adhesives in various applications, including consumer electronics, automotive, and industrial equipment

- This widespread adoption is further supported by strong manufacturing capabilities, a growing electronics industry, and government initiatives promoting smart manufacturing, establishing Electronic Adhesives as a preferred solution across multiple sectors

China Electronic Adhesives Market Insight

The China electronic adhesives market captured the largest revenue share of 42% in 2024 within Asia-Pacific, driven by rapid urbanization, a growing middle class, and high technological adoption. China is a key hub for electronics manufacturing, and Electronic Adhesives are widely used in consumer electronics, industrial devices, and automotive applications. The government’s push for smart cities and affordable, high-performance adhesives is significantly contributing to market expansion.

Japan Electronic Adhesives Market Insight

The Japan electronic adhesives market is witnessing steady growth due to the country’s advanced electronics sector, high-tech culture, and rising demand for efficient and durable adhesives. Integration of Electronic Adhesives in automotive electronics, industrial machinery, and consumer devices is driving adoption. Japan’s aging population is also increasing the demand for reliable and easy-to-use solutions in both residential and industrial applications.

Which Region is the Fastest Growing Region in the Electronic Adhesives Market?

The North America electronic adhesives market is poised to grow at the fastest CAGR of 10.58% during the forecast period of 2025 to 2032, driven by increasing demand for consumer electronics, EVs, and advanced industrial automation. The region’s emphasis on smart manufacturing, R&D innovation, and rising adoption of advanced electronics is fueling growth.

U.S. Electronic Adhesives Market Insight

The U.S. electronic adhesives market accounted for the largest share within North America in 2024, driven by rapid adoption of smart electronics, automotive innovations, and connected devices. Manufacturers are increasingly prioritizing high-performance adhesives for circuit boards, EV batteries, and industrial equipment. Government initiatives supporting advanced manufacturing and sustainability further enhance market growth, making North America the fastest-growing regional market for Electronic Adhesives.

Which are the Top Companies in Electronic Adhesives Market?

The electronic adhesives industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Emerald Performance Materials (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Henkel Adhesives Technologies India Private Limited (Germany)

- Bostik (France)

- Masterbond (U.S.)

- Ellsworth Adhesives India PTY Limited (U.S.)

- Fuller Company (U.S.)

- Kyocera Chemical Corp (Japan)

- DOW (U.S.)

- Bondline Electronic Adhesives, Inc. (U.S.)

- Creative Materials Inc (U.S.)

- Evonik Industries AG (Germany)

- Heraeus Holding (Germany)

- LG Chem (South Korea)

- Hitachi Chemical Co. Ltd (Japan)

What are the Recent Developments in Global Electronic Adhesives Market?

- In July 2024, Henkel completed Phase III of its manufacturing facility in Kurkumbh, India, reinforcing its strong commitment to the Indian market. The new Loctite plant is designed to meet the rising demand for high-performance adhesive solutions, including Electrical & Electronics Adhesives, across manufacturing, automotive, and MRO sectors. The expansion aims to localize Henkel’s product portfolio, reduce reliance on imports, and support the 'Make in India' initiative. The Kurkumbh facility is LEED Gold certified and aims for carbon neutrality by 2030 through the use of green energy solutions, marking a significant step toward sustainable growth in the adhesives industry

- In May 2024, H.B. Fuller Company acquired ND Industries Inc., expanding its product and service offerings in high-growth segments such as Electrical & Electronics Adhesives. ND Industries specializes in adhesives and fastener solutions for the automotive, electronics, and aerospace industries. This acquisition strengthens H.B. Fuller's portfolio by adding ND Industries' Vibra-Tite brand and expertise in pre-applied fastener technology, epoxy, cyanoacrylate, UV curable, and anaerobic products, enhancing its competitive edge and ability to serve customers requiring advanced Electronic & Electrical Adhesives solutions

- In January 2024, Intertronics released a Structural Adhesives Selector Guide to assist manufacturers in selecting the most suitable adhesive for their applications. The guide covers five structural adhesive chemistries, including epoxies and UV-curable adhesives, detailing 28 materials, their properties, and compatibility with metals, plastics, and composites. Tailored for automotive, aerospace, and electronics industries, the guide supports Electrical & Electronics Adhesives applications by enabling reliable assembly of electronic devices, helping manufacturers achieve stronger and more durable bonds for high-performance products

- In May 2023, Arkema acquired Polytec PT, enhancing its capabilities in adhesives and thermal management for electronics applications. The acquisition strengthens Bostik’s portfolio in battery and electronics solutions with specialized thermal interface materials essential for efficient heat dissipation. Polytec PT’s technology complements Bostik’s existing adhesives, enabling the company to offer advanced solutions for electronics and battery applications. This move positions Arkema for significant revenue growth in high-performance materials, reinforcing its role in the Electrical & Electronics Adhesives market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.