Global Electronic Clinical Outcome Assessment Ecoa Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

5.52 Billion

2024

2032

USD

1.70 Billion

USD

5.52 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 5.52 Billion | |

|

|

|

|

Electronic Clinical Outcome Assessment (eCOA) Market Size

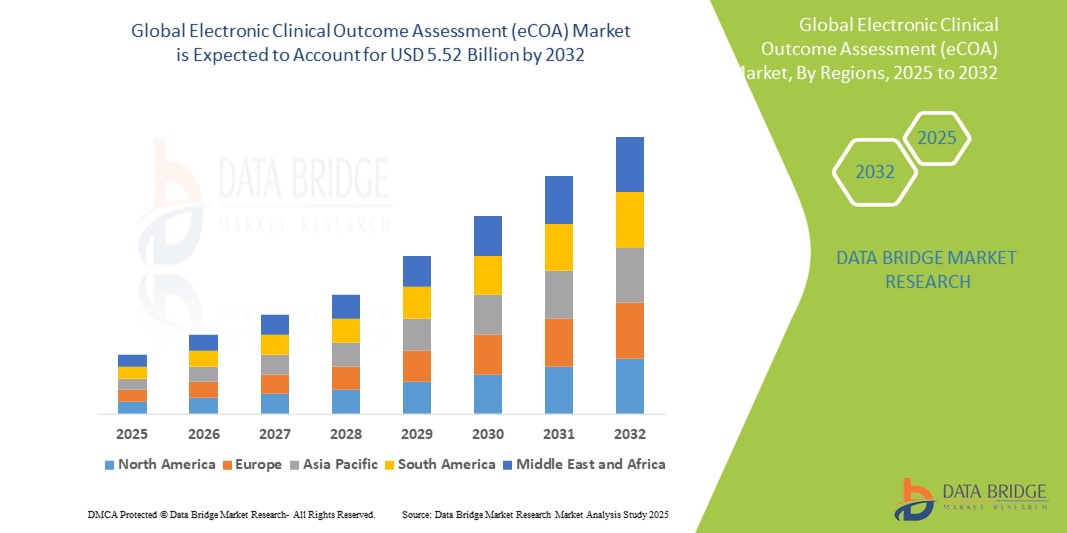

- The global electronic clinical outcome assessment (eCOA) market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 5.52 billion by 2032, at a CAGR of 15.80% during the forecast period

- The market growth is primarily driven by increasing adoption of digital technologies in clinical trials and healthcare research, facilitating more accurate and efficient patient data collection and monitoring

- In addition, the rising demand for real-time patient insights, improved regulatory compliance, and enhanced data integrity is propelling the uptake of eCOA solutions across pharmaceutical companies, contract research organizations (CROs), and healthcare providers

Electronic Clinical Outcome Assessment (eCOA) Market Analysis

- eCOA solutions, enabling electronic capture of clinical outcome data directly from patients, caregivers, or clinicians, are increasingly vital components of modern clinical trials and healthcare research due to their enhanced data accuracy, real-time monitoring capabilities, and seamless integration with digital health ecosystems

- The escalating demand for eCOA is primarily fueled by the widespread adoption of digital health technologies, growing emphasis on patient-centric trials, and a rising preference for remote, user-friendly data collection methods that improve trial efficiency and compliance

- North America dominates the electronic clinical outcome assessment (eCOA) market with the largest revenue share of 43.5% in 2024, characterized by early adoption of digital clinical trial solutions, strong pharmaceutical and biotech sectors, and regulatory frameworks supporting electronic data capture, with the U.S. experiencing substantial growth driven by innovations from both established vendors and emerging tech providers focusing on mobile and cloud-based platforms

- Asia-Pacific is expected to be the fastest growing region in the electronic clinical outcome assessment (eCOA) market during the forecast period due to increasing clinical trial activities, rising healthcare investments, and growing awareness of digital tools’ benefits across emerging markets such as China and India

- Patient Reported Outcome Assessment (PRO) segment dominates the electronic clinical outcome assessment (eCOA) market with a market share of 48.5% in 2024, driven by its critical role in capturing patient perspectives on treatment efficacy and quality of life, which are increasingly prioritized by sponsors and regulatory agencies.

Report Scope and Electronic Clinical Outcome Assessment (eCOA) Market Segmentation

|

Attributes |

Electronic Clinical Outcome Assessment (eCOA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electronic Clinical Outcome Assessment (eCOA) Market Trends

“Enhanced Clinical Trial Efficiency Through AI and Remote Patient Monitoring”

- A significant and accelerating trend in the global eCOA market is the deepening integration of artificial intelligence (AI) and remote patient monitoring technologies within clinical trial data collection platforms. This fusion of technologies is significantly enhancing the accuracy, timeliness, and patient-centricity of clinical outcome assessments

- For instance, leading eCOA providers such as Medidata and ERT incorporate AI-driven analytics to identify patterns in patient-reported data, enabling early detection of adverse events and improved trial decision-making. Similarly, wearable devices paired with eCOA platforms facilitate continuous real-time monitoring of patient health metrics beyond traditional site visits

- AI integration in eCOA enables features such as predictive analytics for patient adherence, automated data quality checks, and intelligent alerts for unusual patient responses. Furthermore, remote monitoring capabilities provide patients with convenient, user-friendly interfaces to report outcomes from home, improving data completeness and engagement

- The seamless integration of eCOA systems with broader digital health and clinical trial management platforms allows sponsors to centralize data management and streamline trial workflows. Through unified dashboards, clinical teams can monitor patient data, site performance, and regulatory compliance in real time

- This trend towards more intelligent, connected, and patient-friendly clinical outcome solutions is fundamentally reshaping expectations for clinical trial data capture. Consequently, companies such as Oracle Health and CRF Health are developing AI-enabled eCOA platforms with enhanced predictive capabilities and remote data capture functionalities

- The demand for eCOA solutions featuring AI and remote patient monitoring integration is growing rapidly across pharmaceutical, biotechnology, and medical device sectors, as stakeholders increasingly prioritize trial efficiency, data accuracy, and patient experience

Electronic Clinical Outcome Assessment (eCOA) Market Dynamics

Driver

“Increasing Demand for Patient-Centric Trials and Digital Data Accuracy”

- The rising focus on patient-centric clinical trials, combined with the growing need for accurate, real-time digital data collection, is a significant driver for the heightened demand for electronic clinical outcome assessment (eCOA) solutions

- For instance, in January 2024, Medidata, a Dassault Systèmes company, introduced new AI-powered enhancements to its eCOA platform to improve patient compliance and data quality in decentralized trials. Such innovations by key industry players are expected to drive the eCOA market growth during the forecast period

- As pharmaceutical and biotechnology companies seek to streamline clinical trial processes and reduce time-to-market, eCOA platforms offer advanced features such as real-time data capture, remote patient reporting, and automated validation, delivering a substantial improvement over traditional paper-based methods

- Furthermore, the increasing adoption of decentralized and hybrid clinical trial models is positioning eCOA as an essential component for remote data collection, improving patient engagement while maintaining high standards of regulatory compliance

- The ability of eCOA platforms to enhance trial efficiency through electronic data collection, multilingual support, and integration with wearable devices or mobile applications is a key factor propelling their adoption across CROs, pharma companies, and research institutions. The growing emphasis on reducing clinical trial drop-out rates and improving data integrity further supports the widespread integration of eCOA solutions in modern clinical research

Restraint/Challenge

“Concerns Regarding Data Privacy, Regulatory Compliance, and High Implementation Costs”

- Concerns surrounding data privacy, regulatory compliance, and the high initial implementation costs of electronic clinical outcome assessment (eCOA) platforms pose significant challenges to broader market adoption

- As eCOA systems involve the electronic capture and transmission of sensitive patient health data, they are subject to strict data protection regulations such as HIPAA, GDPR, and 21 CFR Part 11, making compliance complex and resource-intensive for sponsors and CROs

- For instance, several clinical trial sponsors have expressed caution in transitioning fully to eCOA systems due to uncertainties around data localization rules and the complexity of ensuring cross-border data compliance, especially in multi-region trials

- Addressing these challenges requires robust data security infrastructure, regular audits, and adherence to global compliance standards. Leading eCOA providers such as Oracle Health and Signant Health invest significantly in encrypted platforms and regulatory training to mitigate risk and maintain trust with trial stakeholders

- In addition, the high upfront cost associated with deploying eCOA systems—including licensing fees, hardware procurement, staff training, and system integration—can be a barrier to entry, particularly for small- and mid-sized research organizations. Although long-term benefits such as improved data accuracy and reduced trial duration are widely acknowledged, the initial financial burden may limit adoption among resource-constrained institutions

- Overcoming these challenges through scalable pricing models, cloud-based delivery, and continued innovation in secure, user-friendly platforms will be essential to drive broader and sustained adoption of eCOA solutions across the clinical research landscape

Electronic Clinical Outcome Assessment (eCOA) Market Scope

The market is segmented on the basis of type, modality, end user, and delivery mode

- By Type

On the basis of type, the electronic clinical outcome assessment (eCOA) market is segmented into patient-reported outcomes (PRO), Clinician-Reported Outcomes (ClinRO), Observer-Reported Outcomes (ObsRO), and Performance Outcomes (PerfO). The Patient-Reported Outcomes (PRO) segment held the largest market revenue share of 48.5% in 2024, driven by its patient-centric approach in capturing firsthand insights into patients' experiences, symptoms, and treatment outcomes. PRO tools empower patients to directly report their health data in real-time through electronic platforms, enhancing data precision and patient involvement, ultimately improving the quality of clinical studies.

The clinician-reported outcomes (ClinRO) segment is anticipated to witness substantial growth during the forecast period, owing to the increasing complexity of clinical trials and the need for precise and standardized data collection methods. ClinRO involves assessments made by trained healthcare professionals, providing objective and reliable data for evaluating clinical interventions, particularly in cases where patient self-reporting is not feasible.

- By Modality

On the basis of modality, the electronic clinical outcome assessment (eCOA) market is segmented into site-based solutions, web solutions, and handheld devices. The web solutions segment held the largest market revenue share in 2024, attributed to its user-friendly interfaces, easy accessibility, and lower investment needs. Web-hosted solutions store client data on cloud servers, accessible via the web with basic computer hardware and internet connectivity, offering flexibility for customization and enabling tailoring to specific customer needs.

The handheld devices segment is expected to witness significant growth during forecast period, driven by the increasing adoption of mobile technologies in clinical trials. Handheld devices facilitate real-time data capture and improve patient compliance, making them an attractive option for decentralized and remote clinical studies.

- By End User

On the basis of end user, the electronic clinical outcome assessment (eCOA) market is segmented into pharmaceutical & biotechnology firms, contract research organizations (CROs), medical device companies, hospitals/healthcare providers, consulting service companies, academic & research institutes, and others. The pharmaceutical & biotechnology firms segment dominates the market, accounting for 50.66% market share in 2024. This dominance is due to the critical role eCOA solutions play in streamlining data collection and analysis during drug development processes, ensuring compliance with regulatory standards, and enhancing the accuracy of clinical trial data.

The contract research organizations (CROs) segment is anticipated to witness substantial growth during forecast period, driven by the increasing trend of major biopharmaceutical and medical device companies outsourcing clinical research management. CROs offer comprehensive services encompassing study design, patient recruitment, data collection, and analysis, making them integral players in the eCOA landscape.

By Delivery Mode

On the basis of delivery mode, the electronic clinical outcome assessment (eCOA) market is segmented into cloud-based and web-hosted solutions. The web-hosted solutions segment held the largest market share of 58.9% in 2025, due to its cost-effectiveness relative to cloud-based solutions. Web-hosted platforms involve lower upfront infrastructure investments for end users, reducing capital expenditures for pharmaceutical companies, CROs, and healthcare providers

The cloud-based solutions segment is expected to witness significant growth during forecast period, driven by its scalability, flexibility, and cost efficiency. Cloud-based platforms facilitate easier and quicker access to data for clinical trial stakeholders, regardless of their location, which is crucial for multi-site trials.

Electronic Clinical Outcome Assessment (eCOA) Market Regional Analysis

- North America dominates the electronic clinical outcome assessment (eCOA) market with the largest revenue share of 43.5% in 2024, driven by early adoption of digital clinical trial solutions, strong pharmaceutical and biotech sectors, and regulatory frameworks supporting electronic data capture

- The region benefits from a robust regulatory framework that supports the digital transformation of clinical research, encouraging pharmaceutical companies and contract research organizations to adopt eCOA platforms to enhance data accuracy and regulatory compliance

- In addition, strong investments in R&D, well-established healthcare infrastructure, and early adoption of decentralized and patient-centric clinical trials contribute significantly to the market growth. The presence of leading eCOA solution providers and CROs further accelerates the regional expansion of electronic clinical outcome assessment tools

U.S. Electronic Clinical Outcome Assessment (eCOA) Market Insight

The U.S. electronic clinical outcome assessment (eCOA) market captured the largest revenue share of 79.6% in 2024 within North America, driven by the nation's leadership in clinical trials and the rapid digitalization of clinical research practices. Regulatory agencies such as the FDA strongly advocate for the use of digital tools to improve data quality and patient engagement, contributing to the widespread adoption of eCOA systems. In addition, the increasing need for decentralized and hybrid clinical trial models is fueling demand for remote, real-time patient data collection platforms. The U.S. market also benefits from strong R&D funding, a large presence of pharmaceutical giants, and sophisticated health IT infrastructure.

Europe Electronic Clinical Outcome Assessment (eCOA) Market Insight

The Europe electronic clinical outcome assessment (eCOA) market is projected to expand at a substantial CAGR throughout the forecast period, fueled by growing regulatory emphasis on real-world evidence, patient-centricity, and data standardization across clinical trials. The increased need for multilingual and culturally adapted digital solutions across the EU is accelerating the adoption of flexible, scalable eCOA platforms. Furthermore, the rise in academic research collaborations, coupled with favorable policies for digital health transformation, supports regional growth. Countries such as Germany, the U.K., and France are leading in technology adoption within their respective trial ecosystems

U.K. Electronic Clinical Outcome Assessment (eCOA) Market Insight

The U.K. electronic clinical outcome assessment (eCOA) market is anticipated to grow at a noteworthy CAGR during the forecast period, bolstered by its strong biopharmaceutical R&D sector and proactive digital health strategies by the NHS. The increasing number of decentralized trials and regulatory clarity around electronic data capture are enhancing market adoption. With an advanced clinical research landscape and significant investment in health informatics, the U.K. is witnessing rapid uptake of eCOA technologies to ensure compliance, improve patient engagement, and enable efficient outcomes tracking.

Germany Electronic Clinical Outcome Assessment (eCOA) Market Insight

The Germany electronic clinical outcome assessment (eCOA) market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s reputation for clinical trial excellence and stringent data protection laws. German regulatory bodies emphasize the reliability and security of clinical data, prompting sponsors and CROs to invest in secure, validated eCOA solutions. In addition, Germany’s growing demand for real-time data capture in phase I-IV trials and its strong healthcare IT infrastructure promote further integration of eCOA technologies across medical device and pharmaceutical research.

Asia-Pacific Electronic Clinical Outcome Assessment (eCOA) Market Insight

The Asia-Pacific electronic clinical outcome assessment (eCOA) market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing clinical research activity and the digital transformation of healthcare in countries such as China, India, South Korea, and Japan. The expansion of multinational trials and the availability of diverse patient populations support regional growth. Government incentives to adopt digital health platforms and the growing demand for mobile-based solutions make eCOA adoption more feasible and widespread across urban and semi-urban regions. Local partnerships between CROs and global pharma firms are further advancing eCOA implementation.

Japan Electronic Clinical Outcome Assessment (eCOA) Market Insight

The Japan electronic clinical outcome assessment (eCOA) market is gaining momentum due to the country’s technological sophistication, aging population, and emphasis on quality data in clinical trials. Japan’s regulatory body, the PMDA, is increasingly receptive to digital endpoints and remote data capture tools. The market is also being shaped by an increase in home-based and outpatient clinical trials, driving the need for accurate and patient-friendly eCOA systems. Integration with broader eClinical ecosystems and AI-driven patient engagement tools are expected to further accelerate growth.

India Electronic Clinical Outcome Assessment (eCOA) Market Insight

The India electronic clinical outcome assessment (eCOA) market accounted for the largest market revenue share in Asia Pacific in 2024, propelled by a surge in clinical trial activity, a tech-savvy population, and expanding pharmaceutical manufacturing capabilities. India’s cost-effective CRO landscape and supportive government policies for health digitization are encouraging global sponsors to deploy eCOA tools in domestic trials. The increasing smartphone penetration, growth of telemedicine, and improved internet connectivity in urban and semi-urban areas are making mobile-based and cloud-hosted eCOA platforms more accessible and widely adopted.

Electronic Clinical Outcome Assessment (eCOA) Market Share

The electronic clinical outcome assessment (eCOA) industry is primarily led by well-established companies, including:

- IQVIA (U.S.)

- Clario (U.S.)

- Medidata (U.S.)

- Veeva Systems (U.S.)

- Earth Resources Technology (U.S.)

- Oracle Health Sciences (U.S.)

- YPrime, LLC (U.S.)

- ArisGlobal LLC (U.S.)

- Castor EDC (Netherlands)

- eClinicalWorks (U.S.)

- Medrio, Inc. (U.S.)

- ClinOne (U.S.)

- Signant Health (U.S.)

- Clinical Ink, Inc. (U.S.)

- Curebase, Inc. (U.S.)

- Kayentis (France)

- Calyx (U.K.)

- Datacubed Health (U.S.)

- HealthDiary, Inc. (U.S.)

Latest Developments in Global Electronic Clinical Outcome Assessment (eCOA) Market

- In May 2025, Clario (US) acquired WCG Clinical's (US) eCOA business, a strategic move to bolster its leadership in digital endpoint data solutions, particularly for neuroscience clinical trials. This acquisition expands Clario's comprehensive endpoint data platform, enabling better support for complex trial environments and further solidifying its position in the rapidly evolving eCOA landscape

- In May 2025, Critical Path Institute (US) continued its "eCOA: Getting Better Together" initiative, aiming to unify sponsors, technology vendors, and regulators. This collaborative effort, extending through March 2025, focuses on establishing pre-competitive best practices and a common lexicon for eCOA data capture, promoting standardization and accelerating adoption across diverse regions

- In November 2023, Clinical Ink enhanced its patient engagement suite by incorporating Observia's SPUR behavioral diagnostic tool. This integration merges behavioral assessment with lifestyle modification, eCOA, eSource, and Digital Biomarkers, aiming to provide a more holistic understanding of patient behavior and improve trial outcomes

- In October 2023, Clario entered a strategic partnership with Trial Data, a decentralized clinical trial (DCT) service provider. This collaboration strengthens Clario's presence in China's clinical trial arena, combining their expertise to deliver state-of-the-art decentralized trial solutions and advance patient-centric approaches in the region

- In December 2022, Suvoda LLC, an eCOA clinical trial technology company, introduced its electronic clinical outcome assessments (eCOA) design toolkit. This toolkit is created to integrate smoothly with Suvoda IRT and eConsent, addressing historical inadequacies in eCOA implementation and aiming to streamline the design process

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.