Market Analysis and Insights of Electronic Design Automation (EDA) Tools in Integrated Circuits (IC) Industry Market

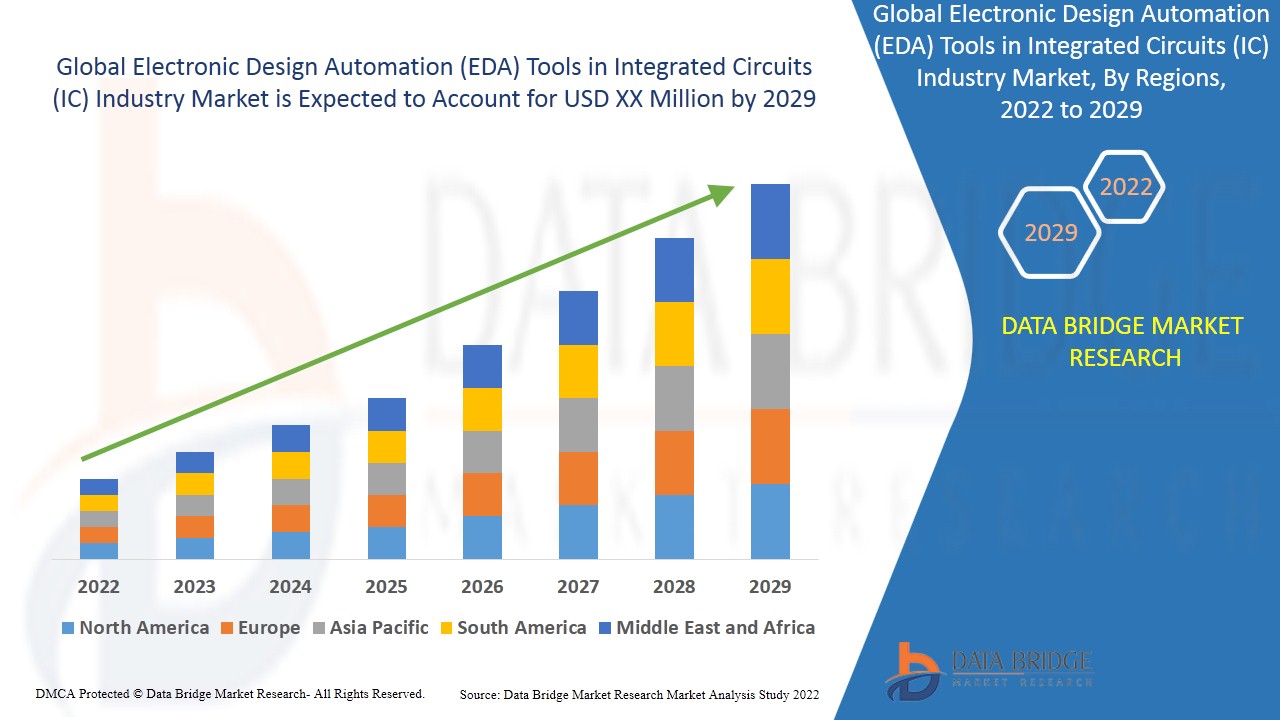

Electronic design automation (EDA) tools in integrated circuits (IC) industry market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses the market to grow at a CAGR of 7.10% in the above-mentioned forecast period.

Electronic design automation (EDA) is a software tool which is basically used for designing electronic system such as integrated circuit boards, printed circuit boards and it also helps in delivering superior levels of scalability in circuit boards. Generally, they are used to design and validate the semiconductor manufacturing process to ensure it delivers the required performance and density. These tools are also used in various applications such as designing verification and simulation.

The factors such as surging demand for system on chip technology and growing demand for water conservation are expected to emerge as the significant factors accelerating the growth of electronic design automation (EDA) tools in integrated circuits (IC) industry market. In addition to this, the, increasing adoption of FinFET architecture, increasing usage of internet of things, rising demand for miniaturized electronic products in several applications will further aggravate the growth of the electronic design automation (EDA) tools in integrated circuits (IC) industry market in the above-mentioned forecast period. The rising complications in semiconductor devices and design are also projected to boost the growth of the market. However, the evolution of technology results as a growth restraint for the market. The introduction of new manufacturing processes and economic conditions are also expected to hamper the market’s growth.

The growing adoption of cloud-based services and significant investments aimed at empowering designers for the reduction of the number of errors are also anticipated to generate lucrative opportunities for the electronic design automation (EDA) tools in integrated circuits (IC) industry market in the forecast period of 2022 to 2029. The impact of COVID-19 on companies offering electronic design automation solutions will pose as a challenge for the electronic design automation (EDA) tools in integrated circuits (IC) industry market.

This electronic design automation (EDA) tools in integrated circuits (IC) industry market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographical expansions, technological innovations in the market. To gain more info on Electronic design automation (EDA) tools in integrated circuits (IC) industry market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Electronic Design Automation (EDA) Tools in Integrated Circuits (IC) Industry Market Scope and Market Size

The electronic design automation (EDA) tools in integrated circuits (IC) industry market is segmented on the basis of type, component, deployment, application and end user. The growth amongst the different segments helps you in attaining the knowledge related to the different growth factors expected to be prevalent throughout the market and formulate different strategies to help identify core application areas and the difference in your target market.

- On the basis of type, the electronic design automation (EDA) tools in integrated circuits (IC) industry market is segmented into computer-aided engineering (CAE), IC physical design and verification, printed circuit board and multi-chip module (PCB and MCM) and semiconductor intellectual property (SIP).

- On the basis of component, the electronic design automation (EDA) tools in integrated circuits (IC) industry market is segmented into solution and services. Solution segment has been further segmented into bundled and standalone. Services segment has been further segmented into managed and professional services.

- On the basis of deployment, the electronic design automation (EDA) tools in integrated circuits (IC) industry market is segmented into cloud and on premise. Cloud based has been further segmented into private cloud, public cloud and hybrid cloud.

- On the basis of application, the electronic design automation (EDA) tools in integrated circuits (IC) industry market is segmented into design, verification and simulation.

- On the basis of end user, the electronic design automation (EDA) tools in integrated circuits (IC) industry market is segmented into communication, consumer electronics, computer, automotive, industrial and others.

Electronic Design Automation (EDA) Tools in Integrated Circuits (IC) Industry Market Country Level Analysis

The electronic design automation (EDA) tools in integrated circuits (IC) industry market is segmented on the basis of type, component, deployment, application and end user.

The countries covered in the electronic design automation (EDA) tools in integrated circuits (IC) industry market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the electronic design automation (EDA) tools in integrated circuits (IC) industry market during the forecast period owing to the prevalence of mid and large sized enterprises. Asia-Pacific on the other hand, is expected to grow in the forecast period of 2020-2027 because of increasing adoption of EDA tools within the region in the forecast period of 2022 to 2029.

The country section of the electronic design automation (EDA) tools in integrated circuits (IC) industry market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Electronic Design Automation (EDA) Tools in Integrated Circuits (IC) Industry Market Share Analysis

The electronic design automation (EDA) tools in integrated circuits (IC) industry market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to Electronic design automation (EDA) tools in integrated circuits (IC) industry market.

Some of the major players operating in the electronic design automation (EDA) tools in integrated circuits (IC) industry market report are Infochips (an Arrow company), Altium Limited, ANSYS, Inc., Cadence Design Systems, Inc., Agnisys, Inc., Aldec, Inc., Mentor Co., Siemens, Synopsys, Inc., Xilinx, Zuken, Sigasi, National Instruments Corp., Intercept Technology GmbH and Silvaco, Inc., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 TECHNOLOGY ANALYSIS

5.2 PORTER’S FIVE FORCES ANALYSIS

6 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, BY TYPE

6.1 OVERVIEW

6.2 COMPUTER-AIDED ENGINEERING (CAE)

6.3 IC PHYSICAL DESIGN AND VERIFICATION

6.4 PRINTED CIRCUIT BOARD AND MULTI-CHIP MODULE (PCB AND MCM)

6.5 SEMICONDUCTOR INTELLECTUAL PROPERTY (SIP)

6.5.1 BY DESIGN IP

6.5.1.1. PROCESSOR IP

6.5.1.2. INTERFACE IP

6.5.1.3. MEMORY IP

6.5.1.4. OTHERS

6.5.2 BY IP CORE

6.5.2.1. SOFT CORE

6.5.2.2. HARD CORE

6.5.3 BY IP SOURCE

6.5.3.1. ROYALTY

6.5.3.2. LICENSING

7 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOLUTION

7.2.1 BUNDLED

7.2.2 STANDALONE

7.3 SERVICES

7.3.1 MANAGED

7.3.2 PROFESSIONAL

8 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 ON-PREMISE

8.3 CLOUD-BASED

8.3.1 PUBLIC

8.3.2 PRIVATE

8.3.3 HYBRID

9 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, BY ENTERPRISE SIZE

9.1 OVERVIEW

9.2 SMALL & MEDIUM ENTERPRISE

9.3 LARGE ENTERPRISE

10 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DESIGN

10.3 VERIFICATION

10.4 SIMULATION

11 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, BY END USER

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.3 AEROSPACE & DEFENSE

11.4 HEALTHCARE

11.5 CONSUMER ELECTRONICS

11.6 TELECOM AND DATA CENTER

11.7 INDUSTRIAL EQUIPMENT

11.8 OTHERS

12 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT & APPROVALS

12.7 EXPANSIONS

12.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, BY REGION

13.1 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1.1 NORTH AMERICA

13.1.1.1. U.S.

13.1.1.2. CANADA

13.1.1.3. MEXICO

13.1.2 EUROPE

13.1.2.1. GERMANY

13.1.2.2. FRANCE

13.1.2.3. U.K.

13.1.2.4. ITALY

13.1.2.5. SPAIN

13.1.2.6. RUSSIA

13.1.2.7. TURKEY

13.1.2.8. BELGIUM

13.1.2.9. NETHERLANDS

13.1.2.10. SWITZERLAND

13.1.2.11. REST OF EUROPE

13.1.3 ASIA-PACIFIC

13.1.3.1. JAPAN

13.1.3.2. CHINA

13.1.3.3. SOUTH KOREA

13.1.3.4. INDIA

13.1.3.5. AUSTRALIA

13.1.3.6. SINGAPORE

13.1.3.7. THAILAND

13.1.3.8. MALAYSIA

13.1.3.9. INDONESIA

13.1.3.10. PHILIPPINES

13.1.3.11. REST OF ASIA-PACIFIC

13.1.4 SOUTH AMERICA

13.1.4.1. BRAZIL

13.1.4.2. ARGENTINA

13.1.4.3. REST OF SOUTH AMERICA

13.1.5 MIDDLE EAST AND AFRICA

13.1.5.1. SOUTH AFRICA

13.1.5.2. SAUDI ARABIA

13.1.5.3. UAE

13.1.5.4. EGYPT

13.1.5.5. ISRAEL

13.1.5.6. REST OF MIDDLE EAST AND AFRICA

13.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, SWOT AND DBMR ANALYSIS

15 GLOBAL ELECTRONIC DESIGN AUTOMATION (EDA) TOOLS IN INTEGRATED CIRCUITS (IC) INDUSTRY MARKET, COMPANY PROFILE

15.1 AGILENT

15.1.1 COMPANY OVERVIEW

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPEMENTS

15.2 CADENCE DESIGN SYSTEMS INC.

15.2.1 COMPANY OVERVIEW

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPEMENTS

15.3 JEDA TECHNOLOGIES

15.3.1 COMPANY OVERVIEW

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPEMENTS

15.4 XILINX INC.

15.4.1 COMPANY OVERVIEW

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPEMENTS

15.5 MUNEDA

15.5.1 COMPANY OVERVIEW

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPEMENTS

15.6 SIGRITY

15.6.1 COMPANY OVERVIEW

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPEMENTS

15.7 ZUKEN

15.7.1 COMPANY OVERVIEW

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPEMENTS

15.8 AGNISYS

15.8.1 COMPANY OVERVIEW

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPEMENTS

15.9 MENTORGRAPHICS

15.9.1 COMPANY OVERVIEW

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPEMENTS

15.1 SYNOPSYS

15.10.1 COMPANY OVERVIEW

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPEMENTS

15.11 INFOCHIPS

15.11.1 COMPANY OVERVIEW

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPEMENTS

15.12 ALTIUM LIMITED

15.12.1 COMPANY OVERVIEW

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPEMENTS

15.13 MENTOR CO.

15.13.1 COMPANY OVERVIEW

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPEMENTS

15.14 AGNISYS, INC

15.14.1 COMPANY OVERVIEW

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPEMENTS

15.15 ALDEC, INC.

15.15.1 COMPANY OVERVIEW

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPEMENTS

15.16 SIEMENS

15.16.1 COMPANY OVERVIEW

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPEMENTS

15.17 XILINX

15.17.1 COMPANY OVERVIEW

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPEMENTS

15.18 ZUKEN

15.18.1 COMPANY OVERVIEW

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPEMENTS

15.19 SIGASI

15.19.1 COMPANY OVERVIEW

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPEMENTS

15.2 NATIONAL INSTRUMENTS CORP

15.20.1 COMPANY OVERVIEW

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

15.21 INTERCEPT TECHNOLOGY GMBH

15.21.1 COMPANY OVERVIEW

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPEMENTS

15.22 SILVACO, INC.

15.22.1 COMPANY OVERVIEW

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPEMENTS

15.23 CADENCE DESIGN SYSTEMS, INC.

15.23.1 COMPANY OVERVIEW

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPEMENTS

15.24 KEYSIGHT TECHNOLOGIES

15.24.1 COMPANY OVERVIEW

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPEMENTS

15.25 SILVACO INC.

15.25.1 COMPANY OVERVIEW

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPEMENTS

15.26 AUTODESK

15.26.1 COMPANY OVERVIEW

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPEMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 CONCLUSION

18 QUESTIONNAIRE

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.