Global Embedded Connectivity Solutions Market

Market Size in USD Billion

CAGR :

%

USD

27.50 Billion

USD

54.12 Billion

2024

2032

USD

27.50 Billion

USD

54.12 Billion

2024

2032

| 2025 –2032 | |

| USD 27.50 Billion | |

| USD 54.12 Billion | |

|

|

|

|

Embedded Connectivity Solutions Market Size

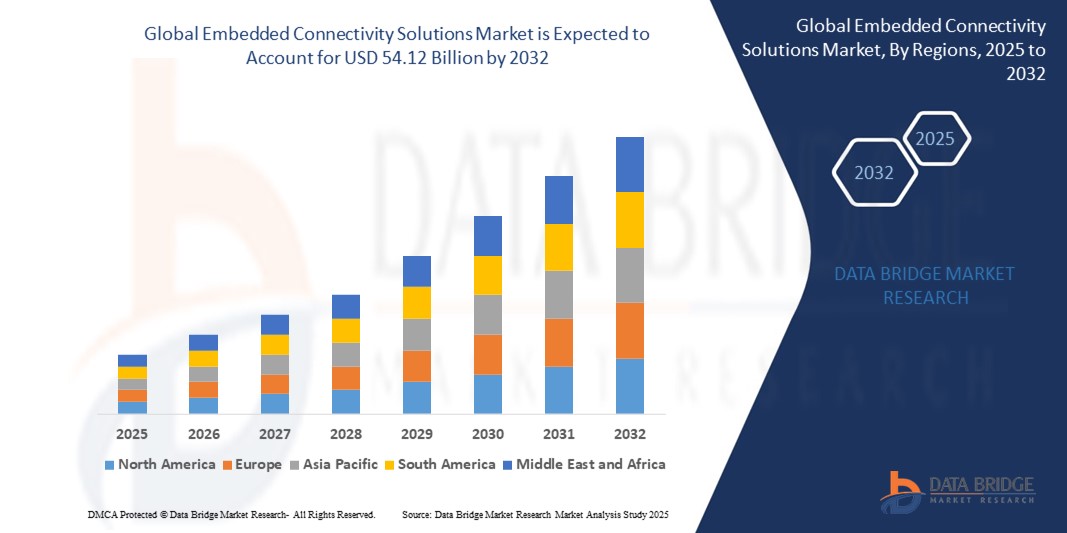

- The global Embedded Connectivity Solutions market size was valued at USD 27.50 Billion in 2024 and is expected to reach USD 54.12 Billion by 2032, at a CAGR of 8.83% during the forecast period

- Rise in demand for automated & management transportation systems is a crucial factor accelerating the market growth, also rise in the production of vehicles in some parts of the world and rise in the demand for new features in the vehicle are the major factors among others boosting the embedded connectivity solutions market.

Embedded Connectivity Solutions Market Analysis

- Embedded connectivity solutions are defined as the type of technological services and offerings that provide real-time information. This solution is basically a part of the overall electrical and mechanical system which includes the hardware, software and mechanical system as well. The implementation of this service in vehicles provide the driver of the vehicle to be connected with various online platforms, providing safety, security, enhanced performance, comfort and better networking technology.

- Increase in the technological advancements and modernization in the connectivity solutions and rise in the research and development activities in the market will further create new opportunities for embedded connectivity solutions market in the forecast period mentioned above.

- North America dominates the Embedded Connectivity Solutions market with the largest revenue share of 44.01% in 2025, Due to the widespread IoT adoption, strong automotive and healthcare industries, and continuous innovation in wireless technologies. Robust infrastructure and government support further accelerate the market’s growth and technology integration.

- Asia-Pacific is expected to be the fastest growing region in the Embedded Connectivity Solutions market during the forecast period due to the rapid industrialization, increasing smartphone and smart device usage, and expanding telecom networks. Rising investments in smart cities and manufacturing automation also play crucial roles, making the region a key driver of embedded connectivity solutions demand.

- The 2G technology segment is anticipated to hold the largest market share of 36.9% in the Embedded Connectivity Solutions Market during the forecast period. The 2G technology segment in the Global Embedded Connectivity Solutions Market remains vital due to its low cost, widespread coverage, and reliability in remote or rural areas. It supports basic IoT applications where high-speed connectivity is not essential.

Report Scope and Embedded Connectivity Solutions Market Segmentation

|

Attributes |

Embedded Connectivity Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Embedded Connectivity Solutions Market Trends

“Powering the Future of Connected Devices”

- One of the most significant trends in the Embedded Connectivity Solutions market is the rapid adoption of 5G and LPWAN technologies, enabling faster, low-latency, and energy-efficient communications across IoT devices. This accelerates the deployment of smart cities, industrial automation, and connected vehicles.

- The integration of edge computing with embedded connectivity solutions is gaining momentum, allowing real-time data processing closer to the source. This reduces latency and bandwidth usage, improving overall system performance and reliability.

- There is a growing focus on secure connectivity solutions, with increased investment in hardware-based security features to protect IoT devices from cyber threats and data breaches. This trend is driven by rising concerns over privacy and regulatory compliance.

- The rise of modular and interoperable connectivity platforms allows seamless integration across various industries, reducing development costs and enhancing scalability for manufacturers deploying connected solutions globally.

Embedded Connectivity Solutions Market Dynamics

Driver

“Expanding IoT Ecosystem and Industry 4.0 Adoption”

- The rapid growth of the IoT ecosystem across sectors such as automotive, healthcare, manufacturing, and consumer electronics is a key driver for the Embedded Connectivity Solutions market. Increasing device connectivity demands sophisticated embedded solutions.

- Industry 4.0 initiatives are pushing manufacturers to adopt smart factories equipped with embedded connectivity for real-time monitoring, predictive maintenance, and enhanced operational efficiency.

- The proliferation of smart homes and wearable devices drives demand for compact, low-power embedded connectivity modules that offer reliable wireless communication.

Restraint/Challenge

“Complex Integration and High Development Costs”

- Integrating embedded connectivity solutions across diverse platforms and ensuring compatibility with legacy systems presents technical challenges, increasing development timelines and costs.

- High initial investments and ongoing R&D expenses for developing advanced connectivity modules limit market entry for smaller companies.

- Regulatory fragmentation across regions concerning wireless communication standards and data security complicates market expansion and increases compliance costs for manufacturers.

Embedded Connectivity Solutions Market Scope

The market is segmented on the battery type, vehicle type, engine type, functions and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Type |

|

|

By Services |

|

|

By End-Users |

|

Embedded Connectivity Solutions Market Scope

The market is segmented on the basis technology, type, services, end-user

- By Technology

On the basis of technology, the Embedded Connectivity Solutions market is segmented into 2G, 3G and 4G/LTE. The 2G segment dominates the largest market revenue share of 36.9% in 2025, The 2G technology segment remains relevant due to its low power consumption, broad coverage, and cost-efficiency. It is ideal for basic IoT applications like smart meters and asset tracking in rural or remote areas, where high-speed connectivity isn't essential.

The 3G segment is anticipated to witness the fastest growth rate of 18.7% from 2025 to 2032, The 3G segment supports higher data rates than 2G, making it suitable for mid-level IoT applications such as telematics and healthcare monitoring. Its established infrastructure and global availability continue to drive adoption, especially in emerging markets transitioning from 2G networks.

- By Type

On the basis of type the Embedded Connectivity Solutions market is segmented into hardware, software and others. The hardware held the largest market revenue share in 2025. The hardware segment is driven by increasing demand for compact, energy-efficient modules like embedded SIMs, microcontrollers, and connectivity chips. Growing IoT deployments across industries require reliable, scalable hardware to support real-time communication and edge processing in connected devices and systems.

The software segment is expected to witness the fastest CAGR from 2025 to 2032, Software demand is rising due to the need for seamless device integration, secure communication protocols, and real-time data management. The growing complexity of IoT ecosystems and emphasis on over-the-air (OTA) updates and cybersecurity drive innovation in embedded connectivity software solutions.

- By Services

On the basis of services the Embedded Connectivity Solutions market is segmented into over-the-air updates, infotainment, driver assistance, live traffic information, e-Call, vehicle self-diagnosis, intelligent parking, safety, entertainment, well-being, vehicle management and mobility management. The infotainment held the largest market revenue share in 2025. The infotainment segment is driven by growing consumer demand for connected, multimedia-rich in-vehicle experiences. Integration of streaming services, navigation, and voice recognition requires robust embedded connectivity solutions to ensure seamless, high-speed data transfer and enhanced user engagement.

The driver assistance segment is expected to witness the fastest CAGR from 2025 to 2032, Driver assistance services gain momentum due to rising safety regulations and consumer interest in advanced features like collision avoidance, lane keeping, and adaptive cruise control. Reliable, low-latency connectivity is essential for real-time sensor communication and effective functioning of these systems.

- By End--User

On the basis of end-user, the Embedded Connectivity Solutions market is segmented into OEM and aftermarket. The OEM segment accounted for the largest market revenue share in 2024 and it is expected to witness the fastest CAGR from 2025 to 2032. Original Equipment Manufacturers (OEMs) drive the embedded connectivity market by integrating advanced connectivity modules directly into vehicles and devices during production. Increasing consumer demand for connected, smart features pushes OEMs to adopt scalable, reliable embedded solutions that enhance functionality, safety, and user experience. OEMs also benefit from government mandates promoting vehicle connectivity and emission controls.

Embedded Connectivity Solutions Market Regional Analysis

- North America dominates the Embedded Connectivity Solutions market with the largest revenue share of 36.9% in 2024, The region benefits from rapid adoption of connected devices and IoT applications across automotive, healthcare, and industrial sectors. Strong investments in 5G infrastructure and government initiatives supporting smart cities are key growth drivers.

- Additionally, the presence of leading semiconductor manufacturers and OEMs in the US accelerates innovation and deployment of embedded connectivity modules. Growing consumer demand for advanced infotainment and driver assistance systems further propels market expansion.

U.S. Embedded Connectivity Solutions Market Insight

The U.S. Embedded Connectivity Solutions market captured the largest revenue share of 71.2% within North America in 2025, Growth is fueled by extensive 5G rollout, increased automotive connectivity, and rising adoption of smart home and wearable devices. Government funding to enhance digital infrastructure and cybersecurity strengthens market development.

Europe Embedded Connectivity Solutions Market Insight

The Europe Embedded Connectivity Solutions market is projected to expand at a substantial CAGR throughout the forecast period, Growth is driven by stringent data privacy regulations and growing demand for secure connectivity in automotive and industrial IoT. European initiatives on smart manufacturing and digital transformation also boost adoption.

Germany Embedded Connectivity Solutions Market Insight

The Germany Embedded Connectivity Solutions market is anticipated to grow at a noteworthy CAGR during the forecast period, Germany’s market is expected to grow robustly, driven by its strong automotive industry emphasizing connected and autonomous vehicles. Government support for Industry 4.0 and sustainable mobility accelerates embedded connectivity integration. Leading manufacturers’ focus on R&D in connectivity hardware and software further drives expansion.

France Embedded Connectivity Solutions Market Insight

The France Embedded Connectivity Solutions market is expected to expand at a considerable CAGR during the forecast period, France’s Embedded Connectivity market is expanding steadily, supported by government incentives promoting connected infrastructure and smart city projects. Rising consumer interest in connected vehicles and enhanced in-vehicle infotainment systems also fuels demand, alongside investments in local technology startups.

Asia-Pacific Embedded Connectivity Solutions Market Insight

The Asia-Pacific Embedded Connectivity Solutions market is poised to grow at the fastest CAGR of over 25.1% in 2025, Rapid urbanization, increasing smartphone penetration, and expanding IoT ecosystems are key drivers. Government initiatives in China, India, and South Korea promote smart infrastructure and connected vehicles, boosting regional market dynamics.

Japan Embedded Connectivity Solutions Market Insight

Japan market growth is driven by technological innovation in embedded connectivity modules, particularly for automotive and robotics applications. Strong government backing for digital transformation and smart manufacturing, combined with leading electronics manufacturers’ capabilities, fosters advanced product development and adoption.

China Embedded Connectivity Solutions Market Insight

The China Embedded Connectivity Solutions market accounted for the largest market revenue share in Asia Pacific in 2025, China commands the largest market share in Asia-Pacific due to its leadership in connected vehicle production and massive IoT deployments. Strong government policies, including subsidies for 5G infrastructure and smart city initiatives, drive growth. High-volume manufacturing and cost-efficient embedded solutions solidify China’s dominant position.

Embedded Connectivity Solutions Market Share

The Embedded Connectivity Solutions industry is primarily led by well-established companies, including:

- Airbiquity Inc.

- TomTom International BV

- Cisco

- Apple Inc.

- Delphi Technologies

- HARMAN International

- Microsoft

- QNX Software Systems Limited

- Verizon

- Sierra Wireless

- Intel Corporation

- Aeris

- NXP Semiconductors

- IMS - Part of Trak Global Group

- Robert Bosch GmbH

- WirelessCar

- Texas Instruments Incorporated

- Vodafone Automotive SpA

Latest Developments in Global Embedded Connectivity Solutions Market

- On April 2025, Qualcomm launched its new Snapdragon Automotive Connectivity Platform, designed to enhance in-vehicle embedded connectivity with 5G and Wi-Fi 6E support, targeting advanced infotainment and telematics systems in electric and autonomous vehicles.

- In February 2025, NXP introduced a new line of secure embedded connectivity chips optimized for Industrial IoT applications, focusing on enhanced cybersecurity features and energy efficiency for smart factories and automated manufacturing.

- In March 2025, STMicroelectronics unveiled its latest multi-protocol connectivity module supporting Bluetooth Low Energy (BLE), Zigbee, and Thread standards, aimed at smart home devices and wearable technology to enable seamless device communication.

- In January 2025, Intel announced a strategic partnership with automotive OEMs to integrate its embedded connectivity solutions into next-generation connected vehicles, emphasizing AI-driven data processing.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.