Global Emc Shielding And Test Equipment Market

Market Size in USD Billion

CAGR :

%

USD

8.40 Billion

USD

13.59 Billion

2024

2032

USD

8.40 Billion

USD

13.59 Billion

2024

2032

| 2025 –2032 | |

| USD 8.40 Billion | |

| USD 13.59 Billion | |

|

|

|

|

What is the Global EMC Shielding and Test Equipment Market Size and Growth Rate?

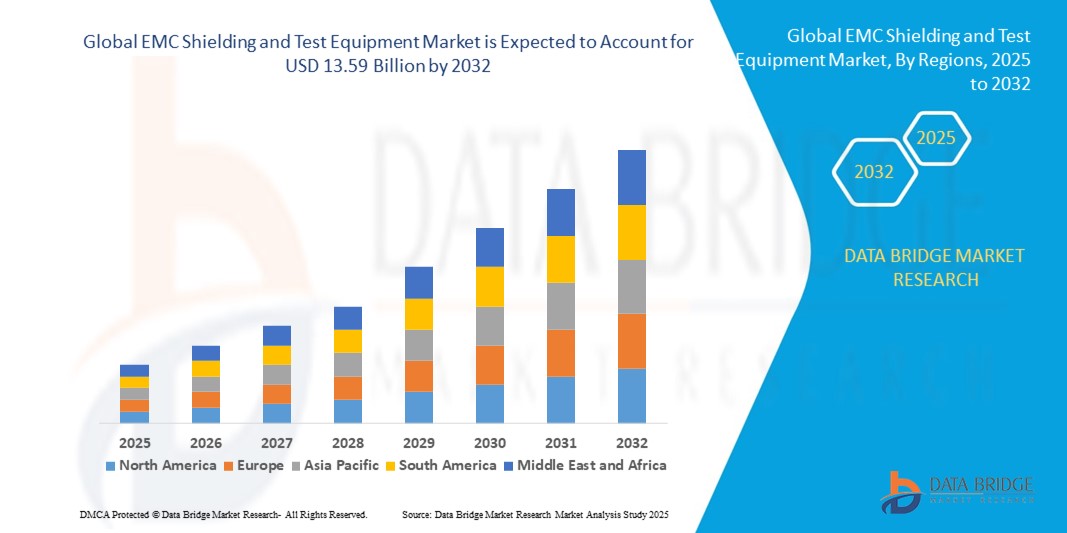

- The global EMC shielding and test equipment market size was valued at USD 8.40 billion in 2024 and is expected to reach USD 13.59 billion by 2032, at a CAGR of 6.20% during the forecast period

- The EMC shielding and test equipment market involve products and services essential for mitigating electromagnetic interference and ensuring compliance with electromagnetic compatibility (EMC) regulations across various industries. These products include EMC shielding materials, enclosures, and test equipment used for evaluating the electromagnetic performance of electronic devices and systems

- The market is witnessing substantial growth driven by the increasing complexity of electronic devices, stringent EMC regulations, and the proliferation of wireless communication technologies

What are the Major Takeaways of EMC Shielding and Test Equipment Market?

- The increasing complexity of electronic devices, coupled with the miniaturization trend, drives the demand for effective EMC shielding and test solutions to mitigate electromagnetic interference and ensure device reliability and performance

- Stringent electromagnetic compatibility (EMC) regulations imposed by regulatory bodies worldwide propel the adoption of EMC shielding and test equipment across industries to meet compliance requirements and avoid costly product recalls and penalties

- North America dominated the EMC shielding and test equipment market with the largest revenue share of 36.49% in 2024, driven by the rising adoption of 5G infrastructure, connected devices, and increasing demand for EMI/EMC compliance in electronics and automotive industries

- Asia-Pacific market is set to grow at the fastest CAGR of 9.7% between 2025 and 2032, fueled by rapid urbanization, expanding electronics manufacturing, and government-backed digitalization initiatives

- The EMC Shielding segment dominated the market with the largest revenue share of 61.3% in 2024, primarily driven by the rising demand for shielding materials in consumer electronics, automotive electronics, and aerospace systems

Report Scope and EMC Shielding and Test Equipment Market Segmentation

|

Attributes |

EMC Shielding and Test Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the EMC Shielding and Test Equipment Market?

Integration of AI-Driven Testing and Automation

- A major trend in the global EMC shielding and Test equipment market is the increasing adoption of AI-powered automation in testing and compliance processes. AI enables faster identification of electromagnetic interference (EMI) patterns, predictive failure analysis, and optimization of shielding performance

- For instance, Keysight Technologies introduced AI-enhanced EMC compliance testing solutions that automate data collection and analysis, reducing testing time significantly. Similarly, Rohde & Schwarz offers AI-driven spectrum analysis tools to ensure accurate detection of interference in high-frequency environments

- AI integration also allows adaptive shielding solutions that dynamically adjust shielding effectiveness based on real-time electromagnetic conditions, improving reliability in defense, automotive, and 5G applications. This shift towards AI-powered EMC testing enhances accuracy, reduces operational costs, and accelerates certification cycles

- Furthermore, automation in EMC laboratories is enabling remote testing capabilities, allowing manufacturers to conduct compliance assessments across multiple sites with minimal manual intervention

- This trend is fundamentally transforming the EMC testing ecosystem, driving efficiency, accuracy, and faster time-to-market for advanced electronics

What are the Key Drivers of EMC Shielding and Test Equipment Market?

- The rapid growth of 5G, EVs, and autonomous vehicles is fueling demand for advanced EMC shielding and testing solutions, as these technologies operate in highly complex electromagnetic environments

- For instance, in March 2024, ETS-Lindgren partnered with NXP Semiconductors to develop advanced EMC test chambers tailored for automotive radar and 5G devices. Such collaborations highlight the critical role of EMC testing in next-generation electronics

- The surge in consumer electronics, coupled with stringent regulatory compliance standards (FCC, CE, CISPR), is further driving investments in EMC test equipment. Manufacturers are compelled to adopt precise testing to ensure device reliability and safety

- In addition, the defense and aerospace industries are increasingly deploying EMC shielding to protect mission-critical systems from EMI, boosting market growth

- Rising awareness of electromagnetic compatibility in healthcare devices, wearables, and industrial automation is also accelerating adoption, making EMC shielding and testing indispensable across multiple sectors

Which Factor is Challenging the Growth of the EMC Shielding and Test Equipment Market?

- One of the major challenges is the high cost of advanced EMC test equipment and shielding solutions, which can be a significant barrier for small and mid-sized manufacturers. Complex testing chambers, spectrum analyzers, and shielding enclosures require substantial capital investment

- For instance, advanced AI-enabled EMC test systems from leading providers such as Keysight Technologies and Rohde & Schwarz are priced at a premium, making them less accessible to cost-sensitive markets

- Another critical challenge is the technical complexity and shortage of skilled professionals capable of operating and interpreting sophisticated EMC testing systems. This limits adoption, particularly in emerging economies

- Furthermore, the continuous evolution of electronic technologies (such as 5G, IoT, and EVs) demands frequent updates in EMC standards and testing methodologies, creating compliance uncertainties for manufacturers

- Overcoming these challenges will require vendors to offer cost-effective, modular, and user-friendly solutions while also investing in training programs to address the skill gap. This will be crucial for wider adoption and sustained market growth

How is the EMC Shielding and Test Equipment Market Segmented?

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the EMC shielding and test equipment market is segmented into EMC Shielding and EMC Test Equipment. The EMC Shielding segment dominated the market with the largest revenue share of 61.3% in 2024, primarily driven by the rising demand for shielding materials in consumer electronics, automotive electronics, and aerospace systems. Increasing miniaturization of devices and growing electromagnetic interference concerns across industries further fuel the adoption of advanced shielding solutions. Materials such as conductive coatings, gaskets, and films are in high demand to ensure compliance with regulatory standards and device reliability.

The EMC Test Equipment segment is projected to witness the fastest CAGR from 2025 to 2032, supported by stricter global EMC regulations and rising adoption of advanced testing tools by manufacturers. As 5G networks, IoT devices, and autonomous vehicles expand, demand for precise and efficient EMC testing equipment is expected to accelerate, driving robust growth.

- By Application

On the basis of application, the EMC shielding and test equipment market is segmented into Consumer Electronics, Telecom and IT, Automotive, Aerospace and Defense, Healthcare, and Others. The Consumer Electronics segment held the largest revenue share of 38.5% in 2024, owing to the rapid proliferation of smartphones, laptops, wearables, and smart home devices. Growing product launches and short innovation cycles drive manufacturers to integrate advanced EMC shielding materials and testing solutions to meet compliance while ensuring performance. Rising disposable incomes and demand for connected devices further boost this segment.

The Automotive segment is anticipated to witness the fastest CAGR between 2025 and 2032. The transition toward electric and autonomous vehicles, along with the increasing integration of infotainment systems, ADAS, and battery management systems, creates high EMC risks that require robust shielding and testing. With EV adoption surging globally, automakers are investing heavily in EMC testing solutions, positioning automotive applications as the fastest-growing segment.

Which Region Holds the Largest Share of the EMC Shielding and Test Equipment Market?

- North America dominated the EMC shielding and test equipment market with the largest revenue share of 36.49% in 2024, driven by the rising adoption of 5G infrastructure, connected devices, and increasing demand for EMI/EMC compliance in electronics and automotive industries

- The region benefits from strong R&D investments, advanced testing laboratories, and regulatory standards that require stringent EMC compliance across industries such as defense, aerospace, and consumer electronics

- High penetration of telecommunication equipment, medical devices, and automotive electronics further supports growth, positioning EMC shielding and testing as a critical component in maintaining product reliability and safety

U.S. EMC Shielding and Test Equipment Market Insight

The U.S. EMC Shielding and Test Equipment market captured the largest revenue share in 2024 within North America, supported by its robust electronics, automotive, and aerospace industries. The rising deployment of 5G networks, EV adoption, and IoT devices is fueling demand for EMC compliance solutions. The presence of key players such as Keysight Technologies and ETS-Lindgren strengthens the market outlook, while regulatory requirements from the FCC continue to accelerate adoption.

Europe EMC Shielding and Test Equipment Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent EU directives and CE marking requirements for electronic devices. Growth is further supported by the region’s strong automotive, aerospace, and industrial automation sectors. Increasing focus on energy-efficient and eco-friendly shielding materials, coupled with the integration of EMC testing into R&D, ensures steady adoption across consumer electronics and defense applications.

U.K. EMC Shielding and Test Equipment Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, fueled by its thriving aerospace, automotive, and telecom sectors. The country’s increasing reliance on connected devices, 5G rollout, and defense modernization programs is driving demand for advanced EMC shielding and test equipment. Moreover, a strong focus on innovation and compliance with EU and global standards positions the U.K. as a key growth market in Europe.

Germany EMC Shielding and Test Equipment Market Insight

The Germany market is expected to expand at a considerable CAGR, underpinned by its automotive manufacturing strength, Industry 4.0 initiatives, and high R&D spending. Demand for lightweight, sustainable shielding materials and precision EMC testing is increasing, particularly in electric vehicles, smart factories, and defense systems. Germany’s emphasis on technological innovation and eco-conscious solutions is reinforcing adoption across both consumer and industrial applications.

Which Region is the Fastest Growing in the EMC Shielding and Test Equipment Market?

Asia-Pacific market is set to grow at the fastest CAGR of 9.7% between 2025 and 2032, fueled by rapid urbanization, expanding electronics manufacturing, and government-backed digitalization initiatives. Countries such as China, Japan, and India are leading the adoption due to rising demand for smart devices, EVs, and industrial automation. The presence of low-cost manufacturers and growing R&D investments makes APAC a hub for both production and consumption of EMC solutions.

Japan EMC Shielding and Test Equipment Market Insight

The Japan market is witnessing strong momentum due to its advanced electronics sector, IoT adoption, and urban smart infrastructure projects. With a focus on high-tech consumer electronics and automotive safety, EMC compliance is becoming integral. An aging population and demand for secure, reliable connected systems are further driving adoption in healthcare and residential applications.

China EMC Shielding and Test Equipment Market Insight

The China market accounted for the largest share in APAC in 2024, supported by its massive electronics manufacturing base, growing EV production, and rapid smart city development. Government-backed initiatives promoting local innovation and digitalization are enhancing adoption. Affordable availability of EMC shielding materials and strong presence of domestic manufacturers are solidifying China’s position as the leading APAC market.

Which are the Top Companies in EMC Shielding and Test Equipment Market?

The EMC shielding and test equipment industry is primarily led by well-established companies, including:

- Laird Technologies, Inc. (U.K.)

- Chomerics (U.S.)

- Parker-Hannifin Corporation (U.S.)

- Tech-Etch Inc. (U.S.)

- Rohde & Schwarz GmbH & Co. KG (Germany)

- Keysight Technologies, Inc. (U.S.)

- AR Europe (U.K.)

- Teseq AG (Switzerland)

- Kitagawa Industries Co., Ltd. (Japan)

- Leader Tech Inc. (U.S.)

- KEC Corporation (South Korea)

- Telegärtner Karl Gärtner GmbH (Germany)

- ETS-Lindgren (U.S.)

- Schaffner Holding AG (Switzerland)

- Danaher (U.S.)

- EM Test (Switzerland)

- Analog Devices Inc. (U.S.)

- Kaltman Creations LLC (U.S.)

- Solar Electronics Co., Ltd. (China)

- InTest Corporation (U.S.)

- Empower RF Systems, Inc. (U.S.)

- AMETEK Inc. (U.S.)

- L3Harris Technologies Inc. (U.S.)

What are the Recent Developments in Global EMC Shielding and Test Equipment Market?

- In April 2024, Laird PLC introduced the “EMC ShieldPro Plus,” an advanced EMC shielding material offering enhanced conductivity and flexibility, designed to deliver superior electromagnetic interference (EMI) protection for electronic devices operating in harsh environments. This launch reinforced Laird’s position as an innovator in high-performance EMC solutions

- In November 2023, AMETEK, Inc. launched the CDN 3063A-C100.1, the first 3-phase Teseq coupling network with a switchable current range, enhancing EMC testing setups and providing users with unprecedented flexibility to address diverse testing requirements. This innovation highlighted AMETEK’s commitment to advancing EMC testing capabilities

- In September 2023, Henkel unveiled the Bergquist Gap Pad TGP EM14000, a multifunctional EMI thermal gap pad free of silicone, which combines high thermal conductivity of 4W/mK with EMI shielding effectiveness up to 77 GHz frequencies. This introduction marked Henkel’s step forward in merging thermal management with EMI protection

- In September 2023, PPG Industries, Inc. successfully completed a USD 2.7 million expansion project at its powder coatings plant in Sumaré, Brazil, increasing the facility’s production capacity by 40%. This expansion strengthened PPG’s manufacturing footprint and ability to meet rising market demand

- In November 2021, Rohde & Schwarz GmbH & Co. KG launched the “R&S ESW-B Series,” a new line of EMC test receivers offering improved sensitivity and faster measurement speeds, specifically designed for EMC compliance testing of wireless communication devices and systems. This launch underscored the company’s role in delivering state-of-the-art EMC testing solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Emc Shielding And Test Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Emc Shielding And Test Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Emc Shielding And Test Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.