Global Endoscope Cleaning And Disinfecting Device Market

Market Size in USD Billion

CAGR :

%

USD

2.37 Billion

USD

5.55 Billion

2024

2032

USD

2.37 Billion

USD

5.55 Billion

2024

2032

| 2025 –2032 | |

| USD 2.37 Billion | |

| USD 5.55 Billion | |

|

|

|

|

Endoscope Cleaning and Disinfecting Device Market Size

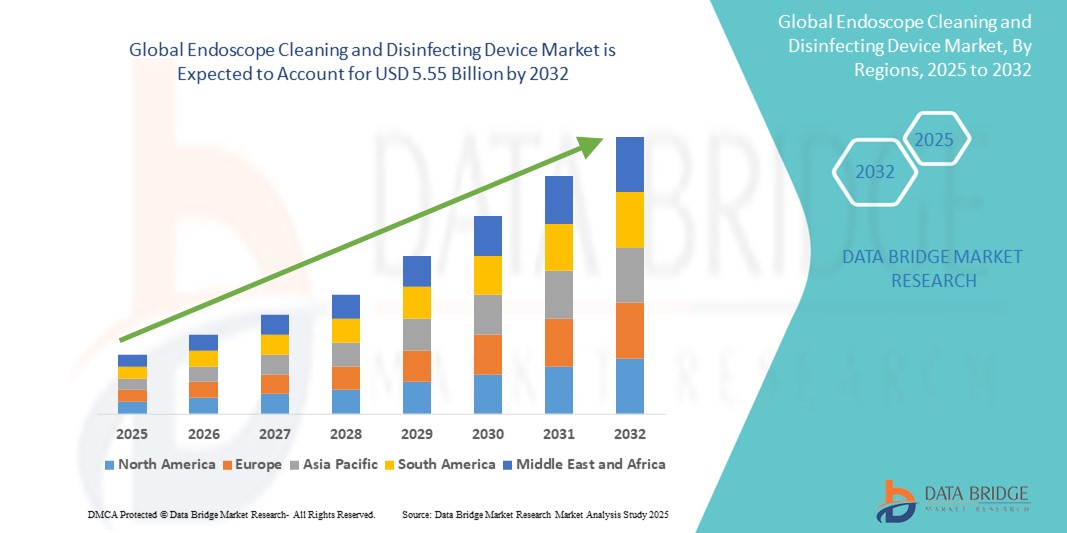

- The global endoscope cleaning and disinfecting device market size was valued at USD 2.37 billion in 2024 and is expected to reach USD 5.55 billion by 2032, at a CAGR of 11.20% during the forecast period

- The market growth is largely fueled by the increasing number of endoscopic procedures globally and the growing awareness about infection control and patient safety in medical facilities, especially post-pandemic

- Furthermore, stringent regulatory standards regarding endoscope reprocessing and the push for automation in hospital workflows are driving the demand for advanced, efficient cleaning and disinfecting systems. These converging factors are accelerating the adoption of such devices, thereby significantly boosting the industry's growth

Endoscope Cleaning and Disinfecting Device Market Analysis

- Endoscope cleaning and disinfecting devices, critical for ensuring patient safety by preventing cross-contamination, are essential components in modern medical and surgical practices across hospitals, clinics, and ambulatory care centers due to their role in effective infection control and adherence to stringent hygiene standards

- The escalating demand for these devices is primarily fueled by the rising number of endoscopic procedures, increasing awareness of hospital-acquired infections (HAIs), and strict regulatory mandates on endoscope reprocessing protocols worldwide

- North America dominated the endoscope cleaning and disinfecting device market with the largest revenue share of 39.1% in 2024, supported by a well-established healthcare infrastructure, strong regulatory enforcement, and growing investments in infection control technologies, particularly in the U.S., which leads the adoption of automated endoscope reprocessors (AERs) and high-level disinfectants

- Asia-Pacific is expected to be the fastest growing region in the endoscope cleaning and disinfecting device market during the forecast period due to increasing healthcare expenditure, improving medical infrastructure, and a growing number of minimally invasive surgeries

- Endoscope cleaning and disinfecting device instruments segment dominated the endoscope cleaning and disinfecting device market with a market share of 58.8% in 2024, driven by its critical role in ensuring consistent, automated reprocessing and reducing infection risks in clinical environments

Report Scope and Endoscope Cleaning and Disinfecting Device Market Segmentation

|

Attributes |

Endoscope Cleaning and Disinfecting Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Endoscope Cleaning and Disinfecting Device Market Trends

“Automation and AI Integration for Enhanced Reprocessing Efficiency”

- A significant and accelerating trend in the global endoscope cleaning and disinfecting device market is the integration of automation and artificial intelligence (AI) into reprocessing workflows, aimed at enhancing operational efficiency, safety, and compliance in medical facilities

- For instance, companies such as Olympus and Cantel Medical have developed advanced Automated Endoscope Reprocessors (AERs) with integrated AI and sensor technology to monitor cycle performance, detect anomalies, and ensure adherence to cleaning protocols, thereby minimizing human error

- AI-powered systems are increasingly being used to track instrument usage, automate documentation, and provide real-time feedback to technicians, improving traceability and reducing the such aslihood of infection transmission due to improper reprocessing. These smart systems can alert users to skipped steps or process failures, reinforcing protocol compliance

- Furthermore, cloud-based connectivity and data analytics are enabling centralized monitoring and performance tracking across hospital networks, contributing to enhanced infection control and quality assurance

- The adoption of intelligent and automated cleaning systems is driven by the rising complexity of endoscopic procedures and increasing scrutiny from health authorities. Manufacturers are responding by introducing devices capable of self-diagnosis, automated leakage testing, and compatibility with a broad range of endoscope models

- This trend toward smarter, data-driven endoscope reprocessing solutions is redefining expectations in infection control standards and pushing the industry toward higher levels of accountability, efficiency, and safety, particularly in high-volume healthcare settings

Endoscope Cleaning and Disinfecting Device Market Dynamics

Driver

“Rising Procedure Volumes and Stricter Infection Control Protocols”

- The rising number of endoscopic procedures worldwide, coupled with increasing awareness of hospital-acquired infections (HAIs), is a significant driver fueling the demand for endoscope cleaning and disinfecting devices

- For instance, in 2024, STERIS launched the Revital-Ox RESERT High-Level Disinfectant platform, aiming to enhance efficacy and reduce cycle time in busy healthcare environments, underscoring the industry's push toward more efficient and standardized solution

- With regulatory agencies such as the CDC, FDA, and ECRI reinforcing strict reprocessing guidelines, healthcare facilities are prioritizing high-level disinfection technologies to ensure compliance and patient safety

- Automated and semi-automated systems that offer reproducible outcomes, digital recordkeeping, and operator guidance are seeing rapid adoption in hospitals and ambulatory surgical centers

- Furthermore, the rising prevalence of chronic conditions and an aging population are increasing the volume of diagnostic and therapeutic endoscopic procedures, thereby intensifying the need for reliable and efficient reprocessing devices

Restraint/Challenge

“High Capital Investment and Compliance Complexity”

- The high upfront cost associated with automated endoscope reprocessing systems and the complexity of regulatory compliance pose challenges to market growth, particularly in low- and middle-income regions

- Smaller clinics and healthcare facilities may find it difficult to invest in costly AERs, drying cabinets, and water treatment systems, despite the long-term benefits of infection control and labor savings

- In addition, varying global standards and complex validation protocols for reprocessing can create operational challenges, especially for institutions lacking specialized staff or dedicated infection control teams

- Missteps in cleaning or disinfection can lead to patient infections, reputational damage, and regulatory penalties, placing pressure on providers to maintain consistently high standards

- Overcoming these barriers will require broader training initiatives, financial support mechanisms, and the introduction of compact, cost-effective reprocessing solutions that meet global compliance standards without compromising performance

Endoscope Cleaning and Disinfecting Device Market Scope

The market is segmented on the basis of product, animal type, application, and end-use.

- By Product

On the basis of product, the endoscope cleaning and disinfecting device market is segmented into endoscope cleaning and disinfecting device instruments, veterinary software, and endoscope cleaning and disinfecting device reagents. The endoscope cleaning and disinfecting device instruments segment dominated the market with the largest revenue share of 58.8% in 2024, driven by the growing need for reliable and automated reprocessing systems in clinical settings to minimize infection risk. Hospitals and surgical centers are increasingly investing in automated endoscope reprocessors (AERs), leak testers, and drying cabinets due to their ability to deliver consistent and compliant disinfection processes with reduced manual intervention.

The reagents segment is projected to witness the fastest growth from 2025 to 2032, owing to the recurring nature of consumable use in reprocessing cycles and growing demand for high-level disinfectants and enzymatic cleaners. The rise in endoscopic procedures and stricter infection control mandates are fueling reagent consumption across healthcare facilities.

- By Animal Type

On the basis of animal type, the market is segmented into small companion animals and large animals. The small companion animals segment held the largest market share of 61.4% in 2024, primarily due to increased pet ownership, higher frequency of diagnostic endoscopy in small animals, and rising veterinary healthcare expenditure globally. Urbanization and growing awareness of pet health have led to the adoption of advanced diagnostic tools and endoscope cleaning systems in veterinary clinics.

The large animals segment is projected to witness the fastest growth from 2025 to 2032, particularly in rural and agricultural sectors, as the use of endoscopic procedures becomes more common in equine and livestock medicine.

- By Application

On the basis of application, the market is segmented into orthopaedics and traumatology, oncology, cardiology, and neurology. The orthopaedics and traumatology segment led the market with the highest revenue share of 32.7% in 2024, owing to the widespread use of arthroscopy and other minimally invasive procedures in musculoskeletal diagnostics and treatment. The rising geriatric population and increasing cases of orthopedic injuries are further driving procedural volumes.

The oncology segment is projected to witness the fastest growth from 2025 to 2032, due to the increased use of endoscopy for early cancer detection, biopsies, and tumor surveillance, particularly in gastrointestinal and respiratory oncology fields.

- By End Use

On the basis of end-use, the market is segmented into hospitals and clinics. The hospitals segment dominated the market with a revenue share of 67.5% in 2024, driven by the high procedural volumes, extensive infrastructure, and stringent infection control regulations in place across tertiary care centers. Hospitals typically invest in automated and integrated reprocessing systems to ensure staff efficiency and patient safety.

The clinics segment is projected to witness the fastest growth from 2025 to 2032, especially among outpatient and ambulatory surgical centers, as these settings adopt compact and cost-effective reprocessing devices to maintain hygiene standards amid rising patient footfall.

Endoscope Cleaning and Disinfecting Device Market Regional Analysis

- North America dominated the endoscope cleaning and disinfecting device market with the largest revenue share of 39.1% in 2024, supported by a well-established healthcare infrastructure, strong regulatory enforcement, and growing investments in infection control technologies, particularly in the U.S., which leads the adoption of automated endoscope reprocessors (AERs) and high-level disinfectants

- Healthcare providers in the region prioritize patient safety and operational efficiency, leading to increased investment in advanced disinfection technologies such as AERs, drying cabinets, and high-level disinfectants.

- This strong market presence is further reinforced by robust healthcare infrastructure, favorable reimbursement policies, and continuous innovation from key players focused on enhancing compliance, traceability, and workflow automation in endoscope reprocessing.

U.S. Endoscope Cleaning and Disinfecting Device Market Insight

The U.S. endoscope cleaning and disinfecting device market captured the largest revenue share of 79.6% in 2024 within North America, fueled by the high procedural volume in gastroenterology, pulmonology, and orthopedic departments. The U.S. healthcare sector’s stringent infection control regulations and rapid adoption of automated reprocessing solutions are major growth drivers. In addition, the presence of leading manufacturers and innovations in high-level disinfection and traceability technologies contribute to the market's advancement, ensuring regulatory compliance and enhanced patient safety.

Europe Endoscope Cleaning and Disinfecting Device Market Insight

The Europe endoscope cleaning and disinfecting device market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong regulatory frameworks such as MDR and heightened awareness of hospital-acquired infections. The region is witnessing increased investments in healthcare automation and a shift toward standardized reprocessing protocols. Rising surgical volumes, particularly in minimally invasive procedures, are fostering demand for efficient and automated disinfection systems across hospitals and specialty clinics.

U.K. Endoscope Cleaning and Disinfecting Device Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased government focus on infection prevention and healthcare modernization. The adoption of endoscope reprocessing systems is gaining traction across NHS hospitals and private clinics, supported by policies emphasizing patient safety and audit-ready documentation. The push for advanced, compact reprocessing units is also aligning with the demand in smaller healthcare facilities and outpatient centers.

Germany Endoscope Cleaning and Disinfecting Device Market Insight

The Germany endoscope cleaning and disinfecting device market is expected to expand at a considerable CAGR, bolstered by the country’s reputation for high healthcare standards and adoption of advanced medical technologies. Strong emphasis on automation, traceability, and eco-friendly disinfection processes is shaping the market. Hospitals and diagnostic centers are increasingly integrating smart reprocessing systems with central sterile services departments (CSSDs), reinforcing Germany’s leadership in infection control practices.

Asia-Pacific Endoscope Cleaning and Disinfecting Device Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by growing healthcare infrastructure, rising patient volumes, and heightened awareness of infection risks. Countries such as China, Japan, and India are witnessing increased adoption of AERs and high-level disinfectants due to the surge in endoscopic procedures and regulatory tightening. Government initiatives to modernize hospitals and promote patient safety are further accelerating market growth.

Japan Endoscope Cleaning and Disinfecting Device Market Insight

The Japan’s market is gaining momentum owing to its aging population, technological sophistication, and high demand for precision healthcare solutions. Hospitals in Japan prioritize infection control and are early adopters of robotic and automated endoscope reprocessing systems. The integration of AI-based monitoring, leak testing, and real-time cycle validation is becoming more common, enhancing both procedural safety and operational efficiency.

India Endoscope Cleaning and Disinfecting Device Market Insight

The India accounted for the largest market revenue share in Asia Pacific in 2024, supported by rapid urbanization, increased healthcare investments, and growing awareness of infection prevention in hospitals and clinics. The expansion of multispecialty hospitals and the rise in outpatient endoscopy centers are driving demand for affordable, compact, and efficient reprocessing solutions. Domestic production of endoscope cleaning systems and government-led quality initiatives are also propelling the market forward.

Endoscope Cleaning and Disinfecting Device Market Share

The endoscope cleaning and disinfecting device industry is primarily led by well-established companies, including:

- Bruker (U.S.)

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Hitachi Ltd. (Japan)

- Siemens Healthineers AG (Germany)

- FUJIFILM Corporation (Japan)

- PerkinElmer (U.S.)

- Clarius Mobile Health (Canada)

- Shenzhen Ricso Technology Co. Ltd. (China)

- Dramiński (Poland)

- Epica Animal Health (U.S.)

- MinXray Inc. (U.S.)

- SIUI (China)

- Sonoscape Medical Corp. (China)

- Reproscan (U.S.)

What are the Recent Developments in Global Endoscope Cleaning and Disinfecting Device Market?

- In April 2023, Olympus Corporation introduced its next-generation OER-Elite Automated Endoscope Reprocessor, enhancing reprocessing speed and efficacy while meeting global infection control standards. This launch underscores Olympus’s focus on advanced automation, helping healthcare providers improve operational efficiency and ensure consistent high-level disinfection across a range of endoscopic devices

- In March 2023, STERIS plc announced the expansion of its Revital-Ox brand portfolio with new high-level disinfectants and compatibility-tested chemistries tailored for a wide range of endoscopes. These products aim to optimize reprocessing workflows and reinforce STERIS’s commitment to safe, fast, and environmentally conscious disinfection processes across global healthcare settings

- In February 2023, Cantel Medical (a division of Steris) launched the ADVANTAGE PLUS Pass-Thru AER system in European markets, which supports high-throughput facilities with secure, one-way workflow integration between contaminated and clean zones. This innovation reflects Cantel’s focus on patient safety, process validation, and space-efficient design, responding to growing demand for seamless infection control systems

- In February 2023, Getinge AB collaborated with leading infection prevention experts to develop enhanced traceability software for endoscope reprocessing, aiming to automate compliance documentation and provide real-time monitoring of cleaning cycles. This advancement aligns with the global shift toward digital transformation in healthcare, boosting transparency and audit readiness

- In January 2023, Ecolab Inc. launched a new line of enzymatic and high-level disinfectant solutions under its EndoSuite platform, tailored to improve cleaning efficacy while reducing reprocessing time. The solutions are formulated for compatibility with major endoscope brands and reflect Ecolab’s mission to deliver integrated, data-supported hygiene systems that enhance safety and operational consistency in endoscopy units

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.