Global Energy And Nutrition Bars Market

Market Size in USD Million

CAGR :

%

USD

871.08 Million

USD

1,164.89 Million

2024

2032

USD

871.08 Million

USD

1,164.89 Million

2024

2032

| 2025 –2032 | |

| USD 871.08 Million | |

| USD 1,164.89 Million | |

|

|

|

|

Energy and Nutrition Bars Market Size

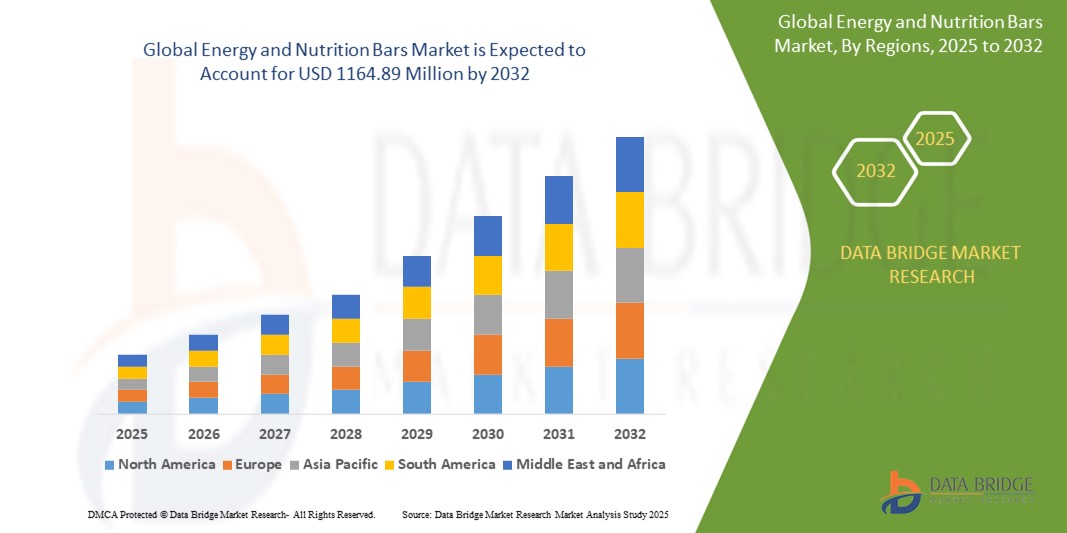

- The global energy and nutrition bars market size was valued at USD 871.08 million in 2024 and is expected to reach USD 1164.89 million by 2032, at a CAGR of 3.70% during the forecast period

- The market growth is largely fueled by increasing health consciousness and the rising demand for convenient, nutritious on-the-go snack options that fit busy lifestyles

- Furthermore, growing fitness trends, expanding consumer preference for high-protein and clean-label products, and greater availability through retail and online channels are driving widespread adoption of energy and nutrition bars, significantly boosting the industry’s expansion

Energy and Nutrition Bars Market Analysis

- Energy and nutrition bars, designed to provide functional benefits such as sustained energy, muscle recovery, and meal replacement, are increasingly popular among health-conscious consumers, athletes, and busy professionals seeking convenient and nutritious snack options

- The escalating demand for energy and nutrition bars is primarily driven by rising fitness awareness, shifting dietary habits toward high-protein and low-sugar foods, and growing interest in clean-label and plant-based formulations

- North America dominated the energy and nutrition bars market with a share of 40.5% in 2024, due to high consumer awareness of health and fitness, widespread adoption of active lifestyles, and the growing popularity of on-the-go functional snacks

- Asia-Pacific is expected to be the fastest growing region in the energy and nutrition bars market during the forecast period due to rapid urbanization, evolving dietary habits, and a surge in health awareness across emerging economies

- Conventional segment dominated the market with a market share of 72.5% in 2024, due to its widespread availability, lower price point, and familiarity among mainstream consumers. Brands in this segment benefit from established retail distribution and broader flavor and ingredient options, which cater to general nutritional needs without premium pricing

Report Scope and Energy and Nutrition Bars Market Segmentation

|

Attributes |

Energy and Nutrition Bars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Energy and Nutrition Bars Market Trends

“Increasing Health Awareness”

- A significant and accelerating trend in the global energy and nutrition bars market is the growing consumer inclination toward health-conscious eating, particularly focusing on high-protein, low-sugar, and clean-label formulations. This shift is driving innovation in bar ingredients and formats

- For instance, RXBAR emphasizes whole food ingredients such as egg whites, dates, and nuts while clearly listing them on the front label to cater to clean-eating consumers

- The rise in health awareness is also fueling the demand for bars enriched with functional ingredients such as superfoods, probiotics, and adaptogens. Brands are developing plant-based, protein-rich, and low-carb options targeting fitness enthusiasts and wellness-focused buyers

- Clean label trends and increasing scrutiny of sugar content are prompting brands to reduce artificial additives and sweeteners. Manufacturers are reformulating products to meet evolving nutritional expectations, offering options that align with keto, paleo, or gluten-free diets

- This shift toward functional and transparent nutrition is fundamentally redefining product development and marketing strategies in the sector. Brands are increasingly positioning their offerings as lifestyle-enhancing products that support wellness goals and specific dietary needs

- The demand for health-driven energy and nutrition bars is expanding rapidly across both developed and emerging markets, as consumers prioritize on-the-go nutrition that complements fitness routines, weight management, and overall well-being

Energy and Nutrition Bars Market Dynamics

Driver

“Rising Demand for Plant-Based Products”

- The increasing consumer shift toward plant-based diets, driven by health, environmental, and ethical concerns, is a significant driver for the heightened demand for energy and nutrition bars

- For instance, in February 2024, Clif Bar & Company expanded its plant-based product line with new protein bars featuring pea protein and organic ingredients, targeting consumers seeking sustainable and vegan-friendly options

- As consumers become more conscious of their food choices and actively seek alternatives to animal-based products, plant-based energy bars offer high-protein, dairy-free, and allergen-friendly formulations that appeal to a broad audience

- Furthermore, the growing popularity of vegan lifestyles and flexitarian diets is prompting manufacturers to innovate with novel plant ingredients such as nuts, seeds, legumes, and superfoods, which enhance both nutritional value and taste

- The convenience of plant-based bars as on-the-go snacks, combined with their alignment with clean-label and natural ingredient trends, is a key factor propelling their adoption in both mainstream and niche health-focused consumer segments. The rising number of product launches and targeted marketing strategies are further contributing to market growth

Restraint/Challenge

“High Cost of Ingredients”

- The high cost of sourcing premium ingredients such as plant-based proteins, organic nuts, superfoods, and functional additives poses a significant challenge to broader market penetration in the energy and nutrition bars market. These ingredients are essential for meeting consumer demand for health-focused and clean-label products, but they increase production expenses

- For instance, companies such as KIND and RXBAR use high-quality ingredients such as almonds, chia seeds, and dates, which contribute to elevated product prices and limit affordability for price-sensitive consumers

- Addressing this cost challenge through efficient sourcing strategies, supply chain optimization, and scalable production is crucial for maintaining profit margins without compromising on product quality. Leading manufacturers are exploring bulk procurement, alternative protein sources, and localized sourcing to mitigate ingredient cost volatility. In addition, the premium positioning of many nutrition bars places them at a disadvantage in cost-driven markets, where affordability is a key purchasing criterion

- While demand for healthy snacks continues to grow, price remains a significant barrier, particularly in emerging economies where lower disposable incomes constrain consumer spending. The balance between premium ingredients and competitive pricing is essential for driving mass-market acceptance

- Overcoming these challenges through ingredient innovation, strategic partnerships with suppliers, and investment in cost-effective production technologies will be vital for achieving sustainable growth in the global energy and nutrition bars market

Energy and Nutrition Bars Market Scope

The market is segmented on the basis of type, form, flavors, distribution channel, and packaging.

- By Type

On the basis of type, the energy and nutrition bars market is segmented into protein bar, cereal bar, snack bar, whole foods bar, meal replacement bar, and fiber bar. The protein bar segment dominated the largest market revenue share in 2024, driven by growing consumer interest in high-protein diets, muscle recovery, and performance enhancement, especially among fitness enthusiasts and athletes. The demand is further reinforced by busy lifestyles that increase the need for convenient, nutrient-dense snacks. Innovations in taste, texture, and plant-based protein formulations are expanding the appeal across both athletic and general consumer segments.

The snack bar segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for on-the-go snacking options that offer both flavor and moderate nutrition. With increasing preference for portion-controlled indulgence, snack bars are gaining popularity among working professionals and school-going children. The variety of ingredients and flexible positioning as mid-meal snacks contribute to their strong growth trajectory.

- By Form

On the basis of form, the energy and nutrition bars market is segmented into organic and conventional. The conventional segment held the largest market share of 72.5% in 2024 due to its widespread availability, lower price point, and familiarity among mainstream consumers. Brands in this segment benefit from established retail distribution and broader flavor and ingredient options, which cater to general nutritional needs without premium pricing.

The organic segment is anticipated to grow at the fastest CAGR of 9.2% from 2025 to 2032, fueled by increasing consumer concerns around artificial ingredients, sustainability, and clean label preferences. Health-conscious buyers are seeking products with certified organic ingredients, minimal processing, and transparent sourcing, creating strong demand, particularly in North America and Europe.

- By Flavors

On the basis of flavors, the market is segmented into chocolate flavor, fruit flavor, mixed flavors, nut flavor, caramel, peanut butter, vanilla, coconut, cookies and cream, and others. The chocolate flavor segment accounted for the largest market share in 2024, driven by its universal appeal, indulgent taste profile, and versatility across different bar types. Chocolate-based bars are often perceived as satisfying yet nutritious, making them a top consumer choice across age groups.

Mixed flavors are expected to witness the fastest growth from 2025 to 2032 due to rising demand for experiential and novel taste combinations. Manufacturers are exploring hybrid flavor innovations—such as chocolate-peanut butter or fruit-nut-caramel fusions—to differentiate their offerings and enhance repeat purchases, especially in mature markets.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into convenience stores, supermarkets/hypermarkets, online retail, specialist retailers, and others. Supermarkets/hypermarkets held the largest market revenue share of 25.5% in 2024, benefiting from high consumer footfall, shelf visibility, and the opportunity to browse various bar types and flavors. In-store promotions and bundled deals in these channels also contribute to sales growth.

Online retail is projected to experience the fastest CAGR from 2025 to 2032, owing to increased digital shopping habits, wider product availability, and the ease of comparing nutritional content and customer reviews. Subscription models and D2C platforms are further boosting online sales, particularly among millennial and Gen Z consumers seeking personalized nutrition.

- By Packaging

On the basis of packaging, the energy and nutrition bars market is segmented into wrappers and boxes. The wrappers segment dominated the market share in 2024, favored for its portability, cost-efficiency, and suitability for single-serve consumption. Most on-the-go snack bars are individually wrapped to retain freshness and convenience, aligning with consumer demand for easy, hygienic snacking.

The boxes segment is expected to grow at the fastest rate from 2025 to 2032, supported by increasing bulk purchases and multi-pack offerings from retailers and online platforms. Box packaging appeals to health-conscious households and gym-goers who prefer to stock up, and it enables attractive branding and extended shelf presence.

Energy and Nutrition Bars Market Regional Analysis

- North America dominated the energy and nutrition bars market with the largest revenue share of 40.5% in 2024, driven by high consumer awareness of health and fitness, widespread adoption of active lifestyles, and the growing popularity of on-the-go functional snacks

- The region shows strong demand for high-protein, low-sugar, and plant-based bars, with consumers favoring clean-label and organic offerings that align with wellness goals

- This robust market presence is supported by an established retail infrastructure, innovative product launches, and growing penetration of bars across gyms, convenience stores, and online platforms

U.S. Energy and Nutrition Bars Market Insight

U.S. energy and nutrition bars market captured the largest revenue share within North America in 2024, fueled by a surge in demand for functional foods that support muscle building, weight management, and energy enhancement. The presence of major brands and private labels offering a wide array of flavors and dietary formulations—such as keto, vegan, and gluten-free—has driven market expansion. Growing fitness trends, busy lifestyles, and the influence of clean-eating movements continue to stimulate demand for both mainstream and specialized nutrition bars.

Europe Energy and Nutrition Bars Market Insight

Europe energy and nutrition bars market is projected to grow at a significant CAGR over the forecast period, supported by rising consumer interest in healthy snacking alternatives and an expanding vegan and vegetarian population. Consumers across the region are shifting towards nutrient-dense, low-sugar bars as part of daily diets. Increased awareness of sports nutrition, coupled with clean-label preferences and sustainable packaging, is further fueling product innovation. Distribution is expanding through health stores, organic markets, and e-commerce platforms.

U.K. Energy and Nutrition Bars Market Insight

U.K. energy and nutrition bars market is expected to witness substantial growth, driven by the popularity of plant-based diets, gym culture, and wellness trends. Consumers are increasingly opting for bars with natural ingredients, high protein, and reduced sugar content. The strong presence of supermarkets and health-focused specialty retailers, along with growing interest in environmentally friendly packaging, is supporting market expansion. Demand from young professionals and fitness-conscious consumers is particularly influential.

Germany Energy and Nutrition Bars Market Insight

Germany energy and nutrition bars market is anticipated to expand at a steady pace, driven by rising demand for organic and functional snack products. Consumers in Germany favor bars that align with sustainable and health-conscious values, including minimal processing and locally sourced ingredients. The market benefits from strong demand across gyms, schools, and workplaces, and is witnessing a rise in private-label offerings from major retailers aiming to meet growing nutritional expectations.

Asia-Pacific Energy and Nutrition Bars Market Insight

Asia-Pacific energy and nutrition bars market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, evolving dietary habits, and a surge in health awareness across emerging economies. Increasing disposable income and the influence of Western fitness and food trends are encouraging the adoption of convenient and healthy snacking options. Expanding distribution networks and the rising number of fitness centers in countries such as China, India, and Japan are key drivers of market growth.

Japan Energy and Nutrition Bars Market Insight

Japan energy and nutrition bars market is gaining traction due to a growing health-conscious population and demand for functional, convenient foods. The market is influenced by an aging demographic, leading to increased preference for easily digestible, nutrient-rich bars. Bars with ingredients such as soy protein, green tea, and collagen are gaining popularity. Japan’s advanced retail landscape and preference for innovation in food formulation support continuous product development and premiumization.

China Energy and Nutrition Bars Market Insight

China energy and nutrition bars market accounted for the largest revenue share within Asia-Pacific in 2024, driven by growing fitness trends, government initiatives promoting healthy lifestyles, and a rising middle class with changing dietary preferences. The market is experiencing strong growth in e-commerce sales, with domestic brands offering competitive, localized products. Increasing gym memberships and interest in sports nutrition are also catalyzing demand, especially among young urban consumers seeking performance and wellness-focused snacks.

Energy and Nutrition Bars Market Share

The energy and nutrition bars industry is primarily led by well-established companies, including:

- Premier Nutrition Company, LLC (U.S.)

- Kellanova (U.S.)

- General Mills Inc. (U.S.)

- Mondelez International (U.S.)

- PepsiCo, Inc. (U.S.)

- Mars, Incorporated (U.S.)

- Verb Energy Inc. (U.S.)

- Nellson Nutraceutical, LLC (U.S.)

- Naturell India Pvt. Ltd. (U.S.)

- Your Bar Factory (Netherlands)

- SternLife GmbH & Co. KG (Germany)

- Numix Industries (France)

- EQUAL EXCHANGE UK (U.K.)

- BUILT Brands, LLC (U.S.)

- Aurora Intelligent Nutrition (Canada)

- Nutrition & Santé (France)

What are the Recent Developments in Global Energy and Nutrition Bars Market?

- In June 2023, the Seattle-based brand founded by Sahale Snacks co-founder Josh Schroeter introduced a line of bars made with just four ingredients, incorporating whole almonds, cashews, hazelnuts, peanuts, or pistachios with honey and other natural binders. This minimal-ingredient, nut-focused formulation aligns with clean-label and health-conscious trends, strengthening the brand’s position in the premium segment of the energy and nutrition bars market and appealing to consumers seeking simple, transparent, and nutrient-dense snack options

- In August 2022, Mondelez International, Inc., acquired Clif Bar & Company, expanding its global snack bar business to over USD 1 billion. This acquisition integrates Clif's popular brands such as CLIF, CLIF Kid, and LUNA with Mondelez's existing portfolio, enhancing its presence in the performance nutrition market in the United States and the United Kingdom

- In August 2021, General Mills, Inc., introduced Performance Protein bars under its Cinnamon Toast Crunch and Golden Grahams brands. These bars offer up to 20 g of protein in a 63 g bar, with reduced sugar content, targeting health-conscious consumers seeking convenient, high-protein snack options

- In April 2021, Kellogg India launched K Energy bars to tap into the 'In-between meal' segment. These bars cater to consumers looking for quick and nutritious snack options, aligning with the growing trend towards functional foods that provide sustained energy between meals

- In January 2021, Clif Bar & Company debuted CLIF BAR thins, a new thin and crispy energy snack bar available in chocolate chip, chocolate peanut brownie, and white chocolate macadamia nut flavors. Each bar contains 100 calories, 5 g of sugar, and features plant-based organic ingredients such as rolled oats, appealing to health-conscious consumers seeking lighter snack alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Energy And Nutrition Bars Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Energy And Nutrition Bars Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Energy And Nutrition Bars Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.