Global Enterprise Medical Image Viewers Market

Market Size in USD Million

CAGR :

%

USD

104.52 Million

USD

158.34 Million

2025

2033

USD

104.52 Million

USD

158.34 Million

2025

2033

| 2026 –2033 | |

| USD 104.52 Million | |

| USD 158.34 Million | |

|

|

|

|

Enterprise Medical Image Viewers Market Size

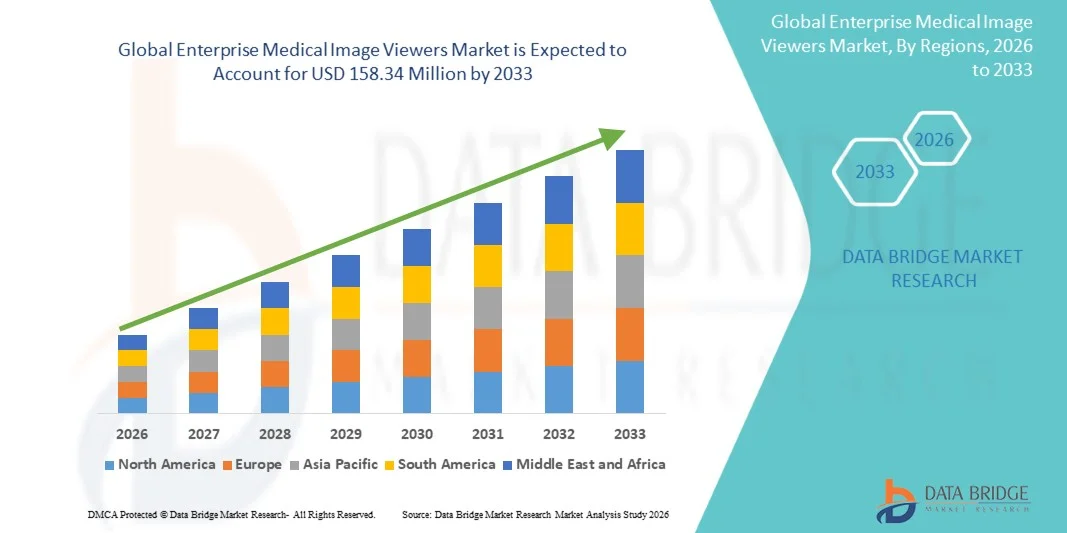

- The global enterprise medical image viewers market size was valued at USD 104.52 million in 2025 and is expected to reach USD 158.34 million by 2033, at a CAGR of 5.33% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced healthcare IT infrastructure, integration of digital imaging solutions, and rising demand for efficient, interoperable medical image access across healthcare facilities, enhancing diagnostic workflows and clinical decision‑making

- Furthermore, the growing emphasis on telemedicine, cloud‑based imaging platforms, and AI‑driven analytics is driving healthcare providers to deploy enterprise image viewers that offer secure, real‑time access to high‑resolution medical images, making them essential tools for modern diagnostic and treatment processes

Enterprise Medical Image Viewers Market Analysis

- Enterprise medical image viewers, providing centralized access and visualization of diagnostic medical images across healthcare facilities, are becoming essential components of modern healthcare IT ecosystems due to their ability to streamline clinical workflows, enhance diagnostic accuracy, and integrate seamlessly with electronic health record (EHR) systems

- The rising demand for enterprise medical image viewers is primarily driven by increasing adoption of digital imaging technologies, growing need for interoperable and secure image access, and the emphasis on improving clinical efficiency and patient outcomes through timely diagnostics

- North America dominated the enterprise medical image viewers market with the largest revenue share of 40.2% in 2025, supported by early adoption of advanced healthcare IT infrastructure, high healthcare spending, and a strong presence of leading vendors, with the U.S. witnessing significant deployment of enterprise image viewers across hospitals and imaging centers, fueled by innovations in AI-assisted image analysis and cloud-based platforms

- Asia-Pacific is expected to be the fastest-growing region in the enterprise medical image viewers market during the forecast period due to expanding healthcare infrastructure, increasing number of diagnostic centers, and rising investments in telemedicine and digital health solutions

- Software segment dominated the market with a share of 65.4% in 2025, driven by the demand for advanced analytics, cloud-based solutions, and integration capabilities with existing healthcare IT systems

Report Scope and Enterprise Medical Image Viewers Market Segmentation

|

Attributes |

Enterprise Medical Image Viewers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Enterprise Medical Image Viewers Market Trends

“Enhanced Diagnostic Efficiency Through AI and Cloud Integration”

- A significant and accelerating trend in the global enterprise medical image viewers market is the deepening integration with artificial intelligence (AI) and cloud-based platforms, enabling faster, more accurate diagnostics and real-time access to imaging data across multiple healthcare facilities

- For instance, the Aidoc AI-powered image viewer provides automated anomaly detection for radiologists, helping prioritize urgent cases and reduce workflow bottlenecks, while Sectra PACS Viewer offers cloud-based access for seamless collaboration across hospitals

- AI integration in medical image viewers enables features such as automated image analysis, anomaly detection, and predictive insights, improving clinical decision-making efficiency. For instance, some Siemens Healthineers and IBM Watson Health solutions leverage AI to highlight suspicious regions in radiology scans, reducing interpretation time and human error

- Cloud integration facilitates secure, centralized access to medical images from multiple locations, allowing clinicians to view, share, and annotate images without relying on on-site servers, improving telemedicine and remote consultation capabilities

- The trend towards more intelligent, collaborative, and cloud-enabled imaging platforms is reshaping expectations in healthcare IT. Consequently, companies such as Philips and GE Healthcare are developing AI-enabled image viewers with predictive analytics and cloud-based accessibility to enhance clinical workflows

- The demand for enterprise medical image viewers with AI and cloud integration is growing rapidly across hospitals and diagnostic centers, as healthcare providers prioritize faster diagnosis, interoperability, and streamlined collaboration

- Growing patient-centric care initiatives are encouraging hospitals to adopt image viewers that allow secure patient access to their diagnostic images, fostering engagement and transparency in healthcare delivery

Enterprise Medical Image Viewers Market Dynamics

Driver

“Growing Demand Due to Rising Diagnostic Workload and Digital Health Adoption”

- The increasing prevalence of complex diagnostic cases and growing adoption of digital health technologies is a significant driver for the heightened demand for enterprise medical image viewers

- For instance, in March 2025, Sectra announced enhancements to its PACS and cloud-based imaging solutions to support remote diagnostics for multi-site hospital networks, driving market adoption

- As healthcare providers face increasing workloads and the need for rapid image analysis, enterprise viewers offer advanced features such as AI-assisted diagnostics, automated reporting, and centralized image management, improving efficiency

- Furthermore, the growing emphasis on telemedicine, remote consultations, and interoperable healthcare IT systems is making image viewers an essential tool, enabling seamless integration with EHRs and other hospital IT systems

- The convenience of remote access, collaborative review of high-resolution images, and secure multi-user capabilities are key factors propelling adoption among hospitals, radiology centers, and diagnostic labs, further accelerated by the availability of user-friendly, cloud-enabled solutions

- Increasing government initiatives and funding to digitize healthcare infrastructure, particularly in emerging markets, are accelerating the deployment of enterprise medical image viewers

- Rising awareness among healthcare providers about the benefits of AI-assisted diagnostics in reducing errors and improving patient outcomes is boosting adoption rates across advanced and mid-tier hospitals

Restraint/Challenge

“Data Security Concerns and High Implementation Costs”

- Concerns surrounding data privacy, cybersecurity vulnerabilities, and compliance with healthcare regulations pose significant challenges to broader market adoption, as enterprise image viewers store sensitive patient information digitally

- For instance, reports of vulnerabilities in PACS and cloud-based medical imaging systems have made some healthcare providers hesitant to fully deploy these solutions across multiple sites

- Addressing these security concerns through robust encryption, secure access controls, and HIPAA/GDPR compliance is crucial for building trust. Companies such as Philips and Sectra emphasize their secure data handling and compliance measures to reassure clients

- In addition, the high initial investment for advanced AI-enabled or cloud-based viewers, coupled with ongoing maintenance costs, can be a barrier for smaller hospitals and clinics, particularly in developing regions or budget-constrained facilities

- While prices are gradually becoming more competitive, the perceived premium for advanced enterprise imaging solutions may limit adoption among institutions that do not see an immediate ROI, making cybersecurity, cost-efficiency, and user training critical for sustained growth

- Limited IT infrastructure and insufficient technical expertise in smaller hospitals or rural healthcare centers can hinder deployment and adoption of sophisticated enterprise image viewers

- Resistance to change among clinicians accustomed to traditional imaging workflows can slow implementation, requiring comprehensive training and change management initiatives

Enterprise Medical Image Viewers Market Scope

The market is segmented on the basis of components and end users.

- By Components

On the basis of components, the enterprise medical image viewers market is segmented into hardware and software. The software segment dominated the market with the largest market revenue share of 65.4% in 2025, driven by the increasing reliance on advanced analytics, AI-powered diagnostic tools, and cloud-enabled platforms. Software solutions offer interoperability with hospital IT systems, including PACS and EHR, which enables centralized access and streamlined workflows. Hospitals and diagnostic centers increasingly prefer software solutions for their scalability, flexibility, and ease of updates, which help integrate new features without additional hardware investment. The software segment also benefits from rising telemedicine adoption, allowing clinicians to access medical images remotely. In addition, continuous enhancements in AI and machine learning capabilities have made software-driven viewers essential for early detection, predictive analysis, and improved clinical decision-making. Strong vendor focus on user-friendly interfaces and customizable dashboards further consolidates the software segment’s dominance.

The hardware segment is anticipated to witness the fastest growth rate of 14% from 2026 to 2033, fueled by the need for high-resolution displays, dedicated workstations, and imaging servers in hospitals and large diagnostic centers. Advanced hardware ensures better image rendering, reduces latency, and supports 3D visualization, which is critical for complex diagnostics. Growing demand for on-site PACS servers and secure storage solutions is driving the expansion of the hardware segment. Hospitals in emerging markets are increasingly investing in hardware upgrades to support AI-assisted software applications. Hardware improvements also enhance clinician experience by providing ergonomically designed workstations with dual-monitor setups for multi-modality image viewing. Moreover, the rising adoption of integrated imaging suites combining hardware and software components contributes to the accelerated growth of the hardware segment.

- By End Users

On the basis of end users, the enterprise medical image viewers market is segmented into doctors, surgeons, and other medical professionals. The doctors segment held the largest market revenue share of 50% in 2025, owing to the crucial role physicians play in daily diagnostics and patient care. Doctors rely heavily on enterprise image viewers to access, analyze, and interpret diagnostic images for accurate decision-making. Integration with EHRs and collaborative features allows doctors to review images remotely, improving patient care efficiency. The segment benefits from the increasing adoption of AI-assisted tools for prioritizing cases and identifying anomalies, enabling doctors to optimize workflow. High demand for secure and reliable access to imaging data also contributes to the dominance of this segment. In addition, hospitals and clinics prioritize doctor-focused interfaces with annotation, measurement, and reporting capabilities, making these viewers indispensable.

The surgeons and other medical professionals segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing demand for pre-operative planning, intraoperative imaging, and multidisciplinary collaboration. Enterprise medical image viewers allow surgeons to visualize high-resolution 3D images, enhancing surgical precision and outcomes. Integration with cloud-based systems enables real-time sharing with anesthesiologists, radiologists, and other specialists during procedures. The rise of minimally invasive and robotic surgeries further boosts the need for advanced imaging tools. In addition, the segment growth is supported by increasing awareness among allied health professionals about the benefits of collaborative diagnostics. Hospitals are investing in tailored solutions for surgical teams to facilitate rapid image access and team-based treatment planning.

Enterprise Medical Image Viewers Market Regional Analysis

- North America dominated the enterprise medical image viewers market with the largest revenue share of 40.2% in 2025, supported by early adoption of advanced healthcare IT infrastructure, high healthcare spending, and a strong presence of leading vendors, with the U.S. witnessing significant deployment of enterprise image viewers across hospitals and imaging centers, fueled by innovations in AI-assisted image analysis and cloud-based platforms

- Healthcare providers in the region increasingly rely on enterprise image viewers for faster, accurate diagnostics, remote consultations, and streamlined workflows across hospitals and diagnostic centers

- This widespread adoption is further supported by the integration of AI-assisted diagnostic tools, cloud-based imaging platforms, and high interoperability with EHR and PACS systems, establishing enterprise image viewers as essential solutions for hospitals, radiology centers, and clinics

U.S. Enterprise Medical Image Viewers Market Insight

The U.S. enterprise medical image viewers market captured the largest revenue share of 82% in North America in 2025, fueled by the rapid adoption of advanced healthcare IT infrastructure and AI-enabled imaging solutions. Healthcare providers increasingly prioritize faster and more accurate diagnostics, remote consultations, and seamless integration with EHR and PACS systems. The growing emphasis on telemedicine and hospital network interoperability further propels market growth. In addition, strong government initiatives supporting digital health adoption, coupled with high healthcare spending and a tech-savvy clinical workforce, significantly contribute to market expansion.

Europe Enterprise Medical Image Viewers Market Insight

The Europe enterprise medical image viewers market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent healthcare regulations and the growing need for efficient and interoperable diagnostic solutions. Increasing investments in digital health infrastructure and PACS systems are fostering adoption across hospitals and diagnostic centers. European healthcare providers are also motivated by improved workflow efficiency, collaborative diagnostics, and patient care optimization. The region witnesses strong growth in both public and private hospitals, with viewers being integrated into new hospital setups as well as modernization projects.

U.K. Enterprise Medical Image Viewers Market Insight

The U.K. enterprise medical image viewers market is expected to grow at a noteworthy CAGR during the forecast period, driven by the digital transformation of the healthcare sector and increasing demand for accurate, real-time imaging solutions. The emphasis on improving patient outcomes and reducing diagnostic errors is encouraging hospitals and clinics to adopt advanced enterprise viewers. The U.K.’s robust healthcare IT framework, coupled with a focus on telemedicine and cross-institutional image sharing, is supporting market growth. In addition, government-led initiatives for healthcare digitization and strong adoption of cloud-based platforms continue to stimulate demand.

Germany Enterprise Medical Image Viewers Market Insight

The Germany enterprise medical image viewers market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of digital healthcare solutions and the increasing focus on high-quality diagnostic services. Well-developed hospital infrastructure, technological innovation, and compliance with strict healthcare regulations drive adoption. Germany is witnessing a growing integration of AI-enabled viewers and cloud-based solutions, supporting efficient collaboration between radiologists, surgeons, and other specialists. Healthcare providers are increasingly investing in solutions that enhance patient safety, reduce diagnostic delays, and enable secure multi-location access.

Asia-Pacific Enterprise Medical Image Viewers Market Insight

The Asia-Pacific enterprise medical image viewers market is poised to grow at the fastest CAGR of 24% during the forecast period, driven by increasing healthcare infrastructure investments, rising adoption of digital imaging solutions, and government initiatives promoting telemedicine. Countries such as China, Japan, and India are rapidly expanding their diagnostic facilities, creating strong demand for enterprise viewers. The rise of multi-hospital networks and cloud-based imaging platforms facilitates cross-location collaboration and remote diagnostics. Moreover, affordability, technological awareness, and training initiatives in APAC are accelerating adoption among both public and private healthcare providers.

Japan Enterprise Medical Image Viewers Market Insight

The Japan enterprise medical image viewers market is gaining momentum due to the country’s advanced healthcare IT infrastructure, high adoption of AI-assisted diagnostics, and demand for precise imaging in complex procedures. The integration of enterprise viewers with PACS, EHR, and other hospital systems supports efficient patient care and interdisciplinary collaboration. Rapid urbanization, telemedicine growth, and a focus on minimally invasive surgeries further fuel market adoption. In addition, Japan’s aging population drives the need for faster and more reliable imaging solutions in both hospitals and outpatient diagnostic centers.

India Enterprise Medical Image Viewers Market Insight

The India enterprise medical image viewers market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, increasing number of diagnostic centers, and growing adoption of digital health technologies. India is witnessing rising demand for efficient imaging solutions in both urban hospitals and rural clinics. Government initiatives such as digital health missions, the push for smart hospitals, and increasing telemedicine penetration are key factors driving growth. The availability of cost-effective enterprise viewers, combined with rising awareness among healthcare professionals, further supports market expansion.

Enterprise Medical Image Viewers Market Share

The Enterprise Medical Image Viewers industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- Agfa HealthCare (Belgium)

- INFINITT Healthcare (South Korea)

- Intelerad Medical Systems (Canada)

- Merative (Merge Imaging) (U.S.)

- McKesson Corporation (U.S.)

- Mach7 Technologies (Australia)

- Novarad (U.S.)

- Sectra AB (Sweden)

- Hyland Software, Inc. (U.S.)

- Carestream Health (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- TeraRecon, Inc. (U.S.)

- Ambra Health (U.S.)

- PaxeraHealth (U.S.)

- Kofax, Inc. (U.S.)

- Zebra Medical (Israel)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

What are the Recent Developments in Global Enterprise Medical Image Viewers Market?

- In November 2025, Royal Philips introduced Philips Image Management 15, a new evolution of its Vue PACS platform featuring a zero‑footprint, web‑based diagnostic viewer that delivers full radiology capabilities via a standard web browser and integrates advanced AI and interactive reporting tools, improving accessibility and workflow efficiency across the enterprise

- In November 2025 at RSNA, Visage Imaging (Pro Medicus) unveiled enhancements to its Visage 7 Enterprise Imaging Platform, spotlighting AI‑optimized workflow prioritization, cloud support, digital pathology viewing, and expanded collaborative features that reinforce a unified enterprise viewer for imaging and clinical data

- In November 2024, Mach7 Technologies introduced UnityVue and other imaging informatics innovations aimed at next‑generation radiology viewing and enterprise diagnostics, enhancing cloud‑based viewing, interoperability, and real‑time access for clinical teams

- In October 2024, GE HealthCare announced a new offering aimed at accelerating the adoption of artificial intelligence within its enterprise imaging solutions, enabling more intelligent interpretation assistance, enhanced workflow optimization, and deeper integration of AI capabilities into imaging review processes

- In November 2021 at HIMSS, multiple vendors demonstrated revamped PACS and enterprise imaging viewers with improved speeds, deeper integration with vendor neutral archives (VNAs), zero‑footprint viewing for radiologists and physicians, and tighter AI/third‑party application support, indicating early market momentum toward modern enterprise image access

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.