Global Entry Level Smartphones Market

Market Size in USD Billion

CAGR :

%

USD

769.20 Billion

USD

1,036.62 Billion

2024

2032

USD

769.20 Billion

USD

1,036.62 Billion

2024

2032

| 2025 –2032 | |

| USD 769.20 Billion | |

| USD 1,036.62 Billion | |

|

|

|

|

Entry-Level Smartphones Market Size

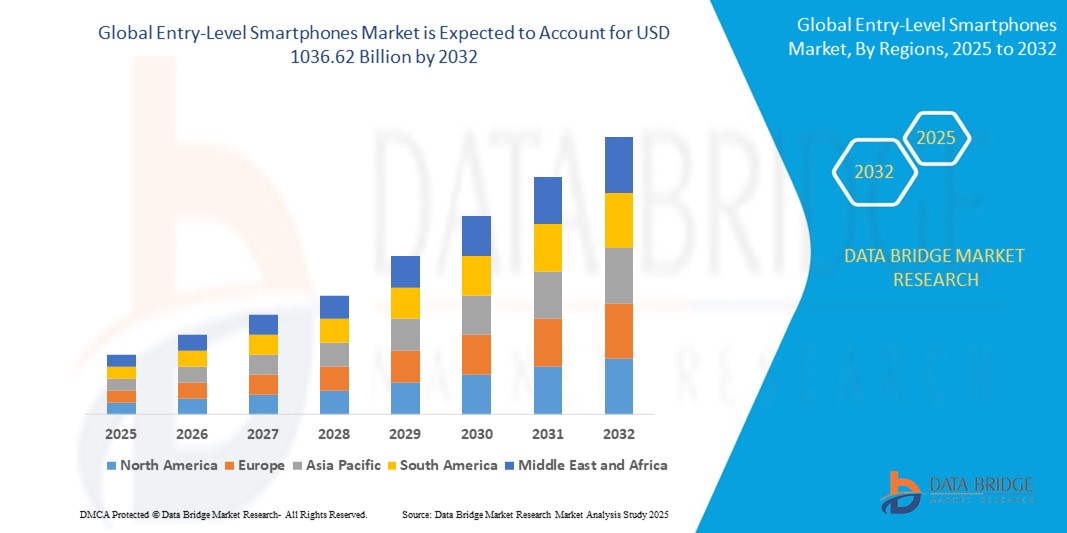

- The global entry-level smartphones market was valued at USD 769.2 billion in 2024 and is expected to reach USD 1,036.62 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.80% primarily driven by the increasing demand for affordable mobile technology in emerging economies

- This growth is driven by factors such as the rising internet penetration, expanding digital payment infrastructure, and growing youth population seeking budget-friendly smart devices

Entry-Level Smartphones Market Analysis

- Entry-level smartphones are affordable, basic mobile devices designed to offer essential features such as calling, texting, and light internet usage, targeting budget-conscious consumers.

- The entry-level smartphone market is witnessing a downturn, as seen in 2024 when several brands reduced their focus on this segment

- For instance, companies such as Lava and Itel faced inventory build-up due to slower sales in the under-budget category

- Many buyers are now choosing mid-range phones over entry-level devices, drawn by better features and offers

- For instance, models such as the Redmi Note 13 and Realme Narzo series are priced just above the entry-level bracket but offer significantly better value

- Supply chain constraints and rising component prices have impacted production planning. Brands such as Samsung and Xiaomi have publicly stated they are allocating more resources to mid-tier and flagship lines

- The rise of refurbished and second-hand smartphones is also affecting the new entry-level market. Platforms such as Cashify and Flipkart’s Renewed section are seeing increased traction among price-conscious users

- New launches in the entry-level range are becoming rare. In 2024, there were fewer sub-category devices introduced by top manufacturers, showing a slowdown in this segment’s innovation cycle

Report Scope and Entry-Level Smartphones Market Segmentation

|

Attributes |

Entry-Level Smartphones Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Entry-Level Smartphones Market Trends

“Increasing Shift of Consumers Toward Refurbished and Second-Hand Smartphones”

- The increasing shift toward refurbished and second-hand smartphones is evident as more consumers opt for better value at lower prices, with platforms such as Cashify and Flipkart’s Renewed section seeing higher demand for pre-owned devices, particularly in India, where a growing number of buyers prefer budget-friendly options

- Consumers are increasingly choosing refurbished models from top brands such as Apple, Samsung, and Xiaomi, attracted by better specifications and performance at a fraction of the price of new entry-level smartphones

- For instance, older iPhone models such as the iPhone 11 and Samsung Galaxy S10 are in high demand in the second-hand market

- The growing popularity of refurbished devices is pushing major retailers to expand their offerings, with brands such as Amazon and Best Buy now providing certified pre-owned options with warranties, such as Amazon’s “Renewed” program, which offers refurbished phones with a one-year warranty for peace of mind

- Many first-time smartphone users are opting for second-hand phones rather than new budget models, as seen in the increasing sales of older iPhone models in emerging markets such as India, where refurbished phones provide a reliable and affordable alternative to new entry-level models

- This trend is not only cost-effective but also environmentally friendly, as it helps reduce electronic waste, aligning with the increasing focus on sustainability in the tech industry

- For instance, Apple’s trade-in and recycling programs have allowed millions of devices to be refurbished and reused, helping to reduce waste while offering more affordable options to consumers

Entry-Level Smartphones Market Dynamics

Driver

“Increasing Demand for Affordable Mobile Technology”

- One key driver of the entry-level smartphone market is the increasing demand for affordable mobile technology, particularly in emerging markets

- For instance, India, where over 300 million people are expected to purchase smartphones by 2025, with a significant portion opting for budget-friendly models under $100, such as the Xiaomi Redmi 9 and Realme C15

- In regions such as sub-Saharan Africa, where economic conditions limit consumer purchasing power, entry-level smartphones are becoming increasingly popular for their ability to provide essential services such as internet access, mobile banking, and social media usage at an affordable price

- For instance, the Tecno Spark 7, which offers key features at a low cost

- The rise of 4G and 5G-enabled entry-level smartphones is also driving market demand, offering improved connectivity and data speeds at a lower price than high-end models

- For instance, as seen with brands such as Xiaomi and Realme launching affordable 5G smartphones such as the Redmi Note 10 5G and Realme Narzo 30 5G, bringing advanced features to budget-conscious consumers

- The affordability of entry-level smartphones is playing a significant role in bridging the digital divide, particularly in developing countries such as India, where smartphones are crucial for access to education, online banking, and government services, with devices such as the Samsung Galaxy A02 and Micromax in Note 1 offering solutions at accessible price points

- Companies such as Xiaomi, Realme, and Samsung are capitalizing on this growing demand by introducing feature-rich, budget-friendly smartphones, with models such as the Samsung Galaxy A02 and Xiaomi Redmi 9 proving popular due to their performance and affordability, making technology accessible to a larger audience in cost-sensitive regions

Opportunity

“Increasing Adoption of 5G Connectivity in Budget Devices”

- One significant opportunity in the entry-level smartphone market is the increasing adoption of 5G connectivity in budget devices. As 5G technology becomes more accessible, manufacturers can offer affordable devices supporting 5G networks

- For instance, Realme Narzo 30 5G allows consumers to experience 5G at a budget price, making it an attractive option for users seeking affordable future-proof devices

- The introduction of cost-effective 5G smartphones is expanding market reach in regions where 4G adoption is already high. India, with its expanding 5G infrastructure, has seen increased demand for budget-friendly 5G devices such as Xiaomi’s Redmi Note 10 5G, which caters to price-sensitive consumers while offering the latest technology

- Brands such as Xiaomi and Realme are already launching affordable 5G smartphones, such as the Redmi Note 10 5G and Realme Narzo 30 5G. This shift is helping brands tap into markets such as Brazil, where mobile internet usage is rapidly growing, and consumers are eager to adopt the latest 5G technology at a lower price

- The growing internet usage and data consumption in emerging markets present a major opportunity for affordable 5G smartphones

- For instance, India’s push for digital transformation is driving more consumers to adopt smartphones such as the Samsung Galaxy M32, which offers a mix of affordability and functionality for new users in these markets

- The cost reduction of 5G chips from companies such as MediaTek and Qualcomm is also fueling this trend, allowing brands such as Xiaomi to keep 5G smartphone prices low. Xiaomi’s Redmi Note 10 5G, powered by the MediaTek Dimensity 700, is an instance of how affordable 5G devices are being made accessible to budget-conscious buyers

Restraint/Challenge

“Increasing Cost of Manufacturing”

- A key challenge in the entry-level smartphone market is the increasing cost of manufacturing due to rising component prices and supply chain disruptions

- For instance, the global semiconductor shortage, which has affected industries worldwide, led to delays and higher production costs for companies such as Xiaomi and Samsung in 2021, making it difficult for them to keep budget-friendly models such as the Xiaomi Redmi 9 available in large quantities

- The shortage of critical components such as chips and displays has increased production costs, directly impacting the price of entry-level smartphones

- For instance, Samsung and Xiaomi had to adjust their production schedules and raise the prices of certain models, such as the Samsung Galaxy A12, due to supply chain challenges, which ultimately made these phones less affordable for price-sensitive consumers

- These increased costs are especially challenging for brands that rely on razor-thin profit margins in the entry-level market. As a result, some manufacturers have been forced to either raise prices or compromise on the quality of components, such as using lower-quality displays or processors in models such as the Realme C12, which can affect the user experience

- In addition, the growing demand for better features, such as better cameras, faster processors, and larger batteries, is putting pressure on manufacturers to include these in entry-level devices. However, integrating advanced features while keeping prices affordable has proven to be difficult, as seen with the trade-offs in models such as the Xiaomi Redmi 9A, which offers basic functionality but lacks the advanced performance of higher-end smartphones

- Manufacturers are under pressure to innovate within these constraints while facing stiff competition from both established players such as Samsung and new entrants such as Micromax, which is trying to capture market share with affordable but feature-packed smartphones, such as the Micromax in Note 1

Entry-Level Smartphones Market Scope

The market is segmented on the basis of camera, ram size, screen size, purpose, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Camera |

|

|

By RAM Size |

|

|

By Screen Size |

|

|

By Purpose |

|

|

By Distribution Channel |

|

Entry-Level Smartphones Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Entry-Level Smartphones Market”

- The Asia-Pacific region is the dominating market for entry-level smartphones, holding a significant share of global sales

- The region benefits from a large and diverse population, particularly in countries such as India, China, and Indonesia, where mobile technology has become a vital part of daily life

- Entry-level smartphones in these areas are essential tools for communication, education, and accessing digital services, especially in rural and underserved populations

- Xiaomi, Samsung, and Realme have capitalized on this demand by offering affordable devices with essential features for price-conscious consumers

- The expanding availability of 4G and 5G networks in these countries has further accelerated smartphone adoption, increasing the region's dominance in the global market

- As more consumers in the Asia-Pacific region seek affordable ways to stay connected, the region continues to lead in market share and volume within the entry-level smartphone segment

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is both the dominating and fastest-growing market for entry-level smartphones

- The region’s large and diverse population, especially in countries such as India, China, and Indonesia, makes it the key player in global smartphone sales

- Mobile technology in these regions is crucial for communication, education, and digital services, driving high demand for affordable smartphones

- Xiaomi, Samsung, and Realme have successfully targeted this market by offering budget-friendly devices that cater to price-sensitive consumers

- The rapid rollout of 4G and 5G networks has further accelerated smartphone adoption, contributing to Asia-Pacific's leadership in both sales volume and market growth

- The expanding middle class and increased internet penetration, especially in India and Southeast Asia, continue to fuel the region’s growth, solidifying its position as both the dominant and fastest-growing market for entry-level smartphones

Entry-Level Smartphones Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Xiaomi (China)

- Samsung (South Korea)

- Realme (China)

- Oppo (China)

- Vivo (China)

- Motorola (U.S.)

- Huawei (China)

- Nokia (Finland)

- Infinix (China)

- Itel (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Entry Level Smartphones Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Entry Level Smartphones Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Entry Level Smartphones Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.