Global Epigenetics Based Kits Market

Market Size in USD Billion

CAGR :

%

USD

19.55 Billion

USD

51.60 Billion

2025

2033

USD

19.55 Billion

USD

51.60 Billion

2025

2033

| 2026 –2033 | |

| USD 19.55 Billion | |

| USD 51.60 Billion | |

|

|

|

|

Epigenetics-Based Kits Market Size

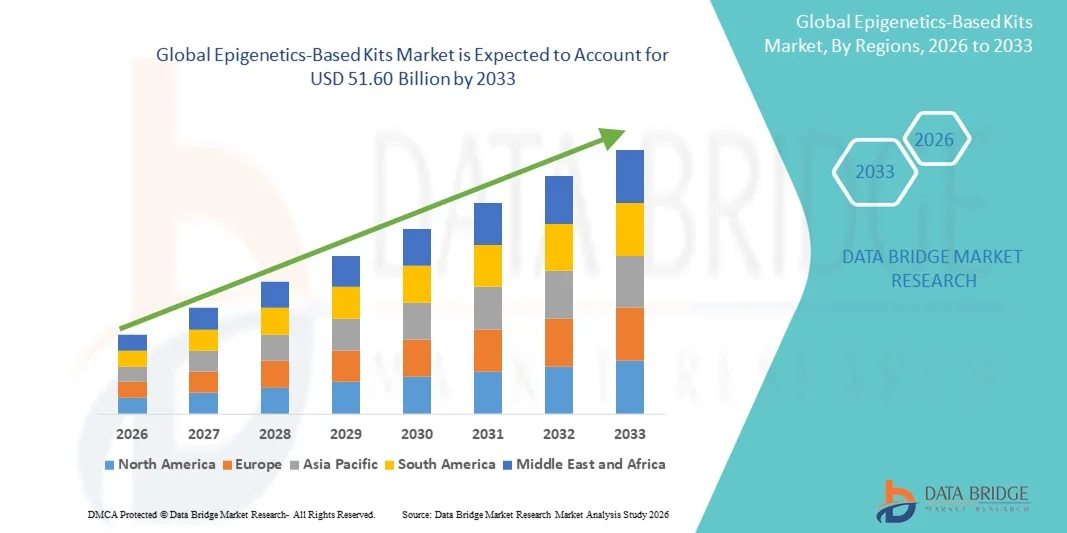

- The global eigenetics-based kits market size was valued at USD 19.55 billion in 2025 and is expected to reach USD 51.60 billion by 2033, at a CAGR of 12.90% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in genomics and molecular biology research, leading to increased demand for precise and high-throughput epigenetic analysis in both academic and pharmaceutical sectors

- Furthermore, rising focus on personalized medicine, biomarker discovery, and epigenetic-based drug development is accelerating the uptake of Epigenetics-Based Kits solutions, thereby significantly boosting the industry's growth

Epigenetics-Based Kits Market Analysis

- Epigenetics-Based Kits, encompassing reagents and assay kits for DNA methylation, histone modification, non-coding RNA analysis, and chromatin structure studies, are increasingly essential tools in both academic research and pharmaceutical development due to their ability to enable precise, high-throughput epigenetic profiling

- The rising adoption of epigenetic biomarkers in drug discovery, personalized medicine, and disease diagnostics is driving demand for advanced kits that provide reproducible and scalable results

- North America dominated the epigenetics-based kits market with the largest revenue share of approximately 44% in 2025, supported by the presence of leading life science research institutions, a strong pharmaceutical and biotechnology sector, and high investment in epigenetics research

- Asia-Pacific is expected to be the fastest-growing region in the epigenetics-based kits market, projected to expand at a CAGR from 2026 to 2033, driven by rapid investments in genomics and personalized medicine initiatives

- The Bisulfite Conversion Kit segment dominated the largest market revenue share of 38.5% in 2025, driven by its extensive application in DNA methylation studies, which are critical for understanding gene regulation and epigenetic modifications in cancer, developmental biology, and other disease areas

Report Scope and Epigenetics-Based Kits Market Segmentation

|

Attributes |

Epigenetics-Based Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Illumina, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Epigenetics-Based Kits Market Trends

Growing Adoption of Advanced Epigenetic Analysis Kits

- A key trend in the global Epigenetics-Based Kits market is the increasing adoption of advanced kits for DNA methylation, histone modification, chromatin structure, and RNA-based analyses. These kits are becoming essential tools for research in oncology, developmental biology, immunology, and drug discovery

- For instance, companies like Zymo Research and Active Motif are offering comprehensive DNA methylation and histone modification kits, enabling researchers to streamline workflows and obtain reliable, reproducible results

- Researchers are increasingly focusing on high-throughput and automation-compatible kits to accelerate experimental timelines while maintaining accuracy

- The trend also includes the integration of kits with next-generation sequencing (NGS) and quantitative PCR (qPCR) workflows, allowing for more detailed epigenomic profiling

- In addition, the rising need for kits that support reproducibility and standardization in academic and pharmaceutical research is driving market adoption

- The market is witnessing growth in multi-functional kits that can be applied across multiple sample types, including tissue, blood, and cell cultures, making them versatile for diverse research applications

- Overall, the shift toward more user-friendly, high-sensitivity, and comprehensive epigenetics kits is reshaping research practices and expectations

Epigenetics-Based Kits Market Dynamics

Driver

Rising Investment in Genomics and Epigenetics Research

- The growing investment by governments, academic institutions, and pharmaceutical companies in genomics and epigenetics research is a primary driver of market growth

- For instance, in 2025, the National Institutes of Health (NIH) in the U.S. allocated increased funding for epigenomics projects, supporting the widespread adoption of commercial epigenetics kits

- Pharmaceutical and biotechnology companies are leveraging these kits to study disease mechanisms, identify novel drug targets, and support precision medicine initiatives

- The increasing prevalence of cancer, autoimmune disorders, and other chronic diseases is driving demand for epigenetic profiling tools that can aid in diagnostics and treatment research

- Academic and research institutions are adopting epigenetics kits for large-scale studies, enabling comprehensive analysis of gene regulation and epigenomic patterns

- The development of new kits with higher sensitivity, broader applicability, and compatibility with advanced instrumentation further propels market growth

- As awareness of epigenetics’ role in disease mechanisms expands, the demand for robust, reliable kits continues to rise across the globe

Restraint/Challenge

High Costs and Technical Complexity

- One of the key challenges for the Epigenetics-Based Kits market is the high cost of advanced kits, particularly those compatible with high-throughput sequencing or requiring multiple reagents

- For instance, premium histone modification or methylation kits from established suppliers can be cost-prohibitive for smaller academic labs or emerging biotechnology companies

- Technical complexity and the need for specialized training in handling sensitive biological samples pose additional barriers to adoption

- Inconsistent sample quality and the requirement for strict laboratory conditions can affect reproducibility and reliability, discouraging some potential users

- The limited availability of standardized protocols for newer kits can also slow adoption in multi-center or collaborative studies

- While prices are gradually decreasing and kit designs are becoming more user-friendly, smaller labs and institutions may still face budgetary constraints

- Addressing these challenges through cost-effective kit development, improved training, and simplified protocols is critical for broader adoption and sustained market growth

Epigenetics-Based Kits Market Scope

The market is segmented on the basis of product, technology, application, and end-user.

- By Product

On the basis of product, the Epigenetics-Based Kits market is segmented into Bisulfite Conversion Kit, Chip Sequencing Kit, Deep Sequencing Kit, Whole Genome Amplification Kit, RNA Sequencing Kit, Immunoprecipitation Kit, 5-HMC and 5-MC Analysis Kit, and Others. The Bisulfite Conversion Kit segment dominated the largest market revenue share of 38.5% in 2025, driven by its extensive application in DNA methylation studies, which are critical for understanding gene regulation and epigenetic modifications in cancer, developmental biology, and other disease areas. These kits are highly valued for their precision, reproducibility, and compatibility with high-throughput workflows, enabling accurate analysis of multiple sample types including blood, tissue, and cultured cells. Academic and clinical researchers rely heavily on these kits for biomarker discovery and mechanistic studies, while pharmaceutical and biotechnology companies use them for drug development and epigenetic profiling. The segment benefits from widespread adoption of automated workflows, user-friendly protocols, and strong support from key kit manufacturers globally. The versatility and robustness of bisulfite kits further cement their leadership, ensuring consistent demand across regions.

The RNA Sequencing Kit segment is expected to witness the fastest CAGR of 14.2% from 2026 to 2033, driven by the rapidly increasing demand for transcriptomic analysis in developmental biology, oncology, immunology, and personalized medicine. RNA sequencing kits allow high-resolution analysis of gene expression, regulatory RNAs, and non-coding RNA elements, providing insights into cellular processes and disease mechanisms. The segment is fueled by technological advancements that enhance sensitivity, reduce sample input requirements, and enable high-throughput workflows compatible with next-generation sequencing (NGS) platforms. Increasing academic and industrial research focusing on RNA biology, microRNA modifications, and epigenetic regulation further drives growth. The growing number of publications, collaborations between research institutes and pharmaceutical companies, and adoption in biomarker discovery pipelines enhance market expansion. Continuous innovation, integration with bioinformatics tools, and rising awareness of RNA-based diagnostics are supporting the segment’s accelerated growth trajectory globally.

- By Technology

On the basis of technology, the market is segmented into DNA Methylation, Histone Methylation, Histone Acetylation, Large Non-Coding RNA, MicroRNA Modification, and Chromatin Structures. The DNA Methylation segment held the largest market revenue share of 41% in 2025, driven by its fundamental role in regulating gene expression, identifying disease-associated epigenetic markers, and developing diagnostics and therapeutics. DNA methylation analysis is central to oncology research, developmental biology studies, and drug discovery programs. The segment benefits from high adoption in both academic and industrial research, with kits offering high precision, automation, and compatibility with multiple sample types. Strong R&D investments, increasing collaborations among universities, research institutes, and pharmaceutical companies, and the growing demand for biomarker validation across disease studies further consolidate its leadership. DNA methylation kits are widely recognized for reproducibility, scalability, and integration with other omics technologies, ensuring consistent and long-term market dominance.

The MicroRNA Modification segment is expected to witness the fastest CAGR of 13.5% from 2026 to 2033, driven by the expanding recognition of microRNAs as key regulators of gene expression in cancer, neurological disorders, and immunology. MicroRNA modification kits enable the study of miRNA biogenesis, regulatory mechanisms, and their potential as diagnostic and therapeutic targets. Rising academic and pharmaceutical research on miRNA-based therapeutics, increased awareness of non-coding RNA biology, and growing interest in precision medicine applications are major drivers. The segment is further supported by the availability of high-sensitivity kits compatible with NGS and RT-qPCR platforms, allowing accurate quantification and profiling. Increasing collaborations between biotech companies and academic research centers, along with the rising number of clinical studies involving miRNA, contribute to its rapid expansion. The segment’s innovative workflows, ease of integration, and growing adoption in multi-disciplinary research support its accelerated CAGR.

- By Application

On the basis of application, the market is segmented into Oncology, Non-Oncology, Developmental Biology, Drug Discovery, and Others. The Oncology segment accounted for the largest market revenue share of 45% in 2025, driven by the high demand for epigenetic profiling in cancer diagnostics, prognosis, and therapeutic research. Oncology applications rely heavily on epigenetics-based kits for analyzing DNA methylation patterns, histone modifications, and non-coding RNA regulation. The segment benefits from extensive academic and pharmaceutical research, increasing prevalence of cancer globally, and the critical need for biomarker identification. Pharmaceutical companies extensively use these kits for drug target validation, clinical trial research, and developing personalized treatment strategies. The availability of high-throughput, reliable, and automated kits further strengthens segment dominance. Continuous advancements in cancer epigenomics, government research funding, and collaborations among research institutions ensure sustained leadership of the oncology application segment.

The Drug Discovery segment is projected to witness the fastest CAGR of 12.8% from 2026 to 2033, fueled by the growing adoption of epigenetics kits to identify novel drug targets, evaluate therapeutic efficacy, and support biomarker development. This growth is driven by rising investments in pharmaceutical R&D, expansion of biotech companies, and increasing focus on precision medicine. Drug discovery applications benefit from high-throughput kits that streamline workflows, reduce experimental variability, and allow multi-sample processing. Increasing collaborations between academia and industry, growing pharmaceutical pipelines targeting epigenetic regulators, and advancements in multi-omics integration are key factors propelling the segment. Continuous innovations and the development of user-friendly, reproducible kits enhance the adoption of drug discovery applications globally.

- By End-User

On the basis of end-user, the market is segmented into Academic and Research Institutes, Pharmaceutical Companies, Biotechnology Companies, and Contract Research Organizations (CROs). Academic and Research Institutes dominated the largest market revenue share of 42% in 2025, supported by increasing government funding, growing epigenetics-focused research, and widespread adoption of kits for basic and translational studies. Universities, national research institutes, and medical centers rely heavily on these kits for understanding disease mechanisms, biomarker discovery, and functional genomics. High adoption of automated workflows, compatibility with high-throughput sequencing, and scalability for large studies further strengthen this segment. The growing demand for cutting-edge epigenetic tools and international collaborations in research ensures long-term dominance.

The Pharmaceutical Companies segment is projected to witness the fastest CAGR of 11.9% from 2026 to 2033, driven by the integration of epigenetics kits in preclinical research, drug discovery, and biomarker validation pipelines. Growth is fueled by rising R&D investments, increasing focus on epigenetic drug targets, and collaborations with academic research institutes. High-throughput, automated, and reproducible kits streamline drug discovery workflows, enabling faster target identification and validation. Expansion of personalized medicine initiatives and growing adoption of multi-omics approaches further contribute to rapid growth. Pharmaceutical end-users are increasingly leveraging epigenetics-based kits to enhance therapeutic development efficiency, fueling market expansion globally.

Epigenetics-Based Kits Market Regional Analysis

- North America dominated the epigenetics-based kits market with the largest revenue share of approximately 44% in 2025, supported by the strong presence of leading life science research institutions, a well-established pharmaceutical and biotechnology industry, and high investments in genomics and epigenetics research

- The region benefits from early adoption of advanced molecular biology tools, widespread availability of research funding from government and private organizations, and strong academic–industry collaborations that accelerate epigenetics-based research

- Increasing use of bisulfite conversion kits, sequencing kits, and immunoprecipitation kits in oncology research, biomarker discovery, and drug development further strengthens regional dominance, particularly in the U.S. and Canada

U.S. Epigenetics-Based Kits Market Insight

The U.S. epigenetics-based kits market accounted for the largest revenue share within North America in 2025, driven by substantial federal funding for biomedical research, including NIH-supported epigenomics initiatives. The country hosts a high concentration of pharmaceutical companies, biotechnology firms, and academic research institutes actively engaged in DNA methylation, histone modification, and non-coding RNA studies. Strong adoption of bisulfite conversion kits and sequencing-based workflows in cancer research and precision medicine significantly contributes to market growth. In addition, the presence of major kit manufacturers and continuous product innovation further reinforce the U.S. market’s leadership position.

Europe Epigenetics-Based Kits Market Insight

The Europe epigenetics-based kits market is projected to grow at a steady CAGR during the forecast period, driven by increasing investments in life sciences research and expanding epigenetics programs across academic and clinical research settings. European countries emphasize translational research, personalized medicine, and oncology-focused studies, supporting the adoption of epigenetics-based kits. The region benefits from collaborative research frameworks, such as cross-border EU-funded projects, which promote the use of standardized epigenetics tools. Growing demand for DNA methylation and chromatin structure analysis kits across research institutes and pharmaceutical companies further supports market expansion.

U.K. Epigenetics-Based Kits Market Insight

The U.K. epigenetics-based kits market is anticipated to expand at a notable CAGR during the forecast period, supported by strong academic research capabilities and government-backed genomics initiatives. The country has a well-developed research infrastructure focused on cancer epigenetics, developmental biology, and rare disease studies. Increasing adoption of bisulfite conversion kits and RNA sequencing kits in academic and translational research laboratories is driving market growth. Strategic collaborations between universities, research hospitals, and biotechnology firms further accelerate demand for advanced epigenetics-based kits.

Germany Epigenetics-Based Kits Market Insight

The Germany epigenetics-based kits market is expected to grow at a considerable CAGR, driven by the country’s strong emphasis on scientific research, innovation, and biotechnology development. Germany’s pharmaceutical and biotech sectors extensively use epigenetics-based kits for drug discovery, target validation, and preclinical research. Rising investments in precision medicine and cancer research, along with the availability of advanced laboratory infrastructure, support market growth. The adoption of high-quality DNA methylation and histone modification kits is particularly strong across academic and industrial research settings.

Asia-Pacific Epigenetics-Based Kits Market Insight

The Asia-Pacific epigenetics-based kits market is expected to grow at the fastest CAGR from 2026 to 2033, driven by rapid investments in genomics, personalized medicine, and biotechnology research. Governments across the region are increasing funding for life sciences, while academic institutions are expanding epigenetics-focused research programs. Growing demand for cost-effective bisulfite conversion kits, sequencing kits, and RNA-based analysis tools is accelerating adoption. The expansion of pharmaceutical manufacturing, increasing clinical research activity, and rising awareness of epigenetic biomarkers further fuel regional growth.

Japan Epigenetics-Based Kits Market Insight

The Japan epigenetics-based kits market is witnessing steady growth due to the country’s strong research culture and focus on advanced biomedical sciences. Japanese research institutions actively use epigenetics-based kits in oncology, regenerative medicine, and developmental biology studies. The growing integration of epigenetics into drug discovery pipelines and biomarker research is boosting demand for high-precision kits. In addition, collaborations between academic institutions and pharmaceutical companies support continued market expansion.

China Epigenetics-Based Kits Market Insight

The China epigenetics-based kits market held the largest revenue share in Asia-Pacific in 2025, driven by rapid expansion of genomics research, rising healthcare R&D spending, and strong government support for biotechnology development. China’s growing number of research institutes and biopharmaceutical companies actively adopt epigenetics-based kits for cancer research and drug development. The increasing availability of locally manufactured, cost-effective kits further accelerates adoption. Large-scale genomics projects and expanding academic collaborations continue to strengthen China’s position in the regional market.

Epigenetics-Based Kits Market Share

The eigenetics-based kits industry is primarily led by well-established companies, including:

• Illumina, Inc. (U.S.)

• Thermo Fisher Scientific (U.S.)

• Agilent Technologies, Inc. (U.S.)

• New England Biolabs, Inc. (U.S.)

• Diagenode (Belgium)

• Zymo Research Corp. (U.S.)

• EpiGentek (U.S.)

• Active Motif, Inc. (U.S.)

• PerkinElmer, Inc. (U.S.)

• Oxford Nanopore Technologies (U.K.)

• Qiagen N.V. (Netherlands)

• Promega Corporation (U.S.)

• Cellecta, Inc. (U.S.)

• Bio-Rad Laboratories, Inc. (U.S.)

• SeqWell, Inc. (U.S.)

• GenScript Biotech Corporation (China)

• Sigma-Aldrich (U.S.)

• Epizyme, Inc. (U.S.)

• Active Motif Europe (France)

• Tecan Group Ltd. (Switzerland)

Latest Developments in Global Epigenetics-Based Kits Market

- In February 2024, New England Biolabs (NEB) announced the launch of the NEBNext® Enzymatic 5hmC-seq Kit (E5hmC-seq), a novel enzyme-based kit that enables specific detection of 5-hydroxymethylcytosine (5hmC) at single-base resolution. This kit improves epigenetic analysis accuracy by minimizing DNA damage and enabling researchers to discriminate 5hmC from unmodified cytosine and 5mC, advancing epigenomic research workflows.

- In June 2024, start-up Epigenica introduced the EpiFinder Platform, featuring patented high-throughput, multiplexed quantitative ChIP-seq (hmqChIP-seq) technology along with the EpiFinder Genome solution designed for comprehensive genome-wide epigenomic profiling. This platform supports advanced biomarker discovery and deepens epigenetic analysis capabilities

- In June 2024, Thermo Fisher Scientific expanded its epigenetics portfolio with upgraded bisulfite conversion and methylation-specific PCR assay kits that simplify workflows for biomarker analysis in oncology and neurological disorder research. These kits are targeted to clinical laboratories and research institutions, improving accessibility and efficiency of DNA methylation studies

- In May 2025, Ellis Bio launched its SuperMethyl Fast Bisulfite Conversion Kit, designed to accelerate bisulfite conversion workflows in epigenetics research and allow faster processing of methylation analysis for high-throughput applications. This product reflects increasing innovation in epigenetic kit development aimed at scaling research throughput

- In January 2025, New England Biolabs launched the EM-seq™ v2 kit, an updated enzymatic methylation sequencing kit designed for more sensitive detection of 5-methylcytosine (5mC) and 5hmC with lower DNA input requirements and streamlined workflow. The kit enhances performance for clinical and research settings by enabling high-quality methylation data from ultra-low DNA inputs, broadening usability in epigenetics studies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.