Global Epigenetics Diagnostic Market

Market Size in USD Billion

CAGR :

%

USD

15.96 Billion

USD

69.55 Billion

2024

2032

USD

15.96 Billion

USD

69.55 Billion

2024

2032

| 2025 –2032 | |

| USD 15.96 Billion | |

| USD 69.55 Billion | |

|

|

|

|

Epigenetics Diagnostic Market Size

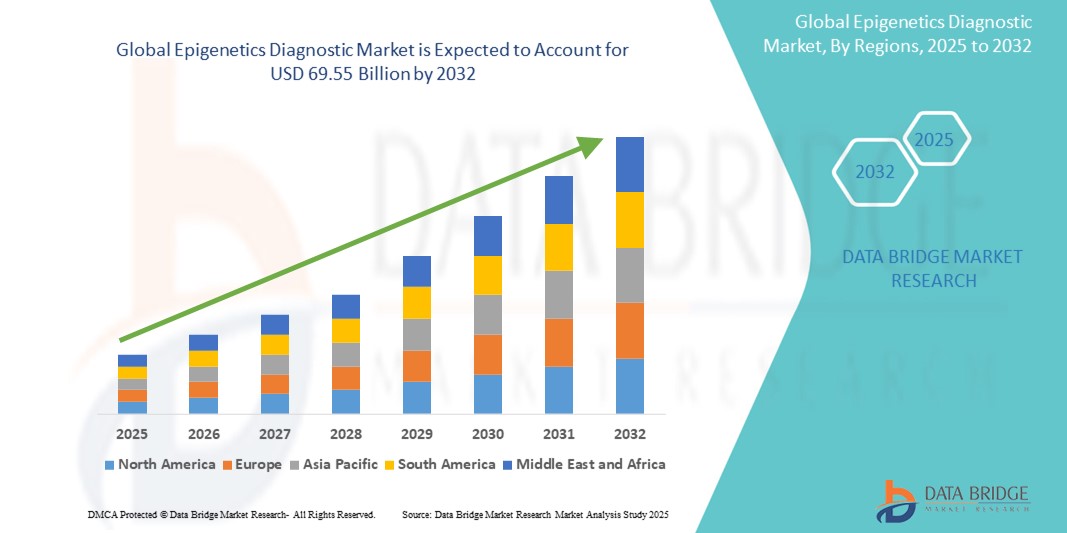

- The global epigenetics diagnostic market size was valued at USD 15.96 billion in 2024 and is expected to reach USD 69.55 billion by 2032, at a CAGR of 20.20% during the forecast period

- The global epigenetics diagnostic market growth is largely fueled by the growing understanding of epigenetic mechanisms in disease pathogenesis and technological progress within molecular diagnostics, leading to increased digitalization in both research and clinical settings

- Furthermore, rising demand for accurate, user-friendly, and integrated solutions for disease prediction, early detection, and personalized treatment monitoring is establishing epigenetics diagnostics as a modern approach in precision medicine. These converging factors are accelerating the uptake of epigenetics diagnostics solutions, thereby significantly boosting the industry's growth

Epigenetics Diagnostic Market Analysis

- Epigenetics diagnostics refers to the identification, measurement, and analysis of epigenetic modifications (such as DNA methylation, histone modifications, and non-coding RNA expression) to detect, diagnose, or predict the progression of diseases—especially cancers, neurological disorders, and autoimmune conditions

- Furthermore, rising demand for precise, early disease detection, prognostic biomarkers, and personalized medicine solutions is establishing epigenetics diagnostics as a crucial tool in modern healthcare. These converging factors, coupled with increasing investments in R&D by pharmaceutical companies and academic institutions, are accelerating the uptake of epigenetics diagnostics solutions, thereby significantly boosting the industry's growth

- North America dominates the epigenetics diagnostic market with the largest revenue share of 41.3% in 2024, characterized by high awareness among the population, advanced medical infrastructure, and substantial R&D expenditure

- Asia-Pacific is expected to be the fastest-growing region in the epigenetics diagnostic market during the forecast period, with a projected CAGR of 16.92%. This growth is primarily due to increasing urbanization, rising disposable incomes, and a growing emphasis on healthcare infrastructure development and research investments in countries such as China and India

- Oncology segment dominates the epigenetics diagnostic market with a market share of 69.7% in 2024, driven by the high and increasing incidence of various cancers worldwide, the critical role of epigenetic alterations in cancer development and progression, and the continuous development of epigenetic biomarkers for cancer diagnosis, prognosis, and therapeutic monitoring

Report Scope and Epigenetics Diagnostic Market Segmentation

|

Attributes |

Epigenetics Diagnostic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Epigenetics Diagnostic Market Trends

“Advancing Diagnostics Through Technological Innovation”

- A significant and accelerating trend in the global epigenetics diagnostic market is the deepening integration of advanced analytical technologies and high-throughput sequencing methods. This fusion of techniques is significantly enhancing the ability to characterize and interpret epigenetic modifications in disease

- For instance, innovations in Next-Generation Sequencing (NGS) platforms are seamlessly integrating with epigenetic profiling methods (like DNA methylation analysis and histone modification analysis), allowing researchers and clinicians to process vast amounts of data and identify subtle epigenetic changes across the entire genome

- Technological advancements in epigenetics diagnostics enable features such as comprehensive mapping of epigenetic modifications for various diseases and providing more precise insights into disease development and progression

- The seamless integration of these advanced technologies with laboratory workflows and broader clinical diagnostic platforms facilitates streamlined analysis and interpretation of epigenetic data. Through sophisticated bioinformatics tools, users can manage complex data sets, correlate epigenetic findings with clinical outcomes, and enhance the overall diagnostic process

- The demand for epigenetics diagnostics solutions that offer seamless integration of advanced technologies is growing rapidly across both research and clinical sectors, as stakeholders increasingly prioritize accurate biomarker identification, non-invasive testing methods, and the translation of epigenetic research into clinical applications

Epigenetics Diagnostic Market Dynamics

Driver

“Growing Need Due to Rising Chronic Disease Burden and Advancements in Precision Medicine”

- The increasing prevalence of chronic diseases among the global population, particularly various types of cancer and neurological disorders, coupled with the accelerating adoption of precision medicine approaches, is a significant driver for the heightened demand for epigenetics diagnostics

- For instance, in recent years, significant advancements in understanding the role of epigenetic modifications in disease progression have led to the development of novel diagnostic assays. Such discoveries and strategies by key research institutions and diagnostic companies are expected to drive the epigenetics diagnostics industry growth in the forecast period

- As healthcare providers and patients become more aware of the potential for early disease detection, risk stratification, and personalized treatment selection based on epigenetic biomarkers, epigenetics diagnostics offer advanced features such as non-invasive testing (e.g., liquid biopsy), highly sensitive detection, and prognostic capabilities, providing a compelling upgrade over traditional diagnostic methods

- Furthermore, the growing popularity of personalized healthcare and the desire for more targeted therapeutic interventions are making epigenetics diagnostics an integral component of these systems, offering seamless integration with genomics and other 'omics' data

- The convenience of non-invasive sample collection, rapid turnaround times for certain tests, and the ability to provide actionable insights for clinical decision-making are key factors propelling the adoption of epigenetics diagnostics in both research and clinical sectors. The trend towards integrating epigenomics into routine clinical practice and the increasing availability of user-friendly epigenetics diagnostics options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Test Complexity and High Initial Costs”

- Concerns surrounding the technical complexity and challenges in data interpretation of epigenetics diagnostics, along with the relatively high initial costs associated with these advanced tests, pose a significant challenge to broader market penetration. As epigenetics diagnostics rely on sophisticated laboratory techniques and intricate bioinformatics analysis, they can be susceptible to variations in experimental protocols and data processing, raising anxieties among potential users about the consistency and generalizability of results

- For instance, the lack of widespread standardization for certain epigenetic assays across different laboratories and the need for specialized expertise in interpreting complex epigenetic profiles have made some clinicians hesitant to widely adopt these solutions in routine practice

- Addressing these complexity concerns through robust validation studies, development of industry-wide standardized protocols, and easily interpretable reporting mechanisms is crucial for building user trust. Diagnostic companies are focusing on improving the reproducibility and reliability of their kits and services to reassure potential buyers.

- In addition, the relatively high initial cost of some advanced epigenetics diagnostics platforms and assays compared to traditional diagnostic methods can be a barrier to adoption for price-sensitive healthcare systems, research institutions, or for widespread population screening. While the cost of basic epigenetic analyses is gradually decreasing, premium features such as comprehensive epigenome sequencing often come with a higher price tag

- While prices are anticipated to decline with technological maturity and increased scale, the perceived premium for cutting-edge epigenetic testing can still hinder widespread adoption, especially for those who do not see an immediate cost-benefit or direct clinical utility over existing diagnostic pathways

Epigenetics Diagnostic Market Scope

The epigenetics diagnostic market is segmented into four notable segments based on product, application, technology, and end user.

- By Product

On the basis of product, the epigenetics diagnostic market is segmented into enzymes, instruments and consumables, kits, and reagents. The kits and reagents segment held the largest market revenue share in 2024. This dominance is driven by their comprehensive nature, offering all necessary components for various epigenetic assays in a single package, thus streamlining workflows and ensuring reproducibility for researchers and clinicians.

The instruments segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by continuous technological advancements leading to more automated and high-throughput platforms.

- By Application

On the basis of application, the epigenetics diagnostic market is segmented into oncology, metabolic diseases, developmental biology, immunology, cardiovascular diseases, and others. the oncology segment held the largest market revenue share of 69.7% in 2024. This dominance is driven by the increasing incidence of various cancers worldwide and the critical role of epigenetic alterations in cancer development, diagnosis, and treatment monitoring.

The metabolic diseases segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing research into epigenetic markers for a broader range of diseases.

- By Technology

On the basis of technology, the epigenetics diagnostic market is segmented into DNA methylation, histone methylation, and others. The DNA Methylation segment held the largest market share of 44.6% in 2024. This is driven by its well-established role as a fundamental epigenetic modification, its relative stability, and the widespread availability of robust detection technologies like bisulfite sequencing.

The histone methylation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing understanding of its complex roles in gene regulation and disease.

- By End User

On the basis of end user, the epigenetics diagnostic market is segmented into academic and research institutes, pharmaceutical companies and biotechnology companies, and contract research organizations (CROs). The academic and research institutes segment accounted for the largest market share in 2024. This is driven by increased investments in fundamental and translational epigenetics research to uncover novel mechanisms and biomarkers.

The pharmaceutical and biotechnology companies segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing R&D investments in drug discovery and personalized medicine leveraging epigenetic insights.

Epigenetics Diagnostic Market Regional Analysis

- North America dominates the epigenetics diagnostic market with the largest revenue share of 41.3% in 2024, driven by a confluence of factors including high healthcare expenditure, significant investments in research and development, and a strong focus on precision medicine

- Healthcare systems in the region highly value the advancements in epigenetic biomarker discovery, the potential for early disease detection, and the integration of these diagnostics into personalized treatment protocols

- This widespread adoption is further supported by high awareness among the population regarding chronic diseases, the presence of a robust medical infrastructure, and continuous government funding for epigenetic research, establishing epigenetics diagnostics as a favored solution in both academic and clinical settings

U.S. Epigenetics Diagnostic Market Insight

The U.S. epigenetics diagnostic market captured a substantial revenue share largest revenue share of 75.6% in 2024 within North America, fueled by the swift uptake of advanced molecular diagnostics and the expanding trend of personalized medicine. Healthcare providers and researchers are increasingly prioritizing the enhancement of disease detection and patient stratification through intelligent, biomarker-driven systems. The growing preference for non-invasive diagnostic setups, combined with robust demand for high-throughput sequencing and advanced bioinformatics integration, further propels the epigenetics diagnostic industry. Moreover, the increasing integration of cutting-edge research technologies, such as next-generation sequencing and microarray platforms, is significantly contributing to the market's expansion.

Europe Epigenetics Diagnostic Market Insight

The Europe epigenetics diagnostic market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in biotechnology and healthcare research, and the escalating need for enhanced diagnostic precision in chronic diseases. The increase in the prevalence of cancer and neurological disorders, coupled with the demand for advanced molecular diagnostics, is fostering the adoption of epigenetics diagnostics. European healthcare systems are also drawn to the potential for early disease detection and personalized treatment strategies these technologies offer. The region is experiencing significant growth across various applications, including oncology, immunology, and neurology, with epigenetics diagnostics being incorporated into both academic research and clinical validation projects.

U.K. Epigenetics Diagnostic Market Insight

The U.K. epigenetics diagnostic market is anticipated to grow at a noteworthy CAGR from 2025 to 2032, driven by the escalating focus on personalized medicine and a desire for heightened diagnostic accuracy and therapeutic targeting. Additionally, concerns regarding the rising burden of chronic diseases are encouraging both academic researchers and pharmaceutical companies to choose advanced epigenetic biomarker solutions. The U.K.'s embrace of cutting-edge biomedical research, alongside its robust R&D infrastructure and strong academic-industry collaborations, is expected to continue to stimulate market growth.

Germany Epigenetics Diagnostic Market Insight

The Germany epigenetics diagnostic market is expected to expand at a considerable CAGR from 2025 to 2032 during the forecast period, fueled by increasing awareness of the critical role of epigenetic modifications in disease and the demand for technologically advanced, high-precision diagnostic solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and robust research funding, promotes the adoption of epigenetics diagnostics, particularly in oncology and neurodegenerative disease research. The integration of epigenetics diagnostics with comprehensive 'omics' data analysis is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local regulatory expectations.

Asia-Pacific Epigenetics Diagnostic Market Insight

The Asia-Pacific epigenetics diagnostic market is poised to grow at the fastest CAGR of 16.92% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards advanced healthcare technologies, supported by government initiatives promoting digitalization in healthcare and research, is driving the adoption of epigenetics diagnostics. Furthermore, as APAC emerges as a prominent hub for biotechnology research and manufacturing, the affordability and accessibility of epigenetics diagnostic components and systems are expanding to a wider clinical and research base.

Japan Epigenetics Diagnostic Market Insight

The Japan epigenetics diagnostic market is gaining momentum, projected to grow at a CAGR of approximately 12.8% during 2025-2033, due to the country’s high-tech research culture, rapid advancements in precision medicine, and demand for highly accurate diagnostic tools. The Japanese market places a significant emphasis on comprehensive disease understanding, and the adoption of epigenetics diagnostics is driven by the increasing number of research projects and clinical trials focused on epigenetic biomarkers. The integration of epigenetics diagnostics with other multi-omics data, such as genomics and proteomics, is fueling growth. Moreover, Japan's aging population is likely to spur demand for advanced, non-invasive diagnostic solutions for age-related diseases in both research and clinical sectors.

China Epigenetics Diagnostic Market Insight

The China epigenetics diagnostic market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding healthcare investments, rapid urbanization, and high rates of technological adoption in diagnostics. China stands as one of the largest markets for advanced medical technologies, and epigenetics diagnostics are becoming increasingly popular in research, clinical, and biotechnology sectors. The push towards precision medicine initiatives and the availability of increasingly affordable epigenetics diagnostic options, alongside strong domestic manufacturers and research capabilities, are key factors propelling the market in China.

Epigenetics Diagnostic Market Share

The epigenetics diagnostic industry is primarily led by well-established companies, including:

- Illumina, Inc. (U.S.)

- Merck KGaA (Germany)

- QIAGEN (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Eisai Co., Ltd. (Japan)

- Novartis AG (Switzerland)

- Diagenode S.A. (U.S.)

- Active Motif, Inc. (U.S.)

- Zymo Research Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Syndax (U.S.)

- New England Biolabs (U.S.)

- Epizyme, Inc. (U.S.)

- Domainex (U.K.)

- Agilent Technologies, Inc. (U.S.)

- PerkinElmer (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- AsisChem Inc. (U.S.)

- Enzo Biochem Inc. (U.S.)

- Epigentek Group Inc. (U.S.)

- Bio-Techne (U.S.)

- Promega Corporation (U.S.)

- GeneTex, Inc. (U.S.)

- PacBio (U.S.)

Latest Developments in Global Epigenetics Diagnostic Market

- In April 2024, Generation Lab announced the upcoming official spring launch of what it calls the first clinically validated test that measures biological age and illness risk using epigenetic information. This development highlights the increasing trend of translating epigenetic research into consumer-facing diagnostic tools for preventative health

- In January 2024, AtlasXomics and EpiCypher collaborated to develop CUT&Tag products and diagnostic services for epidemiology applications. This partnership signifies a move towards expanding epigenetic diagnostics into public health and population-level studies

- In January 2024, Moonwalk Biosciences, a biotechnology startup, was launched after completing its seed and Series A financing rounds with USD 57 million to advance its epigenetic profiling and engineering technology platform. This significant funding indicates strong investor confidence in the future potential of epigenetic technologies for diagnostics and therapeutics

- In August 2023, Watchmaker Genomics Inc. teamed up with Exact Sciences Corp. to develop and commercialize a novel DNA methylation analysis technology called TET-assisted pyridine borane sequencing (TAPS). This partnership aims to improve cancer screening and diagnostic capabilities through advanced methylation analysis, crucial for early cancer detection and monitoring minimal residual disease

- In July 2023, FOXO Technologies Inc., a major player in epigenetic biomarker technology, introduced its cutting-edge Bioinformatics Services to leverage the full potential of epigenetic data. This service aims to help overcome challenges associated with data analysis and processing, indicating a growing emphasis on interpreting the vast amounts of epigenetic data generated

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.