Global Epigenome Analysis Market

Market Size in USD Billion

CAGR :

%

USD

1.94 Billion

USD

5.94 Billion

2024

2032

USD

1.94 Billion

USD

5.94 Billion

2024

2032

| 2025 –2032 | |

| USD 1.94 Billion | |

| USD 5.94 Billion | |

|

|

|

|

Epigenome Analysis Market Size

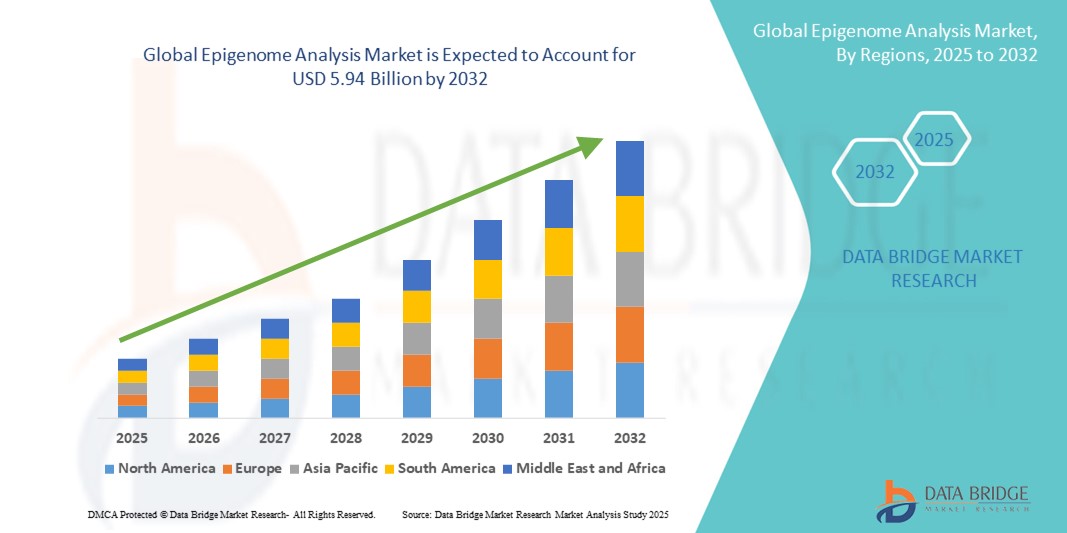

- The global epigenome analysis market size was valued at USD 1.94 billion in 2024 and is expected to reach USD 5.94 billion by 2032, at a CAGR of 15.00% during the forecast period

- This significant growth is driven by the increasing prevalence of chronic diseases, advancements in genomics technologies, and heightened funding for research and development in the field of epigenetics.

- In addition, the rising demand for personalized medicine and the growing focus on understanding gene regulation mechanisms are establishing epigenome analysis as a critical tool in modern healthcare and research

Epigenome Analysis Market Analysis

- Epigenome analysis, encompassing technologies such as ChIP-qPCR, ELISA, and sequencing platforms, is increasingly vital in both research and clinical settings due to its ability to provide insights into gene regulation, disease mechanisms, and potential therapeutic targets

- The escalating demand for epigenome analysis is primarily fueled by advancements in next-generation sequencing and high-throughput technologies, growing prevalence of chronic diseases such as cancer and neurological disorders, and a rising focus on personalized medicine and targeted therapies

- North America dominated the epigenome analysis market with the largest revenue share of 40.18% in 2024, characterized by advanced healthcare infrastructure, substantial research funding, and a strong presence of key industry players, with the U.S. experiencing substantial growth in epigenetic research, particularly in oncology and neurological studies, driven by innovations from both established genomics companies and startups focusing on high-throughput sequencing and bioinformatics

- Asia-Pacific is expected to be the fastest-growing region in the epigenome analysis market during the forecast period due to increasing research investments, rising healthcare access, and expanding adoption of advanced epigenetic technologies

- ChIP-qPCR technology segment dominated the epigenome analysis market with a market share of 37% in 2024, driven by its established reputation for high sensitivity, specificity, and reliability in detecting epigenetic modifications

Report Scope and Epigenome Analysis Market Segmentation

|

Attributes |

Epigenome Analysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Epigenome Analysis Market Trends

Advancements Through High-Throughput Sequencing and AI-Driven Analytics

- A significant and accelerating trend in the global epigenome analysis market is the integration of high-throughput sequencing technologies with AI-driven data analytics. This combination is significantly enhancing the speed, accuracy, and depth of epigenetic profiling across research and clinical applications

- For instance, platforms such as Illumina NovaSeq coupled with AI-based software can process vast amounts of DNA methylation and histone modification data, enabling researchers to uncover complex epigenetic patterns efficiently. Similarly, Oxford Nanopore Technologies provides real-time sequencing solutions, allowing rapid epigenetic profiling for both DNA and RNA modifications

- AI integration enables predictive modeling of epigenetic changes, identification of potential biomarkers, and more precise interpretation of large datasets. For instance, some platforms utilize machine learning algorithms to detect disease-associated methylation patterns, improving diagnostic and therapeutic insights

- The seamless integration of epigenome analysis platforms with cloud-based data storage and bioinformatics pipelines facilitates centralized and collaborative research, allowing scientists to analyze, visualize, and share complex epigenetic data in real time

- This trend towards more intelligent, high-throughput, and data-driven epigenetic research is fundamentally reshaping expectations in biomedical research. Consequently, companies such as Pacific Biosciences and Thermo Fisher Scientific are developing AI-enabled epigenome analysis solutions with enhanced predictive capabilities and automated workflows

- The demand for epigenome analysis platforms that offer high throughput, integrated AI analytics, and robust bioinformatics support is growing rapidly across academic, pharmaceutical, and biotechnology sectors, as researchers increasingly prioritize efficiency, accuracy, and actionable insights

Epigenome Analysis Market Dynamics

Driver

Growing Demand Driven by Disease Research and Personalized Medicine

- The increasing prevalence of chronic diseases such as cancer, neurological disorders, and cardiovascular diseases, coupled with the rising adoption of personalized medicine, is a significant driver for the heightened demand for epigenome analysis

- For instance, in 2024, Illumina announced enhancements in its methylation sequencing workflows aimed at enabling large-scale epigenetic profiling for cancer research, reflecting how technological advancements are accelerating market growth

- As researchers and clinicians seek a deeper understanding of disease mechanisms and individualized therapeutic targets, epigenome analysis platforms provide critical insights into gene regulation, chromatin accessibility, and DNA-protein interactions

- Furthermore, the integration of epigenetic studies with drug development pipelines is making epigenome analysis an essential tool for biomarker discovery, clinical trials, and precision medicine strategies

- The scalability, high sensitivity, and versatility of modern epigenome analysis platforms are key factors propelling adoption in academic research, pharmaceutical companies, and biotechnology firms

Restraint/Challenge

High Cost and Complexity of Technologies

- The relatively high cost of advanced epigenome analysis platforms and associated consumables can be a barrier to adoption, particularly for smaller research labs or institutions in developing regions. High-throughput sequencing, AI analytics, and multi-omics integration often require substantial investments in equipment, software, and skilled personnel

- For instance, platforms such as Pacific Biosciences’ Sequel II and Illumina’s NovaSeq are expensive, making it challenging for budget-conscious laboratories to adopt the latest technologies

- In addition, the complexity of epigenetic data analysis, including interpretation of DNA methylation, histone modifications, and chromatin accessibility patterns, can require specialized bioinformatics expertise, limiting widespread adoption

- Addressing these challenges through the development of more cost-effective workflows, cloud-based bioinformatics solutions, and automated analysis pipelines will be crucial for expanding market penetration

- As platform costs gradually decrease and training in bioinformatics becomes more widespread, adoption is expected to accelerate, but overcoming these technical and financial hurdles remains critical for sustained market growth

Epigenome Analysis Market Scope

The market is segmented on the basis of technology, components, methods, and end users.

- By Technology

On the basis of technology, the epigenome analysis market is segmented into ELISA, ChIP-qPCR, ChIP-on-Chip, and others. The ChIP-qPCR segment dominated the market with the largest revenue share of 37% in 2024, driven by its high sensitivity, reproducibility, and specificity in detecting DNA-protein interactions and histone modifications. Researchers prefer ChIP-qPCR for quantitative insights into transcriptional regulation, epigenetic changes, and chromatin structure. Its compatibility with high-throughput workflows has made it a preferred choice in both academic research and pharmaceutical studies. In addition, ChIP-qPCR supports downstream sequencing and bioinformatics analyses, enhancing its value in multi-omics research. The widespread adoption of ChIP-qPCR in biomarker discovery and drug development further reinforces its dominance. Moreover, training resources and standardization protocols contribute to its steady preference across laboratories worldwide.

The ELISA segment is anticipated to witness the fastest growth rate of 19.8% from 2025 to 2032, fueled by its cost-effectiveness, user-friendly workflow, and scalability. ELISA enables high-throughput screening of histone modifications, DNA methylation, and other epigenetic markers, making it ideal for academic labs and biotechnology startups. Its automation and multiplexing capabilities allow simultaneous analysis of multiple samples, accelerating research timelines. ELISA’s relatively lower equipment and operational requirements increase accessibility for small to mid-sized labs. Growing adoption of ELISA in drug discovery, clinical diagnostics, and large-scale epigenetic studies is expanding its market potential. The integration of ELISA platforms with data analytics and cloud-based reporting is also enhancing efficiency and driving adoption.

- By Components

On the basis of components, the epigenome analysis market is segmented into methylation, acetylation, phosphorylation, ubiquitylation, and sumoylation. The methylation segment dominated the market with over 45% share in 2024, as DNA methylation plays a central role in gene regulation and disease progression, particularly in cancer and neurological disorders. Methylation analysis is extensively used for biomarker discovery, clinical diagnostics, and personalized medicine applications. High-throughput sequencing, microarrays, and bisulfite conversion methods have enhanced the accuracy and scalability of methylation studies. Researchers value methylation assays for their ability to provide genome-wide insights and link epigenetic changes to disease mechanisms. Regulatory approvals for methylation-based diagnostics further fuel market demand. The integration of methylation studies with drug development pipelines strengthens its prominence among pharmaceutical and biotech companies.

The acetylation segment is expected to witness the fastest growth rate of 18.5% from 2025 to 2032, driven by rising interest in histone acetylation’s role in transcriptional regulation, immune response, and epigenetic therapeutics. Acetylation studies help identify novel drug targets and inform epigenetic therapy development. Advanced detection techniques, multiplexed assays, and high-throughput platforms are enabling rapid adoption in research and clinical labs. Increasing research grants and investments in epigenetic therapeutics support the segment’s expansion. Acetylation analysis is also gaining traction in functional genomics studies, contributing to its growth trajectory. The need for cost-effective, sensitive, and scalable assays further propels adoption across academic and industrial sectors.

- By Methods

On the basis of methods, the epigenome analysis market is segmented into DNA methylation analysis, analysis of DNA/protein interactions, chromatin accessibility, and conformation assays. The DNA methylation analysis segment dominated the market in 2024, owing to its wide application in cancer research, biomarker discovery, and personalized medicine. DNA methylation assays allow researchers to study gene silencing, epigenetic regulation, and disease-related signatures. High-throughput sequencing, automated workflows, and robust bioinformatics pipelines make DNA methylation analysis highly reliable and reproducible. The segment benefits from strong adoption in both academic and pharmaceutical research. Regulatory approvals for methylation-based diagnostics enhance its market relevance. Its scalability and precision have made it a foundational method in epigenetic studies globally.

The chromatin accessibility segment is expected to witness the fastest growth rate of 20.3% from 2025 to 2032, driven by the increasing need to study open chromatin regions for enhancer mapping, transcription factor binding, and gene expression regulation. Assays such as ATAC-seq and DNase-seq provide rapid and sensitive insights into chromatin structure. Single-cell chromatin accessibility studies are further driving demand in advanced research applications. Growth is supported by integration with high-throughput sequencing and bioinformatics tools. Rising interest in functional genomics and epigenetic drug discovery fuels adoption. Chromatin accessibility analysis is becoming indispensable for both academic and clinical research, enabling better understanding of disease mechanisms.

- By End Users

On the basis of end users, the epigenome analysis market is segmented into academic and research institutes, pharmaceutical companies, biotechnology companies, and contract research organizations (CROs). The academic and research institutes segment dominated the market with over 39% share in 2024, driven by extensive engagement in basic and translational epigenetic research. These institutions are major adopters due to funding availability, demand for high-throughput data, and expertise in bioinformatics. Academic labs lead in methodological innovation and large-scale studies, reinforcing dominance. Collaboration with industry partners further enhances research capabilities. Access to state-of-the-art platforms and training resources supports sustained adoption. The segment also benefits from publications and patents arising from academic research, highlighting its pivotal role.

The biotechnology companies segment is expected to witness the fastest growth rate of 21.1% from 2025 to 2032, fueled by increased investments in epigenetic therapeutics, biomarker discovery, and personalized medicine. Startups and mid-sized biotech firms are rapidly adopting advanced epigenome analysis platforms to accelerate research and development timelines. The focus on drug discovery and novel therapy development is expanding demand for high-throughput, AI-enabled platforms. Biotechnology companies also leverage partnerships with CROs and academic institutions to access advanced technologies. The growing need for precision medicine and targeted interventions drives adoption further. Rising venture funding and government support in epigenetics research are additional growth catalysts.

Epigenome Analysis Market Regional Analysis

- North America dominated the epigenome analysis market with the largest revenue share of 40.18% in 2024, characterized by advanced healthcare infrastructure, substantial research funding, and a strong presence of key industry players

- Researchers and institutions in the region highly value the precision, scalability, and integration capabilities of modern epigenome analysis platforms, which support studies in cancer, neurological disorders, and personalized medicine

- This widespread adoption is further supported by government initiatives, strong academic and pharmaceutical research ecosystems, and the availability of skilled bioinformatics professionals, establishing epigenome analysis as a critical tool in both academic and industrial applications

U.S. Epigenome Analysis Market Insight

The U.S. epigenome analysis market captured the largest revenue share of 81% in 2024 within North America, fueled by rapid adoption of next-generation sequencing and AI-driven bioinformatics platforms. Researchers are increasingly prioritizing advanced epigenetic profiling for disease research, biomarker discovery, and personalized medicine applications. The growing preference for high-throughput, automated, and integrated workflows further propels market growth. In addition, robust funding for genomics research and strong collaborations between academic institutions and pharmaceutical companies significantly contribute to market expansion. Moreover, regulatory support for clinical epigenetic testing and precision medicine initiatives is enhancing adoption. The U.S. continues to lead as a hub for innovation in epigenome analysis technologies, establishing it as the dominant market in the region.

Europe Epigenome Analysis Market Insight

The Europe epigenome analysis market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increased funding for biomedical research and the growing adoption of personalized medicine. Stringent regulations around disease diagnostics and biomarker validation encourage the use of high-quality epigenome analysis platforms. Increasing urbanization, advanced research infrastructure, and demand for precision therapeutics are fostering market growth. European researchers value integrated, high-throughput workflows that support both academic and pharmaceutical studies. The region also sees growth in CROs offering epigenetic services, supporting wider adoption. Collaboration between biotech startups and research institutes further strengthens Europe’s position in the global market.

U.K. Epigenome Analysis Market Insight

The U.K. epigenome analysis market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investment in genomics research and the emphasis on precision medicine. Increased focus on oncology, neurological disorders, and chronic disease research encourages adoption of advanced epigenetic profiling platforms. In addition, the integration of AI analytics and cloud-based bioinformatics is enabling faster, more accurate data interpretation. Academic institutions and pharmaceutical companies in the U.K. are leading adopters due to strong government support and collaboration with biotech firms. Regulatory support for biomarker discovery and clinical validation is also boosting market growth. Overall, the U.K.’s robust research ecosystem continues to drive demand for epigenome analysis technologies.

Germany Epigenome Analysis Market Insight

The Germany epigenome analysis market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of epigenetics in disease research and drug development. Germany’s advanced laboratory infrastructure and focus on innovation support the adoption of high-throughput sequencing and AI-driven analysis platforms. Researchers are increasingly leveraging epigenome analysis to identify biomarkers and develop targeted therapies. Growing investments from both government and private sectors in personalized medicine are further supporting market growth. The integration of epigenetic studies with pharmaceutical R&D pipelines is increasing adoption in both academic and industrial sectors. Germany’s emphasis on precision, quality, and reproducibility aligns with local and global research standards, driving expansion.

Asia-Pacific Epigenome Analysis Market Insight

The Asia-Pacific epigenome analysis market is poised to grow at the fastest CAGR during the forecast period, driven by increasing research investments, expanding biotechnology infrastructure, and rising awareness of personalized medicine. Countries such as China, Japan, and India are rapidly adopting high-throughput epigenetic profiling platforms for disease research and clinical applications. Government initiatives promoting genomics and digital healthcare are accelerating market adoption. Furthermore, the region is emerging as a hub for cost-effective epigenome analysis services, making technologies more accessible to a wider scientific community. Collaborative research between academic institutions, pharmaceutical companies, and CROs is also driving growth. The expanding talent pool in bioinformatics and epigenetic research further supports the market’s rapid expansion.

Japan Epigenome Analysis Market Insight

The Japan epigenome analysis market is gaining momentum due to the country’s strong emphasis on advanced biomedical research, precision medicine, and technological innovation. Japanese researchers prioritize accurate, high-throughput, and automated epigenetic profiling for disease diagnostics and biomarker discovery. The integration of epigenome analysis platforms with AI-based data interpretation is fueling adoption in both academic and clinical settings. Growing government support for genomics initiatives and increased funding for translational research further enhance market growth. Japan’s focus on precision and reliability in research aligns with global epigenetic standards. Moreover, the aging population and demand for improved healthcare solutions are such asly to drive sustained adoption of epigenome analysis technologies.

India Epigenome Analysis Market Insight

The India epigenome analysis market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid expansion of biotechnology research, increasing academic and pharmaceutical initiatives, and government-backed precision medicine programs. India is emerging as a key hub for epigenetic services due to cost-effective laboratory infrastructure and growing adoption of high-throughput technologies. Collaborative projects between research institutes, biotech startups, and pharmaceutical companies are accelerating growth. Rising awareness of chronic diseases and cancer research fuels demand for epigenome analysis. In addition, the availability of affordable platforms and skilled bioinformatics professionals supports wider adoption. The push towards digital healthcare and genomics-driven initiatives further strengthens the market in India.

Epigenome Analysis Market Share

The epigenome analysis industry is primarily led by well-established companies, including:

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Eisai Co. Ltd. (Japan)

- Element Biosciences, Inc. (U.S.)

- Cantata Bio (U.S.)

- Promega Corporation (U.S.)

- Abcam plc (U.K.)

- QIAGEN N.V. (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Zymo Research Corporation (U.S.)

- Merck KGaA (Germany)

- FOXO Technologies Inc. (U.S.)

- Epigenomics AG (Germany)

- 10x Genomics, Inc. (U.S.)

- Epigene Labs (France)

- Mogrify Limited (U.K.)

- Storm Therapeutics LTD (U.K.)

- EpiCypher (U.S.)

What are the Recent Developments in Global Epigenome Analysis Market?

- In July 2025, Thermo Fisher Scientific announced the launch of the Ion Torrent Oncomine Comprehensive Assay Plus. This assay is now available on their Ion Torrent Genexus System and is designed to provide comprehensive genomic profiling (CGP) results, including targeted methylation profiling, for oncology research. The launch makes it possible for researchers to get results as soon as the next day, which helps to accelerate precision oncology research and biomarker discovery

- In June 2025, Illumina announced a definitive agreement to acquire SomaLogic, a company specializing in proteomics. This acquisition is a strategic move to accelerate Illumina's "multi-omics" strategy, which aims to integrate data from genomics, epigenomics, and proteomics to provide more comprehensive insights for researchers

- In January 2025, Leading epigenome editing company Tune Therapeutics (Tune) today announced the completion of over USD 175M in financing led by New Enterprise Associates, Yosemite, Regeneron Ventures and Hevolution Foundation. The funding will accelerate the development of the company’s existing pipeline, currently anchored by Tune-401 – its clinical-stage epigenetic silencing drug for chronic Hepatitis B (HBV)

- In November 2024, Epigenic Therapeutics received approval to begin clinical trials for its therapeutic candidate, EPI-003, a liver-targeting antiviral therapy for chronic Hepatitis B (CHB). This is a landmark moment as EPI-003 is set to become the world's first epigenetic therapy to reach clinical trials for an infectious disease

- In February 2024, PharmaKure, a clinical-stage pharmaceutical company, announced a new epigenetics collaboration with Sheffield Hallam University. The partnership will focus on using "gene-based environmental biomarkers," also known as epigenetic markers, to develop a predictive risk score for Alzheimer's disease

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.