Global Exhaust Sensor Market

Market Size in USD Billion

CAGR :

%

USD

37.46 Billion

USD

41.87 Billion

2024

2032

USD

37.46 Billion

USD

41.87 Billion

2024

2032

| 2025 –2032 | |

| USD 37.46 Billion | |

| USD 41.87 Billion | |

|

|

|

|

Exhaust Sensor Market Size

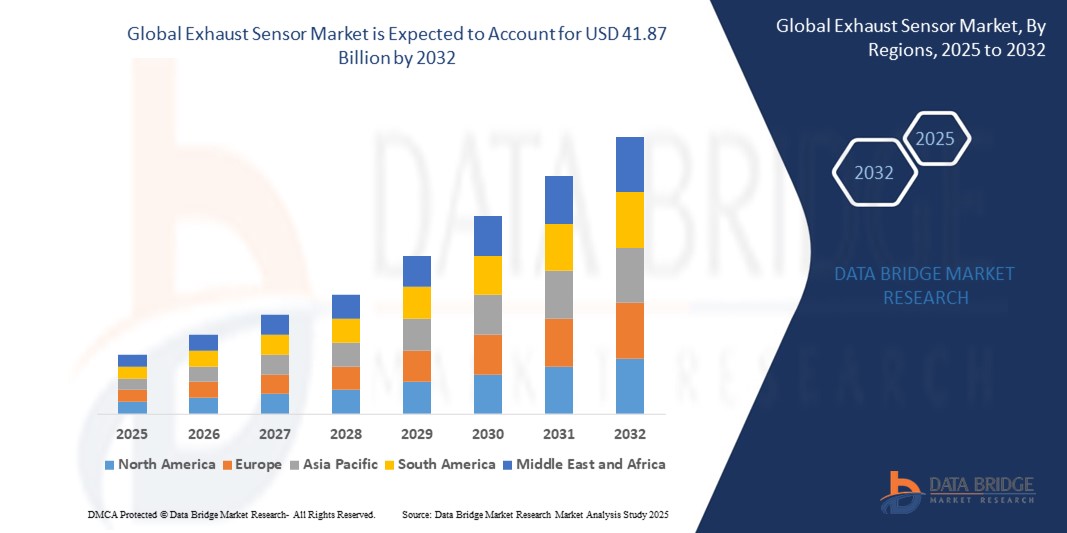

- The global exhaust sensor market size was valued at USD 37.46 billion in 2024 and is expected to reach USD 41.87 billion by 2032, at a CAGR of 1.40% during the forecast period

- The market growth is primarily driven by the stringent emission regulations enforced by governments worldwide, encouraging the adoption of advanced exhaust sensing technologies across the automotive industry to monitor and control harmful emissions

- Furthermore, the growing production of internal combustion engine (ICE)-based vehicles in developing nations and the integration of advanced sensor systems in commercial and passenger vehicles are supporting the market's steady expansion

Exhaust Sensor Market Analysis

- Exhaust sensors, which detect and manage emissions in internal combustion engine vehicles, are increasingly crucial in modern automotive systems due to their role in regulatory compliance, fuel efficiency, and real-time engine diagnostics across commercial and passenger vehicles.

- The growing demand for exhaust sensors is primarily fueled by the implementation of stringent vehicle emission standards, rising global vehicle production, and the need for advanced emission control technologies to reduce environmental impact.

- Asia-Pacific dominates the exhaust sensor market with the largest revenue share of 41.6% in 2025, driven by the region’s robust automotive manufacturing base, rapid urbanization, and government-mandated emission norms in countries such as China, India, and Japan that are accelerating the deployment of emission control systems.

- North America is expected to be the fastest-growing region in the exhaust sensor market during the forecast period, supported by stringent EPA regulations, increased consumer demand for cleaner vehicles, and growing adoption of advanced sensing technologies in commercial fleets across the U.S. and Canada.

- The NOx sensor segment is expected to dominate the exhaust sensor market with a market share of 46.5% in 2025, attributed to its essential role in diesel engine emission control systems and compliance with nitrogen oxide emission limits in both on-road and off-road vehicles

Report Scope and Exhaust Sensor Market Segmentation

|

Attributes |

Exhaust Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Exhaust Sensor Market Trends

“Integration of Smart Diagnostics and Predictive Maintenance”

- A significant and accelerating trend in the global exhaust sensor market is the integration of advanced diagnostics and predictive maintenance capabilities enabled by sensor intelligence and data connectivity. This evolution is enhancing operational efficiency and emissions management across automotive and commercial vehicle fleets

- For instance, Bosch and Continental have developed exhaust sensor systems capable of transmitting real-time emissions data to onboard diagnostic units, allowing for precise control of combustion processes and early detection of component failures

- Integration with AI-based vehicle management systems enables predictive maintenance, where exhaust sensors monitor gas compositions and alert vehicle systems to impending issues such as catalytic converter degradation or particulate filter blockages—reducing downtime and repair costs

- Advanced exhaust sensor systems are now being embedded into connected vehicle ecosystems, enabling continuous remote diagnostics and performance analysis, particularly valuable in fleet management. These systems also support compliance with increasingly stringent emission regulations by ensuring real-time tracking and reporting

- This trend toward smarter exhaust systems is encouraging automotive manufacturers and Tier 1 suppliers to invest in IoT-enabled sensor modules capable of cloud-based data sharing and over-the-air (OTA) updates, further enhancing vehicle lifecycle management

- Consequently, companies such as Denso and Sensata Technologies are pioneering intelligent exhaust sensor technologies that combine environmental data capture with predictive analytics, helping automakers meet both environmental targets and customer expectations for reliability and performance

- The demand for exhaust sensors with embedded smart diagnostics and connectivity features is growing rapidly across both passenger and commercial vehicle segments, as the industry shifts toward data-driven maintenance and emission compliance solutions

Exhaust Sensor Market Dynamics

Driver

“Increasing Stringency of Emission Regulations and Focus on Environmental Compliance”

- The growing global emphasis on reducing vehicle emissions and improving air quality, coupled with stricter government regulations, is a significant driver behind the rising demand for advanced exhaust sensor technologies

- For instance, in March 2024, the European Union reaffirmed the implementation of Euro 7 emission norms to be rolled out by 2025, compelling automakers to integrate more accurate and responsive exhaust sensors such as NOx, oxygen, and particulate matter sensors to comply with tighter emission thresholds

- As environmental concerns continue to escalate, vehicle manufacturers are prioritizing technologies that enable precise monitoring of exhaust gases, allowing engines to operate within optimal parameters while reducing harmful emissions

- Furthermore, regulations such as China VI, BS-VI in India, and Tier 3 standards in the U.S. are reinforcing the necessity for sensor-driven emission control systems in both passenger and commercial vehicles

- Exhaust sensors play a critical role in systems such as Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPF) by providing real-time feedback necessary for regulatory compliance, improving fuel efficiency, and reducing overall vehicle emissions

- As automakers shift toward sustainability and cleaner mobility solutions, the integration of exhaust sensors has become a standard across new ICE-powered models. This regulatory-driven demand, combined with the push for predictive diagnostics, is fueling sustained growth in the global exhaust sensor market

Restraint/Challenge

“High Sensor Replacement Costs and Performance Sensitivity in Harsh Environments”

- One of the primary challenges in the widespread adoption of exhaust sensors lies in their performance sensitivity to extreme operating conditions such as high temperatures, vibrations, and exposure to corrosive exhaust gases. These factors can lead to premature sensor degradation or failure, impacting long-term vehicle performance and compliance with emission regulations

- For instance, in September 2023, multiple reports from aftermarket service providers in the U.S. highlighted increased warranty claims related to early NOx sensor failures in diesel commercial vehicles, raising concerns about the durability and lifecycle costs of advanced exhaust sensors

- Exhaust sensors, especially NOx and particulate matter sensors, are intricate and costly components. The high replacement and maintenance costs, particularly in large fleet operations or heavy-duty vehicles, can deter adoption—especially in cost-sensitive markets or for vehicles operating under harsh usage cycles such as mining or long-haul transportation

- In addition, fluctuations in sensor calibration accuracy due to extreme thermal cycling or contamination from oil or fuel residues can impair sensor performance, leading to false diagnostics or suboptimal engine operation, which undermines both consumer confidence and regulatory compliance

- While advancements in materials science and sensor design are helping to mitigate some of these limitations, manufacturers must continue to invest in ruggedized sensor technologies and predictive maintenance systems to reduce long-term operational costs and improve reliability

- Overcoming these barriers will require continuous R&D investment, better vehicle-sensor integration strategies, and broader industry collaboration to ensure sensor longevity and cost-effectiveness across diverse automotive applications

Exhaust Sensor Market Scope

The market is segmented on the basis type, fuel type, vehicle type, component, and sales channel.

- By Type

On the basis of type, the exhaust sensor market is segmented into oxygen/lambda sensors, NOx sensors, particulate matter sensors, differential pressure sensors, engine coolant temperature sensors, exhaust temperature & pressure sensors, and MAP/MAF sensors. The oxygen/lambda sensors segment dominates the largest market revenue share in 2025, driven by their critical role in optimizing air-fuel ratio and reducing harmful emissions. These sensors are widely adopted across various vehicle types due to their reliability and compatibility with emission control systems. The growing stringency of emission norms globally further propels demand for oxygen sensors

The NOx sensors segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing implementation in diesel vehicles to comply with stringent nitrogen oxide emission regulations. NOx sensors enable precise monitoring and control of exhaust gases, helping manufacturers meet regulatory standards and improve fuel efficiency

• By Fuel Type

On the basis of fuel type, the exhaust sensor market is segmented into gasoline, diesel, and others. The gasoline segment held the largest market revenue share in 2025, driven by the widespread use of gasoline-powered passenger cars and light commercial vehicles. Gasoline engines require accurate exhaust sensing to optimize combustion and meet emission norms, which supports steady demand for sensors in this segment

The diesel segment is expected to witness the fastest CAGR from 2025 to 2032, attributed to rising diesel vehicle sales in emerging markets and the increasing need for advanced exhaust sensors to comply with stricter emission regulations such as Euro 6 and BS VI

• By Vehicle Type

On the basis of vehicle type, the exhaust sensor market is segmented into passenger cars, light-weight commercial vehicles (LCVs), heavy-weight commercial vehicles (HCVs), and hatchback/sedan. The passenger cars segment held the largest market revenue share in 2025, driven by the high volume production of passenger vehicles globally and increasing consumer focus on emission control and fuel efficiency

The heavy-weight commercial vehicle segment is anticipated to witness the fastest growth from 2025 to 2032, supported by regulatory mandates targeting commercial vehicles and the integration of advanced exhaust sensor technologies to meet these standards

• By Component

On the basis of component, the exhaust sensor market is segmented into exhaust manifold, muffler, oxygen sensor, and others. The oxygen sensor component segment accounted for the largest market revenue share in 2025, owing to its essential function in emission control systems and engine performance optimization. Oxygen sensors are commonly integrated within exhaust manifolds and after-treatment systems, ensuring accurate detection of exhaust gases

The exhaust manifold segment is expected to witness steady growth due to increasing integration of sensors for real-time monitoring of exhaust gases close to the engine, enhancing emissions control and engine management

• By Sales Channel

On the basis of sales channel, the exhaust sensor market is segmented into OEM and aftermarket. The OEM segment held the largest market revenue share in 2025, driven by the integration of exhaust sensors in new vehicle production to comply with regulatory requirements and improve vehicle performance

The aftermarket segment is anticipated to witness robust growth from 2025 to 2032, supported by rising vehicle parc, demand for sensor replacements, and retrofitting of emission control technologies in older vehicles to meet updated emission norms

Exhaust Sensor Market Regional Analysis

- Asia-Pacific dominates the exhaust sensor market with the largest revenue share of approximately 41.6% in 2024, driven by rapid automotive production, increasing vehicle sales, and stringent emission regulations across countries such as China, India, Japan, and South Korea

- Consumers and manufacturers in the region highly value the implementation of advanced exhaust sensor technologies to meet evolving standards such as China 6 and Bharat Stage VI, while improving fuel efficiency and reducing harmful emissions

- This widespread adoption is further supported by the presence of major automotive manufacturers, expanding urbanization, rising disposable incomes, and government initiatives promoting cleaner and greener vehicles, establishing exhaust sensors as essential components across passenger cars, commercial vehicles, and two-wheelers in the Asia-Pacific region

Japan Exhaust Sensor Market Insight

The Japan exhaust sensor market is gaining momentum due to the country’s advanced automotive industry, stringent emission regulations, and increasing demand for fuel-efficient and environmentally friendly vehicles. Japanese OEMs prioritize integrating sophisticated exhaust sensors in passenger cars and commercial vehicles to comply with regulations such as Japan’s Post New Long-Term Emission Regulations. The growing focus on connected and hybrid vehicles, along with Japan’s aging vehicle fleet requiring sensor replacements, is further driving market growth

China Exhaust Sensor Market Insight

The China exhaust sensor market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s rapid automotive production, expanding vehicle parc, and strict emission standards such as China 6. China’s push towards new energy vehicles and smart emission control technologies supports the adoption of advanced exhaust sensors. The expanding middle class and government initiatives promoting cleaner vehicles and smart cities are significant growth drivers in China

Europe Exhaust Sensor Market Insight

The European exhaust sensor market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent emission regulations such as Euro 6 and the Green Deal policies targeting carbon neutrality. The region’s strong automotive manufacturing base, especially in Germany, France, and the UK, demands advanced sensor technologies to reduce NOx and particulate emissions. Increasing consumer awareness about environmental impact and demand for fuel-efficient vehicles also fuel market growth

U.K. Exhaust Sensor Market Insight

The U.K. exhaust sensor market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by stringent emission control norms and the rising adoption of electric and hybrid vehicles. Increasing investments in vehicle modernization and retrofit programs to meet emission standards also boost sensor demand. The integration of exhaust sensors in both passenger and commercial vehicles remains crucial for compliance and performance enhancement

Germany Exhaust Sensor Market Insight

The German exhaust sensor market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s leadership in automotive technology and stringent environmental regulations. Germany’s emphasis on sustainability, coupled with the automotive industry’s shift towards electrification and advanced combustion engines, promotes the adoption of high-precision exhaust sensors. Collaboration between OEMs and sensor manufacturers fosters innovation in sensor design and functionality

Asia-Pacific Exhaust Sensor Market Insight

The Asia-Pacific exhaust sensor market is poised to grow at the fastest CAGR over the forecast period, driven by increasing vehicle production, rapid urbanization, and tightening emission standards across countries such as China, India, Japan, and South Korea. Government initiatives encouraging cleaner and greener vehicles, alongside rising disposable incomes, are expanding the adoption of advanced exhaust sensors. The region is also becoming a manufacturing hub for sensor technologies, improving affordability and accessibility

North America Exhaust Sensor Market Insight

North America dominates the exhaust sensor market with the largest revenue share in 2024, propelled by strict emission regulations such as EPA Tier 3 and California LEV, as well as a strong automotive manufacturing ecosystem. Consumers and manufacturers prioritize sensors that improve fuel efficiency and comply with environmental norms. The region’s growing focus on electric and hybrid vehicles, combined with robust R&D and government incentives for cleaner vehicles, is expanding market opportunities

U.S. Exhaust Sensor Market Insight

The U.S. exhaust sensor market captured the largest revenue share within North America in 2025, fueled by the widespread adoption of emission control technologies and stringent federal and state-level regulations. The increasing demand for passenger and commercial vehicles equipped with advanced exhaust sensing systems is significant. Additionally, growing investments in aftermarket sensor replacements and retrofitting older vehicles support market growth

Exhaust Sensor Market Share

The exhaust sensor industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Delphi Co. (U.Κ.)

- Denso Corporation (Japan)

- Sensata Technologies (U.S.)

- Hella KGAA Hueck (Germany)

- Hitachi Ltd. (Japan)

- Valeo S.A (France)

- STMicroelectronics NV (Switzerland)

- BorgWarner Inc. (U.S.)

- PHINIA Inc. (U.S.)

- Niterra North America, Inc (U.S.)

- Eberspächer (Germany)

- FORVIA HELLA (Germany)

Latest Developments in Global Exhaust Sensor Market

-

In March 2025, Hindustan Petroleum Corporation Ltd. (HPCL) and Tata Motors joined forces to introduce a co-branded Genuine Diesel Exhaust Fluid (DEF), aimed at enhancing the efficiency and compliance of BS6 commercial vehicles. This high-quality DEF solution is designed to optimize vehicle performance, improve drivetrain efficiency, and extend vehicle longevity. Produced in BIS-approved facilities, it meets the highest industry standards and will be available across HPCL’s extensive network of 23,000+ fuel stations, ensuring easy access for fleet operators and individual vehicle owners

- In December 2024, Denso developed the world's smallest automotive in-cabin air quality sensor, measuring just 12 cubic centimeters. This compact sensor enhances cabin air quality by detecting harmful gases and pollutants. This innovation allows for more efficient and space-saving integration into vehicle ventilation systems, contributing to a healthier and more comfortable driving environment. The sensor's small size and high sensitivity make it ideal for a wide range of automotive applications, improving air quality

- In September 2022, Bosch introduced the BEA 090 particle counter, designed as an add-on to existing emissions analyzers such as the BEA 550. This advanced device utilizes Condensation Particle Counting (CPC), a highly precise method for measuring exhaust emissions from modern Euro 6/VI diesel vehicles. The BEA 090 ensures compliance with evolving regulations and future particulate measurement standards. It connects via Bluetooth to Bosch’s BEA PC software, streamlining emissions testing for workshops and testing organizations

- In April 2022, Continental expanded its range of Exhaust Gas Temperature (EGT) sensors, enhancing engine management and emissions control. These sensors provide precise temperature readings, optimizing combustion efficiency and reducing fuel consumption. Designed for durability, they withstand harsh conditions while ensuring high reliability in modern vehicles. The updated EGT sensors help manufacturers meet stricter emissions standards, contributing to cleaner and more fuel-efficient automotive solutions

- In December 2021, Napino Group partnered with Kerdea Technologies to advance oxygen sensor technology for the automotive industry. This licensing partnership enables Napino to integrate Kerdea’s proprietary resistive O₂ sensor technology, improving engine efficiency and emissions control. The sensors enhance fuel efficiency, detect engine misfires, and offer 360-degree mounting flexibility, reducing catalytic converter size and costs. With BS-VI and upcoming OBD2 norms, demand for these sensors is expected to rise across vehicle segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.