Global Expression Vectors Market

Market Size in USD Million

CAGR :

%

USD

406.40 Million

USD

667.56 Million

2024

2032

USD

406.40 Million

USD

667.56 Million

2024

2032

| 2025 –2032 | |

| USD 406.40 Million | |

| USD 667.56 Million | |

|

|

|

|

Expression Vectors Market Size

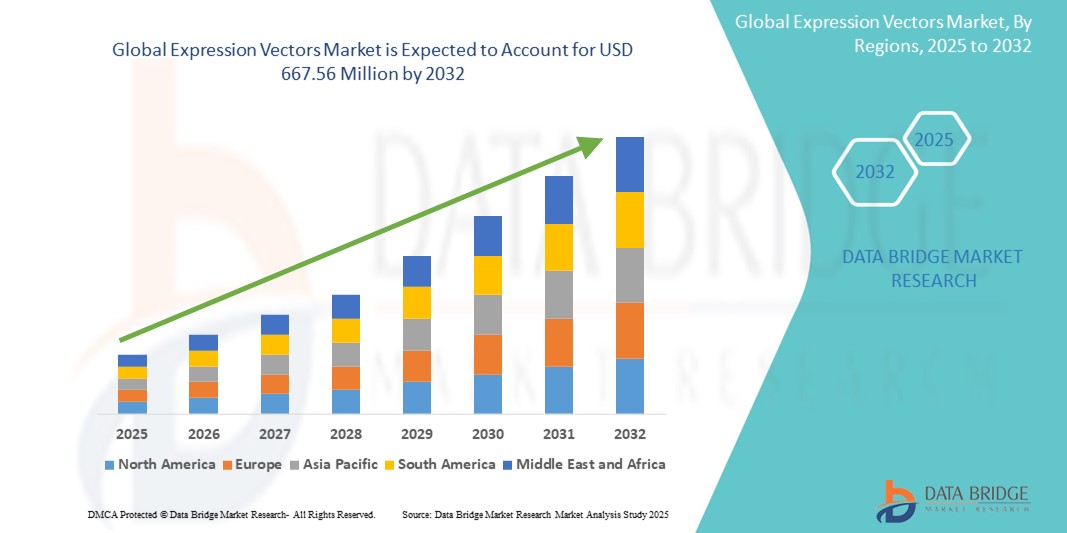

- The global expression vectors market size was valued at USD 406.40 million in 2024 and is expected to reach USD 667.56 million by 2032, at a CAGR of 6.40% during the forecast period

- This growth is driven by factors such as the increasing demand for biopharmaceuticals, technological advancements in genetic engineering and growing research in personalized medicine and gene therapy

Expression Vectors Market Analysis

- Expression vectors are essential tools in molecular biology and biotechnology, serving as vehicles for delivering genetic material into host cells to produce recombinant proteins, therapeutic antibodies, and gene therapies. They play a critical role in research, drug development, and the production of biopharmaceuticals

- The demand for expression vectors is significantly driven by the increasing use of biologics, advancements in genetic engineering technologies, and the growing focus on personalized medicine and gene therapies

- North America is expected to dominate the expression vectors market, with 40.8% market share, driven by advanced biotechnology research, strong investment in gene therapy, and the presence of leading biopharmaceutical companies

- Asia-Pacific is expected to be the fastest growing region in the expression vectors market, with 28.7% of the global market share, driven by increasing investments in biotechnology, expanding pharmaceutical manufacturing, and growing demand for advanced therapeutics

- Therapeutic applications vectors segment is expected to dominate the market with a market share of 52.05% due to the rapid growth of gene therapy research and development. As a critical component in delivering therapeutic genes into patients' cells to treat genetic and acquired diseases, expression vectors play a vital role in advancing personalized medicine.

Report Scope and Expression Vectors Market Segmentation

|

Attributes |

Expression Vectors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Thermo Fisher Scientific, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Expression Vectors Market Trends

“Advancements in Expression Vectors for Gene Therapy and Biopharmaceutical Production”

- A key trend in the evolution of expression vectors is the increasing integration of advanced genetic engineering techniques and optimization methods

- These innovations enhance the efficiency and specificity of gene expression, improving the development of therapeutic proteins and genetic treatments

- For instance, next-generation expression vectors are being designed to facilitate higher-yield production of biopharmaceuticals such as monoclonal antibodies, hormones, and enzymes, making them critical in personalized medicine and large-scale pharmaceutical manufacturing

- Advancements in vector design, such as the use of viral and non-viral delivery systems, have significantly enhanced the ability to target specific cells or tissues, leading to more precise gene therapies. This is particularly beneficial for the treatment of genetic disorders, cancers, and other chronic conditions

- These advancements are transforming the expression vectors market, improving therapeutic efficacy, accelerating drug discovery, and driving demand for increasingly sophisticated expression systems

Expression Vectors Market Dynamics

Driver

“Rising Demand for Biopharmaceuticals and Gene Therapies”

- The increasing demand for biopharmaceuticals and gene therapies is a major driver for the expression vectors market, as these vectors are essential for producing therapeutic proteins, antibodies, and personalized medicines

- The growing prevalence of chronic diseases such as cancer, genetic disorders, and infectious diseases has created a significant demand for innovative therapies, accelerating the use of expression vectors in drug development and manufacturing

- The shift towards personalized medicine, where treatments are tailored to individual patient profiles, further fuels the demand for advanced expression systems capable of producing complex biologics

For instance,

- In March 2024, according to a report published by the International Society for Cell & Gene Therapy (ISCT), the global cell and gene therapy market is expected to reach USD 25.0 billion by 2027, driven by the increasing number of gene therapy approvals and the rapid advancement of genetic engineering technologies

- As a result, the demand for high-efficiency expression vectors is rising, supporting the large-scale production of biologics and gene therapies

Opportunity

“Emergence of Synthetic Biology and Advanced Vector Engineering”

- The emergence of synthetic biology and advanced vector engineering technologies offers significant growth opportunities for the expression vectors market

- Synthetic biology enables the design of highly optimized vectors with improved gene expression, reduced immunogenicity, and enhanced safety profiles, making them ideal for therapeutic applications

- Advanced vector engineering, including the use of self-amplifying RNA (saRNA) and CRISPR-based systems, allows for precise genetic modifications, expanding the range of possible therapeutic targets

For instance,

- In January 2025, a study published in Nature Biotechnology highlighted the development of novel self-amplifying RNA vectors, which can significantly enhance the efficiency of gene expression, reduce production costs, and improve the scalability of gene therapies

- These advancements in synthetic biology and vector engineering are expected to transform the field of gene therapy, enabling the production of next-generation biologics and personalized medicines

Restraint/Challenge

“Complex Manufacturing Processes and High Production Costs”

- The complex manufacturing processes and high production costs associated with expression vectors pose a significant challenge to market growth

- Expression vectors require precise engineering and rigorous quality control to ensure their stability, safety, and efficiency, leading to high production costs and extended development timelines

- These factors can limit the scalability and affordability of gene therapies, especially for smaller biotech companies and research institutions with limited budgets

For instance,

- In September 2024, a report published by the American Society of Gene & Cell Therapy (ASGCT) noted that the high costs of vector production remain a critical barrier to the widespread adoption of gene therapies, with manufacturing expenses accounting for nearly 70% of total therapy costs

- Consequently, this cost barrier can hinder the commercial viability of gene therapies, limiting their accessibility and market reach

Expression Vectors Market Scope

The market is segmented on the basis of host type, application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Host Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the therapeutic applications is projected to dominate the market with a largest share in application segment

The therapeutic applications segment is expected to dominate the expression vectors market with the largest market share of 52.05% due to the rapid growth of gene therapy research and development. As a critical component in delivering therapeutic genes into patients' cells to treat genetic and acquired diseases, expression vectors play a vital role in advancing personalized medicine. The increasing prevalence of chronic diseases, such as cancer and genetic disorders, has further propelled the demand for expression vectors in developing protein-based therapeutics, contributing to the segment's substantial market share.

The bacterial expression vectors is expected to account for the largest share during the forecast period in host type market

In 2025, the bacterial expression vectors segment is expected to dominate market with the largest share of 39.8% in 2025 due to its versatility and efficiency in protein production. Bacterial expression systems, particularly those utilizing Escherichia coli (E. coli), are widely employed due to their simplicity, rapid growth, and cost-effectiveness. These vectors are extensively used in research laboratories for studying gene expression, protein function, and structure, as well as in the biopharmaceutical industry for the large-scale production of therapeutic proteins and enzymes, further driving market growth.

Expression Vectors Market Regional Analysis

“North America Holds the Largest Share in the Expression Vectors Market”

- North America dominates the expression vectors market, accounting for approximately 40.8% of the global market share, driven by advanced biotechnology research, strong investment in gene therapy, and the presence of leading biopharmaceutical companies

- U.S. holds a significant share of 35.6% of the global market share, primarily due to its robust biopharmaceutical industry, extensive funding for genetic research, and widespread adoption of gene editing technologies such as CRISPR

- In addition, the U.S. leads in technological advancements, including the development of next-generation expression systems and high-efficiency viral and non-viral vectors, further strengthening the market

- The availability of state-of-the-art research facilities, a highly skilled workforce, and supportive regulatory frameworks for gene therapy and biopharmaceutical production are key factors driving market growth in this region

“Asia-Pacific is Projected to Register the Highest CAGR in the Expression Vectors Market”

- Asia-Pacific is expected to witness the highest growth rate in the expression vectors market, with 28.7% market share, driven by increasing investments in biotechnology, expanding pharmaceutical manufacturing, and growing demand for advanced therapeutics

- Countries such as China, India, and Japan are emerging as key markets due to their rapidly expanding biopharmaceutical sectors, supportive government policies, and significant investments in genomic research

- Japan, known for its advanced biotechnology research, remains a crucial market for expression vectors, with high adoption rates for cell and gene therapy applications. The country continues to lead in the deployment of innovative vector technologies to support personalized medicine and precision oncology

- India is projected to register the highest CAGR of 6.7% in the region, driven by growing R&D investments, increasing clinical trials, and a rising focus on developing cost-effective biologics and gene therapies

Expression Vectors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

• Thermo Fisher Scientific, Inc. (U.S.)

• Promega Corporation (U.S.)

• Agilent Technologies, Inc. (U.S.)

• Bio-Rad Laboratories Inc. (U.S.)

• QIAGEN (Germany)

• Merck KGaA (Germany)

• TAKARA HOLDINGS INC. (Japan)

• New England Biolabs (U.S.)

• GenScript (U.S.)

• Synbio Technologies (U.S.)

• Addgene, Inc. (U.S.)

• OriGene Technologies, Inc. (U.S.)

• InvivoGen (U.S.)

• GeneCopoeia, Inc. (U.S.)

• ATCC (U.S.)

• tebu-bio (France)

• System Biosciences, LLC. (U.S.)

• Sanofi (France)

• transOMIC (U.S.)

• Genlantis Inc. (U.S.)

• Macrogen, Inc. (South Korea)

• Gene Bridges GmbH (Germany)

Latest Developments in Global Expression Vectors Market

- In February 2025, Thermo Fisher Scientific, Inc. announced the launch of its next-generation expression vector system, designed to enhance protein expression in mammalian cells. This system includes advanced regulatory elements and optimized vector backbones, improving expression efficiency and reducing time to market for biopharmaceutical companies developing protein-based therapeutics. The new platform also integrates with Thermo Fisher’s proprietary gene synthesis services, enabling seamless gene-to-protein workflows for faster drug development

- In November 2024, Agilent Technologies, Inc. introduced its latest suite of CRISPR-compatible expression vectors, designed to streamline genome editing and functional genomics research. These vectors feature enhanced cloning efficiencies, improved transfection rates, and robust protein production capabilities, supporting the rapid expansion of gene therapy research and personalized medicine. The new tools are expected to significantly reduce the time and cost associated with gene expression studies

- In October 2024, Promega Corporation launched its high-efficiency bacterial expression vectors, optimized for large-scale protein production in E. coli. These vectors are designed to address the growing demand for recombinant proteins in the pharmaceutical and biotechnology industries, offering rapid expression, high yields, and compatibility with downstream purification processes. The launch reflects Promega’s commitment to advancing life science research and biomanufacturing capabilities

- In September 2024, QIAGEN announced the release of its proprietary mammalian expression vectors, which incorporate next-generation promoters and enhancers for high-yield protein production. These vectors are tailored for use in therapeutic protein production, including monoclonal antibodies and vaccine antigens. The launch comes as QIAGEN continues to expand its portfolio of molecular biology tools, supporting drug discovery and development pipelines worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.