Global Extruded Snacks Market

Market Size in USD Million

CAGR :

%

USD

195.33 Million

USD

298.63 Million

2024

2032

USD

195.33 Million

USD

298.63 Million

2024

2032

| 2025 –2032 | |

| USD 195.33 Million | |

| USD 298.63 Million | |

|

|

|

|

Extruded Snacks Market Size

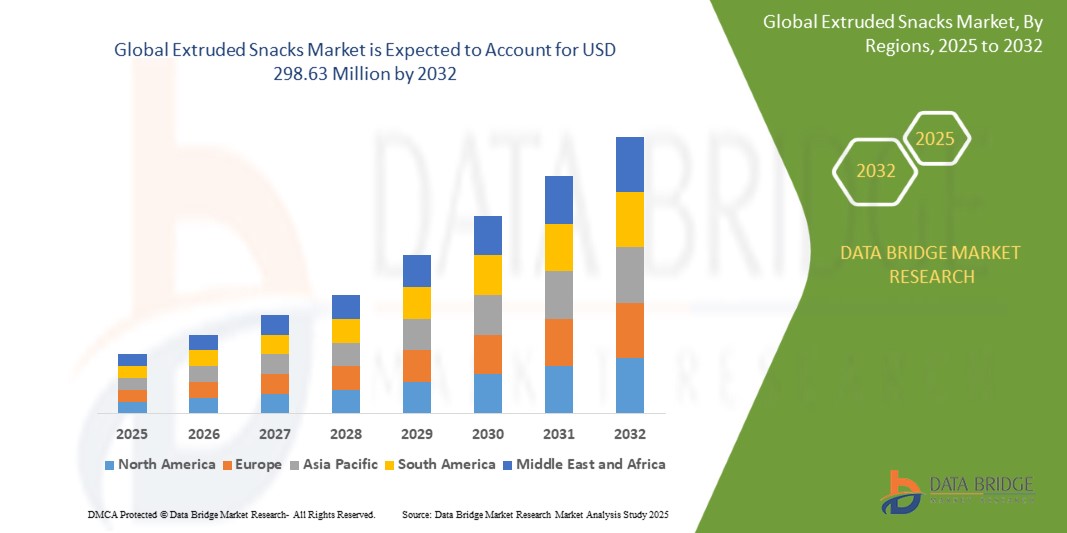

- The global extruded snacks market was valued at USD 195.33 million in 2024 and is expected to reach USD 298.63 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.5%, primarily driven by the increasing use of healthier, plant-based ingredients such as quinoa, lentils, chickpeas, and sweet potatoes.

- This growth is driven by factors such as the growing demand for convenient, healthy, and rising popularity of plant-based and protein-rich snacks

Extruded Snacks Market Analysis

- The extruded snacks market is driven by the increasing consumer demand for convenient, healthier snack options, with a shift towards products that offer improved nutritional value, such as high-protein, low-fat, and gluten-free snacks.

- The growing popularity of clean-label and non-GMO products is pushing manufacturers to innovate, focusing on simpler ingredients and transparent sourcing to cater to health-conscious consumers. Furthermore, the rise in demand for vegan, organic, and sustainable snacks is influencing product development.

- North America and Europe are leading markets for extruded snacks, driven by their established retail infrastructure, innovation in snack varieties, and consumer preference for on-the-go, healthier snack options. The Asia-Pacific region is expected to register the highest growth due to increasing urbanization, changing diets, and rising disposable incomes.

Report Scope and Extruded Snacks Market Segmentation

|

Attributes |

Extruded Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Extruded Snacks Market Trends

“Adoption of Health-Conscious Ingredients and Flavors to Meet Consumer Demand for Nutritious and Flavorful Snacks”

- A key trend in the extruded snacks market is the increasing use of healthier, plant-based ingredients such as quinoa, lentils, chickpeas, and sweet potatoes. These alternatives to traditional ingredients like corn and potatoes provide consumers with more nutrient-dense options, offering higher fiber, protein, and micronutrient content.

- Extruded snack brands are focusing on the development of bold, innovative flavors such as spicy sriracha, smoky barbecue, and exotic herb blends. Alongside flavor innovation, the incorporation of functional additives like probiotics, omega-3s, and plant-based proteins is gaining popularity to meet the demand for snacks that support health and wellness.

- Manufacturers are increasingly adopting clean label practices, with a greater emphasis on using non-GMO, organic, and sustainably sourced ingredients. This trend reflects the rising consumer preference for transparency and ethical sourcing in food products.

For instance, A 2024 article by TIME highlights the growing popularity of alternative chocolates made without cocoa, using ingredients like sunflower protein flour and grape seeds, as a response to sustainability concerns and the desire for novel flavors in snacks.

Extruded Snacks Market Dynamics

Driver

“Growing Demand for Convenient, Healthy, and On-the-Go Snacking Options”

- Modern lifestyles and busy schedules have increased consumer preference for convenient and ready-to-eat food products, significantly driving the growth of the extruded snacks market. These snacks are portable, easy to consume, and offer a quick energy boost, making them ideal for on-the-go consumption.

- Consumers are increasingly seeking healthier snack alternatives that are low in fat, high in fiber or protein, and free from artificial additives. Extruded snacks made with whole grains, legumes, and natural flavorings are emerging as popular choices.

- The rising health awareness among millennials and Gen Z, combined with a demand for novelty in flavors and textures, is prompting manufacturers to innovate with multi-grain, vegetable-based, and protein-fortified extruded snack formulations.

For instance,

- Post-pandemic, UK consumers have shifted towards healthier snack options. There's been a notable increase in the consumption of snacks like fruit, nuts, protein bars, and yoghurts over traditional treats such as biscuits and chocolate. This change is influenced by economic pressures, rising costs of ingredients, and a growing health consciousness among consumers.

- As consumers continue to prioritize convenience and nutrition, the extruded snacks market is expected to grow steadily, with manufacturers developing products that cater to evolving dietary preferences and health trends.

Opportunity

“Expansion of Better-for-You Extruded Snacks with Functional Ingredients and Clean Labels”

- The growing health consciousness among consumers is fueling demand for extruded snacks enriched with functional ingredients such as plant-based proteins, fiber, vitamins, and minerals, positioning them as healthier snacking alternatives.

- Manufacturers are incorporating legumes, whole grains, and superfoods like quinoa, lentils, chickpeas, and spirulina into extruded snacks, enhancing their nutritional profile and catering to diets such as keto, vegan, or gluten-free.

- Clean-label trends are encouraging brands to reformulate extruded snacks without artificial flavors, preservatives, or synthetic additives—aligning with consumer demand for transparency and natural ingredients.

- Innovations in extrusion technology are enabling low-oil or oil-free processing, the use of non-traditional ingredients, and customization of shapes and textures to appeal to a broad consumer base.

For instance,

- Naturell introduced India's first protein-rich extruded snack, RiteBite Max Protein Chips, made from oats, wheat, soy, ragi, gram, corn, and rice. These hot-air puffed chips contain 10 grams of protein and three grams of fiber per serving, catering to health-conscious Indian consumers seeking nutritious, convenient snacks.

As consumer interest in health-forward snacking continues to rise, there is a significant opportunity for brands to lead the market with functional, clean-label, and nutritionally dense extruded snacks that serve both indulgence and well-being.

Restraint/Challenge

“Balancing Clean Label Demand with Taste, Texture, and Shelf-Life Stability”

- The rising consumer preference for clean-label extruded snacks—free from artificial preservatives, colors, and additives—creates formulation challenges for manufacturers trying to maintain taste, texture, and shelf-life.

- Removing synthetic ingredients often leads to issues such as flavor degradation, textural inconsistency (e.g., sogginess or staleness), and shorter shelf stability, which can affect product appeal and increase food waste.

- Natural alternatives such as plant-based emulsifiers, stabilizers, or antioxidants are typically more expensive, less effective in small quantities, or not always available in consistent quality, adding cost and complexity.

- Reformulating popular extruded snacks to align with clean-label standards can require extensive R&D investments, longer development cycles, and even process redesigns for extrusion equipment.

For instance,

- The Snacklins brand emphasizes clean-label ingredients, but they acknowledge that removing preservatives can lead to shorter shelf life. They are actively working on solutions to enhance product longevity while maintaining their clean-label standards.

Extruded Snacks Market Scope

The market is segmented on the basis type, raw material, distribution channel and manufacturing method.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Raw Material |

|

|

By Manufacturing Method |

|

|

By Distribution Channel |

|

Extruded Snacks Market Regional Analysis

“North America is the Dominant Region in the Extruded Snacks Market”

- North America commands the largest share of the global extruded snacks market, driven by high per-capita snack consumption and a long-standing snacking culture

- The U.S. leads the region due to widespread availability of a diverse range of extruded snacks, strong retail and e-commerce networks, and continuous product launches catering to health- and flavor-focused consumers

- Major foodservice chains and quick-service restaurants in North America routinely feature extruded snacks on their menus, further entrenching consumer habits

- Rising demand for better-for-you options—such as protein-fortified and grain-blend extrudates—combined with heavy marketing investment sustains North America’s market leadership

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is set to post the fastest growth in the extruded snacks market, propelled by rapid urbanization, rising disposable incomes, and shifting consumer lifestyles

- China and India are key drivers, as young, urban populations embrace convenient, portable snack formats amid busy workdays and growing health awareness

- Southeast Asian markets—particularly Indonesia and Vietnam—are seeing local manufacturers innovate with regionally inspired flavors (e.g., chili garlic, seaweed) in extruded snacks

- Expansion of modern retail channels and online grocery platforms in Asia-Pacific improves product accessibility, accelerating adoption of extruded snacks across both urban and secondary cities

Extruded Snacks Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Calbee, Inc. (Japan)

- PepsiCo, Inc. (U.S)

- Kellogg Company (U.S)

- Campbell Soup Company (U.S)

- General Mills Inc. (U.S)

- ITC Limited (India)

- Grupo Bimbo, S.A.B. de C.V. (Mexico)

- Old Dutch Foods Inc. (U.S)

- Lorenz Snack-World (Germany)

- Amica Chips S.P.A. (Italy)

- Universal Robina Corporation (Philippines)

- Balance Foods, Inc. (U.S)

- JFC International (U.S)

- Ballreich Snack Food Company (U.S)

- Barrel O’ Fun Snack Foods Co., Inc. (U.S)

- Chipita S.A.(Greece)

- Tropical Heat (Kenya)

- Griffin’s Foods Limited (New Zealand)

- ICA Foods International (Italy)

- San Carlo (Italy)

Latest Developments in Global Extruded Snacks Market

- In October 2019, Calbee (US) acquired Warnock Food Products, Inc. to expand its presence in the US market and neighboring countries.

- Little Debbie has launched Nutty Buddy Creme Pies, a new treat that merges the flavors of peanut butter and chocolate. This product transforms the classic Nutty Buddy wafer bars into a soft and chewy sandwich cookie format, appealing to consumers seeking nostalgic yet innovative snacks.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Extruded Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Extruded Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Extruded Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.