Global Facial Fat Transfer Market

Market Size in USD Billion

CAGR :

%

USD

2.76 Billion

USD

6.25 Billion

2025

2033

USD

2.76 Billion

USD

6.25 Billion

2025

2033

| 2026 –2033 | |

| USD 2.76 Billion | |

| USD 6.25 Billion | |

|

|

|

|

Facial Fat Transfer Market Size

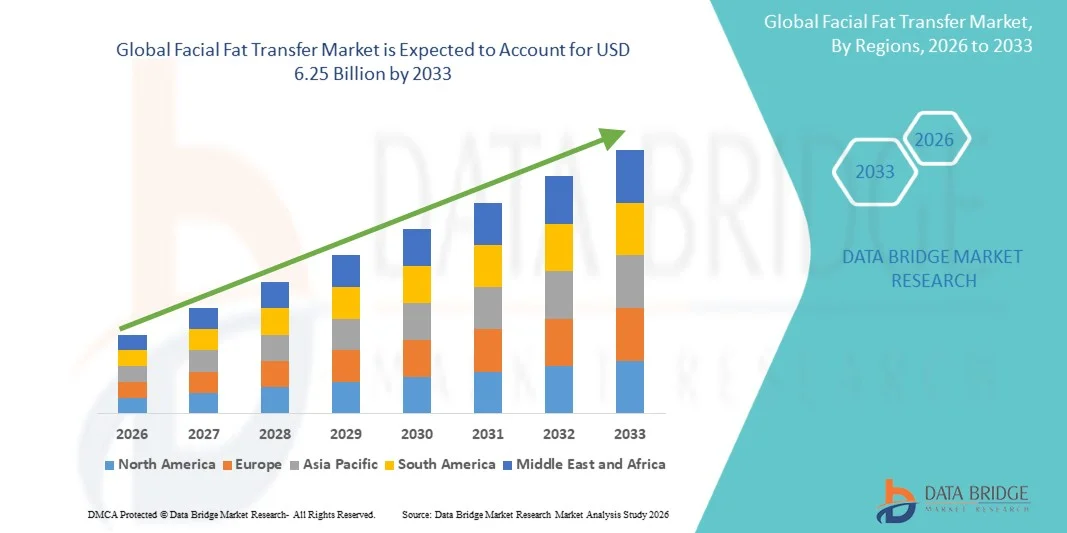

- The global facial fat transfer market size was valued at USD 2.76 billion in 2025 and is expected to reach USD 6.25 billion by 2033, at a CAGR of 10.72% during the forecast period

- The market growth is largely fueled by increasing demand for minimally invasive cosmetic procedures, rising awareness of autologous fat grafting benefits, and advancements in fat harvesting and injection techniques, driving higher adoption among aesthetic clinics and plastic surgeons

- Furthermore, growing consumer preference for natural-looking results, longer-lasting effects compared to synthetic fillers, and increasing investments in cosmetic and reconstructive procedures are positioning facial fat transfer as a preferred solution for facial rejuvenation and contouring. These converging factors are accelerating the uptake of facial fat transfer procedures, thereby significantly boosting the industry's growth

Facial Fat Transfer Market Analysis

- Facial fat transfer, involving the harvesting and reinjection of autologous fat for facial augmentation and rejuvenation, is becoming an essential procedure in cosmetic and reconstructive surgery due to its natural results, minimally invasive nature, and long-lasting effects

- The rising demand for facial fat transfer is primarily driven by increasing consumer awareness of non-surgical cosmetic procedures, the desire for natural-looking facial enhancements, and growing popularity of minimally invasive aesthetic treatments among both men and women

- North America dominated the facial fat transfer market with the largest revenue share of 38.9% in 2025, fueled by advanced healthcare infrastructure, high adoption of cosmetic procedures, and strong presence of leading aesthetic clinics and plastic surgeons, with the U.S. witnessing significant growth in facial fat transfer procedures, particularly for anti-aging and facial contouring, supported by innovations in fat processing and injection techniques

- Asia-Pacific is expected to be the fastest-growing region in the facial fat transfer market during the forecast period due to rising disposable incomes, increasing interest in aesthetic procedures, and growing awareness of autologous fat grafting among urban populations

- Fat injection segment dominated the facial fat transfer market with a market share of 47.5% in 2025, driven by its safety, natural results, and preference over synthetic dermal fillers for long-lasting facial rejuvenation and contouring

Report Scope and Facial Fat Transfer Market Segmentation

|

Attributes |

Facial Fat Transfer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Facial Fat Transfer Market Trends

“Rising Preference for Minimally Invasive Natural Aesthetic Procedure”

- A significant and accelerating trend in the global facial fat transfer market is the growing preference for minimally invasive procedures that provide natural-looking results, reducing dependency on synthetic fillers

- For instance, autologous fat grafting is increasingly chosen over dermal fillers for lip augmentation, under-eye rejuvenation, and naso-labial fold correction, as it offers long-lasting effects with lower risk of allergic reactions

- Advances in fat harvesting, purification, and injection techniques are enabling more precise contouring, improved graft survival, and faster recovery times, enhancing overall patient satisfaction

- Integration of facial imaging and 3D mapping technologies with fat transfer procedures allows surgeons to plan and execute treatments more accurately, leading to consistent and aesthetically pleasing results

- Growing collaboration between aesthetic clinics and technology providers is fostering innovation in fat transfer techniques, devices, and post-procedure care

- Expansion of medical tourism for cosmetic procedures is increasing access to facial fat transfer in emerging markets, driving demand globally

- This trend towards natural, patient-specific, and minimally invasive facial rejuvenation procedures is shaping consumer expectations and driving clinics to adopt advanced fat transfer solutions

- The demand for facial fat transfer is growing rapidly across cosmetic surgery clinics and hospitals, as patients increasingly prioritize safety, natural results, and long-term benefits over temporary synthetic alternatives

Facial Fat Transfer Market Dynamics

Driver

“Increasing Demand Due to Rising Awareness and Aesthetic Preferences”

- The rising awareness of facial fat transfer benefits, coupled with growing consumer interest in non-surgical cosmetic enhancements, is a key driver for market expansion

- For instance, more individuals are opting for fat injection procedures to correct facial volume loss, reduce under-eye hollows, and enhance lip and cheek contours, seeking natural and long-lasting results

- The proliferation of cosmetic surgery clinics, coupled with marketing campaigns highlighting minimally invasive techniques, is encouraging more patients to consider facial fat transfer over traditional surgical interventions

- Increasing media exposure and social media influence on aesthetic standards are driving higher adoption rates, particularly among millennials and urban populations

- The convenience, safety, and efficacy of autologous fat procedures, along with shorter recovery times compared to invasive surgeries, are further propelling market growth

- Rising demand for corrective and reconstructive procedures following trauma or aging is expanding clinical applications of facial fat transfer

- Continuous R&D in improving fat retention and reducing complications is increasing patient confidence and procedure adoption rates

Restraint/Challenge

“High Procedure Costs and Limited Fat Availability”

- The high costs associated with facial fat transfer procedures, especially those involving advanced equipment and specialized techniques, pose a significant challenge to market growth

- For instance, patients may be deterred by the overall expense compared to dermal fillers or other temporary treatments, limiting adoption in price-sensitive regions

- The requirement of sufficient donor fat from the patient’s own body can restrict the procedure for individuals with low body fat, reducing the potential customer pool

- In addition, variations in fat graft survival rates and procedural outcomes may affect patient satisfaction and willingness to undergo repeated treatments

- Regulatory compliance and standardization of fat processing techniques across regions can also act as hurdles, affecting the consistency and safety of procedures

- Lack of trained specialists in emerging markets may limit access and slow adoption of advanced fat transfer techniques

- Potential post-procedure complications such as uneven volume retention or swelling may discourage some patients, impacting market growth

- Overcoming these challenges through cost optimization, technological innovation, and improved clinical protocols will be vital for sustained market growth

Facial Fat Transfer Market Scope

The market is segmented on the basis of target area, treatment, and end-user.

- By Target Area

On the basis of target area, the facial fat transfer market is segmented into naso-labial folds, lips, marionette folds, temples, chin, and under-eye area. The under-eye area segment dominated the market with the largest revenue share in 2025, driven by the high prevalence of tear trough deformities and the growing demand for minimally invasive rejuvenation procedures. Patients increasingly prefer fat transfer over synthetic fillers for the under-eye area due to its natural results, long-lasting effects, and lower risk of allergic reactions. Surgeons favor this segment as it allows precise volume restoration, addressing hollowing, dark circles, and early signs of aging. Clinics offering specialized under-eye fat transfer treatments are witnessing consistent patient inflow, supported by advancements in micro-fat harvesting and injection techniques. The segment also benefits from social media and cosmetic trends emphasizing youthful and refreshed appearances. The consistent success rates and minimal downtime further reinforce its market dominance.

The lips segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing aesthetic consciousness and the rising popularity of fuller, natural-looking lips among millennials and urban populations. Fat injection in the lips is preferred for its natural feel and reduced risk of adverse reactions compared to synthetic fillers. Innovations in precision injection techniques and fat processing are enhancing patient satisfaction. Influencer trends, cosmetic marketing, and social media exposure are driving higher adoption. The segment is also benefiting from medical tourism, where patients seek specialized procedures for lip enhancement. Easy recovery and repeatable outcomes further contribute to its rapid growth trajectory.

- By Treatment

On the basis of treatment, the facial fat transfer market is segmented into dermal fillers, fat injection, and others. The fat injection segment dominated the market with the largest revenue share of 47.5% in 2025, supported by its safety profile, natural results, and growing preference for autologous solutions in facial rejuvenation. Fat injection offers versatility across multiple facial areas, enabling surgeons to address aging signs, volume loss, and contouring in a single procedure. The procedure’s long-lasting outcomes compared to temporary dermal fillers drive patient preference. Technological advancements in fat processing and grafting techniques are increasing success rates and patient confidence. Clinics are investing in training and equipment to optimize fat injection procedures. The segment benefits from rising cosmetic awareness and minimally invasive aesthetic trends globally.

The dermal fillers segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its non-invasive nature, immediate results, and lower cost compared to fat transfer. Dermal fillers remain popular for patients seeking subtle enhancements or those unable to provide sufficient donor fat. Advances in hyaluronic acid fillers and novel formulations enhance safety and longevity, boosting adoption. Quick procedures, minimal downtime, and growing awareness through cosmetic influencers are driving patient preference. Emerging markets with increasing disposable incomes and expanding cosmetic clinic networks are contributing to rapid growth. Continuous innovation in filler materials and injection techniques is further accelerating the segment’s market penetration.

- By End-User

On the basis of end-user, the facial fat transfer market is segmented into hospitals, cosmetic surgery clinics, and others. The cosmetic surgery clinics segment dominated the market with the largest revenue share in 2025, as these clinics specialize in minimally invasive aesthetic procedures and offer personalized treatments with high precision. Clinics benefit from repeat patient visits, bundled aesthetic packages, and marketing campaigns targeting urban and affluent populations. Skilled surgeons, advanced equipment, and procedure-specific expertise drive patient trust and preference for these clinics. Cosmetic surgery clinics are often early adopters of new technologies and techniques, contributing to higher procedure volumes. High patient satisfaction and positive outcomes support market dominance in this segment.

The hospitals segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the expansion of hospital-based cosmetic and reconstructive surgery units, particularly in emerging regions. Hospitals provide access to multidisciplinary teams, advanced infrastructure, and comprehensive care, attracting patients seeking safe and high-quality procedures. Growing awareness of reconstructive and corrective facial fat transfer applications post-trauma or surgery is boosting adoption. Insurance coverage in some regions for reconstructive procedures also fuels growth. Hospitals’ ability to combine aesthetic treatments with other medical services further enhances market penetration. Continuous training programs and collaborations with cosmetic experts are increasing procedural capacity, supporting rapid growth

Facial Fat Transfer Market Regional Analysis

- North America dominated the facial fat transfer market with the largest revenue share of 38.9% in 2025, fueled by advanced healthcare infrastructure, high adoption of cosmetic procedures, and strong presence of leading aesthetic clinics and plastic surgeons

- Consumers in the region highly value natural-looking results, long-lasting effects, and the safety of autologous fat transfer over synthetic fillers, leading to higher adoption among both men and women

- This widespread adoption is further supported by advanced healthcare infrastructure, high disposable incomes, a strong presence of skilled cosmetic surgeons, and the proliferation of specialized aesthetic clinics, establishing facial fat transfer as a preferred solution for anti-aging and reconstructive facial treatments

U.S. Facial Fat Transfer Market Insight

The U.S. facial fat transfer market captured the largest revenue share of 79% in 2025 within North America, fueled by increasing consumer awareness of minimally invasive aesthetic procedures and the growing demand for natural-looking facial rejuvenation. Patients are increasingly prioritizing treatments that restore facial volume, reduce under-eye hollows, and enhance lip and cheek contours using autologous fat. The rising trend of cosmetic procedures among millennials and aging populations, combined with advanced clinical infrastructure and skilled cosmetic surgeons, further propels market growth. Moreover, innovations in fat harvesting and injection techniques, along with integration of 3D imaging for precise contouring, are significantly contributing to market expansion.

Europe Facial Fat Transfer Market Insight

The Europe facial fat transfer market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising aesthetic awareness and the increasing popularity of minimally invasive cosmetic procedures. Consumers are increasingly seeking natural alternatives to synthetic fillers for facial volume restoration and anti-aging treatments. Urbanization, coupled with the growth of specialized aesthetic clinics and cosmetic surgery centers, is fostering adoption. European patients value safety, precision, and long-lasting results, making facial fat transfer a preferred option. The market is experiencing significant growth across hospitals and cosmetic clinics, with procedures incorporated into both new treatments and corrective surgeries.

U.K. Facial Fat Transfer Market Insight

The U.K. facial fat transfer market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing trend of cosmetic enhancements and the demand for natural-looking facial rejuvenation. Concerns regarding facial aging, hollowing, and volume loss are encouraging patients to choose autologous fat transfer over traditional fillers or surgical interventions. The U.K.’s strong healthcare infrastructure, combined with widespread awareness of cosmetic procedures, is expected to stimulate market growth. Clinics offering advanced fat transfer techniques and minimally invasive procedures are witnessing higher patient inflow. Cosmetic tourism within the region further contributes to adoption.

Germany Facial Fat Transfer Market Insight

The Germany facial fat transfer market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of non-surgical aesthetic procedures and the demand for technologically advanced, precise solutions. Germany’s well-developed healthcare infrastructure, along with high disposable incomes and preference for natural cosmetic results, promotes the adoption of facial fat transfer. The integration of 3D facial imaging and refined fat injection techniques is becoming increasingly prevalent, with patients seeking safe, long-lasting, and minimally invasive facial rejuvenation. The market is also supported by the country’s focus on quality healthcare services and skilled cosmetic professionals.

Asia-Pacific Facial Fat Transfer Market Insight

The Asia-Pacific facial fat transfer market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising disposable incomes, increasing aesthetic awareness, and rapid urbanization in countries such as China, Japan, and India. The growing inclination towards cosmetic enhancements, coupled with expanding networks of cosmetic surgery clinics and hospitals, is driving adoption. Government initiatives promoting medical tourism and digital healthcare infrastructure further support market growth. Moreover, Asia-Pacific’s large patient population and growing acceptance of minimally invasive procedures are contributing to market expansion.

Japan Facial Fat Transfer Market Insight

The Japan facial fat transfer market is gaining momentum due to the country’s high aesthetic awareness, rapid urbanization, and demand for natural-looking cosmetic procedures. Japanese consumers place strong emphasis on facial rejuvenation and anti-aging treatments, with autologous fat transfer being preferred for its long-lasting and safe results. The integration of advanced fat processing and 3D imaging technologies in clinics is fueling growth. Moreover, Japan’s aging population is likely to drive demand for minimally invasive facial contouring solutions in both residential cosmetic and hospital-based reconstructive applications.

India Facial Fat Transfer Market Insight

The India facial fat transfer market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rising aesthetic awareness, and increasing access to cosmetic surgery services. India has emerged as a major hub for minimally invasive aesthetic procedures, with facial fat transfer gaining popularity in hospitals, cosmetic clinics, and medical tourism. The push towards advanced healthcare infrastructure, coupled with affordable procedure options and skilled cosmetic surgeons, is propelling market growth. Strong domestic clinics and increasing social media influence on cosmetic trends further contribute to the market expansion.

Facial Fat Transfer Market Share

The Facial Fat Transfer industry is primarily led by well-established companies, including:

- Allergan plc (U.S.)

- Merz Pharma GmbH & Co. KGaA (Germany)

- GALDERMA (Switzerland)

- Integra LifeSciences Corporation (U.S.)

- Sinclair Pharma (U.K.)

- SciVision Biotech Inc (Taiwan)

- Suneva Medical Inc (U.S.)

- Bausch Health (Canada)

- TEOXANE (Switzerland)

- Ipsen Pharma (France)

- Sientra Inc (U.S.)

- Ranfac Corp (France)

- Cytori Therapeutics Inc (U.S.)

- Tulip Medical Products (U.S.)

- MicroAire Surgical Instruments (U.S.)

- Human Med AG (Germany)

- Medikan International Inc (U.S.)

- MediNordic Aesthetics ApS (Denmark)

- Black Tie Medical Inc (U.S.)

- Bimini Health Tech (U.S.)

What are the Recent Developments in Global Facial Fat Transfer Market?

- In August 2025, Mansfield Cosmetic Surgery Center announced offering facial fat transfer as a natural and long‑lasting alternative to synthetic dermal fillers, using the patient’s own harvested fat to restore youthful volume, smooth deep facial lines, and enhance specific areas such as cheeks and under‑eyes, highlighting its growing appeal in cosmetic clinics seeking more biocompatible solutions

- In April 2025, Philadelphia plastic surgeon Dr. Joseph DiBello highlighted advanced facial fat transfer practices in a widely circulated surgeon insight, emphasizing the use of microfat and nanofat techniques to achieve more natural‑looking and longer‑lasting aesthetic results in facial rejuvenation, including improvements in areas such as temples, cheeks, deep folds, and under‑eyes, reflecting procedural innovation and growing professional advocacy for refined fat‑grafting approaches

- In May 2025, a widely shared People.com profile of a content creator who spent over USD 120,000 on cosmetic work highlighted a facial fat transfer as a key procedure in her aesthetic journey, underscoring the real‑world popularity and patient‑reported satisfaction of fat grafting for multi‑area facial enhancement among cosmetic surgery enthusiasts

- In January 2025, U.S. media reported a surge in “Face BBLs” (facial fat transfers) as a trending cosmetic solution to address facial volume loss linked to rapid weight loss driven by GLP‑1 drugs such as Ozempic and Wegovy, with interest in the procedure rising sharply compared to prior years and patients seeking natural volume restoration over fillers

- In February 2023, Aesthetic Plastic Surgery & Laser Center reported that fat grafting has been shown to significantly assist with facial volume correction, particularly for patients experiencing volume loss due to aging highlighting that facial fat transfer can provide more lasting and comprehensive correction compared with traditional dermal fillers when used alone or alongside facelift procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.