Global Feminine Hygiene Products Market

Market Size in USD Billion

CAGR :

%

USD

25.98 Billion

USD

36.38 Billion

2024

2032

USD

25.98 Billion

USD

36.38 Billion

2024

2032

| 2025 –2032 | |

| USD 25.98 Billion | |

| USD 36.38 Billion | |

|

|

|

|

Feminine Hygiene Products Market Size

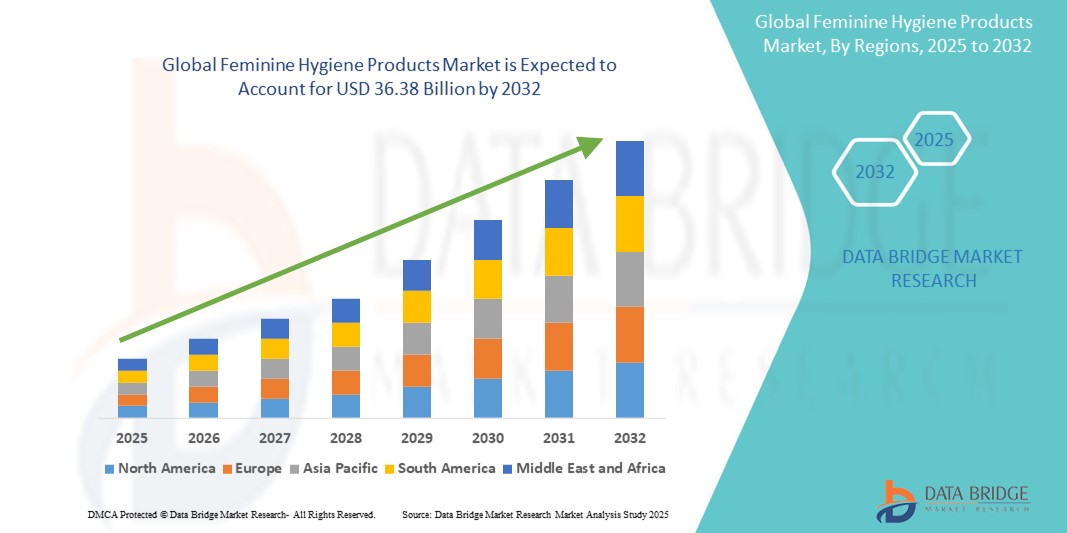

- The global feminine hygiene products market size was valued at USD 25.98 billion in 2024 and is expected to reach USD 36.38 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is largely driven by increasing awareness around menstrual health and hygiene, along with rising disposable incomes and improved access to sanitary products in developing regions

- Furthermore, growing consumer preference for sustainable, organic, and biodegradable alternatives coupled with ongoing product innovations and government-led health initiatives is fostering a shift towards modern hygiene solutions. These collective dynamics are fueling the expansion of the feminine hygiene products industry globally

Feminine Hygiene Products Market Analysis

- Feminine hygiene products, encompassing menstrual care, personal hygiene, and intimate wash solutions, are essential for maintaining women’s health and well-being, with demand growing steadily across both developed and developing markets due to rising health awareness and lifestyle shifts

- The increasing adoption of feminine hygiene products is primarily driven by greater awareness around menstrual hygiene, expanding access to affordable products, and growing support from governments and NGOs promoting menstrual health education

- Asia-Pacific dominated the feminine hygiene products market with the largest revenue share of 39.1% in 2024, attributed to its vast female population base, rising literacy rates, and government-backed programs in countries such as India and China aimed at promoting menstrual hygiene management among rural and urban populations

- North America is expected to be the fastest growing region in the feminine hygiene products market during the forecast period due to growing demand for organic and reusable alternatives such as menstrual cups and period panties

- The sanitary pads segment dominated the feminine hygiene products market with a market share of 52.9% in 2024, supported by their widespread availability, affordability, and strong cultural acceptance across various demographics

Report Scope and Feminine Hygiene Products Market Segmentation

|

Attributes |

Feminine Hygiene Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Feminine Hygiene Products Market Trends

“Shift Toward Sustainable and Organic Hygiene Solutions”

- A significant and growing trend in the global feminine hygiene products market is the increasing consumer shift toward sustainable, organic, and reusable menstrual care solutions. Consumers are becoming more environmentally conscious, prompting a move away from conventional disposable sanitary products that contribute to plastic waste

- For instance, brands such as Saathi and Rael are gaining traction by offering biodegradable sanitary pads made from organic materials such as banana fiber and organic cotton. Similarly, companies such as Diva International and Lunette are promoting reusable menstrual cups, which are both eco-friendly and cost-effective over time

- The demand for products free from harmful chemicals, artificial fragrances, and synthetic materials is rising as awareness grows around potential health risks. Many consumers are opting for pads and tampons labeled “chlorine-free” or “hypoallergenic,” which are now widely available through e-commerce and retail channels

- Furthermore, packaging and branding increasingly reflect sustainability goals, with many companies adopting compostable packaging, refillable options, and carbon-neutral production methods to appeal to eco-aware customers

- This shift is not only evident in developed markets such as North America and Europe but is also emerging in parts of Asia-Pacific and Latin America, where NGOs and government initiatives support the adoption of sustainable menstruation practices. As a result, both startups and established brands are investing in R&D to launch innovative, green hygiene alternatives that meet evolving consumer expectations for performance and environmental responsibility

- The growing preference for ethical, health-conscious, and eco-sustainable feminine hygiene products is fundamentally reshaping market offerings and competitive dynamics, influencing product development, marketing strategies, and consumer engagement globally

Feminine Hygiene Products Market Dynamics

Driver

“Rising Awareness and Support for Menstrual Health & Hygiene”

- The Increasing awareness surrounding menstrual health, combined with growing support from governments, NGOs, and corporate social responsibility (CSR) initiatives, is significantly boosting the feminine hygiene products market

- For instance, national programs such as India’s “Menstrual Hygiene Scheme” and Kenya’s free sanitary towel initiative are aimed at improving access to sanitary products for schoolgirls and low-income women. These efforts not only reduce stigma but also support consistent usage and drive market expansion

- In addition, social media campaigns and education by influencers, activists, and healthcare professionals are empowering women to make informed choices about menstrual products and encouraging openness around menstruation

- In urban areas, rising disposable incomes and changing lifestyles are further contributing to increased demand for premium and innovative hygiene solutions, while rural outreach programs are helping expand penetration in underserved regions

- The expansion of retail and e-commerce networks, along with improved affordability of basic sanitary products, continues to make feminine hygiene solutions more accessible and widely adopted

Restraint/Challenge

“Affordability and Cultural Barriers in Low-Income Regions”

- Despite growing awareness, the high cost of quality feminine hygiene products remains a major challenge in many low- and middle-income countries. In regions where affordability is a barrier, women often resort to unsafe alternatives such as cloth or paper, leading to potential health complications

- For instance, in sub-Saharan Africa and parts of South Asia, the lack of access to affordable sanitary products significantly hinders market penetration and contributes to school absenteeism among girls during menstruation

- Cultural taboos and stigma surrounding menstruation further restrict product usage and awareness in certain communities, limiting discussions and outreach efforts. In some regions, traditional beliefs discourage girls from using sanitary pads or menstrual cups, impeding adoption despite availability

- Overcoming these challenges requires coordinated public-private initiatives, awareness campaigns, and the development of ultra-low-cost, safe hygiene solutions. Companies are increasingly targeting this issue with low-cost products and CSR-led donation campaigns, but broader systemic change is necessary to drive inclusive market growth

- Addressing affordability and deeply rooted societal norms remains crucial for ensuring equitable access to feminine hygiene products and unlocking the full potential of the global market

Feminine Hygiene Products Market Scope

The market is segmented on the basis of nature, product type, packaging, consumer orientation, and distribution channel.

- By Nature

On the basis of nature, the feminine hygiene products market is segmented into disposable and reusable. The disposable segment dominated the market with the largest market revenue share in 2024, driven by widespread usage across urban and semi-urban areas, easy availability, and convenience. Products such as sanitary pads and tampons are heavily relied upon for their hygienic, single-use nature, making them the preferred choice for mass consumers.

The reusable segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer awareness around sustainability and long-term cost-effectiveness. Reusable products such as menstrual cups and period panties are gaining popularity, especially among environmentally conscious consumers looking to reduce plastic waste and adopt eco-friendly alternatives.

- By Product Type

On the basis of product type, the feminine hygiene products market is segmented into sanitary pads, tampons, panty liners, menstrual cups, period panty, intimate washes and cleansers, intimate wipes, intimate moisturizers, hair removal products, intimate deodorants, lubricants, and specialty products. The sanitary pads segment dominated the market with the largest market revenue share of 52.9% in 2024, attributed to their strong cultural acceptance, affordability, and ease of use. They continue to be the most widely used menstrual product, especially in emerging economies.

The menstrual cups segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing preference for reusable solutions, rising awareness about menstrual hygiene, and endorsements from healthcare professionals and sustainability advocates.

- By Packaging

On the basis of packaging, the feminine hygiene products market is segmented into bottles/jars, pumps and dispensers, tubes, flexible packaging, and other packaging types. The flexible packaging segment held the largest market revenue share in 2024 due to its cost-effectiveness, portability, and ability to preserve product hygiene, especially for disposable products such as sanitary pads and panty liners.

The pumps and dispensers segment is projected to grow at the fastest rate during the forecast period, owing to increasing adoption in liquid-based products such as intimate washes and moisturizers. Consumers appreciate the hygiene, precision, and ease of use offered by pump mechanisms.

- By Consumer Orientation

On the basis of consumer orientation, the feminine hygiene products market is segmented into teenage and adult. The adult segment accounted for the largest revenue share in 2024 due to higher product usage frequency, greater awareness levels, and the use of a wider range of products, including specialty items and intimate care solutions.

The teenage segment is expected to register the fastest CAGR from 2025 to 2032, supported by increasing school-based menstrual health initiatives, NGO campaigns, and the availability of beginner-friendly hygiene kits designed specifically for young users.

- By Distribution Channel

On the basis of distribution channel, the feminine hygiene products market is segmented into supermarkets/hypermarkets, pharmacy, online stores, and others. The supermarkets/hypermarkets segment dominated the market with the largest revenue share in 2024, owing to product variety, immediate availability, and the advantage of in-store promotions and discounts.

The online stores segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing internet penetration, the demand for discreet purchasing options, and the popularity of subscription-based services for recurring purchases.

Feminine Hygiene Products Market Regional Analysis

- Asia-Pacific dominated the feminine hygiene products market with the largest revenue share of 39.1% in 2024, attributed to its vast female population base, rising literacy rates, and government-backed programs in countries such as India and China aimed at promoting menstrual hygiene management among rural and urban populations

- Consumers in the region are increasingly adopting sanitary pads and related hygiene products due to government initiatives, educational programs, and the growing influence of health campaigns promoting menstrual hygiene and wellness

- This strong market performance is further supported by improving disposable incomes, rapid urbanization, and the expansion of retail and e-commerce infrastructure, making feminine hygiene products more accessible and affordable to a wider segment of the population

North America Feminine Hygiene Products Market Insight

The North America feminine hygiene products market is anticipated to grow at the fastest CAGR from 2025 to 2032, primarily fueled by rising consumer preference for organic, sustainable, and reusable products. Innovations in eco-friendly materials, along with strong demand for tampons, menstrual cups, and period panties, are reshaping consumer choices. Increased health consciousness, the growing influence of women’s wellness movements, and the expansion of direct-to-consumer brands are driving market expansion. In addition, favorable reimbursement policies and growing awareness about menstrual equity are contributing to market growth across the U.S. and Canada.

U.S. Feminine Hygiene Products Market Insight

The U.S. feminine hygiene products market captured the largest revenue share in North America in 2024, supported by high product accessibility, brand loyalty, and strong consumer preference for premium and natural offerings. A rising shift toward chemical-free and fragrance-free sanitary products, along with the increasing popularity of subscription-based delivery services, is transforming the landscape. The market is also benefiting from growing advocacy around menstrual health, influencing both policy and product development. Expanding e-commerce penetration and social media marketing further enhance product visibility and adoption.

Europe Feminine Hygiene Products Market Insight

The Europe feminine hygiene products market is expected to witness steady growth over the forecast period, driven by increasing demand for biodegradable and plastic-free products amid stringent environmental regulations. Awareness campaigns promoting menstrual hygiene and gender equality are also accelerating the shift toward sustainable options across the region. Countries such as Germany, France, and the U.K. are leading the adoption of reusable alternatives such as menstrual cups and cloth pads. In addition, the presence of major multinational brands and growing online retail infrastructure are contributing to regional market expansion.

U.K. Feminine Hygiene Products Market Insight

The U.K. feminine hygiene products market is poised to grow at a notable CAGR through 2032, driven by rising consumer consciousness around sustainability, wellness, and period poverty. The abolishment of the tampon tax, combined with school-based distribution programs, has expanded product access. The increasing availability of plant-based and reusable products in retail stores and online platforms supports consumer preferences. Strong media advocacy around menstrual health and environmental impact is also encouraging a shift toward conscious consumption and alternative menstrual care solutions.

Germany Feminine Hygiene Products Market Insight

The Germany feminine hygiene products market is projected to experience solid growth, supported by heightened demand for organic and dermatologically safe menstrual care products. Consumer preference is shifting toward hypoallergenic and chemical-free formulations, especially in pads and liners. Germany’s emphasis on environmental sustainability is fostering demand for biodegradable and reusable alternatives. A well-established retail network and high purchasing power further enable broad product accessibility. Educational outreach and health awareness initiatives are also increasing product adoption among young women and first-time users.

Japan Feminine Hygiene Products Market Insight

The Japan feminine hygiene products market continues to thrive, bolstered by a strong cultural emphasis on hygiene, comfort, and innovation. Japanese consumers prioritize high-quality, discreet, and convenient menstrual products, including ultra-thin pads and odor-neutralizing liners. The market also reflects a growing interest in eco-conscious choices, with domestic brands expanding their organic product lines. Advanced packaging, technological enhancements, and a growing online distribution presence further contribute to sustained demand in both urban and aging population segments.

India Feminine Hygiene Products Market Insight

The India feminine hygiene products market held the largest revenue share in Asia-Pacific in 2024, driven by improved awareness, government subsidies, and aggressive rural outreach. The market is experiencing rapid growth due to rising female education levels, increasing workforce participation, and expanding health programs targeting adolescent girls. Affordable product innovations, such as low-cost sanitary pads and biodegradable options, are boosting accessibility and acceptance. In addition, growing support from NGOs and digital campaigns is normalizing menstrual health discussions, further propelling product demand across the country.

Feminine Hygiene Products Market Share

The feminine hygiene products industry is primarily led by well-established companies, including:

- Johnson & Johnson and its affiliates (U.S.)

- Procter & Gamble (U.S.)

- KCWW (U.S.)

- Essity Aktiebolag (Sweden)

- Kao Corporation (Japan)

- Daio Paper Corporation (Japan)

- Unicharm Corporation (Japan)

- Premier FMCG (South Africa)

- Ontex BV (Belgium)

- Hengan International Group Company Ltd. (China)

- Drylock Technologies (Belgium)

- Bodywise (UK) Limited (U.S.)

- First Quality Enterprises, Inc. (U.S.)

- TZMO SA (Poland)

- Rael (U.S.)

- Redcliffe Hygiene Private Limited (India)

- The Keeper, Inc. (U.S.)

- MeLuna GmbH (Germany)

- Diva International Inc. (Canada)

What are the Recent Developments in Global Feminine Hygiene Products Market?

- In April 2023, Procter & Gamble Co. expanded its Always and Whisper brands by launching new biodegradable sanitary pads in select Asia-Pacific markets, targeting environmentally conscious consumers. This innovation reflects the company’s broader commitment to sustainability and addressing the growing demand for eco-friendly menstrual products. By introducing biodegradable options, P&G aims to reduce plastic waste and appeal to a new generation of consumers seeking sustainable personal care solutions

- In March 2023, Essity AB, the parent company of brands such as Libresse and Bodyform, launched a global campaign titled “Vulva Talks” to challenge taboos surrounding feminine hygiene and promote open discussions about intimate care. The initiative combines educational outreach with product innovation, including the release of a new line of intimate washes and wipes tailored for sensitive skin. This strategic move highlights Essity’s focus on brand engagement, consumer empowerment, and holistic intimate wellness

- In February 2023, Kimberly-Clark Corporation introduced reusable menstrual underwear under its Kotex brand in North America, marking a major step into the sustainable feminine care segment. The launch supports the company's goal of delivering more environmentally friendly products while offering consumers long-term, cost-effective menstrual care solutions. The move reinforces Kimberly-Clark’s commitment to innovation and environmental responsibility in the evolving hygiene landscape

- In January 2023, Unicharm Corporation announced the expansion of its Sofy brand in the Middle East and North Africa (MENA) region with the launch of advanced ultra-thin sanitary napkins featuring odor-lock technology. This strategic move aims to meet the growing demand for high-performance feminine hygiene products in emerging markets, while strengthening Unicharm’s global market presence. The innovation emphasizes comfort, discretion, and enhanced protection for active users.

- In January 2023, The Honey Pot Company, a U.S.-based plant-derived feminine care brand, secured additional funding to expand its product line and retail presence across major chains such as Target and Walgreens. The funding will support the development of new intimate care products, including pH-balanced washes and wipes, as well as broaden the brand’s accessibility to diverse consumer groups. This development underscores the growing consumer demand for natural, inclusive, and wellness-oriented feminine hygiene solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.