Global Menstrual Cups Market

Market Size in USD Billion

CAGR :

%

USD

1.03 Billion

USD

1.63 Billion

2024

2032

USD

1.03 Billion

USD

1.63 Billion

2024

2032

| 2025 –2032 | |

| USD 1.03 Billion | |

| USD 1.63 Billion | |

|

|

|

|

Menstrual Cups Market Size

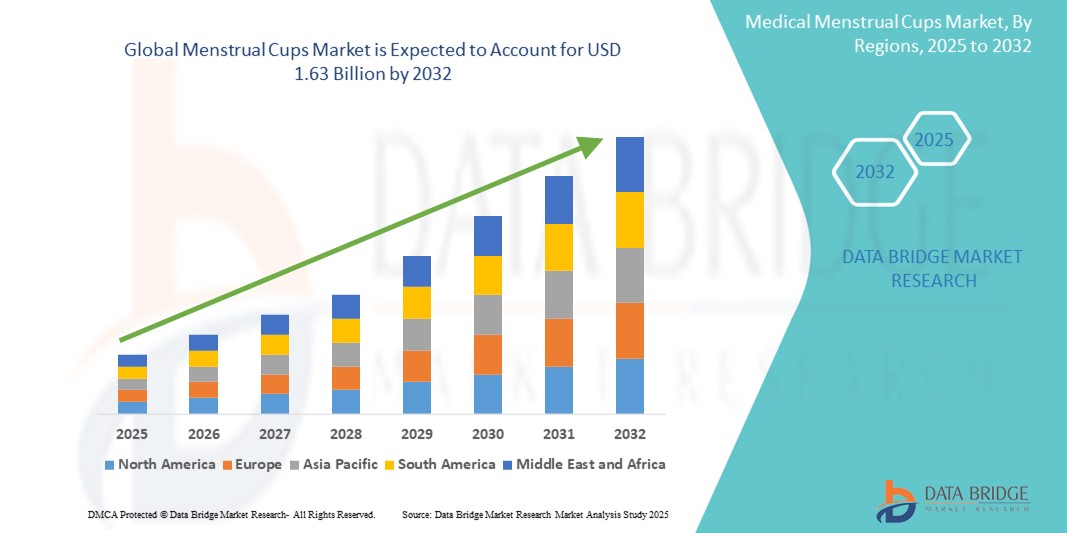

- The global menstrual cups market size was valued at USD 1.03 billion in 2024 and is expected to reach USD 1.63 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fueled by the increasing awareness regarding sustainable menstrual hygiene solutions and the rising adoption of reusable feminine hygiene products, supported by growing environmental consciousness and regulatory encouragement to reduce plastic waste

- Furthermore, rising consumer demand for cost-effective, comfortable, and eco-friendly menstrual care alternatives is establishing menstrual cups as a preferred solution over disposable sanitary products. These converging factors are accelerating the uptake of menstrual cup solutions, thereby significantly boosting the industry's growth

Menstrual Cups Market Analysis

- Menstrual cups, reusable bell-shaped devices made of medical-grade silicone, rubber, or latex, are gaining traction as a sustainable and economical alternative to traditional feminine hygiene products, offering long-lasting protection, lower environmental impact, and reduced long-term cost for users

- The escalating demand for menstrual cups is primarily fueled by increasing environmental awareness, rising incidences of allergic reactions and irritation caused by disposable products, and growing support from health organizations and NGOs advocating for sustainable menstrual hygiene solutions

- North America dominated the menstrual cups market with the largest revenue share of 34.7% in 2024, driven by heightened awareness around eco-friendly menstruation products, availability of advanced product options, and supportive government policies promoting women’s health and environmental sustainability. The U.S. market leads the region, supported by high healthcare literacy and widespread product availability through both retail and online channels

- Asia-Pacific is expected to be the fastest growing region in the menstrual cups market during the forecast period, with a projected CAGR of 7.9%, due to increasing urbanization, rising women’s education levels, government awareness campaigns, and the gradual shift from traditional sanitary solutions to more sustainable alternatives in countries such as India, China, and Southeast Asia

- The reusable segment dominated the menstrual cups market with a market share of 58.3% in 2024, attributed to its cost-effectiveness, long usability lifespan, and growing preference among environmentally conscious consumers looking to minimize their ecological footprint

Report Scope and Menstrual Cups Market Segmentation

|

Attributes |

Menstrual Cups Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Menstrual Cups Market Trends

“Enhanced Convenience Through Sustainability and Customization”

- A significant and accelerating trend in the global menstrual cups market is the increasing consumer preference for sustainable, reusable menstrual hygiene products that align with environmental values. This shift is driven by heightened awareness of plastic pollution, climate change, and the health implications of disposable sanitary products

- For instance, brands such as DivaCup and Saalt have gained popularity by offering high-quality, medical-grade silicone menstrual cups that are free from harmful chemicals and can last up to 10 years, significantly reducing waste and long-term costs

- Manufacturers are also focusing on ergonomically designed menstrual cups in various shapes and sizes to cater to individual anatomical differences, offering improved comfort, leak protection, and ease of insertion and removal. Innovations such as collapsible menstrual cups and those with intuitive removal stems are reshaping user experience

- The market is further benefiting from strong online retail growth and educational outreach programs, which are helping demystify menstrual cups and encourage adoption, especially among first-time users. E-commerce platforms, social media influencers, and awareness campaigns are playing a vital role in improving product visibility and consumer confidence

- In addition, companies are developing menstrual cups with enhanced packaging that includes sterilization containers and biodegradable storage pouches, further reinforcing eco-conscious branding and expanding appeal among environmentally driven consumers

- The demand for personalized, comfortable, and eco-friendly menstrual care solutions is growing rapidly across both developed and emerging markets, as users increasingly seek cost-effective and health-conscious alternatives to traditional sanitary products

Menstrual Cups Market Dynamics

Driver

“Growing Need Due to Rising Health Awareness and Sustainable Menstrual Practices”

- The increasing awareness around menstrual hygiene, combined with the global shift toward sustainable personal care products, is significantly driving the demand for menstrual cups. Consumers are increasingly seeking eco-friendly alternatives to disposable sanitary products due to growing concerns about health, environmental impact, and long-term cost savings

- For instance, in April 2024, Sirona Hygiene Private Limited expanded its product line with the launch of ultra-soft medical-grade silicone menstrual cups with antimicrobial coatings, designed for enhanced hygiene and comfort. Such innovations by key market players are expected to propel the menstrual cups industry during the forecast period

- As users become more informed about the harmful chemicals often present in traditional disposable sanitary products, menstrual cups present a safer and reusable alternative. Features such as long-term usability (up to 10 years), reduced waste, and fewer leak issues make them a compelling option across various demographics

- Furthermore, the growth of women’s health advocacy, increased government and NGO-led awareness campaigns, and better accessibility via online platforms are making menstrual cups more visible and accepted, especially in urban and semi-urban regions

- The convenience of long wear time (up to 12 hours), suitability for active lifestyles, and cost-effectiveness are key factors encouraging adoption in both developed and developing countries. The rise of e-commerce and D2C brands offering personalized sizing and educational support has further fueled market penetration

Restraint/Challenge

“Cultural Taboos and Limited Awareness in Emerging Markets”

- Cultural stigma, misconceptions, and lack of education around menstruation, particularly in emerging economies, pose a significant challenge to the adoption of menstrual cups. Many potential users remain unaware of how menstrual cups function or harbor myths regarding their safety and appropriateness

- For instance, in rural areas of countries such as India and parts of Africa, deep-rooted social taboos surrounding menstruation often inhibit open discussions about menstrual products, limiting exposure to alternatives such as menstrual cups

- Tackling these cultural barriers through targeted awareness campaigns, school education programs, and community engagement will be crucial in breaking down misinformation and improving acceptance. Organizations and brands that collaborate with local NGOs to distribute free samples and provide instructional materials are playing a key role in this transformation

- In addition, initial reluctance due to the perceived discomfort, insertion technique, and lack of familiarity continues to be a deterrent, especially among young or first-time users

- Educational efforts, influencer advocacy, and user-friendly instructional packaging are helping ease this transition, but broader market acceptance will require consistent outreach

- Addressing these challenges through culturally sensitive marketing, product innovation tailored for first-time users, and wider retail availability will be key to expanding the menstrual cups market globally

Menstrual Cups Market Scope

The market is segmented on the basis of material, shape, size, usability, type, end-users, and distribution channel.

• By Material

On the basis of material, the menstrual cups market is segmented into medical grade silicones, natural gum rubber (latex), and thermoplastic elastomer (TPE). The medical grade silicone segment dominated the largest market revenue share of 68.5% in 2024, driven by its excellent biocompatibility, non-toxicity, and widespread acceptance as a safe, flexible material ideal for long-term internal use.

The thermoplastic elastomer (TPE) segment is anticipated to witness the fastest CAGR of 8.9% from 2025 to 2032, owing to its recyclability, cost-effectiveness, and ease of molding.

• By Shape

On the basis of shape, the menstrual cups market is segmented into bell-shaped, cylindrical, V-shaped, disc-style, and collapsible. The bell-shaped segment held the largest market revenue share of 39.7% in 2024, attributed to its ergonomic design that ensures better fit, comfort, and leakage protection.

The disc-style segment is expected to witness the fastest CAGR of 9.1% from 2025 to 2032, supported by its growing popularity among users with high cervixes and for its discreet design.

• By Size

On the basis of size, the menstrual cups market is segmented into small, medium, and large. The medium segment accounted for the largest revenue share of 44.3% in 2024, being the most recommended size for first-time users.

The small size segment is projected to experience the fastest CAGR of 8.5% during the forecast period, driven by increased adoption among adolescents and individuals with lighter flow.

• By Usability

On the basis of usability, the menstrual cups market is segmented into reusable and disposable. The reusable segment dominated the market in 2024 with the highest revenue share of 58.3%, owing to its cost-effectiveness and environmental sustainability.

The disposable segment is expected to grow at a fastest CAGR of 7.2% from 2025 to 2032, appealing to consumers prioritizing convenience and hygiene.

• By Type

On the basis of type, the menstrual cups market is segmented into round, hollow, pointy, and flat. The round segment led the market in 2024 with a revenue share of 36.1%, due to its consistent sealing ability and user comfort.

The flat type segment is anticipated to grow at the fastest CAGR of 8.8% from 2025 to 2032, driven by innovations in slim, ergonomic designs.

• By End-Users

On the basis of end-users, the market is segmented into hospitals, specialty clinics, homecare, and others. The homecare segment held the largest market revenue share of 66.9% in 2024, due to the self-administered nature and rising preference for sustainable period care.

The specialty clinics segment is expected to witness a CAGR of 7.9% from 2025 to 2032, supported by growing medical endorsements.

• By Distribution Channel

On the basis of distribution channel, the menstrual cups market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The online pharmacy segment dominated the market in 2024 with a revenue share of 52.4%, driven by ease of e-commerce, consumer reviews, and discreet shopping.

The retail pharmacy segment is expected to grow at a CAGR of 7.6% from 2025 to 2032, due to broader shelf availability and educational marketing efforts.

Menstrual Cups Market Regional Analysis

- North America dominated the menstrual cups market with the largest revenue share of 34.7% in 2024, driven by growing awareness of sustainable menstrual hygiene products and increasing female participation in wellness-focused consumer decisions

- Consumers in the region are prioritizing eco-friendly, reusable alternatives to disposable sanitary products, which is strengthening demand for menstrual cups

- This trend is further reinforced by high health consciousness, availability of premium brands, and supportive regulatory frameworks promoting sustainable products across both the U.S. and Canada

U.S. Menstrual Cups Market Insight

The U.S. menstrual cups market captured the largest revenue share of 80.05% in 2024 within North America, fueled by the growing adoption of reusable feminine hygiene products and increasing awareness about menstrual health. Consumers are increasingly choosing silicone-based menstrual cups due to their long-term cost-effectiveness and minimal environmental impact. The presence of multiple brands, growing e-commerce penetration, and educational campaigns around sustainable menstruation further bolster the U.S. market.

Europe Menstrual Cups Market Insight

The Europe menstrual cups market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increased environmental awareness and stringent regulations on disposable plastic waste. The adoption of menstrual cups is growing in both Western and Eastern European countries, supported by the promotion of eco-friendly lifestyles, rising retail availability, and government-backed sustainability initiatives.

U.K. Menstrual Cups Market Insight

The U.K. menstrual cups market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing consumer shift towards chemical-free and reusable feminine hygiene products. Public awareness campaigns by NGOs and health organizations about menstrual wellness and sustainable choices are helping boost the market. The UK's thriving e-commerce ecosystem also plays a key role in increasing accessibility.

Germany Menstrual Cups Market Insight

The Germany menstrual cups market is expected to expand at a considerable CAGR during the forecast period ,supported by a strong preference for organic and biodegradable personal care products. The country’s progressive environmental policies and high consumer health awareness are encouraging a shift from pads and tampons to menstrual cups. Brands offering certified, medical-grade materials are gaining strong traction among German consumers.

Asia-Pacific Menstrual Cups Market Insight

The Asia-Pacific menstrual cups market is poised to grow at the fastest CAGR of 7.9% during the forecast period of 2025 to 2032, due to rising awareness of menstrual hygiene, increasing income levels, and a growing focus on sustainability across countries such as India, China, and Japan. Cultural shifts, improving female education, and government-led awareness programs are expanding the consumer base for menstrual cups.

Japan Menstrual Cups Market Insight

The Japan menstrual cups market is witnessing growth, fueled by a blend of tradition and innovation. High standards for hygiene and safety, combined with increasing female workforce participation and an aging demographic seeking convenience, are driving demand for menstrual cups. In addition, domestic brands are innovating with softer materials and ergonomic designs tailored for local preferences.

China Menstrual Cups Market Insight

The China menstrual cups market accounted for the largest revenue share in Asia-Pacific in 2024, propelled by rising health awareness, a growing middle class, and surging demand for cost-effective hygiene products. China’s strong domestic manufacturing capability ensures affordability, while urban women in tier-1 and tier-2 cities are increasingly adopting menstrual cups for their reusability and environmental benefits

Menstrual Cups Market Share

The menstrual cups industry is primarily led by well-established companies, including:

- The Keeper, Inc. (U.S.)

- Asan India (India)

- Diva International Inc. (Canada)

- YUUKI Company s.r.o. (Czech Republic)

- Redcliffe (India)

- Sirona Hygiene Private Limited (India)

- Me Luna GmbH (Germany)

- Ruby Cup (U.K.)

- Fleurcup (France)

- Saalt (U.S.)

- INTIMINA (Sweden)

- SochGreen (India)

- AllMatters (Denmark)

- Lena Cup (U.S.)

- Procter & Gamble (U.S.)

Latest Developments in Global Menstrual Cups Market

- In April 2025, Diva International Inc., a global leader in menstrual care products, announced the launch of its biodegradable menstrual cup line in North America. This innovation aims to address growing consumer demand for sustainable and eco-friendly feminine hygiene solutions. With a strong focus on environmental responsibility, Diva’s new product line reinforces its commitment to reducing plastic waste while maintaining product performance and comfort

- In March 2025, INTIMINA (Sweden) introduced the Ziggy Cup 3, an upgraded version of its popular flat-fit menstrual cup designed for mess-free period sex and all-day comfort. The product features enhanced medical-grade silicone and a leak-proof double rim. This launch targets the growing segment of consumers seeking flexibility and discreet protection, and strengthens INTIMINA’s position in the premium menstrual care segment

- In February 2025, Saalt (U.S.) announced the expansion of its global distribution network through strategic partnerships with health and wellness retailers in Southeast Asia and the Middle East. This initiative aims to enhance accessibility to high-quality reusable menstrual cups in emerging markets where sustainable feminine hygiene products are gaining traction

- In January 2025, Me Luna GmbH (Germany) revealed a custom-fit menstrual cup range in the EU, developed using body-positive sizing models and consumer feedback. These customizable products aim to cater to a broader range of users by offering improved fit, usability, and comfort. The innovation is expected to appeal to first-time users and those with specific anatomical needs

- In December 2024, Sirona Hygiene Private Limited (India) received approval from the Indian FDA to manufacture and distribute its advanced antimicrobial menstrual cups made with copper-infused medical-grade silicone. This product is designed to offer enhanced hygiene and longer-lasting protection, tapping into the demand for health-focused period care solutions in densely populated markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.