Global Fermentation Derived Pharmaceutical Api Market

Market Size in USD Million

CAGR :

%

USD

841.50 Million

USD

1,689.08 Million

2025

2033

USD

841.50 Million

USD

1,689.08 Million

2025

2033

| 2026 –2033 | |

| USD 841.50 Million | |

| USD 1,689.08 Million | |

|

|

|

|

Fermentation-Derived Pharmaceutical API Market Size

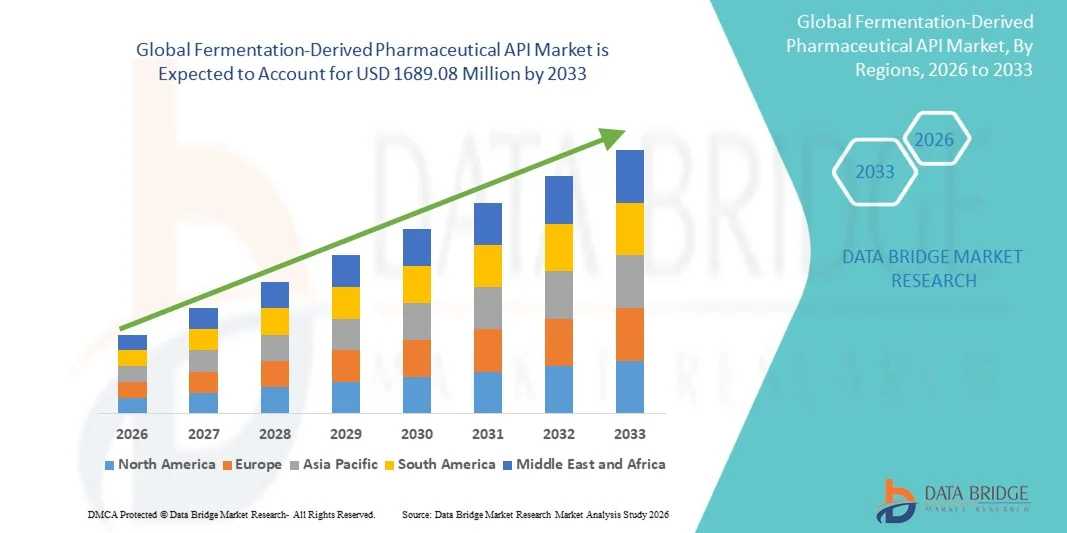

- The global fermentation-derived pharmaceutical API market size was valued at USD 841.50 million in 2025 and is expected to reach USD 1689.08 million by 2033, at a CAGR of 9.10% during the forecast period

- The market growth is primarily driven by the increasing reliance on microbial fermentation for the production of high-purity APIs, coupled with advancements in bioprocessing technologies and the rising preference for sustainable and cost-effective manufacturing methods within the pharmaceutical industry

- Furthermore, growing demand for antibiotics, vitamins, amino acids, and biologically derived APIs, along with expanding pharmaceutical and biotechnology manufacturing capacities across emerging and developed economies, is reinforcing fermentation-derived APIs as a critical component of modern drug production, thereby significantly boosting overall market growth

Fermentation-Derived Pharmaceutical API Market Analysis

- Fermentation-derived pharmaceutical APIs, manufactured using microbial and biotechnological fermentation processes, play a critical role in modern drug production due to their ability to deliver high-purity, complex molecules such as antibiotics, amino acids, vitamins, enzymes, and hormones at commercial scale

- The growing demand for these APIs is primarily driven by the rising prevalence of infectious and chronic diseases, increasing adoption of biologically derived and sustainable manufacturing routes, and continuous advancements in fermentation technology, strain engineering, and downstream processing

- North America dominated the fermentation-derived pharmaceutical API market with the largest revenue share of 40.7% in 2025, supported by a strong pharmaceutical and biotechnology ecosystem, high R&D investments, advanced bioprocessing infrastructure, and the presence of major innovator drug manufacturers and CDMOs, with the U.S. accounting for the majority of regional revenue

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by expanding pharmaceutical manufacturing capacity, cost advantages, and increasing outsourcing of fermentation-based API production to countries such as China and India

- The antibiotics segment dominated the fermentation-derived pharmaceutical API market with a market share of 47.2% in 2025, owing to the extensive use of fermentation processes in antibiotic synthesis, sustained global demand, and the efficiency of microbial production for large-scale commercial manufacturing

Report Scope and Fermentation-Derived Pharmaceutical API Market Segmentation

|

Attributes |

Fermentation-Derived Pharmaceutical API Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Fermentation-Derived Pharmaceutical API Market Trends

“Rising Adoption of Recombinant and Advanced Fermentation Technologies”

- A significant and accelerating trend in the global fermentation-derived pharmaceutical API market is the increasing adoption of recombinant fermentation and advanced bioprocessing technologies to produce high-purity, complex APIs with improved yields and scalability, meeting the evolving demands of modern drug development

- For instance, several leading API manufacturers are expanding the use of genetically engineered microbial strains to enhance productivity and consistency in the production of antibiotics, enzymes, and peptide-based APIs, enabling more efficient large-scale manufacturing

- Advancements in fermentation technologies are enabling features such as better strain optimization, enhanced process control, and improved downstream purification, resulting in higher-quality APIs and reduced batch variability. For instance, continuous fermentation and single-use bioreactor systems are being adopted to increase operational efficiency and reduce contamination risks

- The integration of advanced fermentation platforms with digital process monitoring and automation facilitates centralized control over critical production parameters, allowing manufacturers to optimize yields, ensure regulatory compliance, and reduce production costs across multiple API product lines

- This trend toward more efficient, scalable, and technologically advanced fermentation processes is reshaping manufacturing strategies across the pharmaceutical industry. Consequently, companies such as Lonza and DSM are investing in next-generation fermentation facilities to support the production of complex and high-value pharmaceutical APIs

- The demand for fermentation-derived APIs produced through advanced and recombinant technologies is growing steadily across both innovator and generic pharmaceutical sectors, as manufacturers prioritize quality, sustainability, and supply chain reliability

Fermentation-Derived Pharmaceutical API Market Dynamics

Driver

“Growing Demand for Biologically Derived and Sustainable API Manufacturing”

- The increasing global burden of infectious and chronic diseases, combined with a growing preference for biologically derived and sustainable manufacturing processes, is a major driver fueling demand for fermentation-derived pharmaceutical APIs

- For instance, in March 2025, multiple global pharmaceutical manufacturers announced capacity expansions for fermentation-based antibiotic and vitamin API production to support rising healthcare needs and ensure supply continuity, positively influencing market growth during the forecast period

- As regulatory agencies and pharmaceutical companies place greater emphasis on product quality and environmental sustainability, fermentation-derived APIs offer advantages such as lower chemical waste, reduced reliance on petrochemical synthesis, and improved reproducibility compared to traditional synthetic methods

- Furthermore, the expanding pipeline of biologics, specialty antibiotics, and enzyme-based therapies is increasing the reliance on fermentation technologies, making these APIs a foundational component of modern pharmaceutical manufacturing

- Rising investments by governments and private stakeholders in biotechnology infrastructure and life sciences manufacturing are supporting the expansion of fermentation-based API facilities worldwide

- The increasing outsourcing of complex and fermentation-intensive API production to specialized CDMOs is accelerating market growth, as pharmaceutical companies seek operational flexibility, cost efficiency, and regulatory expertise

- The scalability of fermentation processes, combined with their suitability for producing complex molecules, is encouraging both innovator and generic drug manufacturers to invest in fermentation-based API production, supporting long-term market expansion

Restraint/Challenge

“High Capital Investment and Complex Regulatory Compliance Requirements”

- The high capital investment required for setting up and maintaining fermentation-based API manufacturing facilities, along with stringent regulatory compliance requirements, presents a significant challenge to market growth

- For instance, regulatory inspections related to Good Manufacturing Practices (GMP) and environmental compliance have increased scrutiny on fermentation facilities, making market entry and capacity expansion more complex for smaller manufacturers

- Addressing these challenges requires substantial investment in validated equipment, skilled personnel, and robust quality management systems, which can increase operational costs and limit participation by small and mid-sized players

- In addition, maintaining consistent product quality across large-scale fermentation batches can be technically challenging, as variations in microbial performance or process parameters may impact yield and purity if not tightly controlled

- Limited availability of skilled professionals with expertise in large-scale fermentation, microbial engineering, and downstream processing can constrain operational efficiency and slow capacity expansion

- Fluctuations in raw material availability and input costs, such as fermentation media and energy requirements, can impact production economics and profit margins for fermentation-derived API manufacturers

- Overcoming these challenges through process standardization, advanced monitoring technologies, regulatory alignment, and strategic partnerships with experienced CDMOs will be essential for ensuring sustainable growth in the fermentation-derived pharmaceutical API market

Fermentation-Derived Pharmaceutical API Market Scope

The market is segmented on the basis of type, production technology, fermentation process, and application.

- By Type

On the basis of type, the global fermentation-derived pharmaceutical API market is segmented into antibiotics, amino acids, vitamins, nucleotides, organic acids, biological products, and hormones. The antibiotics segment dominated the market with the largest revenue share of 47.2% in 2025, driven by the long-standing and widespread reliance on microbial fermentation for large-scale antibiotic production. Fermentation remains the most efficient and cost-effective method for manufacturing complex antibiotic molecules with consistent quality and high yields. The sustained global demand for anti-infective therapies, coupled with the continued prevalence of bacterial infections, supports the dominance of this segment. In addition, both innovator and generic pharmaceutical companies extensively depend on fermentation-derived antibiotics, reinforcing stable demand. Regulatory familiarity and established production infrastructure further strengthen this segment’s leading position.

The biological products segment is expected to witness the fastest growth during the forecast period, fueled by the expanding pipeline of enzyme-based therapies, peptide drugs, and complex biologics. Increasing adoption of biologically derived APIs for chronic and rare disease treatments is accelerating demand for fermentation-based biological products. Advances in microbial engineering and recombinant technologies are enabling more efficient production of high-value biologics. Furthermore, the shift toward precision medicine and targeted therapies is boosting the need for specialized fermentation-derived biological APIs. Strong R&D investments and regulatory support for biologics are also contributing to rapid segment growth.

- By Production Technology

On the basis of production technology, the market is segmented into natural fermentation and recombinant fermentation. The natural fermentation segment dominated the market in 2025, owing to its extensive use in the production of traditional APIs such as antibiotics, amino acids, and vitamins. This method benefits from well-established manufacturing protocols, lower development complexity, and broad regulatory acceptance. Many high-volume APIs continue to rely on naturally occurring microbial strains due to proven scalability and cost efficiency. The availability of existing infrastructure and experienced workforce further supports the dominance of natural fermentation. In addition, stable demand from generic drug manufacturers sustains this segment’s leadership.

The recombinant fermentation segment is anticipated to grow at the fastest rate during the forecast period, driven by increasing demand for complex, high-purity, and specialty APIs. Recombinant technology enables precise genetic modification of microorganisms, resulting in higher yields and improved product consistency. Growing emphasis on biologics, enzymes, and peptide-based drugs is accelerating adoption of recombinant fermentation. Pharmaceutical companies are increasingly investing in recombinant platforms to support innovation and differentiation. Enhanced regulatory clarity and technological advancements are further boosting growth prospects for this segment.

- By Fermentation Process

On the basis of fermentation process, the market is segmented into batch fermentation, fed-batch fermentation, and continuous fermentation. The batch fermentation segment held the largest market share in 2025, primarily due to its widespread use across pharmaceutical API manufacturing. Batch processes offer operational simplicity, flexibility in handling different products, and easier compliance with regulatory standards. They are particularly suitable for small- to medium-scale production and APIs requiring strict quality control. Many manufacturers prefer batch fermentation because it allows better control over contamination risks and process variables. Established adoption across antibiotic and vitamin production further reinforces its dominance.

The continuous fermentation segment is expected to register the fastest growth over the forecast period, supported by its advantages in productivity, cost efficiency, and reduced downtime. Continuous processes enable uninterrupted production, higher volumetric yields, and improved resource utilization. Increasing pressure on manufacturers to optimize costs and scale up production is driving interest in continuous fermentation. Technological advancements in process monitoring and automation are making continuous systems more reliable and regulatory-compliant. As demand for high-volume APIs grows, continuous fermentation is gaining traction among large-scale manufacturers.

- By Application

On the basis of application, the market is segmented into pharmaceutical companies, biotechnology companies, contract development & manufacturing organizations (CDMOs), and research & academic institutes. The pharmaceutical companies segment dominated the market in 2025, driven by their large-scale API requirements for both branded and generic drug manufacturing. Pharmaceutical companies rely heavily on fermentation-derived APIs for antibiotics, vitamins, and chronic disease therapies. Strong in-house manufacturing capabilities and long-term production planning support sustained demand from this segment. In addition, established supply chains and regulatory expertise allow pharmaceutical firms to efficiently manage fermentation-based API production. The continuous need for cost-effective and high-quality APIs further underpins segment dominance.

The CDMOs segment is projected to be the fastest-growing application segment during the forecast period, owing to increasing outsourcing of fermentation-based API production. Pharmaceutical and biotechnology companies are increasingly partnering with CDMOs to reduce capital expenditure and accelerate time-to-market. CDMOs offer specialized expertise, regulatory compliance, and scalable fermentation infrastructure, making them attractive partners. Growing complexity of APIs and capacity expansion requirements are further driving outsourcing trends. As a result, CDMOs are emerging as a key growth engine within the fermentation-derived pharmaceutical API market.

Fermentation-Derived Pharmaceutical API Market Regional Analysis

- North America dominated the fermentation-derived pharmaceutical API market with the largest revenue share of 40.7% in 2025, supported by a strong pharmaceutical and biotechnology ecosystem, high R&D investments, advanced bioprocessing infrastructure, and the presence of major innovator drug manufacturers and CDMOs, with the U.S. accounting for the majority of regional revenue

- Manufacturers in the region place strong emphasis on quality compliance, process innovation, and regulatory adherence, which supports the widespread adoption of fermentation-derived APIs across antibiotics, biologics, and specialty therapeutic segments

- This strong market position is further reinforced by high R&D investments, favorable regulatory frameworks, and a well-established ecosystem of pharmaceutical companies and CDMOs, positioning fermentation-derived APIs as a preferred choice for large-scale and high-value drug manufacturing in North America

U.S. Fermentation-Derived Pharmaceutical API Market Insight

The U.S. fermentation-derived pharmaceutical API market captured the largest revenue share within North America in 2025, driven by strong demand for high-quality and high-value APIs used in branded drugs, biologics, and specialty therapeutics. Pharmaceutical manufacturers in the country increasingly prioritize advanced fermentation technologies to ensure product consistency, regulatory compliance, and supply chain reliability. The presence of leading innovator pharma companies, robust CDMO infrastructure, and heavy R&D investments further support market growth. Moreover, the U.S. focus on reshoring critical drug manufacturing and strengthening domestic API production capabilities is significantly contributing to market expansion.

Europe Fermentation-Derived Pharmaceutical API Market Insight

The Europe fermentation-derived pharmaceutical API market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by stringent regulatory standards and a strong emphasis on quality and sustainability in pharmaceutical manufacturing. Increasing demand for biologics, specialty antibiotics, and enzyme-based therapies is fostering adoption of fermentation-derived APIs across the region. European manufacturers are also focused on environmentally friendly production processes, supporting the shift toward fermentation-based APIs. Growth is observed across both innovator and generic drug manufacturing, with strong demand from Western European countries.

U.K. Fermentation-Derived Pharmaceutical API Market Insight

The U.K. fermentation-derived pharmaceutical API market is anticipated to grow at a notable CAGR during the forecast period, supported by a strong life sciences ecosystem and increasing investments in biotechnology and advanced manufacturing. The country’s focus on innovation, research collaborations, and regulatory alignment with global standards is encouraging the use of fermentation-derived APIs. Rising demand for biologics and specialty pharmaceuticals is further driving market growth. In addition, the presence of academic research institutes and emerging biotech firms is strengthening demand for fermentation-based APIs.

Germany Fermentation-Derived Pharmaceutical API Market Insight

The Germany fermentation-derived pharmaceutical API market is expected to expand at a considerable CAGR, driven by the country’s well-established pharmaceutical manufacturing base and emphasis on technological innovation. Germany’s strong focus on process efficiency, quality assurance, and sustainable manufacturing supports the adoption of fermentation-derived APIs. Increasing production of high-value biologics and complex APIs is fueling market growth. The integration of advanced fermentation technologies and automation aligns well with Germany’s precision-driven industrial landscape.

Asia-Pacific Fermentation-Derived Pharmaceutical API Market Insight

The Asia-Pacific fermentation-derived pharmaceutical API market is poised to grow at the fastest CAGR during the forecast period, driven by expanding pharmaceutical manufacturing capacity, cost advantages, and increasing global outsourcing. Countries such as China and India serve as major production hubs for fermentation-based APIs, supplying both domestic and international markets. Rising healthcare demand, improving regulatory standards, and investments in bioprocessing infrastructure are accelerating growth. Furthermore, the region’s role as a global API manufacturing center is enhancing its market prominence.

Japan Fermentation-Derived Pharmaceutical API Market Insight

The Japan fermentation-derived pharmaceutical API market is gaining momentum due to strong demand for high-quality, innovative pharmaceutical products and a focus on advanced biotechnological processes. Japanese manufacturers emphasize precision, quality control, and compliance, which supports the use of fermentation-derived APIs. Growth is driven by increasing production of specialty drugs and biologics for an aging population. The integration of advanced fermentation technologies with automated manufacturing systems is further strengthening market development.

India Fermentation-Derived Pharmaceutical API Market Insight

The India fermentation-derived pharmaceutical API market accounted for a significant revenue share in Asia-Pacific in 2025, attributed to the country’s large-scale manufacturing capabilities, cost competitiveness, and strong presence in generic drug production. India is a key global supplier of fermentation-derived antibiotics, amino acids, and vitamins. Expanding export demand, government initiatives supporting pharmaceutical manufacturing, and investments in fermentation infrastructure are propelling market growth. The growing role of Indian CDMOs in global supply chains further reinforces the country’s market position.

Fermentation-Derived Pharmaceutical API Market Share

The Fermentation-Derived Pharmaceutical API industry is primarily led by well-established companies, including:

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Eli Lilly and Company (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- Sanofi (France)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- AstraZeneca (U.K.)

- GSK plc (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Bayer AG (Germany)

- Takeda Pharmaceutical Company Limited (Japan)

- Astellas Pharma Inc. (Japan)

- Daiichi Sankyo Company, Limited (Japan)

- Biocon Limited (India)

- Concord Biotech Limited (India)

What are the Recent Developments in Global Fermentation-Derived Pharmaceutical API Market?

- In July 2025, TAPI announced the deployment of an AI-powered substrate feeding system in fermentation lines that boosted productivity by over 15% and reduced carbon footprint, marking a technological leap in fermentation API manufacturing. The AI system continuously monitors fermentation conditions and adjusts nutrient delivery in real time to improve consistency and yield, reflecting the growing digital transformation in biopharmaceutical production

- In September 2024, India’s first active pharmaceutical ingredient (API) fermentation unit at Plassra in Nalagarh began large-scale production, significantly advancing local API manufacturing capability. The plant is designed to produce 400 tonnes annually of potassium clavulanate API, which is a key fermentation-derived component used in antibiotics, reducing dependence on imports from China and Korea

- In October 2024, Prime Minister Narendra Modi virtually inaugurated India’s first API fermentation unit in Nalagarh, Himachal Pradesh, underscoring government efforts to enhance domestic API fermentation capacity under production-linked incentive schemes and strengthen pharmaceutical supply chain resilience

- In July 2023, construction plans for India’s first API fermentation unit at Nalagarh were publicly detailed, with an investment of approximately Rs 460 crore and eight 250-kilo-liter fermenters planned. This milestone demonstrated early industry commitment to scaling fermentation-based API production for the antibiotic supply chain

- In March 2023, filing and company updates from ADL Biopharma highlighted improvements in quality and operational standards in precision fermentation biotechnology production, reflecting continuous commercial and process enhancements by fermentation-focused firms in the pharmaceutical biotech space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.