Global Fermented Non Dairy Non Alcoholic Beverages Market

Market Size in USD Billion

CAGR :

%

USD

3.73 Billion

USD

5.11 Billion

2024

2032

USD

3.73 Billion

USD

5.11 Billion

2024

2032

| 2025 –2032 | |

| USD 3.73 Billion | |

| USD 5.11 Billion | |

|

|

|

|

Fermented Non-Dairy Non-Alcoholic Beverages Market Size

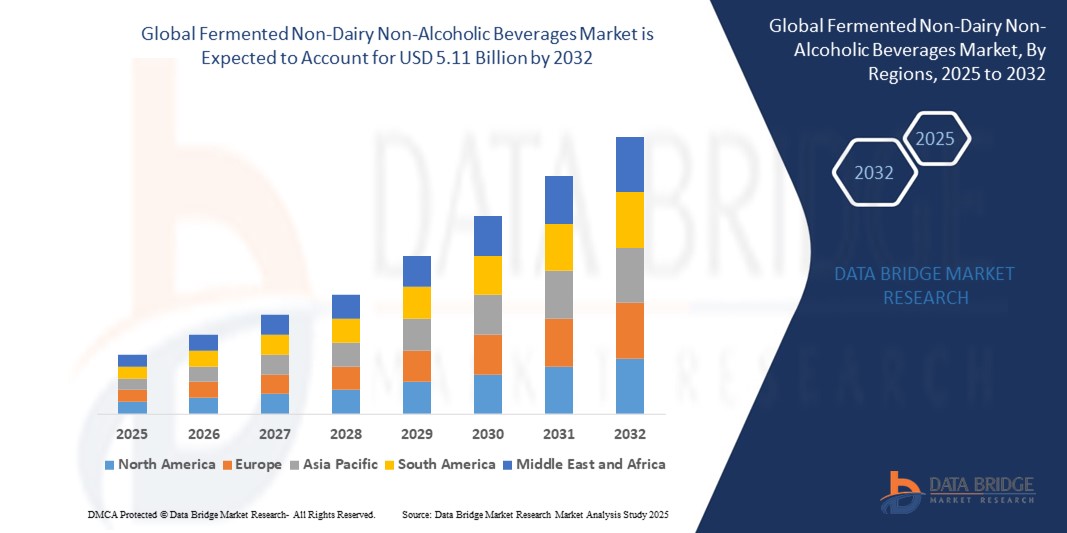

- The global fermented non-dairy non-alcoholic beverages market size was valued at USD 3.73 billion in 2024 and is expected to reach USD 5.11 billion by 2032, at a CAGR of 4.00% during the forecast period

- The market growth is primarily driven by increasing consumer preference for plant-based and health-conscious beverage options, advancements in fermentation technologies, and rising awareness of the health benefits associated with fermented non-dairy beverages

- In addition, growing demand for functional beverages with probiotic content and the shift toward sustainable and vegan lifestyles are positioning fermented non-dairy non-alcoholic beverages as a preferred choice among consumers, significantly boosting industry growth

Fermented Non-Dairy Non-Alcoholic Beverages Market Analysis

- Fermented non-dairy non-alcoholic beverages, such as kombucha, non-dairy kefir, and fermented juices, are gaining popularity as key components of health-focused diets, offering benefits such as improved gut health, enhanced immunity, and natural flavor profiles without dairy or alcohol

- The rising demand for these beverages is fueled by increasing health consciousness, the growing vegan and plant-based movement, and consumer preference for low-sugar, functional beverages with natural ingredients

- Asia-Pacific dominated the fermented non-dairy non-alcoholic beverages market with the largest revenue share of 42.5% in 2024, driven by a strong cultural affinity for fermented foods, rapid urbanization, and a growing middle-class population with high disposable incomes, particularly in countries such as China, Japan, and South Korea

- Middle East and Africa is expected to be the fastest-growing region during the forecast period due to increasing adoption of health-conscious diets, rising disposable incomes, and growing awareness of probiotic beverages

- The fruits segment dominated the largest market revenue share of 38.2% in 2024, driven by the widespread use of fruits such as apples, berries, and pineapples in beverages such as kombucha and fermented juices, which are popular for their appealing flavors and health benefits

Report Scope and Fermented Non-Dairy Non-Alcoholic Beverages Market Segmentation

|

Attributes |

Fermented Non-Dairy Non-Alcoholic Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Fermented Non-Dairy Non-Alcoholic Beverages Market Trends

“Increasing Integration of Advanced Fermentation Technologies and Product Innovation”

- The global fermented non-dairy non-alcoholic beverages market is experiencing a significant trend toward the integration of advanced fermentation technologies and continuous product innovation

- These technologies enable precise control over fermentation processes, enhancing the consistency, flavor profiles, and nutritional benefits of beverages such as kombucha, water kefir, and fermented fruit juices

- Advanced fermentation platforms allow for the development of probiotic-rich beverages, catering to growing consumer demand for functional drinks that support gut health and immunity

- For instance, companies are leveraging innovative fermentation techniques to create novel flavor combinations, such as botanical-infused kombucha or low-sugar fermented lemonades, tailored to diverse consumer preferences

- This trend is increasing the appeal of fermented non-dairy beverages, making them more attractive to health-conscious consumers and expanding their market reach across mainstream and niche segments

- Data analytics and consumer feedback are being used to monitor purchasing trends and preferences, enabling manufacturers to introduce personalized product offerings and optimize production efficiency

Fermented Non-Dairy Non-Alcoholic Beverages Market Dynamics

Driver

“Rising Demand for Plant-Based and Functional Beverages”

- The growing consumer preference for plant-based diets and functional beverages, driven by health, ethical, and environmental concerns, is a major driver for the global fermented non-dairy non-alcoholic beverages market

- These beverages, including dairy-free drinkable yogurts, fermented soft drinks, and non-dairy kefir, offer health benefits such as improved digestion, immune support, and nutrient enrichment, aligning with the rise in veganism and lactose intolerance awareness

- Regulatory support and initiatives promoting plant-based diets, particularly in regions such as Asia-Pacific, are further accelerating market growth by encouraging innovation and adoption

- The proliferation of e-commerce platforms and improved distribution channels, such as supermarkets and specialty stores, is enhancing consumer access to a wide variety of fermented non-dairy beverages

- Manufacturers are increasingly offering innovative products, such as coconut milk kefir and almond milk-based yogurts, as standard or premium offerings to meet evolving consumer expectations and enhance product value

Restraint/Challenge

“High Production Costs and Regulatory Compliance Issues”

- The significant initial investment required for advanced fermentation equipment, quality control systems, and raw materials can be a major barrier to market entry, particularly for small-scale producers in emerging markets such as the Middle East and Africa

- Developing and scaling up production of fermented non-dairy beverages, such as those derived from fruits, vegetables, or cereals, can be complex and resource-intensive, leading to higher product costs

- In addition, regulatory compliance and varying standards across regions pose significant challenges. The production and labeling of probiotic and functional beverages must adhere to strict safety and quality regulations, which can differ widely between countries

- Concerns about microbial safety, accurate labeling of health claims, and compliance with food safety standards create operational complexities for manufacturers and distributors operating internationally

- These factors can limit market expansion, particularly in regions with stringent regulatory frameworks or where cost sensitivity among consumers is a significant factor

Fermented Non-Dairy Non-Alcoholic Beverages market Scope

The market is segmented on the basis of source, type, and distribution channel.

- By Source

On the basis of source, the global fermented non-dairy non-alcoholic beverages market is segmented into fruits, vegetables, cereals, and others. The fruits segment dominated the largest market revenue share of 38.2% in 2024, driven by the widespread use of fruits such as apples, berries, and pineapples in beverages such as kombucha and fermented juices, which are popular for their appealing flavors and health benefits.

The cereals segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer demand for grain-based fermented beverages such as kvass and amazake, particularly in regions such as Asia-Pacific and Africa, where traditional cereal-based fermentation practices are prevalent.

- By Type

On the basis of type, the global fermented non-dairy non-alcoholic beverages market is segmented into dairy-free drinkable yogurts, fermented soft drinks, fermented juices, and non-dairy kefir. The fermented soft drinks segment, particularly kombucha, held the largest market revenue share of 60% in 2024, driven by its popularity among health-conscious consumers, especially millennials, for its probiotic content and diverse flavor profiles.

The non-dairy kefir segment is anticipated to experience the fastest growth rate of 12.8% from 2025 to 2032, propelled by rising demand for plant-based alternatives such as coconut milk kefir and almond milk kefir, which cater to vegan and lactose-intolerant consumers seeking functional beverages with digestive health benefits.

- By Distribution Channel

On the basis of distribution channel, the global fermented non-dairy non-alcoholic beverages market is segmented into retail stores, department stores, supermarkets, hypermarkets, specialty stores, and e-commerce. The supermarkets/hypermarkets segment dominated the market with a revenue share of 45.3% in 2024, attributed to their widespread presence, diverse product offerings, and consumer preference for physically examining products before purchase.

The e-commerce segment is projected to witness the fastest growth rate of 13.5% from 2025 to 2032, driven by increasing internet penetration, convenience of online shopping, and the availability of niche and specialty products. The shift toward e-commerce was further accelerated by the COVID-19 pandemic, enhancing accessibility for health-conscious consumers globally.

Fermented Non-Dairy Non-Alcoholic Beverages Market Regional Analysis

- Asia-Pacific dominated the fermented non-dairy non-alcoholic beverages market with the largest revenue share of 42.5% in 2024, driven by a strong cultural affinity for fermented foods, rapid urbanization, and a growing middle-class population with high disposable incomes, particularly in countries such as China, Japan, and South Korea

- Consumers prioritize fermented beverages for their health benefits, including probiotics for digestive health, immune support, and alignment with vegan and plant-based diets, particularly in regions with rising health consciousness

- Growth is supported by advancements in fermentation technology, such as plant-based fermentation and probiotic enhancement, alongside increasing adoption in both retail and e-commerce distribution channels

Japan Fermented Non-Dairy Non-Alcoholic Beverages Market Insight

Japan’s fermented non-dairy non-alcoholic beverages market is expected to witness rapid growth due to strong consumer preference for high-quality, probiotic-rich beverages that enhance health and wellness. The presence of major food and beverage manufacturers and the integration of products such as kombucha and non-dairy kefir in retail and e-commerce channels accelerate market penetration. Rising interest in health-conscious diets also contributes to growth.

China Fermented Non-Dairy Non-Alcoholic Beverages Market Insight

China holds the largest share of the Asia-Pacific fermented non-dairy non-alcoholic beverages market, propelled by rapid urbanization, rising health consciousness, and increasing demand for plant-based beverages. The country’s growing middle class and focus on preventive healthcare support the adoption of products such as kombucha, fermented juices, and non-dairy kefir. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Middle East and Africa Fermented Non-Dairy Non-Alcoholic Beverages Market Insight

The Middle East and Africa region is expected to witness the fastest growth rate in the fermented non-dairy non-alcoholic beverages market, driven by increasing consumer awareness of health benefits and rising adoption of plant-based diets. Countries such as South Africa and the UAE show significant uptake due to growing demand for probiotic-rich beverages and expanding e-commerce platforms. The region’s focus on health and wellness, coupled with increasing disposable incomes, supports market expansion.

U.S. Fermented Non-Dairy Non-Alcoholic Beverages Market Insight

The U.S. fermented non-dairy non-alcoholic beverages market is expected to witness significant growth, fueled by strong consumer demand for health-conscious beverages and growing awareness of probiotic benefits. The trend toward veganism and plant-based diets, coupled with a robust health and wellness culture, boosts market expansion. The availability of products such as kombucha, non-dairy kefir, and fermented juices in supermarkets and online platforms further drives growth.

Europe Fermented Non-Dairy Non-Alcoholic Beverages Market Insight

The European fermented non-dairy non-alcoholic beverages market is expected to witness rapid growth, supported by increasing consumer focus on health, sustainability, and plant-based diets. Countries such as Germany, France, and the U.K. show significant uptake due to rising demand for probiotic-rich beverages such as kombucha and non-dairy kefir, which enhance digestive health and align with vegan preferences. The growth is prominent in both retail and e-commerce channels, driven by innovation in product offerings.

U.K. Fermented Non-Dairy Non-Alcoholic Beverages Market Insight

The U.K. market for fermented non-dairy non-alcoholic beverages is expected to witness rapid growth, driven by rising consumer interest in health-conscious and plant-based products. Demand for beverages such as kombucha and non-dairy kefir is increasing due to their probiotic content and alignment with vegan diets. Evolving consumer preferences for functional beverages and the expansion of e-commerce platforms further encourage adoption.

Germany Fermented Non-Dairy Non-Alcoholic Beverages Market Insight

Germany is expected to witness rapid growth in the fermented non-dairy non-alcoholic beverages market, attributed to its advanced food and beverage sector and high consumer focus on health and wellness. German consumers prefer beverages with functional benefits, such as kombucha and fermented juices, which support digestive health and sustainability. The integration of these products in supermarkets, specialty stores, and online retail supports sustained market growth.

Fermented Non-Dairy Non-Alcoholic Beverages Market Share

The fermented non-dairy non-alcoholic beverages industry is primarily led by well-established companies, including:

- Good Karma Foods (U.S.)

- Health-Ade LLC (U.S.)

- Konings (Belgium)

- Fentimans (U.K.)

- Lifeway Foods, Inc. (U.S.)

- GT's Living Foods (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Probi (Sweden)

- ORIKA (South Korea)

- DuPont (U.S.)

- Yakult Honsha Co., Ltd. (Japan)

- General Mills Inc. (U.S.)

- A.G.M. Foods Pty. Ltd. (Australia)

What are the Recent Developments in Global Fermented Non-Dairy Non-Alcoholic Beverages Market?

- In November 2024, Bliss Body made waves in India’s health beverage market by launching the country’s first millet-fermented functional drinks in Pineapple, Mango, and Orange flavors. These sugar-free beverages are crafted to support gut health, aid in diabetes management, and promote overall well-being. By harnessing the nutritional power of ancient ingredients such as fermented millet, Bliss Body is redefining functional nutrition with a focus on natural wellness and sustainability. The launch reflects a growing consumer shift toward clean-label, health-forward innovations in the Indian beverage industry

- In August 2024, Yakult Honsha Co., Ltd. unveiled Yakult Plus Peach, a vibrant addition to its fermented milk drink lineup. Bursting with juicy peach flavor, this new variant contains billions of L. casei Shirota bacteria, scientifically proven to support gut health. It’s also rich in vitamin C, fat-free, gluten-free, and suitable for vegetarians, with fewer calories and less sugar than the original formula. Packaged in recyclable cardboard and available in an 8 x 65ml bottle format, Yakult Plus Peach reflects the brand’s commitment to flavor innovation and functional wellness, appealing to health-conscious consumers seeking tasty, non-dairy probiotic options

- In August 2021, First Bev acquired a controlling stake in Health-Ade, a top kombucha brand known for its gut-health benefits and vibrant product lineup. The move was backed by Manna Tree, a nutrition-focused investment firm, and marked a strategic shift to deepen First Bev’s presence in the functional beverage market. Health-Ade’s founders transitioned into new leadership roles, with Jack Belsito—a seasoned beverage executive—appointed CEO to steer the brand’s next growth phase. The acquisition aimed to expand Health-Ade’s reach, boost innovation, and tap into rising consumer interest in digestive wellness and fermented drinks

- In July 2021, Remedy, Australia’s leading fermented beverage brand, made its U.S. debut with a vibrant lineup of live-cultured, sugar-free kombucha drinks. Flavors such as Ginger Lemon, Peach, Mixed Berry, and Raspberry Lemonade were introduced to meet the growing demand for healthy, plant-based fermented beverages. Remedy’s kombucha is brewed using a traditional 30-day fermentation process with a strong live culture (SCOBY), resulting in drinks rich in organic acids, antioxidants, and live active cultures—all without added sugar. The launch marked a strategic move into the world’s largest kombucha market, reinforcing Remedy’s commitment to taste, wellness, and innovation

- In May 2021, Good Karma Foods launched its innovative Plantmilk line—refrigerated, plant-based milks made from a blend of oats, flax, and peas. Available in Original, Vanilla, and Chocolate flavors, these milks offer the creaminess of 2% dairy milk with five times the protein of almond milk and 800 mg of Omega-3s per serving. The launch also included a direct-to-consumer e-commerce platform, expanding accessibility and aligning with growing demand for sustainable, nutrient-rich non-dairy options. This move marked a new chapter for the brand, emphasizing taste, nutrition, and environmental responsibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.