Global Ferric Chloride Market

Market Size in USD Billion

CAGR :

%

USD

7.78 Billion

USD

11.94 Billion

2024

2032

USD

7.78 Billion

USD

11.94 Billion

2024

2032

| 2025 –2032 | |

| USD 7.78 Billion | |

| USD 11.94 Billion | |

|

|

|

|

Ferric Chloride Market Size

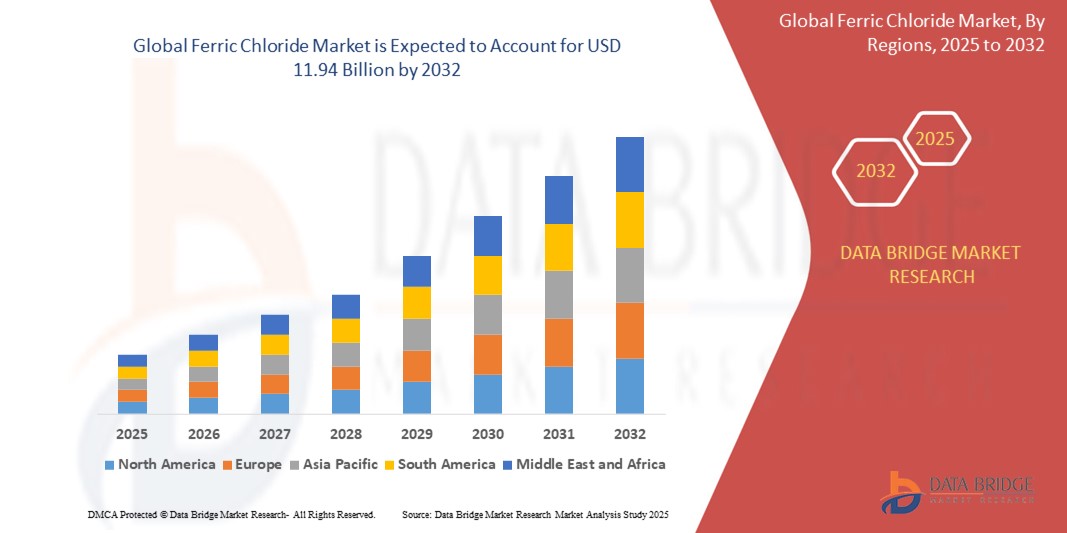

- The global ferric chloride market was valued at USD 7.78 million in 2024 and is expected to reach USD 11.94 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.50% primarily driven by the increasing demand for water treatment solutions

- This growth is driven by factors such as the rising need for industrial waste water treatment, growth in the water treatment industry, and expanding applications in diverse industries such as pharmaceuticals and chemicals

Ferric Chloride Market Analysis

- Ferric Chloride is a chemical compound (Fe Cl₃) widely used in water treatment, metal surface treatment, and the production of printed circuit boards, due to its ability to remove impurities and facilitate various chemical reactions

- The Ferric Chloride market is essential for water treatment, where it helps in removing impurities and managing industrial wastewater, particularly in municipal and industrial applications such as chemical plants and power stations

- For instance, Ferric Chloride is used in large-scale water treatment facilities in cities such as Tokyo and Los Angeles

- It is also used in the chemical industry as a catalyst in manufacturing processes, such as in the production of organic compounds and in semiconductor production, especially in electronics manufacturing for etching printed circuit boards

- For instance, Ferric Chloride plays a key role in the production of printed circuit boards in tech companies such as Samsung and Intel

- With growing concerns about water pollution, Ferric Chloride is increasingly in demand for municipal water treatment plants worldwide, with cities such as London and New York investing heavily in wastewater treatment to meet sustainability goals

- For instance, the New York City Department of Environmental Protection uses Ferric Chloride to treat wastewater in its facilities

- The rise in industrialization and urbanization in emerging markets has led to a surge in Ferric Chloride usage, particularly in countries such as India and China, where rapid industrial growth drives the need for effective water treatment solutions

- For instance, China’s extensive industrial base has seen a steady increase in demand for Ferric Chloride for wastewater treatment in factories and plants

- The market is seeing innovations in the production of Ferric Chloride, with a shift towards more environmentally friendly and cost-effective manufacturing processes, in response to stricter environmental regulations in regions such as the European Union and the U.S.

Report Scope and Ferric Chloride Market Segmentation

|

Attributes |

Ferric Chloride Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ferric Chloride Market Trends

“Increasing Demand for Sustainable and Eco-Friendly Manufacturing Practices”

- The increasing demand for sustainable and eco-friendly manufacturing practices in the Ferric Chloride market is driven by the need to reduce environmental impact in chemical production

- For instance, companies such as Kemira have developed environmentally friendly production methods to reduce energy consumption and waste generation

- Manufacturers are exploring alternative raw materials and production processes to minimize carbon emissions and resource use

- For instance, some companies are focusing on using recycled materials from industrial wastewater, which not only reduces the demand for new raw materials but also promotes recycling initiatives

- Eco-friendly Ferric Chloride production is aligned with global regulatory changes, with stricter environmental standards being implemented in various regions

- For instance, the European Union's REACH regulations encourage manufacturers to adopt greener production methods to comply with environmental safety standards

- Companies are focusing on enhancing the overall sustainability of Ferric Chloride products, including improving their performance and reducing their impact across the product lifecycle. This includes developing formulations that require fewer chemicals and less energy to achieve the desired results in water treatment processes

- The trend towards sustainable manufacturing practices is contributing to long-term cost savings, as more energy-efficient processes reduce production costs. This is seen in companies such as Ferro which are making strides to cut costs and improve environmental sustainability through advanced manufacturing techniques

Ferric Chloride Market Dynamics

Driver

“Increasing Demand for Water Treatment Solutions”

- One of the key drivers of the Ferric Chloride market is the growing global need for water treatment solutions due to rising water pollution, especially in industrialized and urbanized areas

- For instance, large cities such as Beijing and São Paulo face significant water contamination challenges, which increases the demand for effective water treatment solutions

- Ferric Chloride plays a critical role in coagulation and flocculation processes, helping to remove contaminants from wastewater, making it essential in both municipal and industrial water treatment plants

- For instance, the New York City Department of Environmental Protection uses Ferric Chloride to treat water before it is distributed to residents

- The contamination of surface and groundwater sources due to industrial activities and agricultural runoff has led to significant investments in water treatment infrastructure, particularly in emerging economies. In India, cities such as Chennai and Mumbai are investing in advanced water treatment technologies that heavily rely on Ferric Chloride

- Strict environmental regulations, such as those enforced by the Environmental Protection Agency in the U.S., are encouraging industries to adopt advanced water treatment solutions to meet quality standards. This has led to an increased demand for Ferric Chloride in industrial wastewater management across various sectors

- As the demand for clean water grows in developing nations, governments and industries are prioritizing improvements in water treatment facilities

- For instance, the rapid industrialization in China and Southeast Asia has led to an increased reliance on Ferric Chloride for wastewater treatment, benefiting the market

Opportunity

“Rising Adoption in Emerging Economies”

- Emerging economies such as India, China, and Brazil offer substantial growth opportunities for the Ferric Chloride market due to their rapid industrialization and urbanization, which put immense pressure on existing water infrastructure

- For instance, in India, cities such as Chennai and Bangalore are facing water scarcity issues, which has driven local authorities to focus on advanced water treatment methods such as Ferric Chloride use

- These countries face significant challenges in managing water pollution, which has led to a surge in demand for advanced water treatment solutions, with Ferric Chloride being increasingly used to remove impurities from water and treat wastewater

- For instance, the expansion of industrial activities in China's manufacturing sector has resulted in heightened wastewater discharge, leading to the increased adoption of Ferric Chloride in wastewater treatment plants such as those in Shenzhen

- In India, cities such as Delhi and Mumbai, facing severe water pollution, are relying on Ferric Chloride for municipal water treatment, reflecting the rising need for clean water amidst rapid industrial growth. The Delhi Jal Board has been utilizing Ferric Chloride in its wastewater treatment facilities to manage the city's growing water demand

- Similarly, in China, the government's focus on environmental sustainability and pollution control has prompted increased investment in wastewater treatment technologies, making Ferric Chloride a key component in the country’s water treatment processes

- For instance, the Chinese government has made substantial investments in water infrastructure projects that rely on Ferric Chloride to meet the country’s wastewater management needs

- The global awareness of water scarcity and pollution provides an opportunity for companies in the Ferric Chloride market to strengthen their presence in these emerging regions by offering efficient and affordable treatment solutions, helping them gain market share in high-growth economies. Companies such as Kemira and AkzoNobel have been expanding their market reach in countries such as India and Brazil to meet this growing demand

Restraint/Challenge

“Environmental Concerns Related to Chemical Waste”

- One of the major challenges facing the Ferric Chloride market is the environmental impact of its production and disposal, which can contribute to pollution if not managed properly

- For instance, the production process involves using chlorine gas, a hazardous substance that requires careful handling to avoid harmful emissions

- The disposal of waste generated during Ferric Chloride production poses significant environmental risks. Improper disposal can lead to soil and water contamination, which can affect ecosystems and local communities. An instance is seen in some older facilities in industrial regions where untreated waste has been released into nearby rivers, causing long-term environmental damage

- In water treatment applications, the use of Ferric Chloride results in sludge formation, which must be disposed of in an environmentally responsible manner

- For instance, wastewater treatment plants in cities such as New York face challenges in dealing with the sludge that results from Ferric Chloride use, requiring costly and complex waste management solutions

- As environmental regulations become stricter, particularly in developed markets such as the European Union and North America, Ferric Chloride manufacturers are facing increasing pressure to adopt greener production methods

- For instance, the European Union’s environmental regulations on waste disposal and chemical production are pushing companies to find more sustainable alternatives and methods to reduce chemical waste

- Failure to comply with environmental standards and manage waste effectively could result in penalties, loss of market share, or reputational damage. Companies such as Kemira are investing in eco-friendly production methods to avoid such risks and meet the growing demand for sustainable products, helping them maintain their competitive position in the market

Ferric Chloride Market Scope

The market is segmented on the basis of grade, application, and end-use sector

|

Segmentation |

Sub-Segmentation |

|

By Grade |

|

|

By Application |

|

|

By End-Use Sector |

|

Ferric Chloride Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Ferric Chloride Market”

- Asia-Pacific dominates the global ferric chloride market, driven by its increasing use in water treatment and electronics industries

- The demand for Ferric Chloride is surging, particularly in municipal water purification and industrial wastewater treatment across the region

- The growing need for Ferric Chloride in the etching of printed circuit boards (PCBs) is contributing to the market’s expansion in Asia-Pacific

- Countries such as China and India are at the forefront of this growth, thanks to their rapidly expanding industrial sectors and focus on improving water management systems

- With the ongoing urbanization and industrialization in these nations, the demand for Ferric Chloride is expected to see significant growth throughout the forecast period

“North America is Projected to Register the Highest Growth Rate”

- North America is projected to experience significant growth in the Ferric Chloride market, driven by rising demand in pharmaceutical applications and wastewater treatment

- The increasing adoption of Ferric Chloride for sewage and industrial wastewater treatment is particularly evident in the U.S. and Canada, where water management is a key priority

- As environmental regulations around wastewater management tighten, the need for effective and efficient treatment chemicals such as Ferric Chloride is increasing in the region

- North America's focus on improving water quality, along with growing demand in sectors such as pharmaceuticals, is boosting the market for Ferric Chloride

- The combination of stricter regulations and expanding industrial sectors is expected to provide strong momentum for the Ferric Chloride market in North America in the coming years

Ferric Chloride Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF (Germany)

- BPS Products, Inc. (U.S.)

- Tessenderlo Group (Belgium)

- Asia Chemical Corporation, lnc (Taiwan)

- MOLBASE (China)

- KHUSHI CHEMICALS PVT. LTD. (India)

- Akzo Nobel N.V. (Netherlands)

- Chemical Company of Malaysia Bhd (Malaysia)

- Jinan Runyuan Chemical Co., Ltd. (China)

- Sukha Chemical Industries (India)

- Seqens (France)

- Feralco AB (Sweden)

- Kemira (Finland)

- Chemifloc (Ireland)

Latest Developments in Global Ferric Chloride Market

- In February 2022, CAC (Chemieanlagenbau Chemnitz) completed the construction of its first Ferric Chloride plant in Kuwait using its proprietary technology. This development marks a significant milestone for the company, as it expands its capabilities in the production of high-quality Ferric Chloride for water treatment applications. The new plant will enhance the local supply of Ferric Chloride, supporting Kuwait’s growing demand for efficient water treatment solutions. This move is expected to strengthen CAC's presence in the Middle East market and contribute to the region's environmental sustainability efforts

- In July 2021, Nouryon completed the spin-out of its Nobian business, a strategic move to enhance its focus on high-growth chemicals and advanced materials. This separation allows both companies to streamline operations and target growth opportunities more effectively. Nobian will now focus on essential chemicals such as chlor-alkali products, while Nouryon can concentrate on specialty chemicals. The development is expected to strengthen both companies' market positions, boosting innovation and operational efficiency in their respective sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FERRIC CHLORIDE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FERRIC CHLORIDE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL FERRIC CHLORIDE MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 U.K. PRICE TREND ANALYSIS, BY PRODUCT, 2018-2023, (USD/KG)

5.3.1 FERRIC CHLORIDE

5.3.2 FERRIC HYDROXIDE

5.4 RAW MATERIAL PRODUCTION COVERAGE

5.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.6 LIST OF KEY BUYERS

5.7 PORTER’S FIVE FORCES

5.8 VENDOR SELECTION CRITERIA

5.9 PESTEL ANALYSIS

5.1 REGULATION COVERAGE

5.10.1 CERTIFIED STANDARDS

5.10.2 SAFETY STANDARDS

5.10.2.1. MATERIAL HANDLING & STORAGE

5.10.2.2. TRANSPORT & PRECAUTIONS

5.10.2.3. HAZARD IDENTIFICATION

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 IMPACT OF ECONOMIC SLOWDOWN

8.1 PRICE IMPACT

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 CONCLUSION

9 GLOBAL FERRIC CHLORIDE MARKET, BY GRADE, 2022-2031 (USD MILLION) (KILO TONS)

(ASP, VALUE AND VOLUME WILL BE PROVIDED FOR ALL THE SEGMENTS)

9.1 OVERVIEW

9.2 ANHYDROUS

9.2.1 ASP (USD)

9.2.2 MARKET VALUE (USD MILLION)

9.2.3 MARKET VOLUME (KILO TONS)

9.3 FERRIC CHLORIDE HEXAHYDRATE LUMPS

9.3.1 ASP (USD)

9.3.2 MARKET VALUE (USD MILLION)

9.3.3 MARKET VOLUME (KILO TONS)

9.4 FERRIC CHLORIDE LIQUID

9.4.1 ASP (USD)

9.4.2 MARKET VALUE (USD MILLION)

9.4.3 MARKET VOLUME (KILO TONS)

10 GLOBAL FERRIC CHLORIDE MARKET, BY APPLICATION, 2022-2031 (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 WATER & WASTEWATER TREATMENT

10.3 METAL SURFACE TREATMENT

10.4 PRINTED CIRCUIT BOARD (PCB)

10.5 ASPHALT BLOWING

10.6 ELECTRONIC ETCHANTS

10.7 ANIMAL NUTRIENT SUPPLEMENT

10.8 PIGMENT MANUFACTURING

10.9 CATALYST

10.1 OTHERS

11 GLOBAL FERRIC CHLORIDE MARKET, BY END-USE, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 ELECTRONICS

11.3 CHEMICALS

11.4 PHARMACEUTICALS

11.5 INSTITUTIONAL

11.5.1 MUNICIPAL WASTE-WATER TREATMENT

11.5.2 MUNICIPAL PORTABLE WASTE TREATMENT

11.6 METAL & METALLURGY

11.7 OTHERS

12 GLOBAL FERRIC CHLORIDE MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (KILO TONS)

Global FERRIC CHLORIDE market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 ITALY

12.2.4 FRANCE

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 SWITZERLAND

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 LUXEMBURG

12.2.12 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 SINGAPORE

12.3.6 THAILAND

12.3.7 INDONESIA

12.3.8 MALAYSIA

12.3.9 PHILIPPINES

12.3.10 AUSTRALIA & NEW ZEALAND

12.3.11 REST OF ASIA-PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 ISRAEL

12.5.6 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL FERRIC CHLORIDE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15 GLOBAL FERRIC CHLORIDE MARKET- COMPANY PROFILE

15.1 BASF SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 KEMIRA OYJ

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 MERCK KGAA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 CHUNG HWA CHEMICAL INDUSTRIAL WORKS, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 UNIVAR SOLUTIONS INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 MALAY-SINO CHEMICAL INDUSTRIES SDN. BHD.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 PVS CHEMICALS

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 KUHLMANN (PART OF TESSENDERLO GROUP)

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 FERALCO AB

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 SWEDISH JORDANIAN CHEMICALS CO.LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 CHIMIART

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 MISR CHEMICAL INDUSTRIES CO.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 SAF SULPHUR COMPANY

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 KEM ONE

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 SUKHA CHEMICAL INDUSTRIES

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 SEQENS GROUP

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 QUESTIONNAIRE

18 CONCLUSION

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Ferric Chloride Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ferric Chloride Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ferric Chloride Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.