Global Fiber Optic Connectors Market

Market Size in USD Billion

CAGR :

%

USD

5.13 Billion

USD

8.42 Billion

2024

2032

USD

5.13 Billion

USD

8.42 Billion

2024

2032

| 2025 –2032 | |

| USD 5.13 Billion | |

| USD 8.42 Billion | |

|

|

|

|

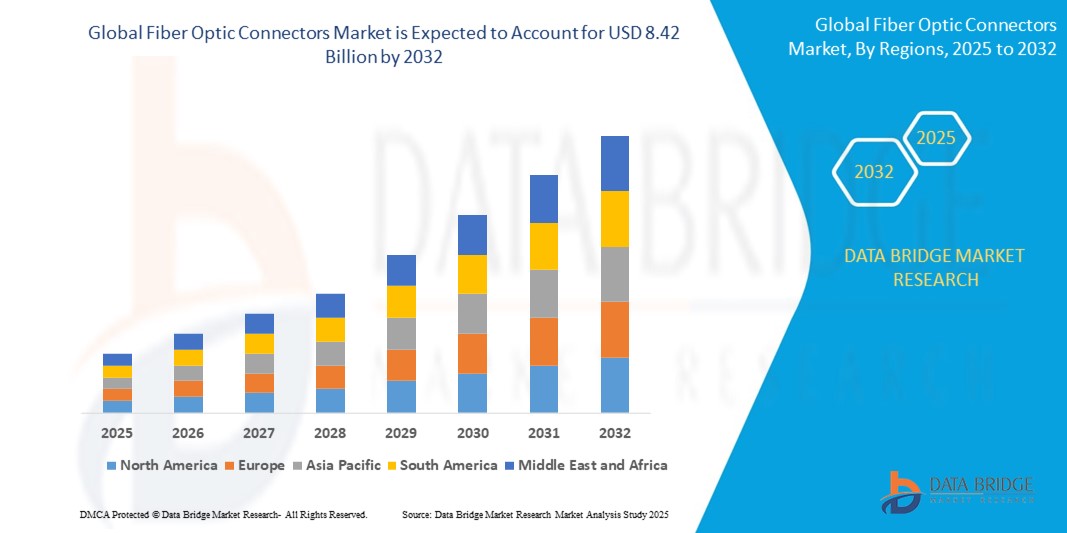

What is the Global Fiber Optic Connectors Market Size and Growth Rate?

- The global fiber optic connectors market size was valued at USD 5.13 billion in 2024 and is expected to reach USD 8.42 billion by 2032, at a CAGR of6.4% during the forecast period

- This robust growth is driven by the rapid expansion of high-speed internet infrastructure, increasing data center deployments, and the global shift toward 5G networks, which demand highly efficient and low-loss data transmission solutions

- In addition, the rising demand for advanced communication systems in sectors such as IT & telecom, defense, and healthcare is significantly propelling the market forward, reinforcing fiber optic connectors as essential components in modern connectivity ecosystems

What are the Major Takeaways of Fiber Optic Connectors Market?

- Fiber optic connectors, enabling high-speed, low-latency data transmission, are becoming indispensable in broadband networks, FTTH deployments, and enterprise IT infrastructures owing to their high reliability, minimal signal loss, and scalability

- Market growth is strongly supported by increased investments in next-generation network infrastructures, rising internet usage, and the demand for cloud-based services, all of which require reliable fiber connectivity

- As businesses and consumers prioritize faster, secure, and high-capacity data transmission, the adoption of fiber optic connectors is expected to remain strong across a wide range of industries, reinforcing their role in the global digital transformation

- North America dominated the fiber optic connectors market with the largest revenue share of 33.25% in 2024, driven by large-scale deployments of fiber networks in data centers, 5G rollouts, and enterprise IT infrastructure upgrades

- Asia-Pacific is the fastest-growing region, expected to expand at a CAGR of 8.26% from 2025 to 2032, fueled by rapid urbanization, digital transformation, and government-led broadband missions. Massive infrastructure projects in China, India, and Japan ranging from smart cities to 5G base stations are significantly boosting demand for advanced fiber connectivity components

- The Subscriber Connector segment dominated the fiber optic connectors market with the largest market revenue share of 28.5% in 2024, driven by its widespread adoption in telecom networks and easy field installation

Report Scope and Fiber Optic Connectors Market Segmentation

|

Attributes |

Fiber Optic Connectors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fiber Optic Connectors Market?

“Rising Demand for High-Speed and Low-Latency Connectivity”

- A major trend shaping the fiber optic connectors market is the escalating demand for ultra-fast and low-latency data transmission, especially in response to rising data consumption from cloud computing, 5G networks, and data centers

- Modern fiber optic connectors such as LC, SC, and MPO are being widely deployed to support higher bandwidths and denser network architectures in enterprise, telecom, and hyperscale environments

- For instance, TE Connectivity introduced new high-density MPO connectors in 2024, offering improved insertion loss and superior performance for 400G/800G applications in cloud data centers

- The shift toward next-generation network infrastructure is propelling innovation in fiber connector types and designs that ensure superior signal integrity, minimal loss, and easy installation

- This trend is further bolstered by increasing investment in fiber-to-the-home (FTTH) and edge computing, necessitating faster and more reliable connectivity across both urban and rural areas

- As data-intensive applications such as AR/VR, AI, and IoT become mainstream, the demand for scalable, high-performance fiber connectivity will continue to drive the market forward

What are the Key Drivers of Fiber Optic Connectors Market?

- Growing investments in 5G infrastructure and broadband expansion, especially in developed and emerging economies, are significantly fueling demand for fiber optic connectors

- For instance, in March 2024, Corning Incorporated partnered with a major U.S. telecom provider to scale up fiber network deployments for nationwide 5G rollouts

- The rapid growth of cloud services, video streaming, and data center traffic is further driving the need for high-speed, low-loss fiber optic interconnects

- In addition, industries such as healthcare, aerospace, and manufacturing are increasingly integrating fiber-based communication systems for improved reliability and real-time data transfer

- The miniaturization of connectors and development of high-density, push-pull locking designs are improving ease of use, driving adoption in space-constrained environments such as mobile networks and compact router

Which Factor is challenging the Growth of the Fiber Optic Connectors Market?

- One of the primary challenges facing the market is the high installation and maintenance costs associated with fiber optic infrastructure, especially in rural or underdeveloped regions

- In many cases, organizations hesitate to transition from legacy copper networks to fiber due to upfront capital expenditures and skilled labor requirements for connector installation

- For instance, several small-scale ISPs in Latin America and Southeast Asia have delayed fiber deployments due to budget constraints and lack of trained technicians

- Moreover, connector contamination and insertion loss remain technical hurdles, especially in high-performance networks, requiring meticulous handling and inspection protocols

- The need for standardization and compatibility across connector types (e.g., LC, SC, ST, MPO) also creates complexity in system integration

- Overcoming these barriers through cost-efficient connector designs, tool-less installation, and technician training programs will be vital to achieving mass adoption

How is the Fiber Optic Connectors Market Segmented?

The market is segmented on the basis of product, cable, application, and end user.

• By Product

On the basis of product, the fiber optic connectors market is segmented into Subscriber Connector, Standard Connectors, Lucent Connectors, Ferrule Connectors, Straight Tip, Multiple-Fiber Push-On/Pull-Off, Master Unit, Fiber Distributed Data Interface, Sub Multi Assembly, and Others. The Subscriber Connector segment dominated the Fiber Optic Connectors market with the largest market revenue share of 28.5% in 2024, driven by its widespread adoption in telecom networks and easy field installation. Subscriber Connectors offer high-performance connections with minimal signal loss, making them the preferred choice for both indoor and outdoor applications, especially in fiber-to-the-home (FTTH) deployments.

The Multiple-Fiber Push-On/Pull-Off (MPO/MTP) segment is anticipated to witness the fastest growth rate during the forecast period, owing to its high-density capabilities, which support rapid data transmission needs in data centers and enterprise networks. Their ability to connect multiple fibers in a compact form is accelerating adoption in high-bandwidth environments.

• By Cable

On the basis of cable type, the fiber optic connectors market is segmented into Simplex, Duplex, and Multi-Fiber. The Simplex segment held the largest market revenue share of 38.9% in 2024, primarily due to its dominance in single-direction data transmission use cases such as point-to-point communication and sensor-based systems. Simplex cables are cost-effective, easy to install, and well-suited for long-distance applications with minimal data requirements.

The Multi-Fiber segment is projected to exhibit the fastest CAGR from 2025 to 2032, fueled by the exponential growth in cloud computing and high-capacity networks. The ability of multi-fiber cables to transmit large volumes of data efficiently makes them ideal for dense network infrastructures and hyperscale data centers.

• By Application

On the basis of application, the fiber optic connectors market is categorized into Datacom, Dense Wavelength Division Multiplexing (DWDM) Systems, High-Density Interconnection, Inter/Intra Building, Security Systems, Community Antenna Television, and Others. The Datacom segment accounted for the largest market revenue share of 34.6% in 2024, driven by the surging demand for bandwidth-intensive applications and cloud-based data services. Fiber optic connectors in datacom systems support high-speed internet, seamless video streaming, and efficient data management, fueling their dominance in this category.

The High-Density Interconnection segment is expected to register the fastest CAGR over the forecast period due to rising investments in advanced data center infrastructure and the need for scalable network solutions. The integration of compact, high-density connectors is critical to improving space utilization and operational efficiency.

• By End User

On the basis of end user, the fiber optic connectors market is segmented into IT and Telecom, Automotive, Banking Financial Services and Insurance (BFSI), Manufacturing, Government, Healthcare, Aerospace and Defence, Oil and Gas, and Others. The IT and Telecom segment dominated the market with the highest market revenue share of 41.2% in 2024, driven by increasing demand for high-speed internet, 5G infrastructure rollout, and fiber-to-the-premises (FTTP) networks. Telecom operators rely heavily on fiber optic connectors for backbone and last-mile connectivity to ensure low latency and high bandwidth transmission.

The Healthcare segment is poised to witness the fastest growth from 2025 to 2032, supported by the growing adoption of telemedicine, digitized patient data management, and networked diagnostic systems. Fiber optic connectors are essential for secure, high-speed data transmission in hospital networks and imaging systems.

Which Region Holds the Largest Share of the Fiber Optic Connectors Market?

- North America dominated the fiber optic connectors market with the largest revenue share of 33.25% in 2024, driven by large-scale deployments of fiber networks in data centers, 5G rollouts, and enterprise IT infrastructure upgrades

- Robust demand for high-speed internet, coupled with federal and private sector investments in fiber backbone expansion, is accelerating adoption across telecom and cloud sectors

- Major players such as Amphenol, Corning, and CommScope are continuously innovating in connector design and performance to cater to U.S. network modernization initiatives

U.S. Fiber Optic Connectors Market Insight

U.S. market dominated the North American market share in 2024, supported by surging data traffic, 5G base station installations, and rising enterprise adoption of cloud and AI technologies. The proliferation of smart cities, FTTH services, and public broadband initiatives is further increasing demand for reliable and scalable fiber connectivity. U.S.-based companies are leading in the development of low-loss, high-density connector solutions that align with evolving telecom and cloud infrastructure needs.

Europe Fiber Optic Connectors Market Insight

The European market is expanding steadily due to the European Union’s Digital Agenda, which emphasizes universal broadband coverage and modernization of communication infrastructure. The region’s push toward carbon-neutral smart buildings and Industry 4.0 is fostering adoption of fiber connectivity in industrial and commercial applications. Countries such as France, Germany, and the U.K. are heavily investing in FTTH and cloud infrastructure, driving demand for durable and high-performance connectors.

U.K. Fiber Optic Connectors Market Insight

The U.K. market is witnessing a strong CAGR driven by government initiatives such as Project Gigabit, which aims to deliver ultra-fast broadband across the country. Widespread adoption of remote work, smart offices, and digital healthcare services is increasing the demand for reliable fiber optic networks supported by advanced connectors. Local ISPs are upgrading their legacy infrastructure with compact, high-speed connectors to meet escalating data demands and latency requirements.

Germany Fiber Optic Connectors Market Insight

Germany’s market is expanding at a significant pace due to investments in fiber backbone development, especially for industrial automation and smart manufacturing hubs. Initiatives to digitize education and public services, coupled with the automotive industry’s shift to connected vehicle platforms, are accelerating fiber optic deployment. Germany also emphasizes eco-friendly and future-proof technologies, fostering demand for high-efficiency, low-loss connectors integrated with green infrastructure.

Which Region is the Fastest Growing in the Fiber Optic Connectors Market?

Asia-Pacific is the fastest-growing region, expected to expand at a CAGR of 8.26% from 2025 to 2032, fueled by rapid urbanization, digital transformation, and government-led broadband missions. Massive infrastructure projects in China, India, and Japan ranging from smart cities to 5G base stations—are significantly boosting demand for advanced fiber connectivity components. The emergence of local manufacturers offering cost-effective, scalable solutions is making fiber optic connectors more accessible across the region.

Japan Fiber Optic Connectors Market Insight

Japan’s market is thriving on the back of next-gen communication technologies, rising demand for ultra-reliable low-latency communication (URLLC), and strong government support for 5G.Major telecom providers are investing in fiber-rich backbone networks, while enterprises are leveraging fiber connectivity to drive AI, IoT, and cloud integration. The adoption of miniaturized, high-density connectors is gaining momentum across densely populated urban zones.

China Fiber Optic Connectors Market Insight

China dominated the Asia-Pacific region in 2024 due to a booming middle class, expansive 5G and FTTH deployment, and strong local manufacturing capabilities. Government-backed smart city initiatives and industrial digitalization are pushing widespread use of rugged, high-speed fiber connectors in residential, commercial, and industrial sectors. Companies such as Huawei, ZTE, and YOFC are spearheading innovation and global expansion of China’s fiber optic ecosystem.

Which are the Top Companies in Fiber Optic Connectors Market?

The fiber optic connectors industry is primarily led by well-established companies, including:

- ALE International, ALE USA Inc. (U.S.)

- Arris Group of Companies (U.S.)

- TE Connectivity. (Switzerland)

- Hitachi Ltd. (Japan)

- Corning Incorporated. (U.S.)

- 3M (U.S.)

- OCC (U.S.)

- Amphenol Corporation (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- HIROSE ELECTRIC CO. LTD. (Japan)

- Extron (U.S.)

- Fibersonics (U.S.)

- Hifi Engineering Inc. (Canada)

- OptaSense (U.K.)

- NTest Inc. (U.S.)

- AP Sensing (Germany)

- Ziebel (Norway)

- Silixa Ltd (U.K.)

- CommVerge Solutions (Philippines)

- DSIT Solutions Ltd. (Israel)

What are the Recent Developments in Global Fiber Optic Connectors Market?

- In May 2023, SABIC, the Saudi-based chemical manufacturing company, expanded its ULTEM portfolio with new colorable, high-flow, and reinforced grades tailored for connectors and thin-wall components. The addition of low-viscosity ULTEM 2120, 2220, and 2320 resins facilitates the creation of miniaturized, high-precision components with intricate geometries. This advancement enhances the ULTEM product range, providing customers in the industry with materials that deliver improved performance and increased design flexibility to meet evolving demands

- In March 2023, Sumitomo Electric Industries joined forces with U.S. Conec Ltd to co-produce MMC connectors and TMT ferrule components, addressing the rising need for advanced, high-density cabling solutions. This strategic collaboration targets hyper-scale data centers, ensuring a robust supply chain for emerging optical link architectures. Initial efforts concentrate on low-loss, 24F single-mode MMC connectors, enhancing connectivity solutions for cutting-edge optical networks

- In May 2022, Optical Cable Corporation and CommScope entered a long-term agreement featuring a cross-licensing arrangement. This pact allows mutual access to specific patent portfolios, fostering innovation in network infrastructure. By leveraging each other's licensed patents and technologies, the agreement between the fiber optic cable manufacturer and network solutions provider facilitates the development of advanced solutions, enhancing their capabilities in the dynamic field of network infrastructure

- In March 2022, CUI Devices' Interconnect Group expanded its connector solution range by launching circular connections, specifically the CDM12 series. This series features a range of male and female variants with 3, 4, 5, 8, and 12 pins. Designed for industrial and manufacturing automation applications, these connectors come in M12 connection types and boast IP67 ratings, ensuring resilience in challenging environmental conditions. The inclusion of circular connections enhances the versatility of CUI Devices' connector offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fiber Optic Connectors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fiber Optic Connectors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fiber Optic Connectors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.