Global Fibrinogen Testing Market

Market Size in USD Billion

CAGR :

%

USD

1.54 Billion

USD

2.69 Billion

2025

2033

USD

1.54 Billion

USD

2.69 Billion

2025

2033

| 2026 –2033 | |

| USD 1.54 Billion | |

| USD 2.69 Billion | |

|

|

|

|

Fibrinogen Testing Market Size

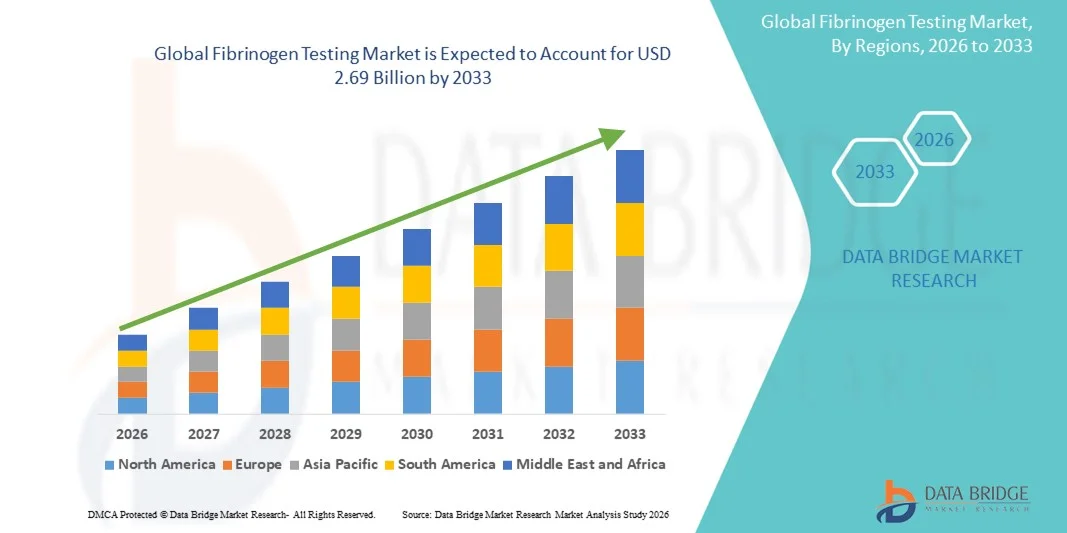

- The global fibrinogen testing market size was valued at USD 1.54 billion in 2025 and is expected to reach USD 2.69 billion by 2033, at a CAGR of 7.22% during the forecast period

- The market growth is largely driven by the increasing prevalence of cardiovascular disorders, bleeding disorders, and other coagulopathies, which are prompting higher demand for accurate and rapid fibrinogen testing

- Furthermore, rising awareness among healthcare providers and patients regarding early diagnosis and monitoring of blood clotting conditions is encouraging the adoption of advanced fibrinogen testing kits and systems. These factors are collectively accelerating the uptake of fibrinogen testing solutions, thereby significantly boosting the industry's growth

Fibrinogen Testing Market Analysis

- Fibrinogen testing, providing quantitative assessment of fibrinogen levels in blood, is becoming increasingly vital for the diagnosis and management of bleeding disorders, cardiovascular diseases, and other coagulation-related conditions in both clinical and laboratory settings due to its accuracy, rapid turnaround time, and compatibility with automated and manual testing systems

- The rising demand for fibrinogen testing is primarily fueled by the increasing prevalence of cardiovascular and thrombotic disorders, growing awareness among healthcare providers about early diagnosis, and advancements in reagent kits and testing methodologies

- North America dominated the fibrinogen testing market with the largest revenue share of 38.9% in 2025, driven by high healthcare expenditure, advanced diagnostic infrastructure, and the presence of leading diagnostic companies, with the U.S. witnessing significant adoption of various fibrinogen reagent types and testing methods in hospitals and diagnostic laboratories

- Asia-Pacific is expected to be the fastest growing region in the fibrinogen testing market during the forecast period due to rising healthcare awareness, increasing prevalence of coagulation disorders, and expanding diagnostic infrastructure in emerging economies such as China and India

- Immunoassays dominated the fibrinogen testing market with a share of 45.8% in 2025, owing to their high sensitivity, specificity, and ease of use in both clinical and research settings

Report Scope and Fibrinogen Testing Market Segmentation

|

Attributes |

Fibrinogen Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Fibrinogen Testing Market Trends

Advancements in Automated and Point-of-Care Testing

- A significant and accelerating trend in the global fibrinogen testing market is the growing adoption of automated analyzers and point-of-care testing devices, enhancing accuracy, turnaround time, and operational efficiency in clinical laboratories and hospitals

- For instance, Siemens Healthineers’ Atellica COAG solution provides automated fibrinogen measurement with high throughput and minimal manual intervention, enabling rapid decision-making in critical care settings

- Integration with laboratory information systems (LIS) and electronic medical records (EMR) enables real-time reporting, trend analysis, and centralized patient data management, improving workflow efficiency and reducing diagnostic errors

- The increasing use of bedside and portable fibrinogen testing devices allows clinicians to obtain rapid results during surgeries or emergency care, improving patient outcomes and enabling timely intervention

- Growing adoption of digital monitoring platforms that track fibrinogen levels over time is enabling personalized patient care and better management of chronic coagulation disorders

- The trend towards combining fibrinogen testing with other coagulation panels is expanding diagnostic capabilities, providing clinicians with comprehensive insights into patient hemostasis

- This trend towards automation, portability, and integration with digital health systems is reshaping laboratory workflows and clinician expectations, driving demand for more sophisticated and user-friendly fibrinogen testing solutions

- The market is witnessing heightened interest from both hospital and diagnostic laboratory segments for advanced systems capable of delivering accurate, rapid, and reproducible fibrinogen results

Fibrinogen Testing Market Dynamics

Driver

Increasing Prevalence of Cardiovascular and Coagulation Disorders

- The rising incidence of cardiovascular diseases, thrombotic disorders, and bleeding complications is a significant driver for the heightened demand for fibrinogen testing

- For instance, Roche Diagnostics has introduced comprehensive coagulation testing panels that include fibrinogen assays to support early diagnosis and ongoing monitoring of high-risk patients

- Growing awareness among healthcare providers regarding the role of fibrinogen in cardiovascular risk assessment and surgical management is further encouraging widespread adoption of fibrinogen testing kits and automated analyzers

- The increasing number of surgical procedures, liver disease cases, and trauma-related hospitalizations necessitating coagulation monitoring is fueling market growth

- Healthcare providers are also emphasizing preventive diagnostics, leading to the integration of fibrinogen testing in routine health checkups and clinical assessments, driving consistent demand

- Expansion of testing capabilities in both hospital and independent laboratory settings is creating opportunities for the adoption of advanced fibrinogen assays and reagents

- Increasing funding and research initiatives for coagulation disorders are accelerating the development and adoption of novel fibrinogen testing solutions

- Strategic partnerships between diagnostic companies and hospitals or research institutes are facilitating faster deployment and clinical validation of fibrinogen assays

Restraint/Challenge

High Cost of Advanced Testing and Reagent Accessibility Issue

- The relatively high cost of automated fibrinogen analyzers, advanced immunoassay kits, and point-of-care devices poses a significant challenge to market growth, particularly in emerging economies

- For instance, portable coagulation testing devices offering rapid fibrinogen results are priced higher than traditional laboratory-based kits, limiting adoption in cost-sensitive regions

- Limited availability and supply chain constraints of specialized fibrinogen reagents and kits, including STA-Fibrinogen and Multifibren U reagents, can delay testing and reduce accessibility in remote or underdeveloped areas

- While laboratory-based manual assays are more affordable, they are labor-intensive and prone to variability, creating a trade-off between cost and accuracy

- Ensuring widespread access to affordable, high-quality fibrinogen testing kits, along with cost-effective automation solutions, is critical to overcoming market adoption barriers

- Addressing pricing concerns, improving reagent distribution, and providing flexible testing solutions will be essential for sustained growth, especially in developing markets

- Regulatory requirements and the need for strict compliance in clinical testing can increase operational complexity and limit market entry for smaller diagnostic providers

- Lack of trained personnel in emerging markets to operate advanced fibrinogen testing systems can slow adoption and hinder the overall market expansion

Fibrinogen Testing Market Scope

The market is segmented on the basis of reagent type, indication, product type, and end user.

- By Reagent Type

On the basis of reagent type, the global fibrinogen testing market is segmented into Q.F.A. Thrombin Kits, Fibrinogen Kits, Multifibren Ureagents, STA-Fibrinogen Kits, and Imidazole Buffer Kits. The Fibrinogen Kits segment dominated the market with the largest revenue share in 2025, driven by its wide clinical applicability in measuring plasma fibrinogen levels for coagulation assessment. Hospitals and diagnostic laboratories prefer these kits due to their accuracy, reliability, and compatibility with both manual and automated testing systems. They are widely used for monitoring cardiovascular disorders, bleeding complications, and liver-related conditions, making them a standard choice for clinical workflows. Integration with coagulation panels and laboratory information systems enhances operational efficiency and result reproducibility. Their standardized protocols and widespread availability support adoption across various healthcare settings. In addition, Fibrinogen Kits are extensively used in pre-surgical assessments and patient monitoring, further reinforcing their dominant position.

The STA-Fibrinogen Kits segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for high-sensitivity, automated coagulation testing. These kits offer rapid results, reproducibility, and integration with automated analyzers, making them suitable for high-volume laboratories and critical care units. Adoption is increasing in advanced healthcare facilities and regions with growing point-of-care testing infrastructure. The accuracy and reliability of STA-Fibrinogen Kits in complex coagulation scenarios support rapid market expansion. Their ability to integrate with modern laboratory workflows enhances adoption. Increasing awareness among clinicians about the benefits of automated, precise testing further drives growth.

- By Indication

On the basis of indication, the market is segmented into congenital fibrinogen disorders, fibrinogen storage diseases, hereditary fibrinogen α-chain amyloidosis, acquired dysfibrinogenemia, cryofibrinogenemia, disseminated intravascular coagulation (DIC), and end-stage liver disease. The DIC segment dominated the market in 2025 due to the high prevalence of sepsis, trauma, and critical illnesses requiring frequent fibrinogen monitoring. Hospitals and ICUs rely on fibrinogen testing for DIC patients to enable timely interventions. Integration of fibrinogen assays into comprehensive coagulation panels enhances clinical decision-making. Growing awareness among clinicians about early detection and management supports adoption. Standardized testing protocols in advanced healthcare facilities sustain strong demand. Regular monitoring of coagulation parameters in surgical and emergency care settings further reinforces dominance.

The Cryofibrinogenemia segment is expected to witness the fastest growth during the forecast period due to increasing recognition of rare coagulation disorders and rising adoption of specialized diagnostic testing. Emerging economies are expanding access to advanced testing kits, which supports rapid growth. Increased research on cryofibrinogenemia and related coagulation conditions further boosts market opportunities. The segment benefits from awareness campaigns targeting early detection and personalized care. Growing availability of reagents and point-of-care testing kits accelerates adoption. Clinicians’ preference for precise and rapid diagnosis drives segment growth.

- By Product Type

On the basis of product type, the market is segmented into heat precipitation test, clotting method, immunoassays, and DNA Tests. Immunoassays dominated the market in 2025 with the largest revenue share of 45.8% due to their high sensitivity, specificity, and quantitative measurement capabilities. Hospitals and diagnostic laboratories widely use immunoassays for routine patient monitoring and thrombotic risk assessment. Compatibility with automated analyzers improves operational efficiency and reduces errors. Integration with coagulation panels and electronic reporting systems strengthens market dominance. Immunoassays are reliable, reproducible, and suitable for both clinical and research applications. Their broad adoption across healthcare settings ensures sustained market leadership.

The DNA Tests segment is expected to witness the fastest growth from 2026 to 2033, driven by rising adoption for hereditary fibrinogen disorder diagnosis and personalized medicine. Advancements in molecular diagnostics and growing clinician awareness contribute to rapid expansion. Increased focus on genetic testing for coagulation disorders supports market adoption. Availability of high-throughput DNA testing platforms accelerates growth. Integration with research and clinical trials further drives segment popularity. Expanding diagnostic capabilities in emerging markets fuels demand.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, diagnostic laboratories, ambulatory care centers, and academics & research institutes. Hospitals dominated the market in 2025 due to the high volume of fibrinogen testing performed for critical care, surgical, and cardiovascular patients. Advanced laboratory infrastructure enables the use of automated analyzers and comprehensive testing panels. Regular monitoring in ICUs, surgical units, and emergency departments drives demand. Integration with hospital information systems ensures accurate and high-throughput testing. Specialized laboratory personnel maintain quality and reliability of results. Hospitals also support clinical trials and research applications, reinforcing their market dominance.

Diagnostic Laboratories are expected to witness the fastest growth from 2026 to 2033, driven by rising outsourcing of fibrinogen testing from hospitals and clinics. These laboratories offer high-throughput, cost-effective, and specialized testing services. Growing patient awareness and preference for outpatient testing boost market growth. Adoption of automated analyzers and advanced reagents further accelerates expansion. Laboratories also serve as research hubs for coagulation studies. Increasing partnerships with healthcare providers enhance accessibility and drive segment growth.

Fibrinogen Testing Market Regional Analysis

- North America dominated the fibrinogen testing market with the largest revenue share of 38.9% in 2025, driven by high healthcare expenditure, advanced diagnostic infrastructure, and the presence of leading diagnostic companies, with the U.S. witnessing significant adoption of various fibrinogen reagent types and testing methods in hospitals and diagnostic laboratories

- Healthcare providers in the region prioritize accurate and rapid fibrinogen testing for critical care, surgical procedures, and routine monitoring of high-risk patients, supporting widespread adoption in hospitals and diagnostic laboratories

- The region’s market growth is further supported by high healthcare expenditure, well-established clinical laboratories, and increasing awareness among clinicians about the importance of early diagnosis and coagulation monitoring

U.S. Fibrinogen Testing Market Insight

The U.S. fibrinogen testing market captured the largest revenue share of 80% in North America in 2025, driven by the high prevalence of cardiovascular diseases, thrombotic disorders, and bleeding complications. Hospitals and diagnostic laboratories prioritize rapid and accurate fibrinogen testing for critical care, surgical procedures, and routine patient monitoring. The increasing adoption of automated analyzers and integration with comprehensive coagulation panels further supports market growth. Growing awareness among clinicians regarding early diagnosis and personalized patient management is boosting demand. In addition, the U.S. healthcare system’s advanced infrastructure and well-established clinical laboratories facilitate widespread deployment of fibrinogen testing solutions. Robust R&D initiatives by leading diagnostic companies continue to propel innovation and adoption of advanced testing kits and reagents.

Europe Fibrinogen Testing Market Insight

The Europe fibrinogen testing market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising prevalence of coagulation disorders and increasing demand for accurate and timely diagnostic solutions. Hospitals and specialized diagnostic laboratories are increasingly incorporating fibrinogen testing in routine health assessments and critical care monitoring. Growing awareness about cardiovascular risks and bleeding disorders is fostering adoption among clinicians and laboratories. The trend towards integration of automated analyzers with laboratory information systems enhances workflow efficiency. European healthcare providers are also emphasizing preventive diagnostics and early intervention, further supporting market growth. The adoption spans both residential health services and commercial diagnostic facilities, with consistent demand from multi-specialty hospitals.

U.K. Fibrinogen Testing Market Insight

The U.K. fibrinogen testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of coagulation disorders and the increasing need for timely, accurate diagnostic results. Hospitals and clinics are adopting automated fibrinogen testing systems to improve workflow efficiency and reduce diagnostic errors. The growing prevalence of cardiovascular and liver-related diseases is encouraging clinicians to incorporate fibrinogen testing in routine monitoring. Government healthcare initiatives supporting preventive diagnostics further bolster market growth. The U.K.’s advanced laboratory infrastructure and strong diagnostic service network facilitate widespread adoption. Increased demand for outpatient and ambulatory testing also contributes to market expansion.

Germany Fibrinogen Testing Market Insight

The Germany fibrinogen testing market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of coagulation disorders and growing emphasis on early detection and patient management. Hospitals and diagnostic laboratories are adopting automated and high-throughput fibrinogen testing systems to support critical care and surgical procedures. Germany’s well-developed healthcare infrastructure and focus on technological innovation support market adoption. Integration of fibrinogen testing with digital reporting systems improves accuracy and efficiency. Growing clinical research initiatives on coagulation disorders further drive the demand for advanced fibrinogen assays. The preference for precise and reliable diagnostic solutions aligns with local healthcare standards and regulatory requirements.

Asia-Pacific Fibrinogen Testing Market Insight

The Asia-Pacific fibrinogen testing market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising prevalence of cardiovascular and liver disorders, increasing healthcare awareness, and expansion of diagnostic infrastructure in countries such as China, India, and Japan. Growing adoption of automated analyzers and point-of-care testing systems is accelerating market growth. Government initiatives promoting preventive healthcare and digitalization are supporting increased demand. The region’s expanding healthcare expenditure and urbanization contribute to improved accessibility of advanced fibrinogen testing. Rising collaborations between diagnostic companies and hospitals are enhancing adoption. In addition, the emergence of cost-effective testing solutions is driving growth in both urban and semi-urban regions.

Japan Fibrinogen Testing Market Insight

The Japan fibrinogen testing market is gaining momentum due to the country’s high prevalence of cardiovascular and thrombotic disorders, advanced healthcare infrastructure, and emphasis on early diagnosis and preventive care. Hospitals and diagnostic laboratories are increasingly adopting automated and high-throughput fibrinogen testing solutions. Integration with laboratory information systems enhances operational efficiency and reporting accuracy. Growing awareness among clinicians regarding personalized patient management is driving adoption. The aging population in Japan further boosts demand for convenient and reliable testing in both residential and clinical settings. Research initiatives and government support for advanced diagnostics continue to stimulate market growth.

India Fibrinogen Testing Market Insight

The India fibrinogen testing market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising prevalence of cardiovascular diseases, rapid urbanization, and increasing healthcare awareness. Hospitals, clinics, and diagnostic laboratories are expanding their testing capabilities with automated analyzers and advanced reagents. Government initiatives promoting preventive healthcare and the development of smart healthcare infrastructure are supporting market growth. Affordability and accessibility of testing kits, along with local manufacturing of reagents, are key factors driving adoption. Rising demand for outpatient and ambulatory diagnostic services further contributes to growth. Strong domestic and multinational presence in India ensures availability of advanced fibrinogen testing solutions.

Fibrinogen Testing Market Share

The Fibrinogen Testing industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Abbott (U.S.)

- Sysmex Corporation (Japan)

- Werfen (Spain)

- Diagnostica Stago (France)

- Bio-Rad Laboratories, Inc. (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- DiaSys Diagnostic Systems GmbH (Germany)

- Randox Laboratories Ltd (U.K.)

- Trinity Biotech plc (Ireland)

- Agappe Diagnostics Ltd (India)

- HYPHEN BioMed (France)

- Sekisui Medical Co., Ltd. (Japan)

- Helena Laboratories Corporation (U.S.)

- ELITechGroup Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Technopath Clinical Diagnostics Ltd (Ireland)

- BIOMÉRIEUX (France)

What are the Recent Developments in Global Fibrinogen Testing Market?

- In June 2025, Sysmex Corporation announced that its automated blood coagulation analyzer CN‑6000 Automated Blood Coagulation Analyzer received U.S. FDA 510(k) clearance covering among others its fibrinogen (Fbg) assay using Dade® Thrombin reagent. This paves the way for its launch in the U.S. and strengthens its presence in hemostasis labs needing high‑throughput fibrinogen testing

- In June 2025, data from the Phase III “AdFIrst” clinical trial of BT524 fibrinogen concentrate by Grifols / Biotest AG were published in the peer‑reviewed journal. The study met its primary endpoint: BT524 was shown to be non‑inferior to standard-of-care (cryoprecipitate or fresh frozen plasma) in reducing intraoperative bleeding in patients with acquired fibrinogen deficiency. This strengthens clinical confidence in fibrinogen supplementation and indirectly supports demand for reliable fibrinogen testing

- In January 2025, Biotest AG submitted a Biologics License Application (BLA) to the U.S. U.S. Food and Drug Administration (FDA) for its fibrinogen concentrate (BT524), covering both acquired fibrinogen deficiency and congenital fibrinogen disorders. If approved, this would add a new therapeutic complement to fibrinogen testing potentially increasing testing demand for monitoring and post‑treatment evaluation globally

- In November 2023, the International Council for Standardisation in Haematology (ICSH) published updated recommendations on fibrinogen assays, thrombin clotting time and related tests reaffirming that the Clauss fibrinogen assay remains the method of choice, but highlighting scenarios where results may be misleading and urging standardization of testing protocols globally

- In June 2022, Biotest AG (part of the Grifols Group) announced a successful interim analysis of its Phase III trial (AdFIrst) for its human fibrinogen concentrate, confirming that the trial could continue as planned with full enrollment — a key step toward eventual approval and broader adoption of fibrinogen therapies, which indirectly drives demand for fibrinogen testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.