Global Finfet Technology Market

Market Size in USD Billion

CAGR :

%

USD

98.13 Billion

USD

1,520.05 Billion

2024

2032

USD

98.13 Billion

USD

1,520.05 Billion

2024

2032

| 2025 –2032 | |

| USD 98.13 Billion | |

| USD 1,520.05 Billion | |

|

|

|

|

FinFET Technology Market Size

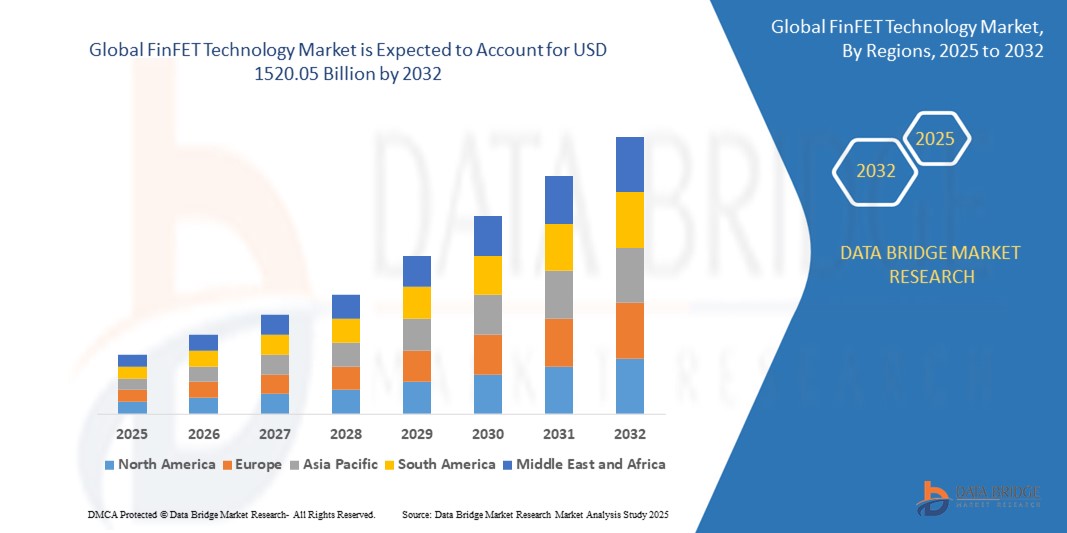

- The global finfet technology market size was valued at USD 98.13 billion in 2024 and is expected to reach USD 1520.05 billion by 2032, at a CAGR of 40.85% during the forecast period

- The market growth is primarily driven by the increasing demand for high-performance and energy-efficient semiconductor devices, coupled with advancements in chip manufacturing processes for smaller node sizes

- The rising adoption of FinFET technology in applications such as AI, 5G, and IoT devices, along with the need for compact and power-efficient chips, is significantly contributing to market expansion

FinFET Technology Market Analysis

- FinFET (Fin Field-Effect Transistor) technology is a critical innovation in semiconductor manufacturing, enabling the production of smaller, faster, and more power-efficient chips for a wide range of applications, from mobile devices to high-performance computing

- The market is propelled by the growing need for advanced processors in smartphones, data centers, and automotive electronics, alongside increasing investments in 5G infrastructure and AI-driven technologies

- Asia-Pacific dominated the FinFET technology market with the largest revenue share of 45.3% in 2024, driven by the presence of major semiconductor foundries, high production volumes, and government support for chip manufacturing in countries such as China, South Korea, and Taiwan

- North America is expected to be the fastest-growing region during the forecast period, fueled by significant R&D investments, the presence of leading chip design companies, and increasing demand for advanced computing solutions in the U.S. and Canada

- The 7nm segment dominated the largest market revenue share of 30% in 2024, driven by its widespread adoption in premium smartphones, high-performance computing, and AI accelerators

Report Scope and FinFET Technology Market Segmentation

|

Attributes |

FinFET Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

FinFET Technology Market Trends

“Increasing Integration of AI and Advanced Semiconductor Nodes”

- The global FinFET technology market is experiencing a prominent trend of integrating Artificial Intelligence (AI) with advanced semiconductor nodes such as 3nm, 5nm, and 7nm

- These technologies enable enhanced processing capabilities, allowing for faster and more efficient handling of complex computations in applications such as AI-driven algorithms, machine learning, and real-time data analytics

- AI-powered FinFET solutions facilitate optimized chip performance, identifying bottlenecks and improving power efficiency for high-performance computing tasks

- For instance, companies are leveraging AI-driven FinFET designs to develop processors for autonomous vehicles, optimizing real-time sensor fusion, and creating energy-efficient chips for IoT devices and wearables

- This trend is increasing the appeal of FinFET technology across diverse industries, enhancing its adoption in mobile, automotive, and cloud computing applications

- AI algorithms integrated with FinFET chips analyze vast datasets, such as those from IoT networks or automotive systems, to improve performance metrics such as latency, throughput, and energy consumption

FinFET Technology Market Dynamics

Driver

“Rising Demand for High-Performance Computing and Connected Devices”

- The growing consumer and enterprise demand for high-performance computing, driven by applications such as AI, 5G, and IoT, is a key driver for the global FinFET technology market

- FinFET technology enhances chip performance by offering superior power efficiency and reduced current leakage, critical for applications in Central Processing Units (CPUs), System-on-Chips (SoCs), and Graphics Processing Units (GPUs)

- Government initiatives and industry standards promoting energy-efficient semiconductors, particularly in Asia-Pacific, are accelerating the adoption of FinFET technology

- The proliferation of 5G networks and IoT ecosystems, coupled with advancements in 3nm, 5nm, and 7nm nodes, enables faster data processing and low-latency communication for connected devices such as smartphones, wearables, and autonomous vehicles

- Major semiconductor manufacturers are increasingly incorporating FinFET technology as a standard in their foundry processes to meet the performance demands of cloud servers, high-end networks, and consumer electronics

Restraint/Challenge

“High Manufacturing Costs and Design Complexity”

- The high initial investment required for developing and manufacturing FinFET technology, particularly for advanced nodes such as 3nm and 5nm, poses a significant barrier for smaller semiconductor companies, especially in emerging markets

- The complexity of designing and fabricating FinFET-based chips, including challenges such as self-heating and process variations, increases production costs and can lower yield rates

- Data security concerns related to the integration of FinFET chips in IoT and connected devices are a major challenge, as these chips handle sensitive data, raising risks of breaches and compliance issues with global data protection regulations

- The fragmented regulatory landscape across regions, particularly in Asia-Pacific and North America, regarding semiconductor manufacturing standards and data privacy, complicates operations for global foundries and chip designers

- These factors may slow market growth in cost-sensitive regions and deter adoption in applications where design simplicity or lower costs are prioritized

FinFET Technology market Scope

The market is segmented on the basis of technology, application, end user, and type.

- By Technology

On the basis of technology, the FinFET technology market is segmented into 3nm, 5nm, 7nm, 10nm, 14nm, 16nm, 20nm, and 22nm. The 7nm segment dominated the largest market revenue share of 30% in 2024, driven by its widespread adoption in premium smartphones, high-performance computing, and AI accelerators. Its balance of performance, power efficiency, and scalability makes it a preferred choice for major semiconductor manufacturers such as TSMC and Samsung.

The 3nm segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by advancements in transistor density and energy efficiency, catering to the rising demand for cutting-edge electronics, 5G technology, and AI applications. Innovations in extreme ultraviolet (EUV) lithography further support the transition to smaller nodes, enhancing performance and reducing power consumption.

- By Application

On the basis of application, the FinFET technology market is segmented into Central Processing Unit (CPU), System-On-Chip (SoC), Field-Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), and Network Processor. The SoC segment dominated with a market revenue share of 35% in 2024, driven by its critical role in smartphones, IoT devices, and automotive systems, where compact, power-efficient chips are essential. Companies such as Apple and Qualcomm leverage SoCs for enhanced performance in consumer electronics.

The GPU segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by increasing demand for high-performance computing in AI, machine learning, and gaming applications. FinFET’s ability to reduce leakage and improve energy efficiency makes it ideal for GPU advancements, particularly in data centers and autonomous vehicles.

- By End User

On the basis of end user, the FinFET technology market is segmented into Mobile, Cloud Server/High-End Networks, IoT/Consumer Electronics, Automotive, Computer and Tablets, Wearable, and Others. The Mobile segment held the largest market revenue share of 40% in 2024, driven by the global proliferation of smartphones and the demand for high-performance, energy-efficient processors. Companies such as Samsung and MediaTek have integrated FinFET technology into mobile chipsets, enhancing functionality and battery life.

The Automotive segment is expected to witness the fastest growth rate of approximately 22% from 2025 to 2032, fueled by the rise of advanced driver-assistance systems (ADAS), autonomous driving, and vehicle-to-everything (V2X) communication. FinFET-based chips enable real-time data processing for navigation, sensor fusion, and connectivity, critical for modern vehicles.

- By Type

On the basis of type, the FinFET technology market is segmented into Shorted Gate (S.G.), Independent Gate (I.G.), Bulk FinFETS, and Silicon On Insulator (SOI) FinFETS. The SOI FinFETS segment held the largest market revenue share of 55% in 2024, attributed to its superior performance in low-power applications and seamless integration with IoT ecosystems. SOI FinFETS are widely used in high-performance computing and mobile devices due to their reduced leakage and enhanced efficiency.

The Independent Gate (I.G.) segment, including dual-gate, triple-gate, and multi-gate FinFETs, is expected to witness significant growth from 2025 to 2032. This growth is driven by its flexibility in high-performance applications, particularly in AI accelerators and automotive processors, where precise control of current flow is critical.

FinFET Technology Market Regional Analysis

- Asia-Pacific dominated the FinFET technology market with the largest revenue share of 45.3% in 2024, driven by the presence of major semiconductor foundries, high production volumes, and government support for chip manufacturing in countries such as China, South Korea, and Taiwan

- Consumers prioritize FinFET technology for its superior power efficiency, enhanced performance, and reduced leakage current, particularly in applications requiring advanced processing capabilities across diverse industries

- Growth is supported by advancements in semiconductor technology, including smaller process nodes such as 3nm and 5nm, alongside rising adoption in both foundry services and fabless semiconductor segments

U.S. FinFET Technology Market Insight

The U.S. finfet technology market is expected to witness significant growth, fueled by strong demand from high-performance computing and AI applications. The trend towards smaller node sizes, such as 5nm and 3nm, and increasing investments in semiconductor R&D further boost market expansion. Leading foundries and fabless companies’ focus on integrating FinFET in CPUs, GPUs, and SoCs complements the growing need for advanced chip designs, creating a dynamic market ecosystem.

Europe FinFET Technology Market Insight

The Europe FinFET technology market is expected to witness significant growth, supported by regulatory emphasis on energy-efficient electronics and automotive advancements. Consumers and manufacturers seek FinFET-based chips that enhance processing power while reducing energy consumption. The growth is prominent in both OEM semiconductor production and aftermarket chip design, with countries such as Germany and France showing significant uptake due to rising demand for AI and 5G applications.

U.K. FinFET Technology Market Insight

The U.K. market for FinFET technology is expected to witness rapid growth, driven by demand for advanced semiconductor solutions in telecommunications and automotive sectors. Increased interest in high-performance, low-power chips for IoT and consumer electronics encourages adoption. Evolving regulations promoting energy efficiency and technological innovation influence market choices, balancing performance with compliance.

Germany FinFET Technology Market Insight

Germany is expected to witness a high growth rate in FinFET technology, attributed to its advanced semiconductor and automotive manufacturing sectors and strong focus on energy-efficient chip designs. German manufacturers prefer technologically advanced FinFET nodes, such as 7nm and 5nm, that enhance computational efficiency and contribute to lower power consumption. The integration of FinFET in premium automotive electronics and aftermarket chip solutions supports sustained market growth.

Asia-Pacific FinFET Technology Market Insight

The Asia-Pacific region dominates the global FinFET technology market, driven by extensive semiconductor production and rising demand for advanced chips in countries such as China, Taiwan, and South Korea. Increasing adoption of 5G, AI, and IoT technologies is boosting demand for FinFET-based processors. Government initiatives promoting semiconductor self-reliance and technological innovation further encourage the use of advanced FinFET nodes.

Japan FinFET Technology Market Insight

Japan’s FinFET technology market is expected to witness a high growth rate due to strong consumer and manufacturer preference for high-quality, technologically advanced chips that enhance performance and efficiency. The presence of major semiconductor companies and integration of FinFET in OEM chip designs accelerate market penetration. Rising interest in aftermarket chip customization for consumer electronics also contributes to growth.

China FinFET Technology Market Insight

China holds the largest share of the Asia-Pacific FinFET technology market, propelled by rapid urbanization, rising demand for consumer electronics, and increasing need for high-performance computing solutions. The country’s growing tech industry and focus on domestic semiconductor production support the adoption of advanced FinFET nodes. Strong manufacturing capabilities and competitive pricing enhance market accessibility.

FinFET Technology Market Share

The finfet technology industry is primarily led by well-established companies, including:

- SAP SE (Germany)

- BluJay Solutions, LLC. (U.S.)

- ANSYS, Inc (U.S.)

- Keysight Technologies (U.S.)

- Analog Devices, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- NXP Semiconductors (Netherlands)

- Renesas Electronics Corporation. (Japan)

- Robert Bosch GmbH (Germany)

- ROHM CO., LTD. (Japan)

- Semiconductor Components Industries, LLC (U.S.)

- Texas Instruments Incorporated (U.S.)

- TOSHIBA CORPORATION (Japan)

What are the Recent Developments in Global FinFET Technology Market?

- In July 2023, Cadence Design Systems, Inc. announced a collaboration with Intel Foundry Services (IFS) to certify its digital and custom/analog flows for the Intel 16 FinFET process technology. This partnership also delivered process design kits (PDKs) to support the development of low-power, high-performance computing applications, enhancing the adoption of Intel’s 16nm FinFET node for diverse industries including aerospace and government

- In May 2023, NXP Semiconductors partnered with TSMC to launch the industry’s first automotive-embedded MRAM (Magnetoresistive Random-Access Memory) using 16nm FinFET technology. This innovative MRAM offers faster code updates (20MB in under three seconds) and up to 10x greater endurance compared to traditional flash memory, targeting automotive mission-critical applications

- In April 2023, Samsung Electronics Co., Ltd. introduced its advanced 3nm FinFET process node with Multi-Bridge Channel FET (MBCFET) technology. This second-generation 3nm node delivers up to 39% higher performance and 49% improved power efficiency compared to previous nodes, targeting high-performance computing and mobile applications

- In March 2023, Qualcomm Technologies, Inc. completed its acquisition of NUVIA, a CPU and technology design company, to enhance its CPU roadmap leveraging FinFET technology. This strategic move strengthens Qualcomm’s position in delivering high-performance processors for Windows, Android, and Chrome ecosystems using advanced FinFET nodes

- In October 2022, Avicena demonstrated its LightBundleTM multi-Tbps chip-to-chip interconnect technology at the European Conference for Optical Communications (ECOC) 2022. This 1Tbps microLED-based Transceiver IC, built on a 16nm FinFET CMOS process, aims to address bandwidth and proximity constraints in high-performance computing applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.