Global Fire Extinguisher Inspection Services Market

Market Size in USD Billion

CAGR :

%

USD

3.92 Billion

USD

6.35 Billion

2024

2032

USD

3.92 Billion

USD

6.35 Billion

2024

2032

| 2025 –2032 | |

| USD 3.92 Billion | |

| USD 6.35 Billion | |

|

|

|

|

Fire Extinguisher Inspection Services Market Size

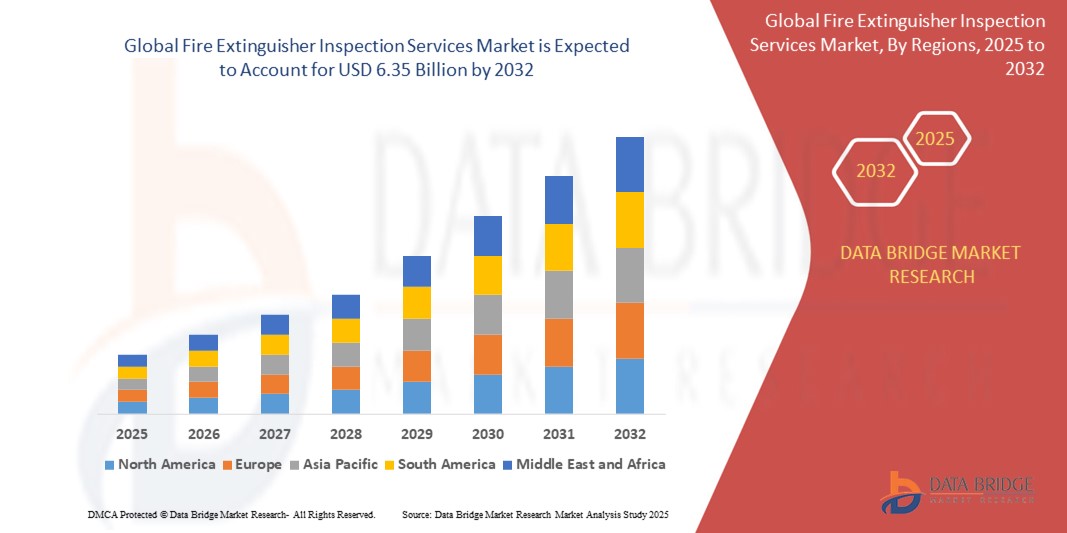

- The global fire extinguisher inspection services market size was valued at USD 3.92 billion in 2024 and is expected to reach USD 6.35 billion by 2032, at a CAGR of 6.20% during the forecast period

- This growth is driven by driven by growing enforcement of stringent fire safety regulations across commercial, industrial, and residential sectors

Fire Extinguisher Inspection Services Market Analysis

- The fire extinguisher inspection services market plays a critical role in ensuring workplace and residential safety by providing routine checks, maintenance, and compliance verification for fire extinguishers and suppression systems. These services include inspection, testing, certification, and repair to ensure readiness during fire emergencies and compliance with local fire safety regulations

- The market is primarily driven by the increasing adoption of fire safety codes, strict regulatory mandates, and growing awareness about the importance of regular equipment checks. In addition, the rising frequency of fire-related incidents, insurance requirements, and the need for digital inspection records are accelerating the adoption of professional inspection services across sectors

- Asia-Pacific dominates the global fire extinguisher inspection services market, backed by rapid industrialization, construction boom, and growing fire safety investments across countries such as China, India, and Japan. Government initiatives promoting workplace safety standards and periodic audits further enhance market penetration in the region

- North America is projected to register the highest CAGR during the forecast period, owing to advanced building safety protocols, the integration of digital inspection technologies, and increasing adoption across commercial, institutional, and industrial establishments in the U.S. and Canada

- The portable fire extinguishers segment is expected to dominate the fire extinguisher inspection services market with the largest share of 48.05% in 2025 due to their adaptability and user-friendly design, making them suitable for diverse environments such as commercial, residential, and industrial settings

Report Scope and Fire Extinguisher Inspection Services Market Segmentation

|

Attributes |

Fire Extinguisher Inspection Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Fire Extinguisher Inspection Services Market Trends

“Increasing Digitalization and Smart Inspection Technologies”

- The fire extinguisher inspection services industry is experiencing a technological shift with the integration of digital platforms, IoT-enabled devices, and automated inspection systems to improve accuracy, compliance, and efficiency

- Smart inspection tools such as mobile apps, barcode/RFID tracking, and real-time cloud reporting are enabling seamless documentation and faster audits across commercial and industrial facilities

- The shift towards predictive maintenance, data-driven risk assessment, and remote diagnostics is empowering companies to enhance fire safety management while reducing manual labor

- For instance, in November 2024, VFS Fire & Security Services introduced a cloud-based fire extinguisher inspection platform, enabling real-time updates and automated compliance reporting for enterprise clients across North America

- This trend is expected to drive the modernization of fire extinguisher maintenance practices and encourage widespread adoption of smart fire safety systems globally

Fire Extinguisher Inspection Services Market Dynamics

Driver

“Stringent Fire Safety Regulations and Insurance Compliance Requirements”

- The increasing enforcement of fire safety regulations by governments and local authorities is compelling businesses to adopt professional inspection and maintenance services

- Fire codes now mandate routine inspections and certifications as part of occupational safety and insurance eligibility, especially in high-risk sectors such as petroleum, healthcare, and education

- Insurance companies are also requiring documented compliance with fire extinguisher standards to issue or renew property coverage, further driving demand

- For instance, in September 2024, The U.S. National Fire Protection Association (NFPA) revised its NFPA 10 standards, tightening annual inspection norms and enhancing third-party accountability

- This regulatory push is expected to strengthen the role of inspection and testing services as an essential part of facility management and risk mitigation strategies

Opportunity

“Expansion into Untapped Residential and Institutional Segments”

- While traditionally focused on commercial and industrial sectors, fire extinguisher inspection services are now finding new opportunities in residential complexes, schools, and small businesses

- Urbanization, rising consumer safety awareness, and local municipality programs are increasing the installation and servicing of fire extinguishers in apartment buildings and educational facilities

- Affordable subscription models, mobile service units, and community outreach campaigns are further enabling service providers to penetrate previously overlooked customer segments

- For instance, in August 2024, FlameShield Solutions launched a mobile inspection unit in Texas aimed at low-income residential areas, offering on-site extinguisher checks and safety training sessions

- This presents a scalable growth avenue for service providers to build brand presence and expand revenue beyond traditional markets

Restraint/Challenge

“Lack of Skilled Workforce and Training Gaps in Developing Regions”

- A major bottleneck in service quality and compliance lies in the shortage of trained technicians and standardized certification programs in emerging markets

- Inconsistent enforcement of fire safety laws and the absence of centralized inspection protocols lead to variability in service outcomes, affecting reliability and trust

- This challenge is particularly acute in rural and semi-urban zones, where fire safety is still seen as non-essential, and qualified service providers are few

- For instance, in March 2024, India’s Fire Safety Council announced a nationwide initiative to train over 50,000 technicians by 2026 to address the growing demand for certified inspection professionals

- Bridging this skill gap through public-private partnerships, e-learning platforms, and certification standardization is crucial to unlocking full market potential and improving fire preparedness globally

Fire Extinguisher Inspection Services Market Scope

The market is segmented on the basis of service, inspection type, type of extinguisher, inspection technology, application, and client size.

|

Segmentation |

Sub-Segmentation |

|

By Service |

|

|

By Inspection Type |

|

|

By Type of Extinguisher |

|

|

By Inspection Technology |

|

|

By Application |

|

|

By Client Size |

|

In 2025, the portable fire extinguishers is projected to dominate the market with a largest share in type of extinguisher segment

The portable fire extinguishers segment is expected to dominate the fire extinguisher inspection services market with the largest share of 48.05% in 2025 due to their adaptability and user-friendly design, making them suitable for diverse environments such as commercial, residential, and industrial settings.

The testing is expected to account for the largest share during the forecast period in service segment

In 2025, the testing segment is expected to dominate the fire extinguisher inspection services market with the largest share of 52.12% due to critical need for regular checks to ensure the functionality and compliance of fire safety systems, including fire extinguishers, alarms, and suppression systems.

Fire Extinguisher Inspection Services Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Fire Extinguisher Inspection Services Market”

- Asia-Pacific dominates the fire extinguisher inspection services market, propelled by rapid industrialization, stringent fire safety regulations, and increased awareness of workplace safety across countries such as China, India, and Japan

- China commands a significant portion of the market due to its booming construction sector, expanding industrial infrastructure, and enforcement of mandatory fire safety audits and inspections in commercial and residential complexes

- The rising integration of advanced inspection technologies, including digital monitoring systems and automated testing devices, across urban developments and smart cities is further driving service adoption in the region

- Moreover, supportive government policies, growing investments in fire protection infrastructure, and the push for certification and compliance across manufacturing and commercial sectors are accelerating the market growth across Asia-Pacific

“North America is projected to register the Highest CAGR in the Fire Extinguisher Inspection Services Market”

- North America is expected to witness the fastest growth rate in the fire extinguisher inspection services market, driven by the rising implementation of fire safety standards, modernization of buildings, and the surge in safety compliance audits across industrial and commercial sectors

- U.S. and Canada are leading contributors, owing to their strict regulatory frameworks, increased adoption of smart inspection technologies, and emphasis on preventive maintenance to reduce fire-related liabilities

- In the U.S., particularly, there is growing demand for real-time monitoring, automated inspection systems, and cloud-based reporting tools in both urban and rural infrastructure, supporting market acceleration

- Furthermore, heightened awareness of public safety, combined with strong support from local authorities and insurance incentives for fire safety compliance, is significantly boosting the demand for Fire Extinguisher Inspection Services throughout North America

Fire Extinguisher Inspection Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Honeywell International Inc. (U.S.)

- Cintas Corporation (U.S.)

- Koorsen Fire & Security (U.S.)

- Convergint Technologies LLC (U.S.)

- Protegis Fire & Safety (U.S.)

- AAA Fire Protection (U.S.)

- Total Safety U.S., Inc. (U.S.)

- Summit Fire & Security LLC (U.S.)

- DGA Security Systems, Inc. (U.S.)

- IMPACT FIRE SERVICES, LLC (U.S.)

- Pye-Barker Fire & Safety, LLC (U.S.)

- Allied Universal (U.S.)

- Johnson Controls (U.S.)

- Securitas AB (Sweden)

- Nanjing Fire Protection Technology Co., Ltd. (China)

- jimsfiresafety (China)

- Wormald International (Australia)

- Chubb Fire & Security (Australia)

- FlameSafe Fire Protection (Australia)

Latest Developments in Global Fire Extinguisher Inspection Services Market

- In October 2024, Pye-Barker Fire & Safety, a prominent fire protection service provider in the U.S., acquired Pasco Fire & Safety Equipment based in Tempa, Florida. This strategic acquisition enabled Pye-Barker to strengthen its presence and expand its fire extinguisher and suppression system services across Florida. The move marks a significant step in consolidating its market leadership in the southeastern region

- In June 2024, ACE Fire Protection, a New York City-based fire extinguisher inspection company, introduced a suite of cutting-edge fire safety solutions aimed at enhancing protection for both businesses and residents. These new offerings were designed to improve the accessibility and performance of fire extinguishers citywide. The initiative reflects the company's commitment to urban fire safety modernization

- In April 2023, Johnson Controls, a global leader in building technologies, announced a collaborative closed-loop steel recycling initiative with Nucor, a major U.S. steel manufacturer. The program is set to reclaim nearly 100% of secondary scrap steel produced at key Johnson Controls facilities throughout the country. This effort demonstrates a robust commitment to sustainability and circular economy practices within the fire safety equipment industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fire Extinguisher Inspection Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fire Extinguisher Inspection Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fire Extinguisher Inspection Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.