Global Flat Steel Market

Market Size in USD Billion

CAGR :

%

USD

605.74 Billion

USD

958.20 Billion

2024

2032

USD

605.74 Billion

USD

958.20 Billion

2024

2032

| 2025 –2032 | |

| USD 605.74 Billion | |

| USD 958.20 Billion | |

|

|

|

|

What is the Global Flat Steel Market Size and Growth Rate?

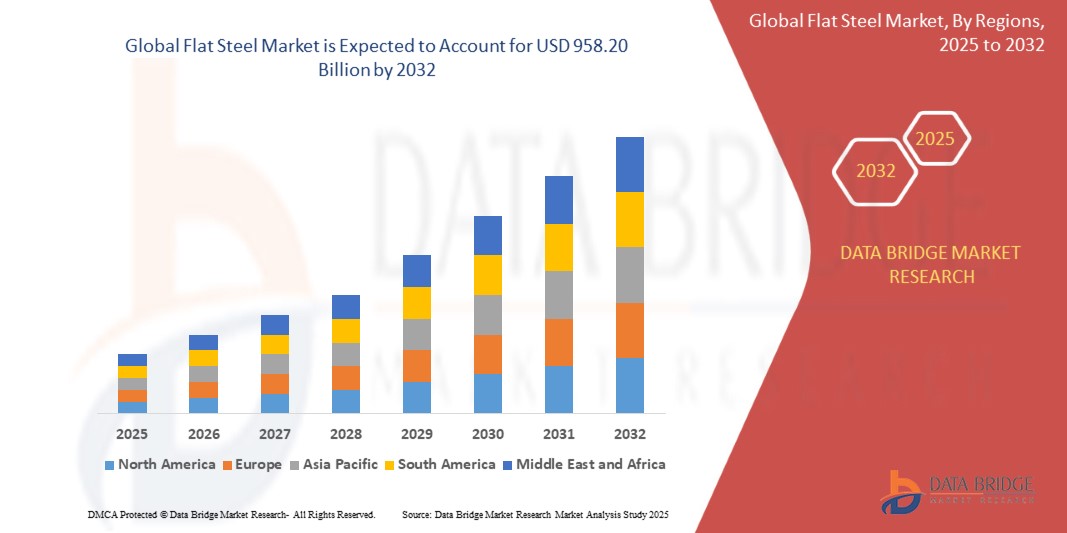

- The global flat steel market size was valued at USD 605.74 billion in 2024 and is expected to reach USD 958.20 billion by 2032, at a CAGR of 5.90% during the forecast period

- Flat steel market growth is driven by advancements in production technologies such as advanced high-strength steel (AHSS) and automation in manufacturing processes. Innovations include continuous casting and advanced coating techniques

- Increased demand in automotive, construction, and appliance sectors fuels market expansion. These technologies enhance performance, reduce costs, and meet evolving industry standards, fostering significant growth

What are the Major Takeaways of Flat Steel Market?

- The growing construction industry significantly drives the flat steel market due to increased urbanization and infrastructure development. For instance, large-scale projects such as smart cities and high-rise buildings require substantial amounts of flat steel for building frames, roofing, and other structural elements

- In countries such as China and India, rapid urban growth and extensive infrastructure projects, such as highways and bridges, further boost the demand for flat steel products

- North America dominated the flat steel market with the largest revenue share of 39.7% in 2024, fueled by increasing demand from automotive, construction, and energy sectors, alongside strong investment in steel recycling and green steel production technologies

- Asia-Pacific is projected to register the fastest CAGR of 15.3% from 2025 to 2032, driven by rising steel consumption across construction, automotive, and industrial sectors in China, India, Japan, and Southeast Asia

- The Hot-Rolled Coil segment dominated the flat steel market with the largest revenue share of 34.6% in 2024, driven by its widespread use in automotive, construction, and industrial manufacturing due to its high strength, cost-effectiveness, and suitability for structural applications

Report Scope and Flat Steel Market Segmentation

|

Attributes |

Flat Steel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Flat Steel Market?

“Sustainability-Driven Demand and Lightweight Construction Revolutionizing Flat Steel Applications”

- A key trend reshaping the flat steel market is the growing demand for lightweight, high-strength steel across automotive, construction, and renewable energy sectors to enhance fuel efficiency, reduce emissions, and improve structural performance

- Automakers are increasingly adopting advanced high-strength flat steels (AHSS) to meet emission regulations and improve crashworthiness, while reducing vehicle weight for better energy efficiency

- In construction, galvanized and coated flat steel is in high demand for its durability, weather resistance, and alignment with green building standards

- The rise of solar and wind projects globally is also boosting usage of flat steel in mounting structures, turbine parts, and transformer cores

- Major players such as ArcelorMittal, POSCO, and Nippon Steel are investing in R&D and low-carbon steel production, including hydrogen-based DRI (direct reduced iron) and electric arc furnaces to meet green material demands

- This sustainability-driven trend is accelerating the shift toward circular manufacturing and eco-friendly infrastructure, positioning flat steel as a core material in the net-zero transition

What are the Key Drivers of Flat Steel Market?

- Rapid urbanization, industrialization, and rising infrastructure development across emerging economies are major growth drivers for the flat steel market

- For instance, in April 2024, Tata Steel announced a USD 1.2 billion investment in green flat steel capacity expansion to cater to renewable energy and electric vehicle (EV) sectors in India

- Surging demand for electric vehicles, renewable energy infrastructure, and modular construction is fueling consumption of coated and cold-rolled flat steel products

- Government initiatives such as the EU Carbon Border Adjustment Mechanism, India’s National Steel Policy, and U.S. Infrastructure Investment Act are propelling production modernization and emission reduction in the steel industry

- In addition, technological advancements in steel processing, automation, and recycling are improving productivity and sustainability across the value chain

- These factors collectively create a strong foundation for sustained demand across key sectors such as automotive, energy, appliances, and construction

Which Factor is challenging the Growth of the Flat Steel Market?

- Volatility in raw material prices, especially iron ore and coking coal, continues to pose a significant challenge for flat steel manufacturers, affecting production costs and profit margins

- For instance, global coking coal prices surged by over 25% in early 2024, disrupting procurement strategies and squeezing margins for mills dependent on blast furnace operations

- In addition, the carbon-intensive nature of traditional steelmaking has come under scrutiny, leading to increased pressure from regulators, investors, and ESG-conscious customers to decarbonize

- Challenges also include overcapacity in some regions, trade restrictions, and price fluctuations triggered by geopolitical tensions and supply chain disruptions

- The complexity of recycling coated or alloyed flat steel further limits circularity in some end-use segments

- To overcome these barriers, the industry must accelerate the adoption of green steel technologies, forge global trade partnerships, and invest in low-emission value chains to ensure competitiveness and environmental compliance

How is the Flat Steel Market Segmented?

The market is segmented on the basis of product type, process, material, and end-use sector.

• By Product Type

On the basis of product type, the flat steel market is segmented into Slabs, Hot-Rolled Coil, Cold-Rolled Coil, Sheets and Strips, Tinplate, Coated Steel, and Others. The Hot-Rolled Coil segment dominated the flat steel market with the largest revenue share of 34.6% in 2024, driven by its widespread use in automotive, construction, and industrial manufacturing due to its high strength, cost-effectiveness, and suitability for structural applications.

The Cold-Rolled Coil segment is projected to register the fastest CAGR from 2025 to 2032, owing to its superior surface finish, enhanced tensile strength, and growing adoption in home appliances, automotive body panels, and consumer electronics.

• By Process

On the basis of process, the flat steel market is segmented into Basic Oxygen Furnace (BOF) and Electric Arc Furnace (EAF). The Basic Oxygen Furnace segment held the largest market share in 2024, owing to its dominance in large-scale, integrated steel plants and its ability to produce high volumes of molten steel efficiently using iron ore and recycled scrap.

The Electric Arc Furnace segment is expected to witness the fastest CAGR from 2025 to 2032, supported by increasing emphasis on decarbonized steel production, scrap recycling, and the transition to electric-based steelmaking, particularly in developed regions such as Europe and North America.

• By Material

On the basis of material, the flat steel market is segmented into Carbon Steel, Alloy Steel, Stainless Steel, and Tool Steel. The Carbon Steel segment accounted for the largest revenue share of 41.2% in 2024, driven by its extensive use in construction, pipeline systems, and heavy machinery due to its durability, strength, and affordability.

The Stainless Steel segment is expected to record the fastest CAGR from 2025 to 2032, fueled by rising demand in medical equipment, kitchenware, automotive components, and renewable energy systems owing to its corrosion resistance and aesthetic appeal.

• By End-Use Sector

On the basis of end-use sector, the flat steel market is segmented into Building and Infrastructure, Mechanical Equipment, Automotive and Other Transport, Consumer Goods and Appliances, Oil and Gas, Energy, and Others. The Building and Infrastructure segment dominated the market with the highest revenue share of 29.7% in 2024, supported by rapid urbanization, ongoing infrastructure projects, and demand for durable structural materials in both emerging and developed economies.

The Automotive and Other Transport segment is projected to witness the fastest growth during the forecast period, driven by lightweight, high-strength flat steel requirements in electric vehicles, public transport systems, and next-generation automotive manufacturing platforms.

Which Region Holds the Largest Share of the Flat Steel Market?

- North America dominated the flat steel market with the largest revenue share of 39.7% in 2024, fueled by increasing demand from automotive, construction, and energy sectors, alongside strong investment in steel recycling and green steel production technologies

- The region benefits from advanced manufacturing infrastructure, growing emphasis on infrastructure modernization, and robust demand for high-strength and corrosion-resistant steel in electric vehicles, pipelines, and industrial applications

- Supportive trade policies, domestic sourcing strategies, and significant investments in decarbonization technologies are further reinforcing North America’s leadership position in the global Flat Steel market

U.S. Flat Steel Market Insight

The U.S. flat steel market captured the largest revenue share within North America in 2024, supported by increased public and private investments in construction, automotive electrification, and offshore wind projects. The U.S. Inflation Reduction Act and infrastructure stimulus plans are significantly boosting domestic flat steel demand across energy, housing, and transportation sectors.

Canada Flat Steel Market Insight

The Canada flat steel market is witnessing steady growth, driven by infrastructure upgrades, demand for eco-friendly steel in the building sector, and growth in the renewable energy industry. Canada's clean energy transition policies and its strategic role in North American manufacturing supply chains are helping expand its flat steel footprint.

Mexico Flat Steel Market Insight

The Mexico flat steel market is expanding, backed by the country’s strong manufacturing base, particularly in automotive and appliance sectors. Favorable trade access to both the U.S. and Latin America, along with foreign direct investment in industrial parks, is supporting flat steel consumption and regional market growth.

Which Region is the Fastest Growing Region in the Flat Steel Market?

Asia-Pacific is projected to register the fastest CAGR of 15.3% from 2025 to 2032, driven by rising steel consumption across construction, automotive, and industrial sectors in China, India, Japan, and Southeast Asia. The region is witnessing massive infrastructure development, urbanization, and rapid expansion of renewable energy projects, all of which require durable and versatile flat steel products. Favorable government policies, expansion of domestic steel manufacturing capacity, and investments in advanced production technologies are accelerating regional market growth and export potential.

China Flat Steel Market Insight

The China flat steel market held the largest share within Asia-Pacific in 2024, driven by strong industrial output, large-scale infrastructure investments, and rapid EV manufacturing growth. China’s continued urban development and steel-intensive projects such as smart cities and high-speed rail are major demand drivers.

India Flat Steel Market Insight

The India flat steel market is experiencing robust growth, fueled by initiatives such as “Make in India,” national infrastructure pipelines, and the expansion of solar and wind energy capacity. India's domestic production of hot-rolled and cold-rolled coil is rising, along with demand from the automotive and appliance sectors.

Japan Flat Steel Market Insight

The Japan flat steel market is growing steadily, supported by demand for high-performance steel in automotive, shipbuilding, and electronics. The country’s focus on sustainable steel production and development of low-carbon technologies is reinforcing its competitive position in premium flat steel markets.

Which are the Top Companies in Flat Steel Market?

The flat steel industry is primarily led by well-established companies, including:

- ArcelorMittal (Luxembourg)

- NIPPON STEEL CORPORATION (Japan)

- United States Steel Corporation (U.S.)

- Tata Steel (India)

- POSCO (South Korea)

- Jiangsu Shagang Group (China)

- Shougang (China)

- China Ansteel Group Corporation Limited (China)

- SSAB (Sweden)

- JFE Steel Corporation (Japan)

- BlueScope Steel Limited (Australia)

- HBIS GROUP (China)

- thyssenkrupp AG (Germany)

- voestalpine Stahl GmbH (Austria)

- SAIL (India)

- China Lucky Steel Co., Ltd. (Taiwan)

- METINVEST (Ukraine)

- JSW (India)

What are the Recent Developments in Global Flat Steel Market?

- In June 2022, Nippon Steel Corporation introduced a 30-year service life warranty program for ZEXEED, its high corrosion-resistant coated steel. This warranty covers perforation caused by corrosion for products meeting specific criteria, enhancing customer service efficiency

- In April 2021, Nippon Steel Corporation launched ZAM-EX, a highly corrosion-resistant coated flat steel sheet for the global market. This product development aims to bolster the company's market competence

- In March 2021, ArcelorMittal introduced XCarb, an initiative to reduce CO2 emissions in steel manufacturing. The company invested in various initiatives to progress towards carbon-neutral steel

- In October 2020, ArcelorMittal Europe announced a CO2 technology strategy to produce green steel solutions. This initiative aims to achieve a 30% CO2 emissions reduction target by 2030 and net zero by 2050. Projects are being implemented at almost all flat product sites to use gases from different sources for blast furnace injection, reducing CO2 emissions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flat Steel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flat Steel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flat Steel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.