Global Flexographic Printing Market

Market Size in USD Billion

CAGR :

%

USD

4.08 Billion

USD

5.68 Billion

2024

2032

USD

4.08 Billion

USD

5.68 Billion

2024

2032

| 2025 –2032 | |

| USD 4.08 Billion | |

| USD 5.68 Billion | |

|

|

|

|

Flexographic Printing Market Size

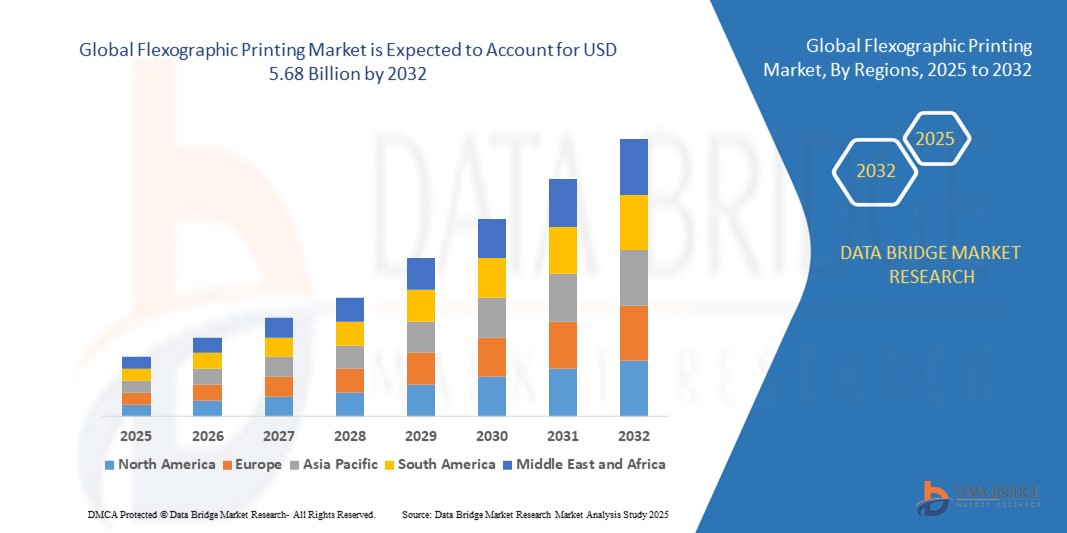

- The global flexographic printing market size was valued at USD 4.08 billion in 2024 and is expected to reach USD 5.68 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is primarily driven by increasing demand for cost-effective and high-speed printing solutions across various packaging applications, especially in the food, beverage, and pharmaceutical industries

- In addition, the shift toward sustainable and flexible packaging, along with advancements in water-based and UV-curable inks, is boosting adoption. These factors are propelling the flexographic printing industry into a new phase of expansion and innovation

Flexographic Printing Market Analysis

- Flexographic printing, a high-speed rotary printing method utilizing flexible relief plates, continues to play a crucial role in the packaging industry across various sectors including food & beverage, personal care, and pharmaceuticals, due to its ability to print on a wide range of substrates with consistent quality and lower production costs

- The growing demand for sustainable and cost-efficient printing solutions is primarily fueling the adoption of flexographic printing, supported by technological advancements such as improved plate-making processes, automation, and environmentally friendly ink formulations

- North America dominated the flexographic printing market with the largest revenue share of 38.9% in 2024, driven by strong demand from the region’s robust packaging industry, technological innovation, and increasing investment in sustainable printing solutions, with the U.S. leading in adoption of advanced flexographic presses and eco-friendly inks

- Asia-Pacific is expected to be the fastest growing region in the flexographic printing market during the forecast period, driven by rapid industrialization, expanding retail and e-commerce sectors, and increased investments in modern printing technologies

- The flexible packaging segment dominated the flexographic printing market with a market share of 48.1% in 2024, owing to its versatility, reduced material usage, and rising preference among brand owners for lightweight and visually appealing packaging formats

Report Scope and Flexographic Printing Market Segmentation

|

Attributes |

Flexographic Printing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flexographic Printing Market Trends

Sustainable Printing and Technological Advancements Driving Market Evolution

- A significant and accelerating trend in the global flexographic printing market is the growing shift toward sustainable, low-VOC inks and environmentally friendly substrates, paired with advancements in automation and digital prepress technologies. These developments are transforming how packaging and label printers operate, improving both efficiency and eco-compliance

- For instance, Esko and Miraclon have introduced advanced platemaking and imaging systems that reduce waste and enhance quality, enabling faster turnaround times and greater design flexibility. Similarly, companies such as Comexi have developed flexographic presses with energy-saving features and low environmental impact

- Modern flexographic printing presses are increasingly integrated with automation systems that enable precise ink control, real-time quality monitoring, and faster job changeovers, allowing printers to meet growing demand for short-run, customized, and visually appealing packaging. In addition, water-based and UV-curable inks are gaining traction due to their lower emissions and compliance with strict global environmental regulations

- These innovations are fostering seamless integration with digital workflows and enhancing overall production sustainability. Printers can now deliver consistent results with fewer resources, aligning with the rising demand for eco-friendly packaging in consumer-driven markets

- This trend toward cleaner, faster, and more automated flexographic printing processes is reshaping industry expectations. Companies such as Flint Group and Siegwerk are investing heavily in R&D to deliver high-performance, sustainable ink solutions tailored to the flexographic segment

- The increasing preference for packaging that meets both performance and sustainability goals is driving adoption of advanced flexographic systems across sectors such as food & beverage, pharmaceuticals, and household products, positioning flexography as a cornerstone of modern packaging production

Flexographic Printing Market Dynamics

Driver

High Demand for Efficient and Sustainable Packaging Solutions

- The growing demand for efficient, high-speed, and sustainable packaging production is a major driver of flexographic printing market growth, especially as brands seek cost-effective methods for mass customization and shorter print runs without compromising quality

- For instance, in February 2024, Bobst announced the launch of a next-generation flexographic press with enhanced automation, optimized ink usage, and reduced waste, designed to meet the evolving needs of fast-paced packaging lines. Such advancements by key players are set to accelerate industry growth in the forecast period

- Flexographic printing is gaining preference for its versatility across diverse substrates including plastic, paper, and foil, making it ideal for food packaging, labels, and corrugated boxes. Its compatibility with eco-friendly inks and recyclable materials further supports growing environmental compliance needs

- Moreover, as retail and e-commerce sectors expand globally, there is increased pressure on packaging converters to deliver high-quality, sustainable packaging at competitive costs. Flexographic printing offers a scalable solution for meeting this demand, with fast turnaround, minimal downtime, and energy-efficient operations

- The ease of integrating flexographic printing into existing production lines and the availability of user-friendly, modular press designs also support broader adoption among both large converters and small-to-medium enterprises

Restraint/Challenge

High Initial Setup Cost and Skilled Labor Dependency

- One of the major challenges restraining the flexographic printing market is the high initial setup cost associated with machinery, platemaking systems, and associated prepress equipment. This can limit adoption among small and budget-sensitive converters, particularly in emerging economies

- For instance, fully automated central impression presses, while highly efficient, require significant capital investment, leading some businesses to delay technology upgrades. In addition, flexographic printing still relies heavily on skilled labor for plate handling, color management, and job setup areas where operator experience directly impacts output quality

- The complexity of achieving color consistency, maintaining press calibration, and managing substrate variations can present hurdles for new adopters, especially where training and technical support resources are limited

- Although advancements in automation and AI-driven press systems are reducing manual intervention, the learning curve associated with transitioning from traditional to modern flexographic systems remains a concern

- Overcoming these barriers through modular equipment offerings, cloud-based press monitoring tools, and workforce training initiatives will be key to unlocking the full potential of flexographic printing across global markets

Flexographic Printing Market Scope

The market is segmented on the basis of offering, component, type, method, form, automation type, and application.

- By Offering

On the basis of offering, the flexographic printing market is segmented into flexographic printing machines and flexographic printing inks. The flexographic printing machines segment dominated the market with the largest market revenue share in 2024, driven by the rising demand for high-speed, versatile equipment across diverse packaging applications. Flexographic machines are widely adopted due to their adaptability to a variety of substrates such as paper, film, and foil, making them ideal for both short and long production runs. The segment continues to grow as packaging converters prioritize efficiency, quality, and automation in their printing processes.

The flexographic printing inks segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing environmental regulations and the shift toward sustainable, low-VOC ink solutions. The growing adoption of water-based and UV-curable inks, particularly in food and beverage packaging, is further accelerating market expansion, as companies focus on eco-friendly formulations without compromising print quality.

- By Component

On the basis of component, the flexographic printing market is segmented into hardware, software, and services. The hardware segment held the largest market revenue share in 2024, driven by consistent demand for press units, anilox rolls, drying systems, and plate mounting tools that form the core of flexographic printing setups. Packaging manufacturers increasingly invest in advanced hardware to improve print accuracy, reduce downtime, and enhance overall operational output.

The software segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the need for streamlined workflows, color management, and digital prepress integration. Software solutions that support automation, predictive maintenance, and cloud-based operations are gaining popularity as converters aim to reduce waste and optimize press utilization in highly competitive markets.

- By Type

On the basis of type, the flexographic printing market is segmented into water-based inks, solvent-based inks, and energy-curable inks. The water-based inks segment dominated the market with the largest market revenue share in 2024, driven by its favorable environmental profile and regulatory acceptance in food-safe packaging. Water-based inks are widely used across corrugated packaging and paper-based applications due to their low VOC emissions and high print quality.

The energy-curable inks segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by their fast curing times, reduced environmental impact, and high durability. UV and EB-curable inks are particularly gaining traction in label and flexible packaging applications where vibrant colors and chemical resistance are essential.

- By Method

On the basis of method, the flexographic printing market is segmented into inline type press, central impression press, and stack type press. The central impression press segment dominated the market with the largest market revenue share in 2024, driven by its excellent color registration and suitability for printing on flexible substrates such as films and foils. These presses are widely used in high-volume flexible packaging production due to their stability and print consistency.

The inline type press segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for modular, customizable printing solutions. Inline presses offer integrated functionalities such as lamination, die-cutting, and slitting, making them ideal for short-run, multi-functional label and packaging jobs.

- By Form

On the basis of form, the flexographic printing market is segmented into narrow web, medium web, and wide web. The wide web segment dominated the market with the largest market revenue share in 2024, driven by its extensive use in printing large-format flexible packaging and shrink sleeves for food, beverage, and household product sectors. Wide web presses offer high productivity, making them suitable for long-run applications.

The narrow web segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the growing demand for custom labels, barcodes, and packaging tags. Narrow web printing offers high resolution and rapid changeovers, making it an ideal solution for label converters serving the pharmaceutical, cosmetics, and logistics industries.

- By Automation Type

On the basis of automation type, the flexographic printing market is segmented into automatic and semi-automatic. The automatic segment dominated the market with the largest market revenue share in 2024, driven by the need for speed, precision, and waste reduction in large-scale packaging operations. Automatic presses are increasingly adopted due to their ability to perform real-time adjustments, auto-registration, and smart diagnostics, improving overall efficiency.

The semi-automatic segment is anticipated to witness moderate growth from 2025 to 2032, supported by small and medium-sized converters seeking affordable solutions. Semi-automatic machines offer a cost-effective balance between manual control and automation, appealing to businesses in developing economies or with limited capital investment.

- By Application

On the basis of application, the flexographic printing market is segmented into corrugated packaging, flexible packaging, labels & tags, cartons, and others. The flexible packaging segment dominated the market with the largest market revenue share of 48.1% in 2024, driven by rising demand for lightweight, durable, and visually appealing packaging in food, beverage, and personal care sectors. Flexographic printing allows for vibrant and quick-turnaround print jobs on flexible films and laminates, making it a preferred choice.

The labels & tags segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing need for high-resolution branding and product identification. The expansion of e-commerce and consumer preference for attractive, functional packaging is boosting the demand for flexographically printed labels across various industries.

Flexographic Printing Market Regional Analysis

- North America dominated the flexographic printing market with the largest revenue share of 38.9% in 2024, driven by strong demand from the region’s robust packaging industry, technological innovation, and increasing investment in sustainable printing solutions, with the U.S. leading in adoption of advanced flexographic presses and eco-friendly inks

- Printers and converters in the region prioritize high-speed production, cost-efficiency, and eco-friendly practices, leading to widespread adoption of flexographic printing across sectors such as food, beverage, pharmaceuticals, and personal care

- This regional growth is further supported by strong R&D investments, regulatory support for low-VOC inks, and an established base of skilled printing professionals, positioning flexography as the preferred method for high-quality and sustainable packaging production in North America

U.S. Flexographic Printing Market Insight

The U.S. flexographic printing market captured the largest revenue share of 79% in 2024 within North America, fueled by its mature packaging industry and rapid adoption of advanced print technologies. High demand for sustainable packaging and short-run, high-speed print jobs is encouraging investment in modern flexographic presses. The growing preference for water-based and UV-curable inks, along with automation and digital workflow integration, further supports market expansion. In addition, robust activity in the food, beverage, and pharmaceutical packaging sectors is driving consistent demand for flexographic solutions.

Europe Flexographic Printing Market Insight

The Europe flexographic printing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by regulatory mandates promoting sustainable packaging and the adoption of low-VOC inks. Rising environmental consciousness and a shift toward recyclable substrates are influencing printing preferences. Europe’s strong presence in label and flexible packaging production, coupled with ongoing innovation in press technology and ink formulations, is fostering steady market growth across industries such as retail, healthcare, and FMCG.

U.K. Flexographic Printing Market Insight

The U.K. flexographic printing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing need for efficient, high-resolution packaging and label solutions. The rise in e-commerce and private label brands is fueling demand for flexible, cost-effective print methods. In addition, government sustainability goals and the push for eco-conscious manufacturing practices are encouraging printers to adopt energy-efficient flexographic technologies and environmentally friendly inks, contributing to the market’s upward trajectory.

Germany Flexographic Printing Market Insight

The Germany flexographic printing market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s technological leadership and emphasis on precision engineering. Germany’s packaging and label sectors are at the forefront of adopting automated flexographic presses and sustainable ink systems. Strong demand from consumer goods and industrial packaging, along with well-established infrastructure and R&D investments, is bolstering the market. The focus on recyclable and biodegradable materials aligns with growing demand for eco-friendly print solutions.

Asia-Pacific Flexographic Printing Market Insight

The Asia-Pacific flexographic printing market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rapid industrialization, rising consumer demand, and expansion in flexible packaging. Countries such as China, India, and Japan are witnessing increasing investment in modern print infrastructure. Supportive government policies, a strong manufacturing base, and the growing use of e-commerce packaging are propelling market adoption. APAC’s competitive production costs and emphasis on innovation are positioning it as a key growth region.

Japan Flexographic Printing Market Insight

The Japan flexographic printing market is gaining momentum due to its highly advanced manufacturing sector and commitment to environmental responsibility. Japanese converters are increasingly transitioning to flexographic systems for printing on sustainable substrates, particularly in food and retail packaging. Integration of automation, quality control, and color management systems is enhancing efficiency. With consumer preferences shifting toward minimalistic and eco-conscious packaging, the market is expected to see consistent growth across both traditional and digital-flexo hybrid platforms.

India Flexographic Printing Market Insight

The India flexographic printing market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s booming packaging sector, population growth, and rising middle-class consumption. India's flexographic industry is expanding rapidly across flexible packaging, corrugated boxes, and label printing. Affordable ink solutions, domestic press manufacturers, and strong demand from FMCG and e-commerce sectors are fueling adoption. In addition, government initiatives promoting “Make in India” and green packaging are further accelerating the flexographic printing market’s growth.

Flexographic Printing Market Share

The flexographic printing industry is primarily led by well-established companies, including:

- Bobst (Switzerland)

- Mark Andy Inc. (U.S.)

- Windmöller & Hölscher (Germany)

- Heidelberger Druckmaschinen AG (Germany)

- MPS Systems B.V. (Netherlands)

- Nilpeter A/S (U.S.)

- Amcor Plc (Australia)

- Aim Machinetechnik Pvt. Ltd (India)

- Rotatek (Germany)

- Koenig & Bauer AG (Germany)

- Comexi (Spain)

- Uteco (Italy)

- Codimag (France)

- Gaullus (Switzerland)

- Tresu Group (Denmark)

- Komori Corporation (Japan)

- Nuova Gidue (Italy)

- Omet Group (Italy)

- Flint Group (Luxembourg)

- Allstein GmbH (Germany)

- Soma Engineering (Czech Republic)

What are the Recent Developments in Global Flexographic Printing Market?

- In July 2025, the Flexo Synergy 2025 event in Chandigarh, India, brought together industry leaders including Acme Rolltech, Alliance Printech, Miraclon, and Tesa to promote innovation through collaboration. Key highlights included advancements in video plate mounting, pure dot plate technology, and robotic anilox engraving. The event emphasized ecosystem integration and standardization to drive quality and operational efficiency in flexographic printing

- In May 2024, Uteco unveiled the OnyxOmnia flexo-digital press at drupa 2024, combining high-speed flexographic printing (up to 400 m/min) with integrated digital capabilities. The press features advanced energy-saving systems, rapid job changeovers, and reduced waste, enabling converters to efficiently handle both short and long runs. This launch highlights Uteco’s focus on hybrid solutions that enhance flexibility, sustainability, and productivity in packaging printing

- In May 2024, Soma introduced the Optima 10-color CI flexo press and the Proxima short-run press at drupa 2024. The Optima² delivers speeds of up to 600 m/min for high-volume jobs, while the Proxima offers 400 m/min performance with enhanced automation for shorter runs. Both presses feature ergonomic design, energy efficiency, and quick-change technology, reflecting Soma’s commitment to meeting diverse converter needs with advanced flexographic equipment

- In May 2024, Windmöller & Hölscher (W&H) showcased its new AlphaFlex CI flexo press at drupa 2024, offering 8-color printing at speeds up to 400 m/min with improved ergonomics and reduced energy consumption. The company also previewed a forthcoming hybrid flexo/digital concept press slated for 2026. These developments underline W&H’s strategy of blending operational efficiency with cutting-edge print technology for flexible packaging

- In April 2024, XSYS debuted the nyloflex FTV LED-optimized flat-top dot plate and the nyloflex XAH thermal plate at InfoFlex 2024. Both products are designed for enhanced durability, faster processing, and superior print quality for tag and label applications, supporting converters in achieving efficient, high-quality production with reduced environmental impact.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.