Global Flight Management Systems Fms And Stable Market

Market Size in USD Billion

CAGR :

%

USD

3.85 Billion

USD

7.07 Billion

2024

2032

USD

3.85 Billion

USD

7.07 Billion

2024

2032

| 2025 –2032 | |

| USD 3.85 Billion | |

| USD 7.07 Billion | |

|

|

|

|

What is the Global Flight Management Systems (FMS) and Stable Market Size and Growth Rate?

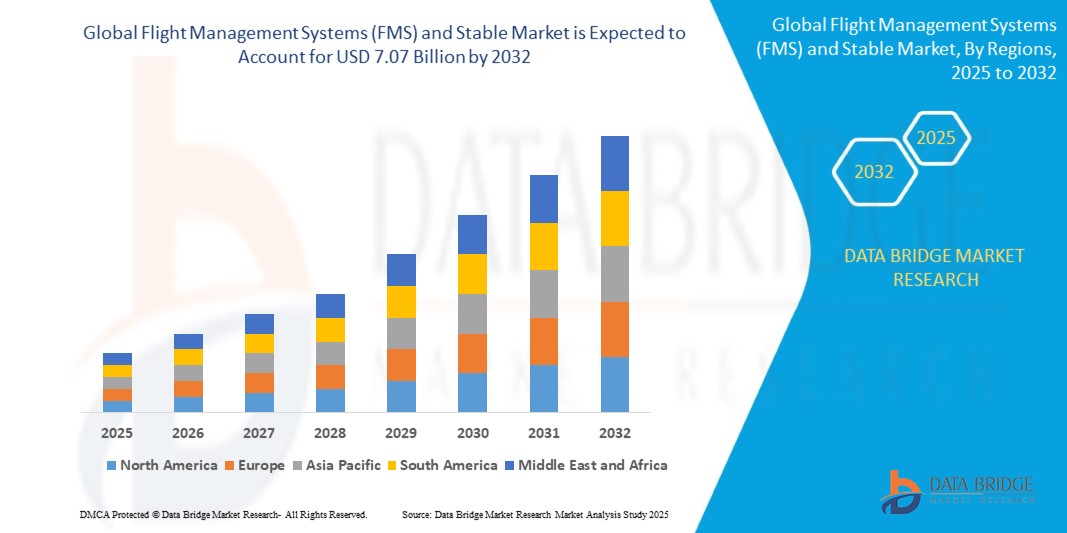

- The global flight management systems (FMS) and stable market size was valued at USD 3.85 billion in 2024 and is expected to reach USD 7.07 billion by 2032, at a CAGR of 7.90% during the forecast period

- Increasing development of glass cockpits resulting in better operational efficiency, rising Demand for next generation flight management system (NG-FMS) and advanced required navigation performance (RNP), increasing growth of the airline industry across the globe, rising fleet orders globally, improved fuel efficiency and flight security along with the reduction in pilot workload, increase in the demand for next-generation aircraft features are some of the major as well as vital factors which will such asly to augment the growth of the flight management systems (FMS) and stable market

What are the Major Takeaways of Flight Management Systems (FMS) and Stable Market?

- One of the key factors driving this growth is the rising demand for advanced required navigation performance (RNP) capabilities, which enable aircraft to fly more precise and optimized routes, reducing fuel consumption and emissions. RNP also allows aircraft to access challenging airports and airspace, improving connectivity and reliability

- FMS are essential for implementing RNP, as they integrate various sensors and data sources to provide accurate navigation guidance and flight planning. FMS also offer other benefits, such as automation, situational awareness, and performance optimization. Therefore, the demand for FMS is expected to increase across various segments of the aviation industry, such as commercial, military, and business aviation

- North America dominated the flight management systems (FMS) market with the largest revenue share of 41.3% in 2024, driven by strong aviation infrastructure, continuous fleet modernization, and the presence of major OEMs and avionics suppliers in the region

- Asia-Pacific (APAC) flight management systems (FMS) market is projected to expand at the fastest CAGR of 13.6% from 2025 to 2032, driven by booming aviation sectors in China, India, and Southeast Asia

- The Line Fit segment dominated the market with the largest revenue share of 58.6% in 2024, owing to the integration of FMS during the aircraft manufacturing stage, which ensures seamless compatibility and reduces post-delivery modification costs

Report Scope and Flight Management Systems (FMS) and Stable Market Segmentation

|

Attributes |

Flight Management Systems (FMS) and Stable Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Flight Management Systems (FMS) and Stable Market?

“Integration of Artificial Intelligence and Predictive Analytics in Flight Operations”

- A key emerging trend in the global flight management systems (FMS) market is the increasing integration of artificial intelligence (AI) and predictive analytics to optimize flight operations, reduce fuel consumption, and enhance safety. This innovation is transforming traditional FMS solutions into intelligent, adaptive systems capable of real-time decision-making

- For instance, in 2024, Honeywell Aerospace introduced an AI-powered FMS enhancement that uses real-time weather, traffic, and airspace data to compute optimal flight paths, reducing delays and improving fuel efficiency

- AI enables advanced features such as predictive maintenance alerts, route optimization based on dynamic conditions, and performance-based navigation, helping airlines lower operational costs and improve fleet utilization

- The incorporation of machine learning also allows FMS systems to learn from past flight data, enhancing the accuracy of fuel burn forecasts and time estimations

- Companies such as GE Aviation and Thales Group are leading this trend by investing in intelligent avionics suites that combine AI with cloud connectivity and data analytics

- This shift toward smarter and more autonomous flight management systems is poised to redefine cockpit operations and improve decision-making for pilots, ultimately enhancing overall flight safety and operational performance

What are the Key Drivers of Flight Management Systems (FMS) and Stable Market?

- The growing demand for fuel-efficient flight operations, rising air traffic, and increasing adoption of modern aircraft are major drivers propelling the flight management systems (FMS) market

- For instance, in April 2024, Collins Aerospace launched an upgraded FMS that reduces fuel burn by up to 5% through real-time trajectory optimization meeting airline goals for sustainability and cost-efficiency

- The increasing implementation of NextGen and SESAR air traffic management programs globally is encouraging airlines and aircraft OEMs to adopt advanced FMS solutions to comply with evolving airspace navigation standards

- Furthermore, the rise in commercial aviation in Asia-Pacific and the Middle East is increasing demand for technologically advanced avionics systems to support navigation, flight planning, and performance management

- The trend of fleet modernization by airlines to replace aging aircraft with new-generation models equipped with cutting-edge flight management systems systems is also supporting sustained market expansion

- In addition, growing interest in connected aircraft ecosystems, where flight management systems interacts with EFBs (Electronic Flight Bags), weather tools, and ground operations systems, is creating new opportunities for integrated flight management solutions

Which Factor is challenging the Growth of the Flight Management Systems (FMS) and Stable Market?

- One of the major challenges facing the flight management systems market is the high cost of system upgrades and integration with legacy avionics in older aircraft fleets

- For instance, retrofitting older narrow-body aircraft with next-gen FMS solutions can require significant downtime and investment, discouraging some airlines from pursuing full upgrades

- The complexity of certification and regulatory compliance across different jurisdictions further adds to deployment timelines, especially when incorporating advanced AI or data connectivity features

- Moreover, cybersecurity vulnerabilities in connected flight management systems platforms pose risks of data breaches and system manipulation, raising concerns about flight safety and aircraft data integrity

- Smaller regional carriers or low-cost airlines may also hesitate to invest due to limited budgets and uncertain ROI, particularly in post-pandemic market conditions

- Overcoming these barriers will require cost-effective retrofit solutions, robust cybersecurity frameworks, and modular flight management systems components that can adapt to varying aircraft platforms and regulatory environments

How is the Flight Management Systems (FMS) and Stable Market Segmented?

The market is segmented on the basis of fit, aircraft type, and hardware.

• By Fit

On the basis of fit, the flight management systems (FMS) and stable market is segmented into Line Fit and Retrofit. The Line Fit segment dominated the market with the largest revenue share of 58.6% in 2024, owing to the integration of FMS during the aircraft manufacturing stage, which ensures seamless compatibility and reduces post-delivery modification costs. OEMs increasingly offer pre-installed, advanced FMS solutions that comply with modern air navigation and performance-based operations.

The Retrofit segment is projected to witness the fastest growth rate of 20.4% from 2025 to 2032, driven by the rising trend of modernizing aging aircraft fleets with updated avionics to meet evolving air traffic regulations and improve operational efficiency. Airlines are investing in upgrading legacy systems to enhance fuel efficiency, route optimization, and overall flight performance.

• By Aircraft Type

On the basis of aircraft type, the market is segmented into Narrow Body Aircraft, Wide Body Aircraft, Very Large Aircraft, and Regional Transport Aircraft. The Narrow Body Aircraft segment accounted for the largest market revenue share of 46.9% in 2024, driven by the high production and deployment of single-aisle aircraft in short- to medium-haul routes globally. Aircraft such as the Airbus A320neo and Boeing 737 MAX are commonly equipped with advanced FMS solutions to support fuel-efficient and performance-based operations.

The Regional Transport Aircraft segment is expected to witness the fastest CAGR from 2025 to 2032, supported by increasing demand for regional connectivity, especially in emerging economies, and fleet expansion by regional carriers. The segment benefits from the integration of compact, cost-efficient FMS units that suit the operational needs of short-haul routes.

• By Hardware

On the basis of hardware, the market is segmented into Visual Display Unit (VDU), Control Display Unit (CDU), and Flight Management Computers (FMC). The Flight Management Computers (FMC) segment held the largest revenue share of 49.3% in 2024, owing to its critical role in performing navigation, performance, and guidance functions. FMCs form the computational core of the FMS and are indispensable in route planning and optimization tasks.

The Control Display Unit (CDU) segment is anticipated to grow at the fastest rate during the forecast period, driven by technological advancements in touchscreen interfaces and compact displays. As pilots increasingly demand intuitive, ergonomic interfaces, modern CDU designs are being adopted for both retrofit and new aircraft programs.

Which Region Holds the Largest Share of the Flight Management Systems (FMS) and Stable Maret?

- North America dominated the flight management systems (FMS) market with the largest revenue share of 41.3% in 2024, driven by strong aviation infrastructure, continuous fleet modernization, and the presence of major OEMs and avionics suppliers in the region

- The region’s early adoption of NextGen air traffic management systems and a high focus on performance-based navigation have made FMS a standard component in both commercial and military aircraft

- In addition, robust government investments in defense aviation, alongside rising demand for advanced avionics in business jets, support North America's leading position in the global FMS market

U.S. Flight Management Systems (FMS) Market Insight

U.S. dominated North America's FMS market revenue in 2024, fueled by a combination of FAA-led modernization programs, increased commercial air travel, and defense spending. Leading aircraft manufacturers and avionics developers based in the U.S., including Boeing and Collins Aerospace, are investing heavily in the development of advanced FMS technology. The growing adoption of autonomous flight systems and satellite-based navigation further accelerates FMS integration in both new and retrofitted aircraft.

Europe Flight Management Systems (FMS) Market Insight

Europe is expected to witness steady growth in the FMS market, supported by mandates from the European Union Aviation Safety Agency (EASA) for flight efficiency and reduced emissions. Key regional airlines are upgrading their fleets with FMS-compatible avionics to comply with SESAR (Single European Sky ATM Research) initiatives. The region’s push for greener aviation, combined with demand for next-gen navigation and route optimization, is boosting FMS deployment in both commercial and regional aircraft.

U.K. Flight Management Systems (FMS) Market Insight

The U.K. market is projected to grow at a healthy CAGR, supported by ongoing investment in modernizing military fleets and the expansion of low-cost carriers. FMS demand is also being driven by the country’s robust aerospace sector, R&D capabilities, and its involvement in multinational defense aviation programs. Increasing emphasis on digital cockpit environments further contributes to growth.

Germany Flight Management Systems (FMS) Market Insight

Germany is emerging as a significant contributor in the European FMS market, driven by a combination of commercial aircraft manufacturing, MRO services, and defense modernization programs. German carriers are focusing on efficiency and sustainability, integrating FMS systems to reduce fuel consumption and streamline airspace navigation. The presence of major aerospace firms such as Lufthansa Technik and Airbus reinforces the market’s growth potential.

Which Region is the Fastest Growing Region in the Flight Management Systems (FMS) Market?

Asia-Pacific (APAC) flight management systems (FMS) market is projected to expand at the fastest CAGR of 13.6% from 2025 to 2032, driven by booming aviation sectors in China, India, and Southeast Asia. Rising air passenger traffic, airport infrastructure expansion, and increasing airline investments in fleet digitalization are accelerating FMS adoption across both commercial and regional fleets. In addition, governments in the region are implementing new air traffic modernization programs and adopting performance-based navigation (PBN) to optimize airspace use.

China Flight Management Systems (FMS) Market Insight

China captured the largest share of the APAC market in 2024, supported by aggressive fleet expansion, the rise of indigenous aircraft such as COMAC’s C919, and growing demand for smart aviation systems. As China aims to reduce dependency on Western avionics, it is also witnessing a surge in domestic FMS development and integration across commercial and military aircraft.

Japan Flight Management Systems (FMS) Market Insight

Japan is focusing on upgrading its aging commercial and defense aircraft, driving FMS market growth. With a strong tradition in aerospace R&D and precision engineering, Japan is investing in advanced avionics systems and automation. The country's emphasis on safety, precision navigation, and sustainable flight operations supports continued FMS adoption across various aircraft categories.

Which are the Top Companies in Flight Management Systems (FMS) and Stable Market?

The flight management systems (FMS) and stable industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- THALES (France)

- General Electric (U.S.)

- Collins Aerospace (U.S.)

- Transdigm Group, Inc. (U.S.)

- Garmin Ltd. (U.S.)

- Universal Avionics Systems Corporation (U.S.)

- Jeppesen (U.S.)

- NAVTECH INC. (U.S.)

- Lufthansa Systems (Germany)

- Leonardo S.p.A. (Italy)

- Black Swift Technologies, LLC (U.S.)

- Latitude Technologies Corporation (Canada)

- Archangel Systems, Inc. (U.S.)

- Innovative Solutions & Support (U.S.)

- RMCI - Smarter Solutions for Rotorcraft (U.S.)

- Smiths Group (U.K.)

- ITHAKA (U.S.)

- Airbus S.A.S. (France)

What are the Recent Developments in Global Flight Management Systems (FMS) and Stable Market?

- In July 2023, Safran announced its decision to acquire Collins Aerospace’s advanced actuation and flight control operations, which are essential for both commercial and military aircraft applications. With approximately 3,700 employees across eight facilities in Europe and Asia, this acquisition aims to strengthen Safran’s integration of flight control components with flight management systems, enhancing aircraft safety and efficiency. This move significantly boosts Safran’s global footprint and its FMS capabilities across varied aviation platforms

- In June 2023, Honeywell revealed the development of a next-generation Flight Management System (FMS) tailored for Boeing’s 777X aircraft, the largest twin-engine commercial jet. The system is designed to enhance operational performance, flight planning, and navigation accuracy. This development is expected to support the 777X’s commercial service entry by 2025, reinforcing Honeywell’s leadership in avionics systems

- In May 2022, Thales was selected by Airbus to provide its commercial aircraft with an advanced flight management system, based on the PureFlyt platform. This newly customized FMS will be integrated into Airbus models such as the A320, A330, and A350, with full operational deployment expected by the end of 2026. This strategic partnership between Thales and Airbus strengthens the evolution of next-gen cockpit solutions in commercial aviation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flight Management Systems Fms And Stable Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flight Management Systems Fms And Stable Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flight Management Systems Fms And Stable Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.