Global Focal Segmental Glomerulosclerosis Market

Market Size in USD Billion

CAGR :

%

USD

26.14 Billion

USD

51.72 Billion

2024

2032

USD

26.14 Billion

USD

51.72 Billion

2024

2032

| 2025 –2032 | |

| USD 26.14 Billion | |

| USD 51.72 Billion | |

|

|

|

|

Focal Segmental Glomerulosclerosis Market Size

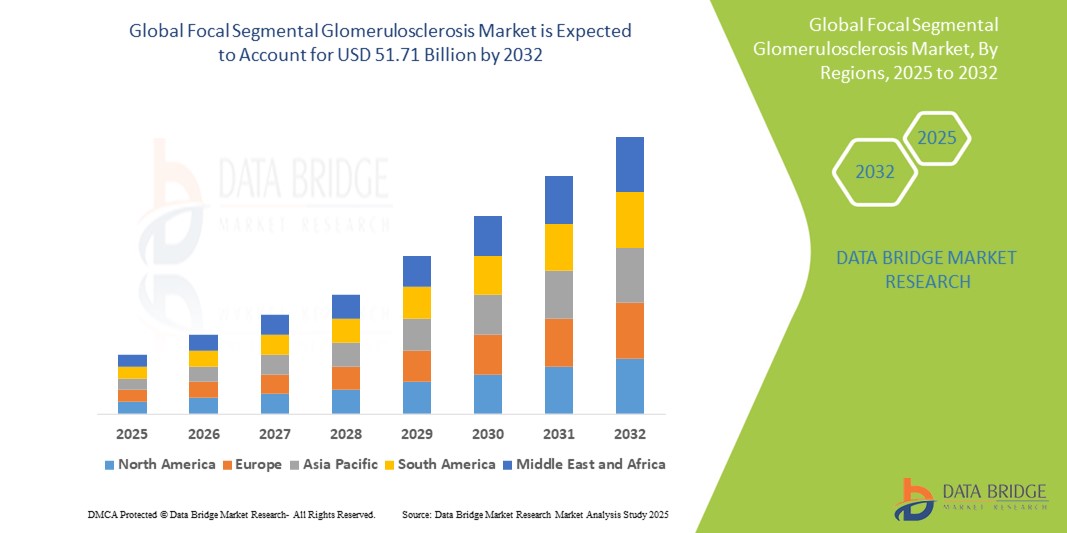

- The global focal segmental glomerulosclerosis market size was valued at USD 26.14 billion in 2024 and is expected to reach USD 51.71 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is primarily driven by the rising prevalence of kidney disorders globally, increasing awareness regarding early diagnosis, and the introduction of innovative therapeutic approaches such as targeted biologics and gene therapies

- In addition, strong investments in nephrology research and development, along with improved access to healthcare facilities and advancements in biomarker identification, are further supporting market expansion. These key drivers are collectively enhancing patient outcomes and fueling significant growth in the FSGS treatment landscape

Focal Segmental Glomerulosclerosis Market Analysis

- Focal Segmental Glomerulosclerosis (FSGS), a severe form of nephrotic syndrome marked by scarring in the kidney’s filtering units, is driving significant focus in the global nephrology therapeutics space due to its progressive nature and potential to cause end-stage renal disease

- The growing prevalence of primary and secondary FSGS, increasing awareness about chronic kidney conditions, and the surge in clinical trials exploring novel treatment modalities, including biologics and immunosuppressants, are key factors fueling market growth

- North America dominated the focal segmental glomerulosclerosis market with the largest revenue share of 47.4% in 2024, driven by the presence of advanced healthcare infrastructure, robust research funding, and rising incidence of kidney diseases, particularly in the U.S. where early diagnosis and access to innovative therapies are accelerating treatment adoption

- Asia-Pacific is expected to witness the fastest growth during the forecast period due to improving healthcare access, growing awareness of nephrology disorders, and increased government initiatives to combat chronic kidney diseases

- Primary segment dominated the focal segmental glomerulosclerosis market with a market share of 70.5% in 2024, driven by its higher prevalence and the urgent need for early and targeted therapeutic interventions due to its progressive nature

Report Scope and Focal Segmental Glomerulosclerosis Market Segmentation

|

Attributes |

Focal Segmental Glomerulosclerosis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Focal Segmental Glomerulosclerosis Market Trends

“Advancements in Targeted Biologics and Precision Medicine”

- A significant and accelerating trend in the global focal segmental glomerulosclerosis (FSGS) market is the growing focus on targeted biologic therapies and precision medicine approaches, aiming to deliver individualized treatment based on specific genetic and immune profiles of patients

- For instance, sparsentan, a dual endothelin and angiotensin receptor antagonist, is emerging as a promising therapy for FSGS by addressing key mechanisms of proteinuria. Similarly, biologics such as rituximab are gaining clinical traction due to their ability to target B-cell mediated immune responses, offering new hope for patients resistant to traditional treatments

- These novel therapies reflect a broader shift toward disease-specific management in rare kidney disorders, driven by advances in molecular diagnostics, biomarker identification, and genetic testing. By differentiating primary from secondary FSGS, clinicians can better tailor treatments, enhancing patient outcomes and reducing the such aslihood of progression to end-stage renal disease

- Furthermore, the increased funding for orphan disease research and regulatory support from agencies such as the FDA and EMA is fostering innovation and speeding up the development of advanced biologics. Companies such as Travere Therapeutics are actively investing in R&D to bring next-generation FSGS treatments to market

- The integration of these biologic therapies with real-time diagnostic insights is fundamentally transforming the treatment landscape of FSGS, enabling a shift from generalized immunosuppression to precision-targeted care

- The demand for such targeted and effective therapies is rising across both developed and emerging regions, particularly where specialized nephrology care and advanced diagnostic infrastructure are expanding to meet the unmet needs of patients with rare glomerular diseases

Focal Segmental Glomerulosclerosis Market Dynamics

Driver

“Rising Prevalence of Chronic Kidney Disease and Advances in Diagnostic Technologies”

- The growing global burden of chronic kidney disease (CKD), particularly among aging populations and individuals with hypertension and diabetes, is significantly contributing to the increasing incidence of FSGS, thereby driving market demand.

- For instance, according to global health data, FSGS accounts for a substantial percentage of nephrotic syndrome cases in both adults and children, highlighting the urgent need for early diagnosis and intervention. The integration of advanced diagnostic tools such as kidney biopsy techniques, immunohistochemistry, and genetic screening is facilitating better differentiation of FSGS subtypes and enabling targeted therapy planning.

- The availability of renal biomarkers and next-generation sequencing technologies has improved the ability of clinicians to detect FSGS at earlier stages and to distinguish between primary and secondary forms, which is essential for guiding effective treatment strategies.

- Furthermore, supportive government policies, orphan drug designations, and rising investment from public and private sectors in rare kidney disease research are fostering market expansion. Patient advocacy groups are also playing a crucial role in enhancing awareness and access to FSGS diagnostics and treatment worldwide

- These converging factors are strengthening the clinical and commercial viability of the FSGS market, enabling more timely interventions and boosting the adoption of advanced treatment solutions

Restraint/Challenge

“Limited Therapeutic Options and High Cost of Advanced Treatments”

- A major challenge facing the focal segmental glomerulosclerosis market is the limited availability of disease-specific treatment options, with existing therapies often centered on symptom control rather than disease modification

- For instance, standard therapies such as corticosteroids and calcineurin inhibitors are associated with significant side effects and are not universally effective, especially in cases of steroid-resistant FSGS. In addition, post-transplant recurrence of FSGS remains a critical issue, often requiring intensive and costly management

- The development of biologic therapies and precision medicine approaches, while promising, comes with high research, development, and commercialization costs, making them less accessible in low- and middle-income regions. Advanced treatments such as rituximab or sparsentan often require specialized administration and monitoring, further increasing the overall treatment burden

- Reimbursement challenges, lack of physician awareness regarding emerging therapies, and insufficient diagnostic infrastructure in certain regions hinder early detection and optimal treatment of FSGS

- To overcome these challenges, it is essential to invest in affordable biologics, enhance global diagnostic capacity, and promote educational initiatives among healthcare providers. In addition, improving healthcare reimbursement models and expanding patient support programs will be crucial for increasing treatment accessibility and driving long-term market growth

Focal Segmental Glomerulosclerosis Market Scope

The market is segmented on the basis of type, treatment, route of administration, end-users, and distribution

- By Type

On the basis of type, the focal segmental glomerulosclerosis market is segmented into primary and secondary. The primary segment dominated the market with the largest market revenue share of 70.5% in 2024, driven by its higher prevalence and the growing recognition of idiopathic FSGS as a leading cause of nephrotic syndrome in both children and adults. This segment benefits from increased clinical attention and demand for specialized treatment strategies, including immunosuppressants and emerging biologic therapies.

The secondary segment is expected to witness a steady growth rate over the forecast period, attributed to the increasing incidence of contributing conditions such as obesity, hypertension, and infections such as HIV. The growing use of advanced diagnostic tools to differentiate secondary from primary forms is also enhancing treatment specificity and driving segment growth.

- By Treatment

On the basis of treatment, the focal segmental glomerulosclerosis market is segmented into drug therapy, dialysis, kidney transplant, and others. The drug therapy segment held the largest market share in 2024, owing to the widespread use of corticosteroids, calcineurin inhibitors, and newer biologic agents in the first-line management of FSGS. Advances in immunomodulatory treatments and pipeline drugs such as sparsentan are enhancing the efficacy of drug therapy and improving patient outcomes.

The kidney transplant segment is projected to grow significantly over the forecast period due to its role as a definitive treatment for patients progressing to end-stage renal disease. However, recurrence of FSGS post-transplant remains a clinical challenge.

- By Route Of Administration

On the basis of route of administration, the focal segmental glomerulosclerosis market is segmented into oral and parenteral. The oral segment dominated the market in 2024, driven by the high use of corticosteroids and other oral immunosuppressants as frontline therapy. Oral treatments are preferred for their ease of use, patient compliance, and cost-effectiveness.

The parenteral segment is expected to grow steadily during forecast period, due to increasing use of intravenous biologics and monoclonal antibodies in patients with steroid-resistant or relapsing forms of FSGS. Biologics such as rituximab require hospital-based administration but offer targeted action, which supports their growing adoption in complex FSGS cases.

- By End User

On the basis of end-users, the focal segmental glomerulosclerosis market is segmented into hospitals, homecare, specialty clinics, and others. The hospital segment dominated the market with the largest revenue share in 2024, supported by the availability of specialized nephrology care, diagnostic services, and access to advanced therapeutic interventions. Hospitals remain the primary setting for FSGS diagnosis, treatment initiation, and management of complications.

The specialty clinics segment is projected to witness the fastest growth during forecast period, fueled by the rise in nephrology-focused centers and outpatient services that cater to chronic kidney disease patients. These clinics provide continuous disease monitoring and personalized care for FSGS patients.

- By Distribution Channel

On the basis of distribution channel, the focal segmental glomerulosclerosis market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment accounted for the largest market share in 2024 due to the high volume of prescriptions dispensed within hospital settings for immunosuppressive drugs, dialysis-related supplies, and injectable biologics.

The online pharmacy segment is anticipated to grow at the fastest rate over the forecast period, driven by the increasing shift toward e-commerce for chronic disease medications and patient preference for home delivery. Improved digital infrastructure and e-prescription services are contributing to this trend.

Focal Segmental Glomerulosclerosis Market Regional Analysis

- North America dominated the focal segmental glomerulosclerosis market with the largest revenue share of 47.4% in 2024, driven by the presence of advanced healthcare infrastructure, robust research funding, and rising incidence of kidney diseases, particularly in the U.S. where early diagnosis and access to innovative therapies are accelerating treatment adoption

- Patients in the region benefit from access to cutting-edge treatments including biologics and personalized medicine, alongside strong support from healthcare reimbursement systems and rare disease research initiatives

- This regional dominance is further supported by increasing incidence of kidney-related disorders such as diabetes and hypertension, growing investment in rare kidney disease research, and the presence of key biopharmaceutical players actively developing targeted therapies for FSGS

U.S. Focal Segmental Glomerulosclerosis Market Insight

The U.S. focal segmental glomerulosclerosis market captured the largest revenue share of 85% in 2024 within North America, driven by advanced healthcare infrastructure, robust clinical research, and high disease awareness. The country’s proactive approach toward orphan and rare disease management, coupled with substantial investments in R&D, supports the adoption of novel therapies. In addition, the presence of major pharmaceutical companies and strong patient advocacy networks fosters faster diagnosis, clinical trials, and accessibility to emerging biologic treatments.

Europe Focal Segmental Glomerulosclerosis Market Insight

The Europe focal segmental glomerulosclerosis market is projected to witness steady CAGR growth during the forecast period, propelled by increasing prevalence of chronic kidney disease and improved access to specialty care. Government initiatives for rare diseases, expansion of nephrology services, and growing clinical collaborations for FSGS treatment contribute to market expansion. Moreover, advancements in biopsy techniques and pathology services are enabling more accurate diagnosis across EU nations, boosting early intervention.

U.K. Focal Segmental Glomerulosclerosis Market Insight

The U.K. focal segmental glomerulosclerosis market is anticipated to grow at a moderate CAGR, driven by a national focus on rare disease strategies, integrated care models, and NHS-funded treatment programs. Rising awareness among healthcare professionals and patients, along with access to investigational drugs through early access schemes, is enhancing the adoption of newer therapies. Supportive government policies and a strong clinical trial framework also reinforce the market’s growth prospects.

Germany Focal Segmental Glomerulosclerosis Market Insight

The Germany focal segmental glomerulosclerosis market is expected to expand steadily due to the country’s comprehensive healthcare infrastructure, high diagnostic accuracy, and significant R&D spending in nephrology. Germany’s focus on precision medicine and biologics for rare diseases ensures continued interest in FSGS therapeutics. Collaborations between academic centers and biotech firms are further stimulating innovation in FSGS drug development and clinical research.

Asia-Pacific Focal Segmental Glomerulosclerosis Market Insight

The Asia-Pacific focal segmental glomerulosclerosis market is poised to grow at the fastest CAGR during the forecast period, driven by rising CKD prevalence, increased healthcare investments, and expanding access to specialty nephrology services. Countries such as China and India are seeing growing awareness of rare renal conditions, supported by public health campaigns and private sector initiatives. In addition, expanding clinical research infrastructure and rising health insurance penetration are improving treatment accessibility in the region.

Japan Focal Segmental Glomerulosclerosis Market Insight

The Japan focal segmental glomerulosclerosis market is gaining traction due to its technologically advanced healthcare system and emphasis on early-stage renal disease management. Japan’s focus on personalized medicine and increasing use of biologics in nephrology contribute to its market growth. In addition, an aging population and high prevalence of diabetes and hypertension are creating sustained demand for targeted renal therapies, including those for FSGS

India Focal Segmental Glomerulosclerosis Market Insight

The India focal segmental glomerulosclerosis market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to improved diagnostic awareness, rapid healthcare expansion, and increasing focus on rare diseases. The growth is further supported by a large patient population, government-led rare disease initiatives, and the emergence of domestic pharmaceutical companies investing in nephrology-based R&D. Urban centers are seeing increased referrals and specialist access, contributing to rising treatment rates.

Focal Segmental Glomerulosclerosis Market Share

The focal segmental glomerulosclerosis industry is primarily led by well-established companies, including:

- Travere Therapeutics, Inc. (U.S.)

- Chinook Therapeutics, Inc. (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Bayer AG (Germany)

- GSK plc (U.K.)

- Sanofi (France)

- AbbVie Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- AstraZeneca (U.K.)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Lilly (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Amgen Inc. (U.S.)

- Reata Pharmaceuticals, Inc. (U.S.)

- Vertex Pharmaceuticals Incorporated (U.S.)

- CSL (Switzerland)

What are the Recent Developments in Global Focal Segmental Glomerulosclerosis Market?

- In March 2024, Chinook Therapeutics, Inc. announced promising clinical results from its ongoing Phase II AFFINITY trial for zigakibart (BION-1301), a novel anti-APRIL monoclonal antibody therapy developed for treating primary FSGS. The data indicated substantial reductions in proteinuria with favorable safety and tolerability, reinforcing zigakibart’s potential as a first-in-class targeted therapy. This development marks a significant stride in addressing the unmet clinical needs of FSGS patients through precision medicine

- In February 2024, Travere Therapeutics, Inc. submitted a supplemental New Drug Application (sNDA) to the U.S. FDA for sparsentan, an investigational dual endothelin angiotensin receptor antagonist (DEARA), for the treatment of FSGS. Sparsentan previously received accelerated approval for IgA nephropathy and has demonstrated encouraging efficacy in reducing proteinuria in FSGS patients. The filing signifies a key milestone for expanding the therapeutic landscape in rare kidney diseases

- In December 2023, Calliditas Therapeutics AB launched a collaborative study with academic institutions across Europe to evaluate Nefecon in patients with overlapping renal pathologies, including FSGS. The study is designed to understand the impact of targeted-release corticosteroid therapy on complex glomerular conditions. This research reflects the growing focus on adaptive treatment strategies tailored to diverse glomerulopathies

- In October 2023, Vertex Pharmaceuticals Incorporated initiated Phase I trials of a novel investigational compound from its renal pipeline, aimed at addressing APOL1-mediated kidney diseases including FSGS. The candidate, developed using Vertex’s precision targeting approach, represents a next-generation solution to tackle genetic drivers of FSGS, particularly prevalent in individuals of African descent. This signals increased industry momentum toward genotype-guided FSGS treatment

- In August 2023, Goldfinch Bio, Inc. announced the continuation of its GFB-887 clinical development, a TRPC5 ion channel inhibitor, in collaboration with nephrology networks across North America and Asia. Early-phase results demonstrated encouraging renal protective effects in patients with FSGS. The advancement of GFB-887 reinforces Goldfinch Bio’s commitment to mechanistic, biomarker-driven innovation in chronic kidney disorders such as FSGS

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.