Global Food Grade Alcohol Market

Market Size in USD Billion

CAGR :

%

USD

6.70 Billion

USD

15.00 Billion

2024

2032

USD

6.70 Billion

USD

15.00 Billion

2024

2032

| 2025 –2032 | |

| USD 6.70 Billion | |

| USD 15.00 Billion | |

|

|

|

|

Food Grade Alcohol Market Size

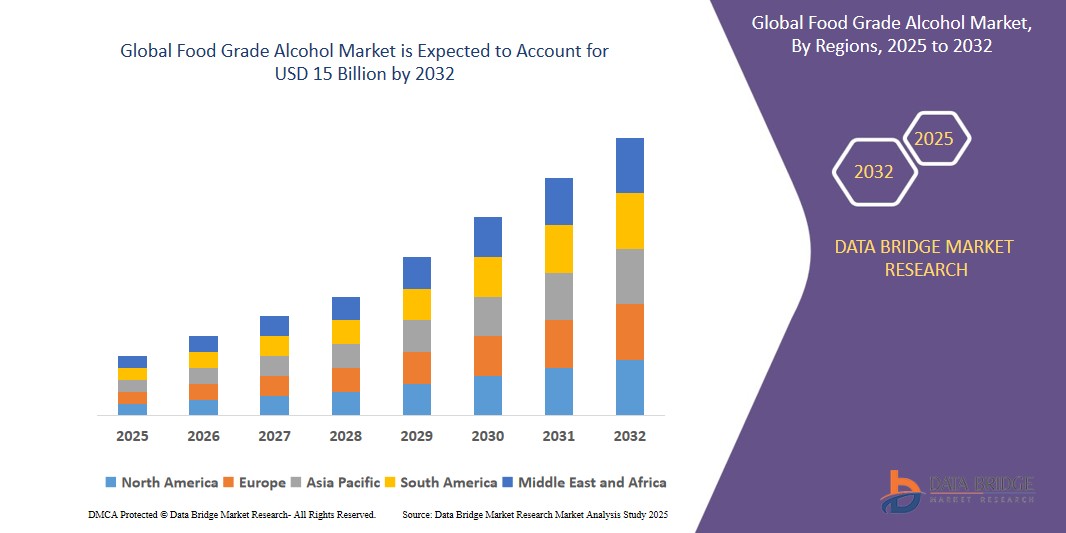

- The global Food Grade Alcohol market size was valued at USD 6.7 billion in 2024 and is expected to reach USD 15 billion by 2032, at a CAGR of 6.2% during the forecast period

- The market growth is largely fueled by rising demand for ethanol in food and beverages, increasing preference for natural and organic ingredients, strict regulatory standards, growing health-conscious consumer trends, and expanding applications in preservation, flavoring, and pharmaceutical industries globally.

- Furthermore, technological advancements in production processes, increased investments in sustainable and eco-friendly manufacturing, expanding food and beverage sectors in emerging markets, and rising awareness about food safety and quality are driving the continuous growth of the global food grade alcohol market.

Food Grade Alcohol Market Analysis

- The Food Grade Alcohol market is expanding due to increasing demand in the food and beverage industry for flavoring, preservation, and sanitization, supported by rising consumer preference for natural and organic ingredients and strict regulatory quality standards worldwide.

- Emerging markets Asia-Pacific are driving growth with rapid urbanization and higher disposable incomes, while technological advancements in production and sustainable manufacturing practices enhance supply efficiency, creating new opportunities for market players globally.

- North America dominates the Food Grade Alcohol market with the largest revenue share of 35% in 2025, characterized by advanced manufacturing technologies, strict regulatory frameworks, high consumer awareness for food safety, strong demand from the food and beverage industry, and significant investments in innovation.

- The Asia-Pacific (APAC) region is currently the fastest-growing market for food-grade alcohol, driven by rapid urbanization, rising disposable incomes, and increasing demand for alcoholic beverages and processed foods. Countries like China, India, and Japan are major consumers and producers, with China leading in market size.

- The ethanol segment is expected to dominate the Food Grade Alcohol market with a significant share of around 60% in 2025, driven by its extensive use in food preservation, flavoring, beverage production, and increasing demand for natural, safe, and versatile alcohol solutions.

Report Scope and Food Grade Alcohol Market Segmentation

|

Attributes |

Food Grade Alcohol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Grade Alcohol Market Trends

“Innovation drives specialty, low-calorie, and functional alcohol products”

- Innovation in the food-grade alcohol market focuses on creating specialty products with unique flavors and enhanced functional benefits to meet diverse consumer needs and preferences, driving product differentiation and opening new opportunities in health-conscious and premium beverage segments globally.

- Developers are formulating low-calorie alcohol options to cater to the growing demand for healthier lifestyles, helping consumers enjoy alcoholic beverages without compromising on calorie intake, which supports weight management and wellness trends in key markets.

- Functional alcohol products infused with vitamins, antioxidants, or botanicals are gaining popularity as consumers seek added health benefits from their drinks, encouraging manufacturers to invest in research and development to create value-added beverages.

- Innovation extends to sustainable production techniques that reduce environmental impact, improve ingredient sourcing, and ensure cleaner manufacturing processes, appealing to eco-conscious consumers and aligning with stricter industry regulations worldwide.

- Collaborations between technology firms and alcohol producers are accelerating innovation cycles, enabling rapid development of novel formulations, improved flavor profiles, and enhanced product safety, ultimately boosting competitiveness and market growth.

Food Grade Alcohol Market Dynamics

Driver

“Rising demand for natural, sustainable, and organic solutions”

- Consumers increasingly prefer food-grade alcohol derived from natural sources, avoiding synthetic additives to support health and wellness, driving producers to focus on organic certification and clean-label products that align with growing clean-eating lifestyles globally.

- Sustainability initiatives are pushing manufacturers to adopt eco-friendly production processes, such as renewable energy use and waste minimization, to reduce carbon footprints and meet regulatory and consumer expectations for environmentally responsible food-grade alcohol products.

- Organic food and beverage sectors are expanding rapidly, encouraging alcohol producers to source ingredients from certified organic farms, ensuring traceability and higher product quality, which appeals to environmentally conscious customers willing to pay premium prices.

- The rise in plant-based and vegan diets also fuels demand for organic and natural alcohol products that avoid animal-derived additives or processing aids, expanding market opportunities and encouraging innovation in ingredient sourcing and formulation.

- Increasing awareness of environmental impact motivates businesses to adopt circular economy models, incorporating biodegradable packaging and sustainable supply chains for food-grade alcohol, which helps improve brand image and consumer loyalty while complying with stricter environmental regulations.

Restraint/Challenge

“Environmental concerns demand costly sustainable manufacturing upgrades”

- Manufacturers are increasingly investing in eco-friendly production technologies to meet environmental standards. While necessary for sustainability, these investments significantly raise production costs, affecting profit margins and challenging smaller companies to compete effectively in the food-grade alcohol market.

- Strict environmental regulations mandate comprehensive upgrades in waste treatment and emission control systems. Compliance requires substantial financial resources and operational adjustments, placing additional burdens on manufacturers to maintain regulatory approval while balancing environmental responsibility with economic viability.

- Sourcing sustainable raw materials has become a major challenge due to limited availability and fluctuating prices. These supply chain issues can cause production delays and increased costs, forcing companies to seek alternative suppliers or innovate ingredient sourcing methods to meet market demand.

- The shift to biodegradable and eco-friendly packaging involves adopting new materials and manufacturing processes, which often come with higher expenses. This transition impacts overall production budgets but is critical for reducing environmental footprints and appealing to eco-conscious consumers.

- Balancing ambitious sustainability goals with the need to remain competitive in the market requires ongoing innovation and capital investment. Companies must continuously improve processes and products to meet environmental standards without sacrificing quality or pricing advantages.

Food Grade Alcohol Market Scope

The market is segmented on the basis of type, application, source and functionality.

- By Type

On the basis of type, the Food Grade Alcohol market is segmented into ethanol and polyols. The ethanol segment dominates the largest market revenue share of approximately 60% in 2025, driven by its widespread use in food preservation, beverages, flavoring, and growing demand for natural and safe alcohol solutions across various industries globally.

The ethanol segment is anticipated to witness the fastest growth rate of around 5.8% CAGR from 2025 to 2032, fueled by increasing demand in the food and beverage industry, expanding pharmaceutical applications, and rising preference for natural and sustainable ingredients worldwide.

- By Application

On the basis of application, the Food Grade Alcohol market is segmented in to food, beverages, healthcare and pharmaceuticals, personal care, others. he food industry is a major driver of the Food Grade Alcohol market due to its extensive use of alcohol in preservation, flavor enhancement, and sanitization, coupled with rising consumer demand for natural ingredients and stringent food safety regulations worldwide.

The food segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for natural preservatives, rising consumption of processed and ready-to-eat foods, stringent food safety standards, and growing consumer preference for clean-label, organic ingredients globally.

- By Source

On the basis of source, the Food Grade Alcohol market is segmented in to sugarcane, molasses, grains, fruits, others. The Sugarcane is a major driver of the Food Grade Alcohol market due to its high yield and cost-effectiveness, providing a sustainable and renewable source for ethanol production, which is widely used in food preservation, flavoring, and beverage industries globally.

The fruits segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for natural fruit-based alcohols, growing consumer preference for healthier and organic beverages, and expanding applications in flavoring, fermentation, and functional food products worldwide.

- By Functionality

On the basis of functionality, the Food Grade Alcohol market is segmented in to coatings, preservatives, coloring and flavoring agent, others. The Coatings are a major driver of the Food Grade Alcohol market due to their critical role in food preservation, enhancing shelf life, and protecting food quality. Increasing demand for edible and protective coatings in processed foods fuels market growth globally.

The coloring segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for natural and vibrant food colors, increasing consumer preference for visually appealing products, stringent regulations against synthetic dyes, and expanding applications in beverages, confectionery, and processed food industries worldwide.

Food Grade Alcohol Market Regional Analysis

- North America dominates the Food Grade Alcohol market with the largest revenue share of 35% in 2025, characterized by advanced manufacturing technologies, strict regulatory frameworks, high consumer awareness for food safety, strong demand from the food and beverage industry, and significant investments in innovation.

- Supportive government policies and funding for clean-label and sustainable food production further strengthen North America's leadership in the food grade alcohol market, encouraging manufacturers to adopt eco-friendly practices and expand their product portfolios to cater to health-conscious and environmentally aware consumers.

- The region's strong consumer awareness of food safety, combined with robust demand from the processed food and beverage industries, fuels market expansion. Additionally, significant investments in research and innovation promote the development of high-purity, functional alcohol products to meet evolving industry needs.

U.S. Food Grade Alcohol Market Insight

The U.S. Food Grade Alcohol market captured the largest revenue share of approximately 80% within North America in 2025, driven by a well-established food and beverage sector, strong demand for high-purity alcohol, and advanced manufacturing and regulatory infrastructure.

Asia Pacific Food Grade Alcohol Market Insight

The Asia Pacific market is projected to expand at a substantial CAGR due to rising demand for processed foods, increasing disposable incomes, expanding food and beverage industries, and growing awareness of food safety and quality across rapidly developing economies like China, India, and Southeast Asia.

India Food Grade Alcohol Market Insight

The India Food Grade Alcohol market is set to grow at a notable CAGR, driven by rapid expansion of the food and beverage industry, increasing health consciousness, rising demand for natural ingredients, and supportive government policies promoting ethanol production and sustainable food practices.

Food Grade Alcohol Market Share

The Food Grade Alcohol industry is primarily led by well-established companies, including:

- Anheuser-Busch InBev (Belgium)

- Pernod Ricard (France)

- Diageo plc (United Kingdom)

- Altria Group, Inc. (USA)

- Beam Suntory, Inc. (USA)

- Constellation Brands, Inc. (USA)

- MGP Ingredients, Inc. (USA)

- Patrón Spirits Company (USA)

- Bacardi Limited (Bermuda)

- Lallemand Inc. (Canada)

- Zhejiang Yatai Group Co., Ltd. (China)

- Shandong Xiwang Group (China)

- Diageo India (India)

- Sazerac Company, Inc. (USA)

- Campari Group (Italy)

Latest Developments in Global Food Grade Alcohol Market

- In September 2023, Archer Daniels Midland (ADM) expanded its organic-certified food-grade alcohol production capacity in Europe to cater to rising demand for natural and premium ingredients. This strategic move enhances ADM’s ability to meet growing consumer preferences for organic and sustainable food components across the beverage, pharmaceutical, and food processing sectors.

- In December 2023, MGP Ingredients commissioned new grain-based alcohol purification technology at its Atchison facility. This advanced setup is aimed at improving the quality and consistency of high-purity alcohol products, particularly for use in premium spirits and health-related applications, strengthening the company’s competitive position in the global food-grade alcohol market.

- In January 2024, Associated Alcohols & Breweries Limited launched ‘NICOBAR’, a premium gin made with botanicals and fine-grain alcohol. This product marks the company’s entry into high-end alcoholic beverages, targeting health-conscious and premium consumers, while also reflecting the increasing trend towards craft and artisanal alcohol products in the Asia-Pacific region.

- In February 2024, Cargill initiated a sustainable sourcing program focused on its food-grade alcohol production. The initiative includes integrating regenerative agriculture practices to reduce environmental impact, improve soil health, and ensure long-term resource availability, aligning with the company's goals to meet sustainability standards and consumer demand for eco-friendly ingredients.

- In April 2024, Cristalco invested in carbon-reduction technologies across its European production network to minimize emissions in alcohol manufacturing. The move is part of the company’s broader sustainability strategy, ensuring compliance with EU climate goals and attracting customers who prioritize environmentally responsible sourcing in food and beverage ingredient procurement.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Grade Alcohol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Grade Alcohol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Grade Alcohol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.