Global Food Texture Market

Market Size in USD Million

CAGR :

%

USD

566.00 Million

USD

1,432.00 Million

2024

2032

USD

566.00 Million

USD

1,432.00 Million

2024

2032

| 2025 –2032 | |

| USD 566.00 Million | |

| USD 1,432.00 Million | |

|

|

|

|

Food Texture Market Size

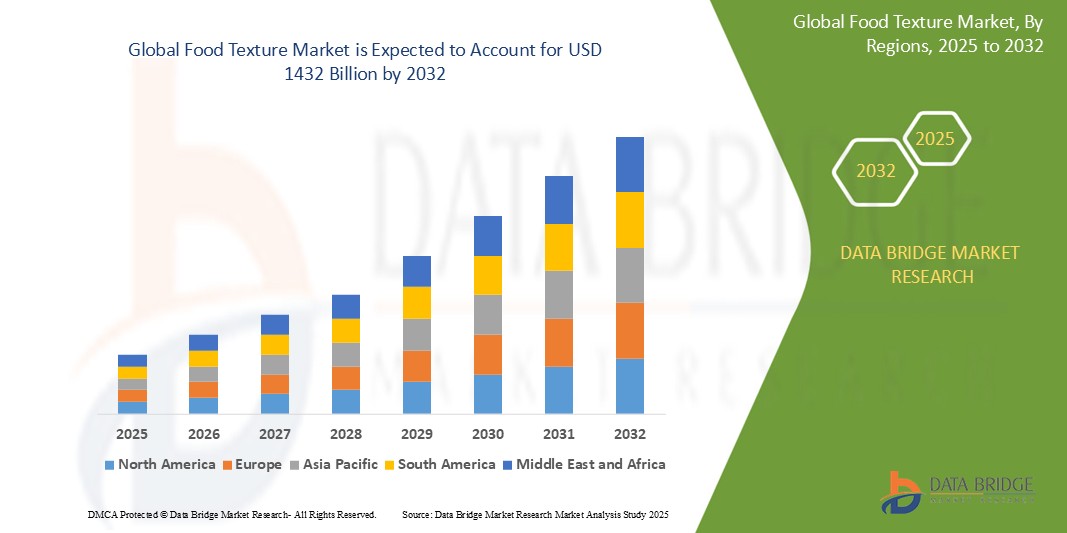

- The Global Food Texture Market was valued at USD 566 Million in 2024 and is expected to reach USD 1432 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.40%, primarily driven by rise in health consciousness across the globe

- This growth is driven by factors such as rise in health consciousness across the globe and the rise in consumer demand for low-fat products

Food Texture Market Analysis

- Food Textures refer to additives or ingredients used to modify and enhance the mouthfeel, consistency, and overall sensory experience of food products. These include emulsifiers, thickeners, gelling agents, and stabilizers, which play a critical role in determining product appeal and consumer satisfaction

- The market demand is significantly driven by increasing consumer preference for processed, convenient, and ready-to-eat food products. Additionally, the rising emphasis on clean-label and plant-based foods has accelerated the need for innovative texture-modifying ingredients that meet both sensory and nutritional expectations

- The Asia-Pacific region leads the market, driven by the growing population, expanding middle class, and increasing urbanization. Countries such as China, India, and Japan are witnessing heightened demand for dairy, bakery, confectionery, and meat substitute products, all of which heavily rely on food texturizers to maintain product quality and appeal

Report Scope and Food Texture Market Segmentation

|

Attributes |

Food Texture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Texture Market Trends

“Growing Demand for Clean Label, Plant-Based, and Multisensory Food Products”

- The rise in health-conscious consumers is accelerating demand for clean-label food products with minimal artificial additives, driving innovation in natural food texturizers like starches, gums, and pectins

- Increased consumption of plant-based and vegan products is creating demand for texture modifiers that replicate the mouthfeel and structure of meat and dairy

- Food manufacturers are enhancing the sensory profile of products, using texture to differentiate and improve consumer satisfaction, particularly in bakery, dairy, and snack foods

- For instance, in January 2024, Ingredion Incorporated launched a new line of plant-based texture systems designed to improve the creaminess and stability of dairy alternatives

- This trend indicates a broader industry movement toward sensory-driven food innovation aligned with health, sustainability, and consumer experience

Food Texture Market Dynamics

Driver

“Rising Demand for Processed and Convenience Foods”

- Increasing urbanization and fast-paced lifestyles have fueled the growth of ready-to-eat and packaged foods, which require consistent texture and shelf stability

- Texturizing agents such as modified starches, hydrocolloids, and emulsifiers are essential in maintaining product quality across processed foods

- Growth in global frozen and refrigerated food sectors is also contributing to higher demand for texture-enhancing ingredients

- For instance, according to the Food and Agriculture Organization (FAO), processed food consumption is expected to grow by 50% globally by 2030, significantly benefiting texture ingredient suppliers

- These factors collectively contribute to the expanding footprint of food texturizers in global food processing industries

Opportunity

“Innovation in Functional Texturizers and Personalized Nutrition”

- Technological advancements are enabling the development of multifunctional texture ingredients that also offer nutritional benefits like fiber enrichment and protein fortification

- The trend of personalized nutrition is opening up new avenues for texture customization in food products targeted at specific age groups, dietary needs, or health conditions

- Increasing investment in R&D to develop natural and allergen-free texture solutions aligns with regulatory and consumer preference shifts

For instance,

- In April 2024, Cargill introduced a new fiber-rich citrus fiber line derived from upcycled fruit, offering clean-label thickening and gelling properties for beverages and sauces

- The synergy between health trends and texture innovation presents lucrative growth prospects for market players

Restraint/Challenge

“Regulatory Compliance and Formulation Complexity”

- Strict food safety and labeling regulations, especially in Europe and North America, challenge the use of certain synthetic texturizers, requiring reformulation efforts

- Achieving consistent texture in plant-based and reformulated products can be technologically complex and may increase production costs

- Supply chain disruptions and fluctuating prices for natural raw materials (like guar gum, locust bean gum) can impact ingredient availability and cost structures

For instance,

- According to the European Food Safety Authority (EFSA), regulatory reviews on certain emulsifiers and stabilizers in 2024 have led manufacturers to reformulate products to maintain market access

- These challenges underline the importance of innovation, transparency, and efficient sourcing strategies in sustaining market competitiveness

Food Texture Market Scope

The market is segmented on the basis of product type, application, distribution channel, material, end users and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Functionalities |

|

|

By Application |

|

In 2025, the Bakery Products is projected to dominate the market with a largest share in application segment

The Bakery Products segment is expected to dominate the Food Texture Market with the largest share of 56.22% in 2025 due to rising global consumption of baked goods, increasing demand for improved mouthfeel and consistency in products like bread, cakes, and pastries, as well as growing innovations in clean-label and gluten-free bakery items that require advanced texturizing solutions.

The Emulsifying Agents is expected to account for the largest share during the forecast period in functionality market

In 2025, the Emulsifying Agents segment is expected to dominate the market with the largest market share of 51.31% due to their critical role in enhancing texture, stability, and shelf life across a wide range of food products such as sauces, dressings, dairy, and bakery goods, along with the increasing consumer preference for smooth, homogenous product consistency and the rising demand for clean-label and plant-based emulsifiers.

Food Texture Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Food Texture Market”

- Asia-Pacific leads the global food texture market, driven by the rapid growth of the food processing industry, rising urban populations, and shifting dietary patterns in countries like China, India, Japan, and Southeast Asia

- China holds a substantial share due to its large-scale production of processed foods, increasing consumption of convenience foods, and strong investments in food technology innovation

- The region benefits from the abundant availability of natural raw materials (such as starches, seaweed, and legumes) and lower manufacturing costs, attracting major global food and ingredient companies

- The growing demand for plant-based and clean-label food products, particularly in South Korea, Japan, and Australia, is boosting adoption of natural food texturizers

- Multinational players are expanding their presence in Asia-Pacific through strategic partnerships and local production facilities to tap into this high-growth market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific leads the global food texture market, driven by the rapid growth of the food processing industry, rising urban populations, and shifting dietary patterns in countries like China, India, Japan, and Southeast Asia

- China holds a substantial share due to its large-scale production of processed foods, increasing consumption of convenience foods, and strong investments in food technology innovation

- The region benefits from the abundant availability of natural raw materials (such as starches, seaweed, and legumes) and lower manufacturing costs, attracting major global food and ingredient companies

- The growing demand for plant-based and clean-label food products, particularly in South Korea, Japan, and Australia, is boosting adoption of natural food texturizers

- Multinational players are expanding their presence in Asia-Pacific through strategic partnerships and local production facilities to tap into this high-growth market

Food Texture Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ajinomoto Co. Inc. (Japan)

- Archer Daniels Midland Co. (United States)

- Ashland Inc. (United States)

- Avebe (Netherlands)

- Cargill Inc. (United States)

- CP Kelco (United States)

- E.I. Dupont De Nemours & Company (United States)

- Estelle Chemicals (India)

- Fiberstar Inc. (United States)

- FMC Corporation (United States)

- Fuerst Day Lawson (United Kingdom)

- Ingredion Inc. (United States)

- Kerry Group (Ireland)

- Lonza Group Ltd (Switzerland)

- Naturex (France)

- Nexira (France)

- Palsgaard A/S (Denmark)

- Penford Corporation (United States)

- Premium Ingredients (Spain)

- Puratos Group (Belgium)

- Riken Vitamin Co. Ltd. (Japan)

- Royal DSM N.V. (Netherlands)

- Taiyo Kagaku Co. Ltd. (Japan)

- Tate & Lyle Plc (United Kingdom)

- Tic Gums Inc. (United States)

- Royal DSM (Netherlands)

Latest Developments in Global Food Texture Market

- In February 2024, Roquette introduced four new multifunctional pea protein ingredients designed to enhance taste and texture in plant-based and protein-rich foods. This innovation supports the growing demand for high-quality, sustainable protein solutions in the food industry.

- In September 2023, Tate & Lyle partnered with IMCD in Finland and the Baltic region, expanding their ingredient distribution. This collaboration aims to broaden Tate & Lyle's reach in the food texture market within these regions.

- In May 2023, Ajinomoto Co., Inc. entered a strategic alliance with Solar Foods to utilize Solein, a CO₂-fed microbial protein, and conduct market feasibility studies in Singapore from fiscal 2024. This partnership focuses on exploring innovative, sustainable protein sources for food applications.

- In January 2023, Archer Daniels Midland Company (ADM) completed the acquisition of Kansas Protein Foods, strengthening its position in the food texture market. This strategic move enhances ADM's capabilities in unflavored textured soy protein, flavored alternatives, and non-GMO proteins.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Texture Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Texture Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Texture Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.