Global Forestry Lubricants Market

Market Size in USD Billion

CAGR :

%

USD

7.93 Billion

USD

11.81 Billion

2024

2032

USD

7.93 Billion

USD

11.81 Billion

2024

2032

| 2025 –2032 | |

| USD 7.93 Billion | |

| USD 11.81 Billion | |

|

|

|

|

What is the Global Forestry Lubricants Market Size and Growth Rate?

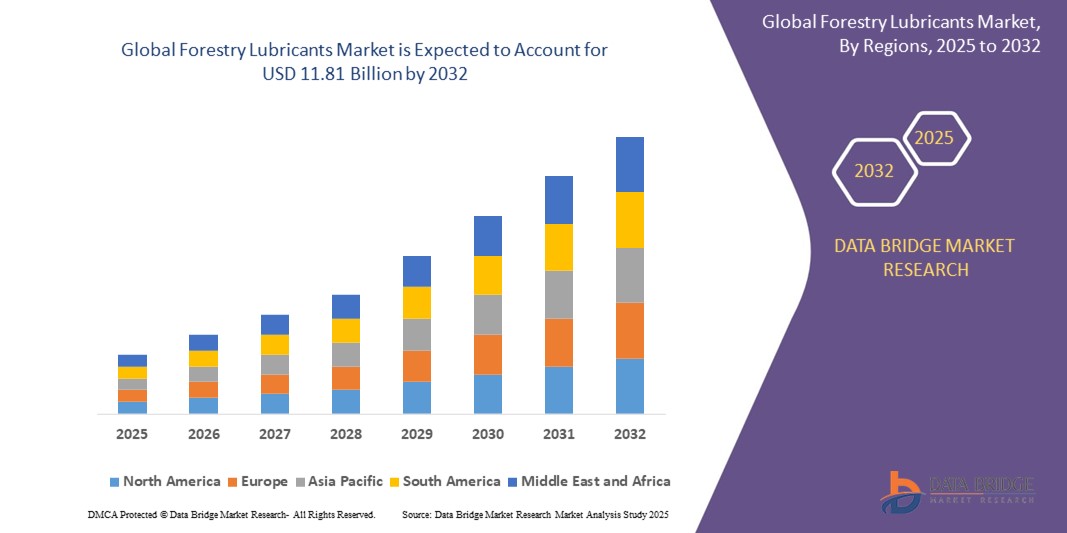

- The global forestry lubricants market size was valued at USD 7.93 billion in 2024 and is expected to reach USD 11.81 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing Forestry Lubricants as the modern access control system of choice. These converging factors are accelerating the uptake of forestry lubricants solutions, thereby significantly boosting the industry's growth

What are the Major Takeaways of Forestry Lubricants Market?

- Forestry Lubricants, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for forestry lubricants is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- North America dominated the forestry lubricants market with the largest revenue share of 42.56% in 2024, driven by high mechanization in forestry operations and the widespread presence of sawmills and logging activities across the region

- Asia-Pacific forestry lubricants market is poised to grow at the fastest CAGR of 8.9% from 2025 to 2032, driven by rapid urbanization, expanding forestry industries, and increasing demand for wood-based products in countries such as China, India, and Japan

- The Synthetic segment dominated the forestry lubricants market with the largest market revenue share of 38.6% in 2024, owing to its superior performance characteristics such as high thermal stability, extended drain intervals, and enhanced wear protection under harsh forestry operating conditions

Report Scope and Forestry Lubricants Market Segmentation

|

Attributes |

Forestry Lubricants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Forestry Lubricants Market?

“Shift Toward Bio-Based and Eco-Friendly Lubricants”

- A major emerging trend in the forestry lubricants market is the increasing adoption of bio-based and environmentally friendly lubricants driven by sustainability goals, regulatory pressures, and rising environmental awareness among end-users

- Forestry operations often occur in sensitive ecosystems, prompting a preference for biodegradable lubricants that reduce soil and water contamination risks. As a result, manufacturers are increasingly investing in renewable resource-based formulations that offer strong lubricity and oxidative stability while meeting green certifications.

- For instance, in March 2023, Fuchs Petrolub SE introduced a new range of biodegradable hydraulic fluids designed specifically for forestry equipment operating in ecologically sensitive zones. These lubricants meet stringent environmental standards while maintaining high performance in extreme conditions

- The trend aligns with broader decarbonization initiatives in the industrial sector, as forestry operators seek to minimize carbon footprints and comply with government mandates on sustainable practices. Bio-based lubricants are also gaining favor due to reduced toxicity and improved safety for operators and surrounding wildlife

- With sustainability becoming a key procurement criterion, companies such as Petro-Canada Lubricants and Klüber Lubrication are expanding their product lines to include vegetable-oil-based and synthetic ester-based lubricants tailored for forestry machinery

- As ecological stewardship becomes increasingly central to forestry operations, the shift toward eco-friendly lubricants is expected to reshape product development and procurement standards across the global market

What are the Key Drivers of Forestry Lubricants Market?

- The increasing mechanization of forestry activities—such as logging, harvesting, and wood processing—has led to a surge in demand for high-performance lubricants that can withstand harsh environments, heavy loads, and extreme weather conditions

- For instance, in January 2024, Chevron Corporation announced the expansion of its Delo product line with formulations designed to improve performance in off-road forestry equipment, including harvesters and feller bunchers

- Forestry lubricants reduce wear and tear on critical components such as chains, engines, and hydraulics, enhancing equipment uptime and reducing maintenance costs key priorities in remote and rugged forestry operations

- Increasing awareness of equipment longevity and operational efficiency is driving demand for specialized lubricant types, including chain oils, hydraulic fluids, and gear oils engineered for forestry-specific applications

- In addition, government regulations related to emissions and lubricant toxicity are encouraging the shift from conventional mineral oils to low-toxicity and biodegradable alternatives, creating further momentum in the market

- The integration of predictive maintenance systems using smart sensors is also supporting the usage of advanced lubricants with data-driven performance monitoring, thereby improving productivity and reducing downtime in forestry operations

Which Factor is challenging the Growth of the Forestry Lubricants Market?

- One of the main challenges hampering the market is the higher cost and performance limitations associated with some bio-based and biodegradable lubricants compared to traditional petroleum-based products

- While eco-friendly lubricants offer sustainability benefits, they often come at a premium price, making them less appealing to cost-sensitive operators, particularly in developing economies or smaller forestry firms with limited budgets

- For instance, a 2022 industry study highlighted that biodegradable hydraulic fluids can cost up to 30% more than conventional alternatives, raising concerns over return on investment in price-driven markets

- Another hurdle is the lack of standardization and compatibility in bio-based lubricant formulations, which can affect equipment performance or void warranties if not properly matched to OEM specifications

- Companies such as Amsoil Inc. and Repsol SA are working on advanced formulations that offer better oxidative stability and water resistance, but widespread adoption remains limited due to performance inconsistencies under extreme conditions

- Overcoming these challenges requires continued R&D investment, increased customer education, and regulatory support through incentives or subsidies for sustainable lubricant adoption in the forestry sector

How is the Forestry Lubricants Market Segmented?

The market is segmented on the basis of product, application, and end-use.

• By Product

On the basis of product, the forestry lubricants market is segmented into Synthetic, Synthetic Blend Oil (SBO), Bio-based, and Mineral. The Synthetic segment dominated the Forestry Lubricants market with the largest market revenue share of 38.6% in 2024, owing to its superior performance characteristics such as high thermal stability, extended drain intervals, and enhanced wear protection under harsh forestry operating conditions. Synthetic lubricants are widely used in modern forestry machinery for reducing equipment downtime and maximizing operational efficiency in rugged terrains.

The Bio-based segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing environmental regulations and growing demand for biodegradable lubricants in ecologically sensitive forestry zones. Bio-based lubricants are gaining traction for their low toxicity, renewable origins, and compliance with sustainability goals across global forestry operations.

• By Application

On the basis of application, the forestry lubricants market is segmented into Engine, Transmission & Gears, Hydraulics, and Greasing. The Engine segment accounted for the largest market revenue share of 41.2% in 2024, due to the essential role of engine oils in maintaining performance and longevity of forestry equipment such as harvesters, skidders, and loaders. Forestry engines often operate in high-stress, high-dust environments, which necessitates the use of high-quality lubricants to prevent wear, overheating, and corrosion.

The Hydraulics segment is anticipated to register the fastest growth rate from 2025 to 2032, propelled by the increasing use of hydraulic-powered machinery in mechanized forestry. As modern equipment relies heavily on hydraulic systems for operational efficiency and precision, the demand for hydraulic fluids with anti-wear, anti-foam, and oxidation resistance properties is rapidly growing.

• By End-Use

On the basis of end-use, the forestry lubricants market is segmented into OEMs, Sawmills, Paper & Paperboard Mills, and Wood Products Manufacturing.

The Sawmills segment dominated the Forestry Lubricants market in 2024 with the highest revenue share of 36.4%, as these facilities utilize high-speed and heavy-duty equipment that require consistent lubrication for saw blades, conveyors, and hydraulics. The intense mechanical operations in sawmills drive demand for high-performance lubricants that can reduce friction, extend equipment life, and improve productivity.

The OEMs segment is projected to witness the fastest CAGR from 2025 to 2032, supported by increasing partnerships between lubricant manufacturers and original equipment manufacturers for factory-fill applications. OEMs are focusing on delivering pre-lubricated, ready-to-deploy machinery to forestry operators, ensuring optimal performance and compliance with warranty standards.

Which Region Holds the Largest Share of the Forestry Lubricants Maret?

- North America dominated the forestry lubricants market with the largest revenue share of 42.56% in 2024, driven by high mechanization in forestry operations and the widespread presence of sawmills and logging activities across the region

- The demand is further fueled by stringent environmental regulations, the need for equipment longevity, and a strong focus on sustainable forestry practices

- The region’s preference for high-performance synthetic and bio-based lubricants, combined with advanced machinery used in harvesting and processing, supports consistent product demand across both OEM and aftermarket segments

U.S. Forestry Lubricants Market Insight

The U.S. forestry lubricants market captured the largest revenue share within North America in 2024, owing to the country’s significant forestry industry and high usage of heavy-duty equipment. Increasing investments in forest management, rising adoption of precision forestry, and the transition toward environmentally friendly lubricants such as bio-based oils are major growth contributors. The presence of key lubricant manufacturers and ongoing innovation in synthetic blends are expected to maintain the market’s dominance in the U.S.

Europe Forestry Lubricants Market Insight

The Europe forestry lubricants market is projected to expand at a substantial CAGR during the forecast period, supported by sustainable forestry initiatives, regulatory pressure to reduce carbon emissions, and increasing reliance on biodegradable lubricants. Rising demand from paper and wood product industries, especially in countries such as Germany and Sweden, is contributing to steady growth. Furthermore, advancements in lubrication technologies and the replacement of mineral oils with synthetic blends are aligning with the EU’s green goals, fueling long-term market expansion.

U.K. Forestry Lubricants Market Insight

U.K. forestry lubricants market is expected to grow at a noteworthy CAGR, supported by an increased focus on forest conservation, eco-friendly product usage, and modernization in the wood processing sector. As the government promotes sustainable forestry management and carbon-neutral initiatives, demand for bio-based lubricants is gaining momentum. In addition, the shift toward advanced logging equipment and the integration of IoT and automation technologies in forestry operations further drive lubricant consumption.

Germany Forestry Lubricants Market Insight

The Germany forestry lubricants market is set to grow at a considerable CAGR, driven by the country’s leadership in green technology and precision machinery. Germany’s strong emphasis on sustainability, innovation, and strict regulatory compliance fosters widespread adoption of low-toxicity, biodegradable lubricants in forestry operations. The use of synthetic lubricants in sawmills, hydraulics, and heavy-duty gear systems continues to rise, reflecting the nation’s preference for efficient and eco-conscious lubrication solutions.

Which Region is the Fastest Growing in the Forestry Lubricants Market?

Asia-Pacific forestry lubricants market is poised to grow at the fastest CAGR of 8.9% from 2025 to 2032, driven by rapid urbanization, expanding forestry industries, and increasing demand for wood-based products in countries such as China, India, and Japan. Government efforts to promote sustainable forest management, growing investments in forestry machinery, and the emergence of regional lubricant manufacturers offering cost-effective and eco-friendly solutions contribute to this growth. The region's strong manufacturing base and rising export-oriented production in wood and paper sectors are expected to continue fueling demand for forestry lubricants.

Japan Forestry Lubricants Market Insight

The Japan forestry lubricants market is gaining traction due to its technological advancement, focus on sustainability, and the use of high-performance forestry equipment. Japan’s aging forestry workforce encourages the adoption of automated and efficient machinery, increasing the need for durable lubricants. Government-supported reforestation and environmental initiatives are further prompting a shift toward bio-based and synthetic lubricants, supporting market growth across both OEM and replacement markets.

China Forestry Lubricants Market Insight

The China forestry lubricants market held the largest revenue share within Asia-Pacific in 2024, driven by the country’s rapid industrialization, extensive forest resource development, and strong investment in infrastructure and wood processing. China’s growing middle class and increased consumption of wood products contribute to the surge in demand for forestry equipment and related lubricants. Domestic production of cost-efficient lubricants and a growing preference for environmentally safe solutions further solidify China’s leading position in the regional market.

Which are the Top Companies in Forestry Lubricants Market?

The forestry lubricants industry is primarily led by well-established companies, including:

- Amsoil Inc. (U.S.)

- Bioblend Renewable Resources (U.S.)

- Chevron Corporation (U.S.)

- China Petroleum & Chemical Corporation (Sinopec Corp) (China)

- Elba Lubrication Inc. (U.S.)

- Exxon Mobil Corporation (U.S.)

- Frontier Performance Lubricants (U.S.)

- Fuchs Petrolub SE (Germany)

- Klondike Lubricants Corporation (Canada)

- Kluber Lubrication (Germany)

- Lubrizol Corporation (U.S.)

- Pennine Lubricants (U.K.)

- Petro Canada Lubricants (Canada)

- Petronas Lubricants International (PLI) (Malaysia)

- Phillips 66 Company (U.S.)

- Repsol SA (Spain)

- Royal Dutch Shell (U.K)

- Rymax Lubricants (Netherlands)

What are the Recent Developments in Global Forestry Lubricants Market?

- In March 2024, Beyond Plastics collaborated with CJ Biomaterials to launch a biodegradable bottle cap made from polyhydroxyalkanoate (PHA), a naturally derived biopolymer that enhances the performance of traditional plastics while offering environmental benefits. This initiative supports the industry's transition towards eco-friendly packaging solutions and demonstrates a growing commitment to sustainable material innovation

- In September 2023, BASF introduced the first biomass-balanced plastic additives in the industry, namely Irganox 1076 FD BMBcert and Irganox 1010 BMBcert, which replace fossil-based feedstock with renewable alternatives. Certified by TÜV Nord under the ISCC PLUS framework, these additives mark a major step forward in integrating sustainability into industrial plastic processing and underline BASF's leadership in eco-conscious chemical development

- In July 2021, Cortec Corporation urged logging professionals to embrace sustainable forestry practices by incorporating EcoLine biobased lubricants into their routine equipment maintenance. This recommendation reinforced the importance of using renewable, environmentally safe lubricants to reduce ecological impact and promote responsible forestry operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.