Global Fortified Beverages Market

Market Size in USD Billion

CAGR :

%

USD

7.45 Billion

USD

12.33 Billion

2024

2032

USD

7.45 Billion

USD

12.33 Billion

2024

2032

| 2025 –2032 | |

| USD 7.45 Billion | |

| USD 12.33 Billion | |

|

|

|

|

Fortified Beverages Market Size

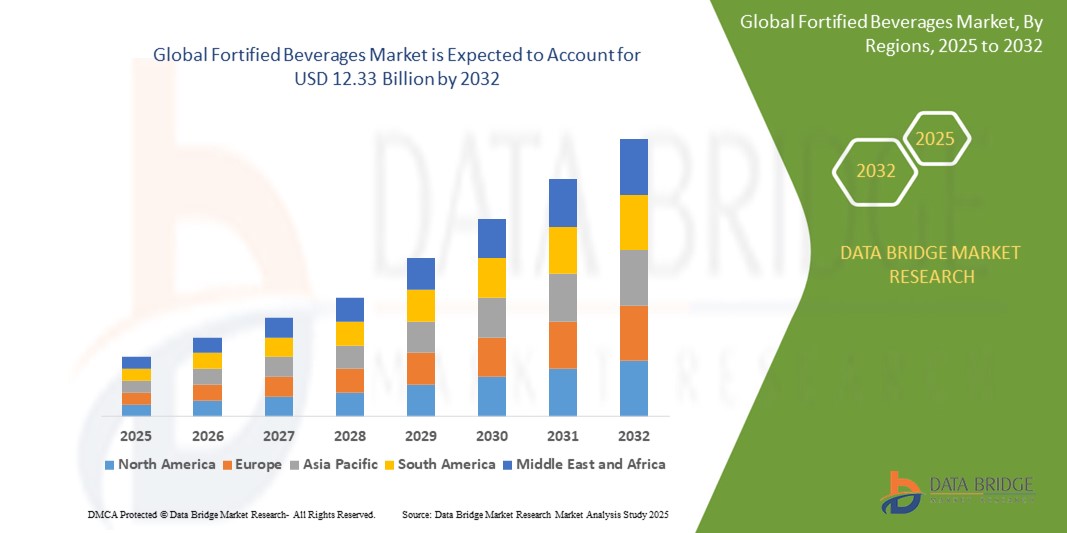

- The global fortified beverages market size was valued at USD 7.45 billion in 2024 and is expected to reach USD 12.33 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by increasing health awareness and rising consumer focus on preventive nutrition, driving demand for functional beverages fortified with essential vitamins, minerals, and other beneficial ingredients across diverse age groups and lifestyles

- Furthermore, the growing availability of fortified beverages across mainstream retail, online platforms, and foodservice channels is enabling greater accessibility and convenience, thereby accelerating consumer adoption and significantly boosting the market's expansion

Fortified Beverages Market Analysis

- Fortified beverages are functional drinks enriched with additional nutrients such as vitamins, minerals, amino acids, or probiotics to enhance their health benefits beyond basic nutrition. These products address specific wellness goals such as immunity support, energy, hydration, and digestive health, catering to a broad spectrum of health-conscious consumers

- The rising demand for fortified beverages is primarily driven by shifting dietary preferences, increased awareness of micronutrient deficiencies, and a growing trend toward clean-label, plant-based, and low-calorie products offering added functional value

- Europe dominated the fortified beverages market with a share of 35.5% in 2024, due to growing health awareness, aging populations, and increasing demand for functional and nutrient-enriched beverages

- Asia-Pacific is expected to be the fastest growing region in the fortified beverages market with a share of during the forecast period due to rapid urbanization, increasing disposable incomes, and a rising focus on health and wellness

- Non-alcoholic beverages segment dominated the market with a market share of 79.1% in 2024, due to the expanding demand for functional drinks such as fortified juices, energy drinks, plant-based milks, and enhanced water. Consumers are increasingly shifting toward preventive health and wellness, especially post-pandemic, with a preference for beverages that combine hydration with health benefits. Fortified non-alcoholic drinks are favored for their accessibility, wide appeal across demographics, and compatibility with clean-label and natural ingredient trends

Report Scope and Fortified Beverages Market Segmentation

|

Attributes |

Fortified Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fortified Beverages Market Trends

“Growing Health and Wellness Trends”

- The fortified beverages market is experiencing strong growth as consumers increasingly prioritize health, wellness, and preventive nutrition, seeking drinks enriched with vitamins, minerals, probiotics, and functional ingredients

- For instance, leading brands such as Nestlé, PepsiCo, Danone, and Coca-Cola are expanding their portfolios with vitamin-infused waters, electrolyte sports drinks, and probiotic dairy beverages to cater to the rising demand for functional and health-oriented products

- The popularity of plant-based and clean-label beverages is driving innovation in natural fortification, with brands introducing products that combine botanical extracts, superfoods, and adaptogens for added health benefits

- E-commerce and direct-to-consumer channels are accelerating market reach, enabling brands to offer personalized and subscription-based fortified beverage options tailored to individual health needs

- Regulatory support for fortification in emerging markets, along with public health campaigns to address micronutrient deficiencies, is further boosting the adoption of fortified beverages

- In conclusion, the convergence of health-conscious consumer behavior, product innovation, and digital retail expansion is positioning fortified beverages as a key segment in the global functional drinks market

Fortified Beverages Market Dynamics

Driver

“Growing Demand for Convenience and On-the-Go Consumption”

- The fast-paced lifestyle of modern consumers is driving demand for convenient, ready-to-drink fortified beverages that offer both nutrition and portability

- For instance, brands are launching single-serve, resealable, and shelf-stable fortified drinks that cater to busy professionals, students, and fitness enthusiasts seeking quick and healthy hydration solutions

- The rise of urbanization and increased participation in sports and fitness activities are fueling the need for easy-to-carry, nutrient-rich beverages

- Technological advancements in packaging and preservation are supporting the development of fortified beverages with longer shelf life and enhanced flavor stability

- Retailers and foodservice operators are expanding their offerings of grab-and-go fortified drinks, making them more accessible in convenience stores, gyms, airports, and vending machines

Restraint/Challenge

“Cost Considerations among Consumer”

- The higher price point of fortified beverages compared to regular drinks can be a barrier for price-sensitive consumers, especially in developing markets

- For instance, brands such as Danone and PepsiCo face challenges in balancing the cost of premium fortification ingredients with consumer willingness to pay, particularly during times of economic uncertainty

- The perception that fortified beverages are luxury or niche products may limit their adoption among lower-income groups

- Ongoing inflation and supply chain disruptions can further increase production costs, impacting retail pricing and market penetration

- Educating consumers about the value and benefits of fortified beverages is essential to justify the price premium and drive broader acceptance

Fortified Beverages Market Scope

The market is segmented on the basis of nutrient type, product type, and distribution channel.

- By Nutrient Type

On the basis of nutrient type, the fortified beverages market is segmented into minerals and vitamins. The vitamin segment dominated the largest market revenue share in 2024, attributed to the rising consumer awareness of vitamin deficiencies and the widespread inclusion of vitamins such as A, C, D, and B-complex in daily beverages. These vitamins play a vital role in immunity, bone health, and energy metabolism, making them an attractive value addition for health-conscious consumers. Beverage manufacturers are capitalizing on this demand by launching innovative products with clean labels and fortified vitamin blends tailored for specific age groups and lifestyles.

The mineral segment is projected to register the fastest CAGR from 2025 to 2032, driven by the growing prevalence of mineral deficiencies—especially calcium, iron, and magnesium—among women, elderly populations, and athletes. Mineral-fortified beverages are increasingly being adopted in functional drink portfolios and plant-based formulations to address nutritional gaps while enhancing hydration and recovery benefits. Enhanced consumer understanding of minerals’ role in muscle function, bone density, and nerve health is accelerating their incorporation into daily nutrition regimes.

- By Product Type

On the basis of product type, the market is segmented into non-alcoholic beverages and alcoholic beverages. The non-alcoholic beverages segment dominated the market share of 79.1% in 2024, owing to the expanding demand for functional drinks such as fortified juices, energy drinks, plant-based milks, and enhanced water. Consumers are increasingly shifting toward preventive health and wellness, especially post-pandemic, with a preference for beverages that combine hydration with health benefits. Fortified non-alcoholic drinks are favored for their accessibility, wide appeal across demographics, and compatibility with clean-label and natural ingredient trends.

The alcoholic beverages segment is expected to witness the fastest growth rate during 2025–2032, supported by a growing trend toward wellness-driven indulgence. Producers are increasingly exploring fortification with botanicals, vitamins, and adaptogens in low-alcohol and functional alcoholic drinks. Younger consumers in developed markets are particularly driving demand for “better-for-you” alcoholic options that support social enjoyment without compromising on health goals, thus opening new innovation pathways in fortified alcoholic beverage development.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into supermarkets and hypermarkets, specialist retailers, convenience stores, and others. The supermarkets and hypermarkets segment led the market share in 2024, driven by their expansive shelf space, strong product visibility, and consumer trust. These outlets provide a one-stop solution with diverse fortified beverage offerings, encouraging bulk buying and impulse purchases through attractive packaging and promotional strategies. Their ability to cater to both premium and budget segments ensures consistent foot traffic and higher conversion rates.

The specialist retailers segment is expected to grow at the fastest CAGR from 2025 to 2032 due to increasing consumer preference for personalized health products and expert guidance. These stores often carry curated inventories of niche, premium fortified beverages with clear labeling and functional claims. Health-focused retail chains, organic stores, and wellness boutiques are seeing higher footfall as consumers seek products aligned with specific dietary needs, allergies, or fitness goals, thus boosting the growth of fortified beverage sales through this channel.

Fortified Beverages Market Regional Analysis

- Europe dominated the fortified beverages market with the largest revenue share of 35.5% in 2024, driven by growing health awareness, aging populations, and increasing demand for functional and nutrient-enriched beverages

- Consumers in the region are actively seeking preventive healthcare solutions, and fortified beverages—especially those enriched with vitamins and probiotics—are gaining traction due to their perceived health benefits

- The market is further supported by strict food fortification regulations, robust R&D capabilities, and the presence of major beverage companies innovating with clean-label, plant-based, and low-sugar fortified drink options

Germany Fortified Beverages Market Insight

The Germany fortified beverages market accounted for a significant revenue share within Europe in 2024, supported by high consumer demand for natural and functional health drinks. The growing popularity of fortified plant-based beverages, immunity-boosting drinks, and sustainable packaging formats is driving product adoption. Germany’s strong infrastructure, well-developed organic product segment, and rising interest in personalized nutrition continue to fuel the expansion of the fortified beverages market.

U.K. Fortified Beverages Market Insight

The U.K. fortified beverages market is projected to grow at a notable CAGR during the forecast period, driven by increasing health awareness, the popularity of plant-based diets, and concerns around nutrient deficiencies. The market is also benefiting from a strong e-commerce presence and wide retail availability of vitamin- and mineral-fortified beverages. The demand for functional drinks that align with lifestyle and dietary preferences, including vegan and allergen-free options, is accelerating the pace of market development.

North America Fortified Beverages Market Insight

North America holds a significant share in the fortified beverages market, driven by widespread adoption of functional drinks and growing consumer demand for health-enhancing products. The U.S. leads the regional market, with strong consumer preference for fortified water, dairy alternatives, and energy beverages enriched with vitamins, minerals, and botanical extracts. The region benefits from advanced retail and online distribution systems, high awareness of nutritional labeling, and strong innovation in clean-label, personalized wellness products

U.S. Fortified Beverages Market Insight

The U.S. fortified beverages market captured the largest revenue share in North America in 2024, fueled by the rising popularity of functional and on-the-go nutrition. Consumers are actively choosing fortified beverages for immunity support, hydration, energy, and cognitive benefits. The rapid growth of e-commerce platforms and direct-to-consumer brands, combined with increasing interest in natural and additive-free products, continues to drive market expansion across various age groups and lifestyles.

Asia-Pacific Fortified Beverages Market Insight

Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period of 2025 to 2032, supported by rapid urbanization, increasing disposable incomes, and a rising focus on health and wellness. Countries such as China, India, and Japan are experiencing strong demand for fortified drinks as consumers seek convenient ways to address nutritional deficiencies through daily beverages. Government-led public health initiatives and growing manufacturing capacity in functional drinks are improving both availability and affordability across diverse population segments

China Fortified Beverages Market Insight

The China fortified beverages market accounted for the largest revenue share in Asia-Pacific in 2024, driven by a growing middle-class population and increasing awareness of nutrition and wellness. Fortified soy milk, functional waters, and children’s health drinks are especially popular. China’s status as a manufacturing hub and the strong presence of domestic brands are contributing to high market penetration across urban and semi-urban regions.

India Fortified Beverages Market Insight

The India fortified beverages market is expected to grow at a considerable CAGR during the forecast period, supported by government nutrition programs and expanding urban consumer bases. Demand is rising for fortified dairy products, immunity-boosting drinks, and affordable nutritional beverages, particularly in metro cities and Tier 2 markets. The availability of fortified products through both modern retail and traditional channels is supporting greater accessibility.

Fortified Beverages Market Share

The fortified beverages industry is primarily led by well-established companies, including:

- PepsiCo (U.S.)

- Nestlé, SA (Switzerland)

- The Coca-Cola Company. (U.S.)

- CG Roxane, LLC (U.S.)

- Tempo Beverage Ltd (Israel)

- Keurig Dr Pepper Inc. (U.S.)

- Dr Pepper/Seven Up, Inc (U.S.)

- Ferrarelle (Italy)

- SANPELLEGRINO (Italy)

- Reignwood Investments U.K. Ltd (U.K.)

- LaCroix Beverages, Inc. (U.S.)

- GEROLSTEINER BRUNNEN GMBH & CO. K.G. (Germany)

- Mountain Valley Spring Beverages (U.S.)

Latest Developments in Global Fortified Beverages Market

- In September 2024, Oxbow Brands launched its new label, Vegan Drink Company (VDC), to address the rising demand for dairy-free alternatives among lactose-intolerant and vegan consumers. This strategic move strengthens the company’s foothold in India’s fortified beverages market, particularly across offline retail and foodservice channels, by expanding accessibility to plant-based, nutrient-rich options

- In May 2022, Nestlé introduced a fortified dairy drink in Pakistan aimed at combating widespread micronutrient deficiencies. This launch has enhanced the company’s role in the region’s functional beverage segment, supporting national nutrition goals while increasing the penetration of affordable fortified products in emerging markets

- In December 2020, Fever-Tree extended its portfolio with the debut of a rhubarb and raspberry tonic beverage, crafted using tart Norfolk-grown rhubarb and Scottish raspberries. Containing naturally derived ingredients and no artificial sugars, the launch contributed to the rising trend of clean-label, low-calorie fortified beverages in Europe, reinforcing consumer preference for botanically infused wellness drinks

- In July 2020, Phocus expanded its flavored beverage portfolio with the introduction of a Cola variant, complementing its existing functional drink range. This product diversification strengthened the brand’s position in the U.S. functional beverage space, appealing to health-conscious consumers seeking flavorful alternatives with added value

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fortified Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fortified Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fortified Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.