Global Foundry Coke Market

Market Size in USD Billion

CAGR :

%

USD

3.18 Billion

USD

4.77 Billion

2024

2032

USD

3.18 Billion

USD

4.77 Billion

2024

2032

| 2025 –2032 | |

| USD 3.18 Billion | |

| USD 4.77 Billion | |

|

|

|

|

What is the Global Foundry Coke Market Size and Growth Rate?

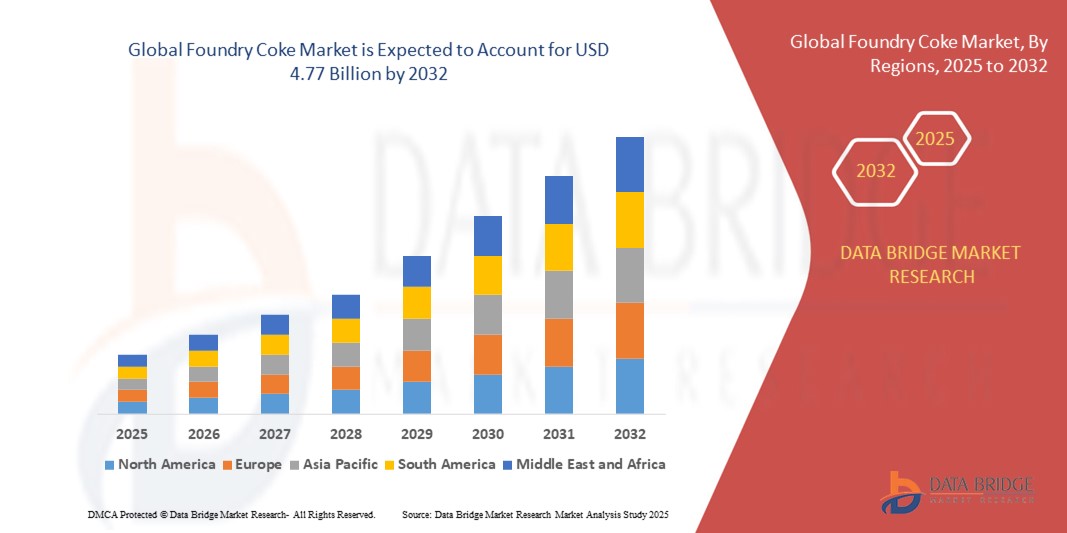

- The global foundry coke market size was valued at USD 3.18 billion in 2024 and is expected to reach USD 4.77 billion by 2032, at a CAGR of 5.2% during the forecast period

- Foundry coke is chiefly used in iron foundries for the production of molten iron. It is the finest source of fuel in a couple of furnaces. It is also used for melting iron as it is used as a carbon source for the melted product. It is used for casting automobile parts, casting machinery and is used for insulation

What are the Major Takeaways of Foundry Coke Market?

- The usage of foundry coke in the cupola furnace is projected to be the key factor driving the foundry coke market forward. The rising global demand for insulating materials is expected to give growth impetus to participants in the foundry coke market during the projected period. The global market is expected to develop in response to rising demand for iron cast components in the automobile industry and the increase in demand for iron casting in the growth of the automotive industry

- Furthermore, the rise of the construction industry, as well as the rapid technological progressions being implemented and the increase in the use of innovative products, are expected to create ample opportunities for the foundry coke market

- Europe dominated the foundry coke market with the largest revenue share of 38.5% in 2024, driven by strong demand from the iron and steel industry and the region’s advanced infrastructure for metal smelting

- The Asia-Pacific foundry coke market is poised to grow at the fastest CAGR of 13.7% from 2025 to 2032, fueled by rapid industrialization, infrastructure development, and rising steel demand in countries such as China, India, and Japan

- The ash content < 8% segment dominated the foundry coke market with the largest revenue share of 46.5% in 2024, owing to its high purity, low impurity levels, and ability to deliver consistent heat in foundry applications

Report Scope and Foundry Coke Market Segmentation

|

Attributes |

Foundry Coke Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Foundry Coke Market?

Shift Towards Sustainable and Low-Emission Production

- A significant and accelerating trend in the global foundry coke market is the transition toward low-emission coke production, driven by stricter environmental regulations and the steel industry’s push to decarbonize. This shift is reshaping operational strategies for coke producers worldwide

- For instance, ArcelorMittal has been investing in cleaner coke oven technologies, focusing on reducing sulfur emissions and enhancing energy recovery from coke plants. Similarly, Nippon Coke & Engineering is developing innovative oven designs that reduce particulate matter and CO2 output, aligning with Japan’s carbon-neutrality goals

- Advancements in production processes are enabling manufacturers to optimize oven efficiency, recycle by-products such as coke oven gas, and minimize environmental footprints. This ensures regulatory compliance and strengthens their long-term competitiveness in the global market

- The adoption of sustainable coke production practices also supports steelmakers who are under pressure to meet climate commitments. For instance, Shanxi Coking Coal Group has integrated waste-heat recovery systems into its coke plants to lower energy intensity

- This trend toward sustainability and green manufacturing is fundamentally reshaping industry dynamics, making eco-friendly foundry coke a critical factor for steel and iron casting industries worldwide

What are the Key Drivers of Foundry Coke Market?

- The growing demand for high-quality casting materials in the iron and steel foundry industry is a major driver for foundry coke, as it provides consistent heat, carbon content, and structural strength for molds

- For instance, in March 2023, Shandong Coking Group announced capacity expansions to meet rising demand from construction and automotive foundries in China, reinforcing the link between industrial growth and coke consumption

- The rise of the construction, automotive, and machinery sectors across developing economies has significantly fueled coke demand, as foundries require steady coke supply for producing cast iron and steel components

- Furthermore, increasing investment in infrastructure projects and industrialization in regions such as India, China, and Southeast Asia is amplifying consumption. The lightweighting trend in automotive production is also indirectly driving foundries to rely on coke for high-grade casting

- The consistent need for high-temperature fuel, combined with the ability of foundry coke to provide metallurgical strength, makes it indispensable, thereby ensuring steady demand growth across industries

Which Factor is Challenging the Growth of the Foundry Coke Market?

- The high environmental impact of coke production, including greenhouse gas emissions and hazardous by-products, remains a significant challenge for the foundry coke market. Strict environmental norms across Europe, the U.S., and China have forced several producers to modernize or shut down inefficient plants

- For instance, in 2022, environmental crackdowns in Shanxi Province, China, led to the closure of multiple small-scale coke plants that failed to meet emission standards, directly impacting supply

- In addition, price volatility of coking coal, the key raw material for foundry coke, continues to affect production economics. Fluctuations in global coal markets, driven by supply disruptions or geopolitical tensions, create cost pressures for coke manufacturers

- The challenge is further intensified by the growing push for alternative low-carbon materials in steel and foundry industries, such as natural gas-based processes or hydrogen technologies. While adoption is still limited, this poses a long-term threat to traditional coke demand

- Overcoming these hurdles will require coke manufacturers to invest in cleaner technologies, efficient raw material sourcing, and carbon mitigation strategies to remain competitive in the evolving global landscape

How is the Foundry Coke Market Segmented?

The market is segmented on the basis of type, furnace size, process, type of metal smelting, and application.

- By Type

On the basis of type, the foundry coke market is segmented into ash content < 8%, 8% < ash content < 10%, and 10% < ash content. The ash content < 8% segment dominated the Foundry Coke market with the largest revenue share of 46.5% in 2024, owing to its high purity, low impurity levels, and ability to deliver consistent heat in foundry applications. This type is widely preferred in producing high-grade pig iron and non-ferrous metals, where quality consistency is critical.

The 8% < ash content < 10% segment is anticipated to witness the fastest CAGR of 6.8% from 2025 to 2032, driven by its cost-effectiveness and balanced performance for medium-grade castings. Growing adoption of this grade in developing markets, where affordability often outweighs absolute purity, supports its strong demand outlook. As industries focus on efficiency and cost optimization, differentiated ash content products are expected to expand adoption across varied foundry applications.

- By Furnace Size

On the basis of furnace size, the foundry coke market is segmented into 600–1200 mm, 1200–1800 mm, and above 1800 mm. The 1200–1800 mm segment dominated the market with the largest revenue share of 41.2% in 2024, as these furnaces are widely used in medium-to-large-scale foundries for producing automotive components, machinery, and structural castings. Their balance of production efficiency, operational flexibility, and relatively lower fuel consumption makes them highly attractive for industrial applications.

The above 1800 mm segment is projected to witness the fastest CAGR of 7.1% from 2025 to 2032, supported by rising demand for large-volume production in heavy industries such as shipbuilding, infrastructure, and steel manufacturing. The segment is also benefiting from technological advancements in furnace designs that improve fuel efficiency and reduce emissions. Overall, the shift toward larger and more efficient furnaces is driving growth in this segment, especially in Asia-Pacific markets with rapid industrial expansion.

- By Process

On the basis of process, the foundry coke market is segmented into beehive process, product recovery process, and others. The product recovery process segment dominated the market with a revenue share of 57.4% in 2024, due to its efficiency in capturing valuable by-products such as tar, ammonia, and benzene, alongside producing high-quality coke. This method also ensures compliance with environmental standards, making it the preferred choice for large-scale industrial operations.

The beehive process segment is expected to witness the fastest CAGR of 5.9% from 2025 to 2032, primarily in developing countries where technological advancements are slower and low-cost, small-scale coke production remains viable. However, the environmental drawbacks of the beehive process continue to limit its adoption in regulated markets. With increasing focus on sustainability, product recovery process is such asly to strengthen its dominance further, while gradual modernization efforts are expected to reduce reliance on traditional beehive coke production globally.

- By Type of Metal Smelting

On the basis of type of metal smelting, the foundry coke market is segmented into pig iron, copper, zinc, lead, tin, and others. The pig iron segment dominated the market with the largest revenue share of 52.8% in 2024, as foundry coke plays a crucial role in iron-making by serving as both a reducing agent and a source of heat. The growing global demand for construction steel, automotive components, and infrastructure materials continues to fuel this segment’s dominance.

The copper smelting segment is projected to grow at the fastest CAGR of 7.4% from 2025 to 2032, driven by surging demand for copper in electrical wiring, renewable energy infrastructure, and electric vehicles. Rising investments in copper-intensive industries across Asia-Pacific and Latin America support this growth. With the dual drivers of construction and electrification, pig iron will remain the backbone of foundry coke demand, while copper emerges as the fastest-expanding smelting segment.

- By Application

On the basis of application, the foundry coke market is segmented into automotive parts casting, machinery casting, insulation, and others. The automotive parts casting segment accounted for the largest revenue share of 44.6% in 2024, owing to rising demand for lightweight and durable vehicle components. Foundry coke is essential in ensuring consistent casting quality, strength, and efficiency in the automotive industry, which remains a major consumer of coke-based foundry processes.

The insulation segment is anticipated to witness the fastest CAGR of 6.7% from 2025 to 2032, driven by the expansion of construction and energy-efficient building projects that require high-grade insulating materials. In addition, machinery casting continues to be a steady demand driver, particularly in heavy equipment and manufacturing industries. As automotive and construction sectors evolve, these applications are expected to shape the future demand landscape, reinforcing the critical role of foundry coke in industrial production.

Which Region Holds the Largest Share of the Foundry Coke Market?

- Europe dominated the foundry coke market with the largest revenue share of 38.5% in 2024, driven by strong demand from the iron and steel industry and the region’s advanced infrastructure for metal smelting. The growing need for high-quality casting in automotive, machinery, and construction sectors continues to propel market expansion

- Consumers and industries in Europe highly value the consistent quality, low ash content, and energy efficiency offered by foundry coke in smelting applications

- This dominance is further supported by stringent environmental regulations, technological innovation in coke production, and the region’s reliance on sustainable, high-grade inputs for industrial processes, positioning foundry coke as a critical material in European heavy industries

U.K. Foundry Coke Market Insight

The U.K. foundry coke market held a significant share in 2024, supported by its strong automotive and machinery casting industries. Foundry coke is widely used in iron foundries across the country, with demand fueled by the need for energy-efficient and durable smelting solutions. Rising investments in green steel and eco-friendly casting technologies are expected to further enhance growth. The U.K.’s industrial modernization and focus on sustainability also continue to encourage the adoption of higher-grade coke.

Germany Foundry Coke Market Insight

The Germany foundry coke market captured the largest share within Europe in 2024, driven by the country’s well-established steel, automotive, and machinery sectors. Germany’s emphasis on innovation and eco-conscious production supports the adoption of low-ash, high-strength coke grades. The country’s leadership in advanced manufacturing technologies, alongside its push for sustainable energy-efficient materials, is fostering significant demand growth. Integration of foundry coke in high-performance industrial processes continues to solidify its importance in the German market.

Which Region is the Fastest Growing Region in the Foundry Coke Market?

The Asia-Pacific foundry coke market is poised to grow at the fastest CAGR of 13.7% from 2025 to 2032, fueled by rapid industrialization, infrastructure development, and rising steel demand in countries such as China, India, and Japan. The availability of low-cost raw materials and the expansion of domestic coke manufacturers are driving both affordability and accessibility across the region.

Japan Foundry Coke Market Insight

The Japan foundry coke market is gaining traction due to the country’s advanced manufacturing culture and strong demand for high-quality casting in automotive and machinery industries. The rising focus on precision engineering, alongside Japan’s push for eco-friendly and efficient smelting processes, is boosting the use of premium-grade foundry coke. Moreover, the country’s reliance on imports for raw materials emphasizes the importance of consistent quality and energy efficiency in coke applications.

China Foundry Coke Market Insight

The China foundry coke market accounted for the largest share within Asia-Pacific in 2024, driven by rapid urbanization, infrastructure projects, and robust demand from the steel and construction sectors. China remains a global hub for coke production, with strong domestic manufacturers supporting both local and export markets. The government’s focus on smart city initiatives and industrial modernization is further encouraging the adoption of efficient and eco-friendly foundry coke, solidifying the country’s leading role in regional market growth.

Which are the Top Companies in Foundry Coke Market?

The foundry coke industry is primarily led by well-established companies, including:

- ArcelorMittal (Luxembourg)

- OKK Koksovny, a.s. (Czech Republic)

- Nippon Coke and Engineering (Japan)

- Walter Energy (U.S.)

- Shandong Coking Group (China)

- ABC Coke (U.S.)

- Shandong Sunshine Focal Electric (China)

- Shanxi Coking Coal Group (China)

- Jiangsu Surun Highcarbon (China)

- GR RESOURCE (China)

- Shanxi Huifeng Xingye Group (China)

- Shanxi Antai (China)

- NalonChem (China)

- Henan Shenhuo (China)

- Weifang Shengheng New Energy (China)

What are the Recent Developments in Global Foundry Coke Market?

- In October 2024, SunCoke Energy renewed its coke supply agreement with U.S. Steel and entered into a new three-year coal handling contract at its Kanawha River terminal, ensuring stable and efficient production of foundry coke used in metal casting operations. This move strengthens the company’s long-term supply stability and reinforces its role in the U.S. foundry coke market

- In June 2024, Tata Steel partnered with SMS group to deploy Paul Wurth Coke Oven Gas injection technology at its Meramandali plant in India, which can reduce coke consumption by around 0.65 kilograms for every kilogram of COG injected, thereby boosting efficiency and sustainability in metal production. This initiative highlights Tata Steel’s commitment to greener manufacturing and resource optimization in the foundry coke sector

- In March 2023, ArcelorMittal invested $50 million to expand its foundry coke production capacity by 30% over a two-year period (2024–2025), with the goal of strengthening its market position in Brazil and supporting regional production growth. This expansion underlines ArcelorMittal’s strategic focus on meeting rising demand across Latin America

- In February 2023, JSW Steel announced plans to establish a new foundry coke facility in India, designed with an annual capacity of 1 million tonnes and scheduled to commence operations before the end of 2025. This project reflects JSW Steel’s ambition to address India’s increasing demand for coke in its metal casting and manufacturing sectors

- In January 2023, Anglo-American unveiled a $100 million investment to boost its foundry coke production capacity in South Africa by 50%, with construction beginning in 2025 and completion shortly thereafter. This initiative demonstrates the company’s commitment to catering to growing regional demand in Africa’s industrial sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Foundry Coke Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Foundry Coke Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Foundry Coke Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.