Global Frozen Drinks Market

Market Size in USD Billion

CAGR :

%

USD

42.24 Billion

USD

68.35 Billion

2024

2032

USD

42.24 Billion

USD

68.35 Billion

2024

2032

| 2025 –2032 | |

| USD 42.24 Billion | |

| USD 68.35 Billion | |

|

|

|

|

Frozen Drinks Market Size

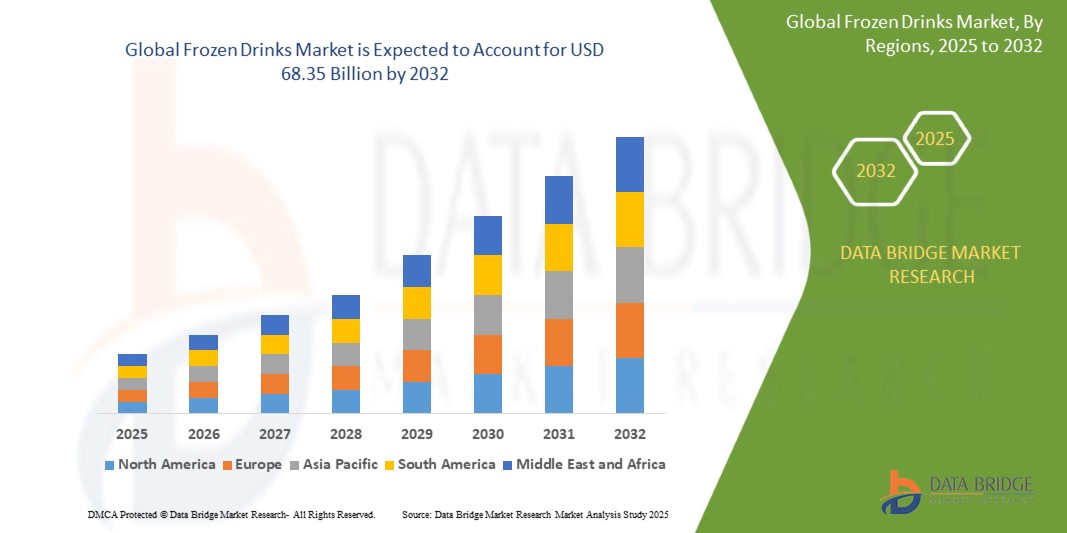

- The global Frozen Drinks market was valued at USD 42.24 billion in 2024 and is expected to reach USD 68.35 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.20%, primarily driven by the increased demand for convenient, refreshing beverages

- This growth is driven by factors such as the growing popularity of frozen beverages in both developed and emerging markets, the rise in consumer preference for novelty and indulgent drinks, and innovative product offerings from manufacturers such as healthier options and seasonal flavour variations

Frozen Drinks Market Analysis

- Frozen drinks are widely consumed in both alcoholic and non-alcoholic forms, catering to diverse consumer preferences. Non-alcoholic frozen beverages are especially popular in cafes and convenience stores

- The primary applications of frozen drinks are seen in bars, restaurants, and cafes, where they are offered as refreshing menu options. These establishments also experiment with unique flavours to attract customers

- The market segmentation includes various product forms such as ice popsicles and freezer pouch drinks, with each form catering to specific consumer needs.

- The increasing demand for innovative frozen drinks, driven by changing consumer preferences, is creating new product development opportunities

- For Instance, some cafes now offer unique frozen cocktails that combine refreshing slushies with alcohol.Globally, Frozen Drinks rank as the second-most crucial piece of equipment in ophthalmic surgical suites, following phacoemulsification systems, and play a pivotal role in ensuring precision and efficacy in eye surgeries

Report Scope and Frozen Drinks Market Segmentation

|

Attributes |

Frozen Drinks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Frozen Drinks Market Trends

“Health and Wellness Focus in Frozen Drinks”

- There's a growing shift towards healthier beverage options, with consumers seeking drinks that offer functional benefits and align with wellness trends

- Frozen drinks are increasingly being formulated with ingredients like turmeric, spirulina, and ashwagandha, known for their health benefits, catering to wellness-focused consumers

- The demand for low- and no-alcohol beverages, such as kava-infused mocktails and kombuchas with mood-enhancing properties, is on the rise, redefining the beverage landscape

- With a global trend towards limiting sugar intake, there's a noticeable shift towards frozen drinks with low calorie counts and natural sweeteners, especially among younger demographics like Gen Z and Millennials Consumers are incorporating functional frozen drinks into their daily routines, seeking options that provide benefits such as enhanced energy, relaxation, or overall wellness

- For instance, Nestlé's 2025 food trends report highlights the growing consumer interest in "little treats," including at-home specialty coffees like ready-to-drink cold foam, reflecting a desire for convenient indulgence

Frozen Drinks Market Dynamics

Driver

“Increasing Demand for Convenient Beverages”

- Modern consumers often seek quick and accessible beverage options to match their hectic schedules

- Frozen beverages offer a convenient and refreshing choice, especially during warmer months, appealing to consumers of all ages

- Young people and millennials are particularly drawn to frozen drinks, aligning with their preference for convenient and indulgent options

- The availability of frozen drinks in various outlets, including convenience stores, cafes, and restaurants, enhances their accessibility to consumers seeking quick refreshment

- Manufacturers are continually introducing new flavors and formulations to cater to the evolving tastes of consumers seeking convenient beverage solutions

Opportunity

“Growth in Emerging Markets”

- Rapid urbanization in regions like Asia Pacific and Latin America increases the demand for convenient, on-the-go beverage options

- Improving economic conditions lead to higher disposable incomes, enabling consumers to spend more on premium frozen drink offerings

- The growth of supermarkets, hypermarkets, and convenience stores in emerging markets enhances the distribution and availability of frozen drinks

- Partnerships between beverage companies and local distributors facilitate deeper market penetration and brand recognition in emerging regions

- The rise of online retailing provides manufacturers with platforms to reach a broader audience, especially in regions with limited physical retail presence

Restraint/Challenge

“Health Concerns over Sugar Content”

- Increased awareness about the health risks associated with high sugar intake, such as obesity and diabetes, leads consumers to seek healthier beverage alternatives

- Governments worldwide are implementing policies like sugar taxes and labeling requirements to curb excessive sugar consumption, impacting the frozen drinks market

- Consumers are gravitating towards low-calorie, sugar-free, and functional drinks, challenging traditional frozen beverage offerings

- To address health concerns, manufacturers must invest in developing healthier frozen drink options, such as reducing sugar content or incorporating natural sweeteners, which may involve additional research and development costs

- Ensuring that healthier frozen drinks maintain appealing taste profiles poses a significant challenge, as consumers may be reluctant to compromise on flavor for health benefits

Frozen Drinks Market Scope

The market is segmented on the basis types, application, and product form

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Product form |

|

Frozen Drinks Market Regional Analysis

“North America is the Dominant Region in the Frozen Drinks Market”

- North America is currently the dominant region in the global frozen drinks market, holding a significant share due to its high consumption rates and advanced infrastructure

- The region benefits from a large presence of both non-alcoholic and alcoholic frozen drinks in restaurants, bars, and convenience stores

- Busy lifestyles in North America drive the demand for convenient beverage options like frozen drinks, especially among millennials

- Consumers in North America have higher disposable incomes, allowing for greater spending on indulgent and premium frozen drink offerings

- Despite competition, North America is projected to maintain its dominant position due to continuous innovation and an expanding retail presence

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific, particularly countries like China and India, is witnessing significant urbanization, leading to a larger consumer base for frozen drinks

- As disposable incomes rise, consumers in the Asia-Pacific region are increasingly purchasing premium beverages, including frozen drinks

- The popularity of frozen beverages is rising rapidly in the region, especially among younger consumers who seek refreshing, on-the-go options

- The region is seeing rapid growth in supermarkets, convenience stores, and e-commerce platforms, making frozen drinks more accessible to a wider audience

- The introduction of region-specific flavors and product innovations contributes to the growing market in Asia-Pacific, driving its rapid growth rate

Frozen Drinks Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Davide Campari-Milano N.V. (Netherlands)

- Diageo PLC (U.K.)

- Halewood Sales (U.K.)

- Asahi Group Holdings, Ltd. (Japan)

- Accolade Wines (Australia)

- Bacardi Limited (Bermuda)

- Mike's Hard Lemonade Co. (U.S.)

- Castel Group (France)

- Suntory Holdings Limited (Japan

- Anheuser-Busch InBev SA/NV (Belgium)

- The Brown-Forman Corporation (U.S.)

- United Brands Company, Inc. (U.S.)

- PernodRicard SA (France)

- The Miller Brewing Company (U.S.)

Latest Developments in Global Frozen Drinks Market

- In 2023, Jubilant FoodWorks unveiled plans to launch 250 new Domino’s outlets and 40-50 Popeye locations in India within 12-18 months, backed by a significant INR 900 crore investment from its accounts. This strategic move aims to bolster the company’s market presence and cater to the increasing demand for quick-service dining options in the region

- In 2023, McDonald’s forged a strategic alliance with Glovo, a delivery platform, with the goal of enhancing customer experience. The partnership focuses on expanding menu choices for consumers on Glovo, improving the McDelivery ordering process through the platform, and ultimately delivering a more comprehensive and satisfying service to customers

- In 2023, Jollibee Foods Corp. announced an ambitious global expansion initiative, aiming to open 600 new stores worldwide by the end of the year. This bold move underscores the company’s commitment to broadening its global footprint and solidifying its position in various markets, reflecting its dedication to sustained growth and market expansion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FROZEN DRINKS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL FROZEN DRINKS MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMAPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 DEMAND AND SUPPLY-SIDE VARIABLES

2.1 CONSUMPTION TREND OF END PRODUCTS

2.11 TOP TO BOTTOM ANALYSIS

2.12 STANDARDS OF MEASUREMENT

2.13 VENDOR SHARE ANALYSIS

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 GLOBAL FROZEN DRINKS MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 EXECUTIVE SUMMARY

6 PREMIUM INSIGHTS

6.1 VALUE CHAIN ANALYSIS

6.2 SUPPLY CHAIN ANALYSIS

6.3 IMPORT-EXPORT ANALYSIS

6.4 PORTER’S FIVE FORCES ANALYSIS

6.4.1 BARGAINING POWER OF SUPPLIERS

6.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

6.4.3 THREAT OF NEW ENTRANTS

6.4.4 THREAT OF SUBSTITUTE PRODUCTS

6.4.5 INTENSITY OF COMPETITIVE RIVALRY

6.5 RAW MATERIAL SOURCING ANALYSIS

6.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

6.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

6.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

6.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

7 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON SUPPLY CHAIN

7.3 IMPACT ON SHIPMENT

7.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

8 REGULATORY FRAMEWORK AND GUIDELINES

9 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

10 PRODUCTION CAPACITY OF KEY MANUFACTURERES

11 BRAND OUTLOOK

11.1 COMPARATIVE BRAND ANALYSIS

11.2 PRODUCT VS BRAND OVERVIEW

12 GLOBAL FROZEN DRINKS MARKET, BY TYPE, (2022-2031) (USD MILLION)

12.1 OVERVIEW

12.2 ALCOHOLIC DRINKS

12.2.1 ALCOHOLIC DRINKS, BY TYPE

12.2.1.1. GIN

12.2.1.2. TEQUILA

12.2.1.3. BEER

12.2.1.4. BRANDY

12.2.1.5. RUM

12.2.1.6. WINE

12.2.1.7. WHISKEY

12.2.1.8. OTHERS

12.2.2 BY ALCOHOL BY VOLUME (ABV) %

12.2.2.1. 3% ABV

12.2.2.2. 5% ABV

12.2.2.3. 6% ABV

12.2.2.4. 7%ABV

12.2.2.5. 8%ABV

12.2.2.6. OTHERS

12.2.3 BY POPULAR DRINKS

12.2.3.1. COSMOPOLITIAN

12.2.3.2. MARTINI

12.2.3.3. MOJITO

12.2.3.4. MARGARITA

12.2.3.5. SANGRIA

12.2.3.6. PINA COLADA

12.2.3.7. SLUSHY

12.2.3.8. MOJITO

12.2.3.9. OTHERS

12.2.4 BY FLAVORS

12.2.4.1. MIXED FLAVORS

12.2.4.2. SINGLE FLAVORS

12.2.4.2.1. APPLE

12.2.4.2.2. PINEAPPLE

12.2.4.2.3. GREEN APPLE

12.2.4.2.4. STRAWBERRY

12.2.4.2.5. RASPBERRY

12.2.4.2.6. BLUEBERRY

12.2.4.2.7. CHERRY

12.2.4.2.8. GINGER

12.2.4.2.9. PEACH

12.2.4.2.10. LEMON

12.2.4.2.11. ORANGE

12.2.4.2.12. MANGO

12.2.4.2.13. COFFEE

12.2.4.2.14. PEAR

12.2.4.2.15. WATERMELON

12.2.4.2.16. COCONUT

12.2.4.2.17. OTHERS

12.3 NON-ALCOHOLIC DRINKS

12.3.1 NON-ALCOHOLIC DRINKS, BY TYPE

12.3.1.1. JUICE

12.3.1.2. SMOOTHIES

12.3.1.3. MOCKTAILS

12.3.1.4. SELTZER

12.3.1.5. LEMONADE

12.3.1.6. LIMEADE

12.3.1.7. SORBET

12.3.1.8. SLUSHY

12.3.2 BY FLAVORS

12.3.2.1. MIXED FLAVORS

12.3.2.2. SINGLE FLAVORS

12.3.2.2.1. APPLE

12.3.2.2.2. PINEAPPLE

12.3.2.2.3. GREEN APPLE

12.3.2.2.4. STRAWBERRY

12.3.2.2.5. RASPBERRY

12.3.2.2.6. BLUEBERRY

12.3.2.2.7. CHERRY

12.3.2.2.8. GINGER

12.3.2.2.9. PEACH

12.3.2.2.10. LEMON

12.3.2.2.11. ORANGE

12.3.2.2.12. MANGO

12.3.2.2.13. COFFEE

12.3.2.2.14. PEAR

12.3.2.2.15. WATERMELON

12.3.2.2.16. COCONUT

12.3.2.2.17. OTHERS

12.4 ALCOHOLIC AND NON-ALCOHOLIC MIX FROZEN DRINKS

12.4.1 BY FLAVORS

12.4.1.1. MIXED FLAVORS

12.4.1.2. SINGLE FLAVORS

12.4.1.2.1. APPLE

12.4.1.2.2. PINEAPPLE

12.4.1.2.3. GREEN APPLE

12.4.1.2.4. STRAWBERRY

12.4.1.2.5. RASPBERRY

12.4.1.2.6. BLUEBERRY

12.4.1.2.7. CHERRY

12.4.1.2.8. GINGER

12.4.1.2.9. PEACH

12.4.1.2.10. LEMON

12.4.1.2.11. ORANGE

12.4.1.2.12. MANGO

12.4.1.2.13. COFFEE

12.4.1.2.14. PEAR

12.4.1.2.15. WATERMELON

12.4.1.2.16. COCONUT

12.4.1.2.17. OTHERS

13 GLOBAL FROZEN DRINKS MARKET, BY PRODUCT FORM, (2022-2031) (USD MILLION)

13.1 OVERVIEW

13.2 ICE POPSICLES

13.3 FREEZER POUCH DRINKS

14 GLOBAL FROZEN DRINKS MARKET, BY FLAVOR, (2022-2031) (USD MILLION)

14.1 OVERVIEW

14.2 MIXED FLAVORS

14.3 SINGLE FLAVORS

14.3.1 APPLE

14.3.2 PINEAPPLE

14.3.3 GREEN APPLE

14.3.4 STRAWBERRY

14.3.5 RASPBERRY

14.3.6 BLUEBERRY

14.3.7 CHERRY

14.3.8 GINGER

14.3.9 PEACH

14.3.10 LEMON

14.3.11 ORANGE

14.3.12 MANGO

14.3.13 COFFEE

14.3.14 PEAR

14.3.15 WATERMELON

14.3.16 COCONUT

14.3.17 OTHERS

15 GLOBAL FROZEN DRINKS MARKET, BY PACKAGING SIZE, (2022-2031) (USD MILLION)

15.1 OVERVIEW

15.2 LESS THAN 100ML

15.3 101-200 ML

15.4 201-300 ML

15.5 301-500ML

15.6 501-700ML

15.7 701-900 ML

15.8 MORE THAN 900ML

16 GLOBAL FROZEN DRINKS MARKET, BY PACKAGING TYPE, (2022-2031) (USD MILLION)

16.1 OVERVIEW

16.2 BOTTLES

16.2.1 GLASS

16.2.2 PLASTIC

16.2.3 METAL

16.2.4 PAPER

16.3 POUCHES

16.4 CANS

16.5 OTHERS

17 GLOBAL FROZEN DRINKS MARKET, BY SUGAR CONTENT, (2022-2031) (USD MILLION)

17.1 OVERVIEW

17.2 REGULR

17.3 LOW SUGAR

17.4 SUGAR FREE

18 GLOBAL FROZEN DRINKS MARKET, BY CATEGORY, (2022-2031) (USD MILLION)

18.1 OVERVIEW

18.2 GMO

18.3 NON-GMO

19 GLOBAL FROZEN DRINKS MARKET, BY DISTRIBUTION CHANNEL, (2022-2031) (USD MILLION)

19.1 OVERVIEW

19.2 STORE BASED RETAILERS

19.2.1 SUPERMARKETS/HYPERMARKETS

19.2.2 GROCERY STORES

19.2.3 CONVENIENCE STORES

19.2.4 SPECIALITY STORES

19.2.5 OTHERS

19.3 NON-STORE RETAILERS

19.3.1 E-COMMERCE RETIAL CHANNELS

19.3.2 COMPANY WEBSITE

20 GLOBAL FROZEN DRINKS MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 MERGERS & ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT & APPROVALS

20.7 EXPANSIONS & PARTNERSHIP

20.8 REGULATORY CHANGES

21 GLOBAL FROZEN DRINKS MARKET, BY GEOGRAPHY, (2022-2031) (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

21.1 NORTH AMERICA

21.1.1 U.S.

21.1.2 CANADA

21.1.3 MEXICO

21.2 EUROPE

21.2.1 GERMANY

21.2.2 U.K.

21.2.3 ITALY

21.2.4 FRANCE

21.2.5 SPAIN

21.2.6 SWITZERLAND

21.2.7 NETHERLANDS

21.2.8 BELGIUM

21.2.9 RUSSIA

21.2.10 TURKEY

21.2.11 REST OF EUROPE

21.3 ASIA-PACIFIC

21.3.1 JAPAN

21.3.2 CHINA

21.3.3 SOUTH KOREA

21.3.4 INDIA

21.3.5 AUSTRALIA

21.3.6 SINGAPORE

21.3.7 THAILAND

21.3.8 INDONESIA

21.3.9 MALAYSIA

21.3.10 PHILIPPINES

21.3.11 REST OF ASIA-PACIFIC

21.4 SOUTH AMERICA

21.4.1 BRAZIL

21.4.2 ARGENTINA

21.4.3 REST OF SOUTH AMERICA

21.5 MIDDLE EAST AND AFRICA

21.5.1 SOUTH AFRICA

21.5.2 UAE

21.5.3 SAUDI ARABIA

21.5.4 KUWAIT

21.5.5 REST OF MIDDLE EAST AND AFRICA

22 SWOT AND DBMR ANALYSIS, GLOBAL FROZEN DRINKS MARKET

23 GLOBAL FROZEN DRINKS MARKET, COMPANY PROFILES

23.1 MANCHESTER DRINKS

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT DEVELOPMENTS

23.2 HARVEST HILL BEVERAGE COMPANY

23.2.1 COMPANY OVERVIEW

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENTS

23.3 KÖLD

23.3.1 COMPANY OVERVIEW

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT DEVELOPMENTS

23.4 ARBOR MIST WINERY

23.4.1 COMPANY OVERVIEW

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 THEICE CO.

23.5.1 COMPANY OVERVIEW

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT DEVELOPMENTS

23.6 THE COCA-COLA COMPANY

23.6.1 COMPANY OVERVIEW

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT DEVELOPMENTS

23.7 PEPSICO

23.7.1 COMPANY OVERVIEW

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENTS

23.8 AMERICAN BEVERAGE CORPORATION

23.8.1 COMPANY OVERVIEW

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 SHOOTER POPS, LLC

23.9.1 COMPANY OVERVIEW

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT DEVELOPMENTS

23.1 LIC

23.10.1 COMPANY OVERVIEW

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT DEVELOPMENTS

23.11 COOLOO

23.11.1 COMPANY OVERVIEW

23.11.2 PRODUCT PORTFOLIO

23.11.3 RECENT DEVELOPMENTS

23.12 POPS

23.12.1 COMPANY OVERVIEW

23.12.2 REVENUE ANALYSIS

23.12.3 PRODUCT PORTFOLIO

23.12.4 RECENT DEVELOPMENTS

23.13 24 ICE

23.13.1 COMPANY OVERVIEW

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENTS

23.14 PUNCHPOPS

23.14.1 COMPANY OVERVIEW

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENTS

23.15 UNILEVER

23.15.1 COMPANY OVERVIEW

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENTS

23.16 ICE DREAMS

23.16.1 COMPANY OVERVIEW

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 RECENT DEVELOPMENTS

23.17 BUZZ POP COCKTAILS

23.17.1 COMPANY OVERVIEW

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 IGLOO'S FROZEN DRINKS

23.18.1 COMPANY OVERVIEW

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 OLD ORCHARD BRANDS, LLC.

23.19.1 COMPANY OVERVIEW

23.19.2 REVENUE ANALYSIS

23.19.3 PRODUCT PORTFOLIO

23.19.4 RECENT DEVELOPMENTS

23.2 NESTLÉ

23.20.1 COMPANY OVERVIEW

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 JEL SERT

23.21.1 COMPANY OVERVIEW

23.21.2 REVENUE ANALYSIS

23.21.3 PRODUCT PORTFOLIO

23.21.4 RECENT DEVELOPMENTS

23.22 JAMBA JUICE FRANCHISOR SPV LLC

23.22.1 COMPANY OVERVIEW

23.22.2 REVENUE ANALYSIS

23.22.3 PRODUCT PORTFOLIO

23.22.4 RECENT DEVELOPMENTS

23.23 DOLE FOOD COMPANY

23.23.1 COMPANY OVERVIEW

23.23.2 REVENUE ANALYSIS

23.23.3 PRODUCT PORTFOLIO

23.23.4 RECENT DEVELOPMENTS

23.24 KERRY GROUP

23.24.1 COMPANY OVERVIEW

23.24.2 REVENUE ANALYSIS

23.24.3 PRODUCT PORTFOLIO

23.24.4 RECENT DEVELOPMENTS

23.25 CANADA DRY MOTT'S INC.

23.25.1 COMPANY OVERVIEW

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT DEVELOPMENTS

23.26 DIAGEO

23.26.1 COMPANY OVERVIEW

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT DEVELOPMENTS

23.27 SNOBAR COCKTAILS

23.27.1 COMPANY OVERVIEW

23.27.2 REVENUE ANALYSIS

23.27.3 PRODUCT PORTFOLIO

23.27.4 RECENT DEVELOPMENTS

23.28 THE ABSOLUT COMPANY

23.28.1 COMPANY OVERVIEW

23.28.2 REVENUE ANALYSIS

23.28.3 PRODUCT PORTFOLIO

23.28.4 RECENT DEVELOPMENTS

NOTE: THE LIST OF COMPANIES IS A TENTATIVE AND THIS CAN BE MODIFIED ACCORDING TO THE CLIENT’S REQUEST AND SUGGESTION.

24 CONCLUSION

25 REFERENCE

26 QUESTIONNAIRE

27 RELATED REPORTS

28 ABOUT DATA BRIDGE MARKET RESEARCH

Global Frozen Drinks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Frozen Drinks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Frozen Drinks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.