Global Frozen Ready Meals Market

Market Size in USD Billion

CAGR :

%

USD

298.90 Billion

USD

455.25 Billion

2024

2032

USD

298.90 Billion

USD

455.25 Billion

2024

2032

| 2025 –2032 | |

| USD 298.90 Billion | |

| USD 455.25 Billion | |

|

|

|

|

Frozen Ready Meals Market Size

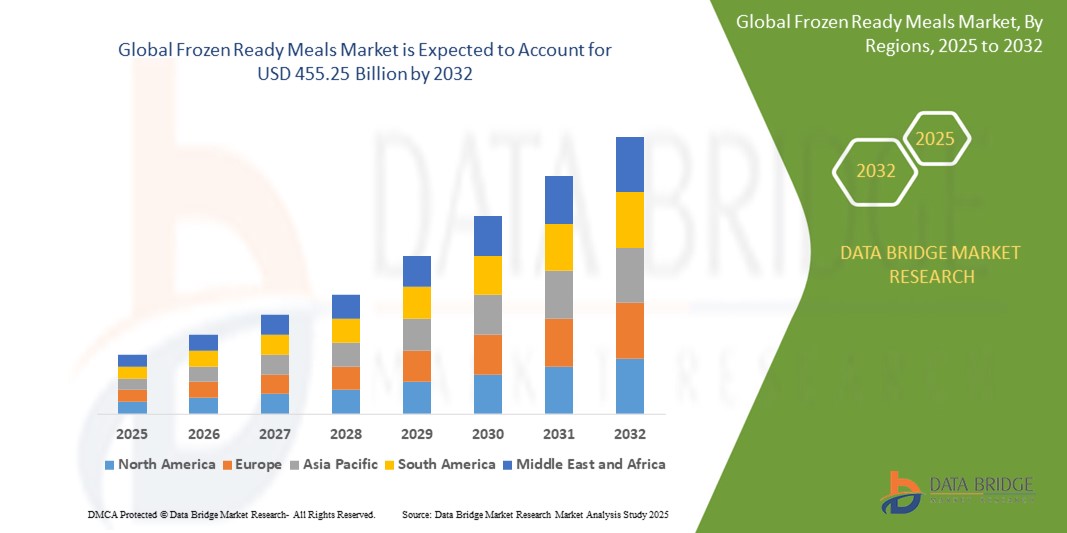

- The global frozen ready meals market size was valued at USD 298.9 billion in 2024 and is expected to reach USD 455.25 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by increasing consumer preference for convenience foods due to busy lifestyles, rising urbanization, and the expanding workforce population seeking time-saving meal options

- Furthermore, advancements in freezing technologies and packaging innovations are enhancing product quality and shelf life, while the growing demand for nutritious, organic, and ready-to-eat frozen options is broadening consumer appeal. These converging factors are accelerating the adoption of frozen ready meals, thereby significantly boosting the industry’s growth

Frozen Ready Meals Market Analysis

- Frozen ready meals are pre-cooked, packaged food products that are preserved through freezing and require minimal preparation before consumption, offering consumers a convenient and time-saving alternative to traditional cooking in both household and commercial foodservice settings

- The rising demand for frozen ready meals is primarily driven by the increasing need for time-efficient meal solutions, growing urban populations, and the expanding consumer inclination toward convenience without compromising on taste or nutrition

- North America dominated the frozen ready meals market with a share of 38.1% in 2024 due to busy lifestyles and a high demand for convenience foods. The region benefits from established retail chains and a wide variety of frozen meal options

- Asia-Pacific is expected to be the fastest growing region in the frozen ready meals market during the forecast period due to increasing urbanization, rising disposable incomes, and a significant shift towards convenience-oriented lifestyles

- Frozen pizza segment dominated the market with a market share of 23.3% in 2024 due to its widespread consumer appeal, convenience, and availability in diverse flavors and formats. Its long shelf life and suitability for quick meals make it a staple in households and food service outlets alike

Report Scope and Frozen Ready Meals Market Segmentation

|

Attributes |

Frozen Ready Meals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Frozen Ready Meals Market Trends

“Rising Demand of Plant-Based Frozen Meals”

- A significant and accelerating trend in the global frozen ready meals market is the rising demand for plant-based options, mirroring a broader shift towards vegetarian and vegan diets for health, ethical, and environmental reasons. This growing consumer preference is prompting manufacturers to diversify their product portfolios to include a wider array of plant-based frozen meals

- For instance, companies such as Amy's Kitchen have long been pioneers in offering a diverse range of vegetarian and vegan frozen meals, including popular options such as lentil soup and vegetable lasagna. Similarly, Gardein, owned by Conagra Brands, specializes in meat-free alternatives that are often featured in frozen ready meal formats such as plant-based beef bowls and meatless chicken tenders

- The increasing demand for plant-based frozen meals is fueled by several factors, including a growing awareness of the health benefits associated with plant-rich diets, such as lower risks of heart disease and certain types of cancer. Ethical considerations regarding animal welfare and the environmental impact of meat production also play a significant role in consumers' choices. Furthermore, advancements in food technology have led to more flavorful and texturally appealing plant-based ingredients, making these meals more attractive to a wider audience

- This trend is not limited to niche brands; major food corporations are also recognizing the potential of the plant-based frozen meal segment and are actively investing in research and development to launch their own meat-free alternatives. The availability of these options across major retail channels is making plant-based frozen meals more accessible to mainstream consumers, further driving the market's expansion

- Consequently, companies such as Nestlé, through its Sweet Earth brand, offer a variety of globally inspired plant-based frozen meals, including bowls and burritos. Similarly, Tofurky provides a range of vegan frozen entrees, catering to the increasing demand for meat-free and dairy-free options in the frozen food aisle

- The demand for frozen ready meals that cater to plant-based diets is growing rapidly across both retail and foodservice sectors, as consumers actively seek convenient and healthy meat-free alternatives. This trend is fundamentally reshaping the frozen food landscape, encouraging innovation and the development of new and exciting plant-based meal options

Frozen Ready Meals Market Dynamics

Driver

“Increasing Demand for Ready-To-Eat Organic Foods”

- The increasing health consciousness among consumers, coupled with a growing preference for foods perceived as natural and free from artificial additives, is a significant driver for the heightened demand for ready-to-eat organic foods within the frozen ready meals market

- For instance, companies such as Amy's Kitchen are well-known for their range of organic frozen meals, catering to consumers seeking healthier and more natural options. Similarly, brands such as Organic Valley offer frozen ready meals made with organic ingredients, including their popular organic mac and cheese bowls

- As consumers become more aware of the potential health benefits of organic foods, such as reduced exposure to pesticides and genetically modified organisms (GMOs), they are increasingly seeking out these options even in convenient formats such as frozen ready meals. This demand reflects a growing commitment to healthier eating habits without sacrificing convenience

- Furthermore, the increasing availability of organic ingredients and advancements in food processing techniques are enabling more manufacturers to enter the organic frozen ready meals market, offering a wider variety of choices to consumers. This growing competition and innovation are making organic options more accessible and appealing to a broader audience

- Consequently, major food companies such as General Mills, through their Cascadian Farm brand, offer organic frozen meal options, including skillet meals and vegetable medleys. In addition, smaller, specialized brands focused on organic and natural foods are further contributing to the growth and diversification of this market segment

- The demand for frozen ready meals made with organic ingredients is growing steadily as consumers increasingly prioritize the nutritional value and perceived safety of organic foods. This trend is encouraging manufacturers to expand their organic product lines and invest in sourcing high-quality organic ingredients to meet this evolving consumer preference

Restraint/Challenge

“Rising Production Costs”

- Concerns surrounding the rising costs of production for food manufacturers pose a significant challenge to the profitability and affordability of frozen ready meals, potentially hindering broader market growth. Fluctuations in the prices of raw ingredients, energy, packaging materials, and transportation directly impact the cost of producing these meals

- For instance, major food companies such as Conagra Brands, which owns brands such as Healthy Choice and Marie Callender's, have noted the impact of increasing commodity costs on their financial performance. Similarly, Nomad Foods, the parent company of Birds Eye, has also indicated the pressures of rising input costs on their frozen food operations

- Addressing these rising production costs through efficient supply chain management, strategic sourcing, and potentially adjusting product pricing becomes crucial for manufacturers. Companies might explore negotiating better deals with suppliers or investing in technologies to optimize their production processes and reduce waste. However, passing these increased costs onto consumers through higher prices can impact demand, particularly among price-sensitive segments

- Overcoming these challenges requires manufacturers to balance cost efficiency with maintaining product quality and value for consumers. Strategies might include product reformulation using more cost-effective ingredients without compromising taste or nutritional value, or exploring alternative packaging solutions

- The need to manage rising production costs effectively is vital for the sustained growth and accessibility of the frozen ready meals market. Manufacturers must innovate in production, sourcing, and pricing strategies to mitigate the impact of these challenges on both their profitability and consumer affordability

Frozen Ready Meals Market Scope

The market is segmented on the basis of type, category, technology, end user, packaging technique, and distribution channel.

- By Type

On the basis of type, the frozen ready meals market is segmented into frozen rice mixes, frozen quinoa food mixes, frozen pizza, frozen pasta, frozen wraps & rolls, frozen snacks, frozen ice cream, frozen yogurt, frozen cakes, frozen sorbet and sherbet, frozen custard, frozen drinks, frozen savory products and frozen soup, frozen dairy products, frozen chicken products, frozen seafood products, and others. The frozen pizza segment dominated the largest market revenue share 23.3% in 2024, driven by its widespread consumer appeal, convenience, and availability in diverse flavors and formats. Its long shelf life and suitability for quick meals make it a staple in households and food service outlets asuch as.

The frozen snacks segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for convenient, on-the-go food options. Busy lifestyles and the rising trend of snacking between meals contribute to the popularity of frozen snacks, with manufacturers introducing healthier and more innovative variants to attract health-conscious consumers.

- By Category

On the basis of category, the market is segmented into organic and conventional. The conventional segment held the largest revenue share in 2024 due to its broad availability and cost-effectiveness. These products cater to the mass market, offering a wide range of flavors and types at accessible price points.

The organic segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing consumer awareness around health, sustainability, and clean-label food products. Increasing preference for additive-free, non-GMO ingredients supports the rising demand for organic frozen ready meals.

- By Technology

On the basis of technology, the market is segmented into flash-freezing/individual quick freezing (IQF), belt freezing, high pressure-assisted freezing, and others. Flash-freezing/IQF held the largest market revenue share in 2024, attributed to its ability to preserve texture, taste, and nutritional content while allowing easy separation of individual food items.

High pressure-assisted freezing is projected to experience the fastest growth rate from 2025 to 2032, as it enhances food safety and quality without chemical preservatives. This technology is increasingly favored by manufacturers seeking to extend shelf life while maintaining freshness and clean-label appeal.

- By End User

On the basis of end user, the market is segmented into the food service sector and households. The household segment accounted for the largest revenue share in 2024, driven by the growing demand for convenient meal solutions, especially among working professionals and busy families. The increasing adoption of frozen meals as quick dinner alternatives supports this trend.

The food service sector is expected to witness the fastest CAGR from 2025 to 2032, as restaurants, cafés, and catering services turn to frozen ready meals for operational efficiency, consistency, and reduced preparation time.

- By Packaging Technique

On the basis of packaging technique, the market is segmented into freezing technique and equipment, and freezing ready meals packaging. The freezing technique and equipment segment dominated the market revenue in 2024, supported by continuous innovation aimed at improving freezing speed and energy efficiency while maintaining product integrity.

Freezing ready meals packaging is anticipated to grow at the fastest pace from 2025 to 2032, propelled by increasing demand for sustainable, convenient, and microwave-safe packaging solutions that align with consumer expectations and regulatory requirements.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into store-based and non-store retailers. Store-based channels held the largest revenue share in 2024, driven by the dominance of supermarkets, hypermarkets, and convenience stores offering wide product visibility and immediate availability.

Non-store retailers are projected to witness the fastest CAGR from 2025 to 2032, owing to the rapid expansion of e-commerce platforms, growing preference for online grocery shopping, and the convenience of home delivery services.

Frozen Ready Meals Market Regional Analysis

- North America dominated the frozen ready meals market with the largest revenue share of 38.1% in 2024, driven by busy lifestyles and a high demand for convenience foods. The region benefits from established retail chains and a wide variety of frozen meal options

- Consumers in North America are increasingly prioritizing health and nutrition, leading to a rise in demand for frozen meals featuring wholesome ingredients such as whole grains, organic vegetables, and lean proteins

- There's a notable surge in demand for frozen vegetarian meals, with brands expanding their offerings to include organic and gourmet options

U.S. Frozen Ready Meals Market Insight

U.S. market captured the largest revenue share in 2024 within North America, with a substantial consumer base that actively seeks convenient meal solutions. The busy schedules of American consumers and a strong preference for ready-to-eat foods drive the demand for frozen options. There is a rising trend of consumers looking for premium frozen meals that offer restaurant-quality experiences at home. Furthermore, the increasing integration of online grocery services and the popularity of meal delivery platforms are making frozen ready meals even more accessible to a wider segment of the population across the United States. Health and wellness trends are significantly influencing product innovation in this market.

Europe Frozen Ready Meals Market Insight

European frozen ready meals market is experiencing significant growth, fueled by increasing urbanization and evolving lifestyles that leave less time for home cooking. Consumers across Europe are drawn to the convenience, affordability, and the extended shelf life offered by frozen meals. Stringent food safety regulations in the region contribute to consumer trust in frozen products. The market caters to diverse tastes and dietary preferences, with a wide range of international cuisines and specific dietary options becoming increasingly available. Furthermore, there is a growing emphasis on sustainable sourcing and packaging within the European frozen food industry, reflecting consumer environmental consciousness.

U.K. Frozen Ready Meals Market Insight

U.K. market demonstrates a strong and growing demand for frozen ready meals, driven by the convenience factor and a desire for easy meal solutions amidst busy work schedules. Concerns regarding food waste also contribute to the popularity of frozen foods due to their longer shelf life. U.K. consumers exhibit a preference for a variety of cuisines and are increasingly seeking out healthier frozen meal options. The well-developed e-commerce and retail infrastructure in the U.K. further supports the accessibility and growth of the frozen ready meals market, with online grocery shopping playing a significant role in consumer purchasing habits.

Germany Frozen Ready Meals Market Insight

German frozen ready meals market is expanding steadily, supported by increasing awareness of the convenience and time-saving benefits of these products. Germany's well-developed infrastructure and emphasis on quality and innovation within the food sector contribute to the market's growth. Consumers in Germany are showing a growing interest in premium and organic frozen ready meal options. The integration of frozen meals into the daily routines of busy professionals and families, coupled with a demand for diverse culinary choices, is a key driver for the continued expansion of this market segment in Germany.

Asia-Pacific Frozen Ready Meals Market Insight

Asia-Pacific frozen ready meals market is poised to grow at the fastest CAGR of 7.4% during the forecast period of 2025 to 2032, fueled by increasing urbanization, rising disposable incomes, and a significant shift towards convenience-oriented lifestyles. Technological advancements in food processing and cold chain logistics are further supporting market growth across countries such as China, Japan, and India. The region's diverse culinary landscape is reflected in the wide variety of frozen ready meal options available to consumers. Government initiatives promoting digitalization and a growing inclination towards smart homes are also indirectly influencing the adoption of convenient food solutions such as frozen meals. The affordability and increasing accessibility of frozen ready meals are key factors propelling market growth in this region.

Japan Frozen Ready Meals Market Insight

Japanese frozen ready meals market is experiencing consistent growth, driven by the country's high-tech culture and rapid urbanization, leading to a demand for convenience and time-saving meal solutions. The increasing number of single-person households and a significant emphasis on efficiency in daily life further contribute to the popularity of frozen options. Japanese consumers place a high value on quality and are increasingly seeking out premium and healthy frozen meal choices. The integration of frozen meals with other convenient food formats and the strong retail sector support the continued expansion of the market in Japan.

China Frozen Ready Meals Market Insight

Chinese frozen ready meals market stands as a major and rapidly evolving market, driven by the country's expanding middle class and accelerated pace of urbanization. High rates of technological adoption, particularly in e-commerce and online grocery platforms, have significantly boosted the accessibility and popularity of frozen ready meals. China's vast consumer base exhibits a growing preference for convenient and ready-to-eat options across residential, commercial, and rental properties. The availability of affordable smart lock options, alongside strong domestic manufacturers and a push towards smart city initiatives, collectively contribute to the market's robust growth trajectory in China.

Frozen Ready Meals Market Share

The frozen ready meals industry is primarily led by well-established companies, including:

The Major Market Leaders Operating in the Market Are:

- McCain Foods Limited (Canada)

- Kraft Heinz (U.S.)

- Kellogg's Company (U.S.)

- Tyson Foods, Inc. (U.S.)

- Nomad Foods (U.K.)

- Grupo Virto (Spain)

- Ajinomoto Co., Inc. (Japan)

- Gulf West Company (Saudi Arabia)

- Sidco Foods Trading L.L.C. (U.A.E.)

- Al Kabeer Group ME (U.A.E.)

- JBS Foods (Brazil)

- Mosaic Foods (U.S.)

- AdvancePierre (U.S.)

- Wawona (U.S.)

- Nestlé (Switzerland)

- General Mills Inc. (U.S.)

- Conagra Brands, Inc. (U.S.)

- Amy's Kitchen, Inc. (U.S.)

- Safco International Gen. Trading Co. L.L.C. (U.A.E.)

- Hakan Agro DMCC (U.A.E.)

- Dr. Oetker (Germany)

- Schwan's Home Delivery (U.S.)

- BRF Global (Brazil)

Latest Developments in Global Frozen Ready Meals Market

- In May 2024, Nestlé introduced a new food line, Vital Pursuit, aimed at supporting weight management for individuals using medications such as Ozempic and Wegovy. These meals are designed with high levels of protein, fiber, and essential nutrients, promoting balanced diets and portion control

- In February 2024, Stouffer’s, a leading brand in frozen foods, launched its Single-Serve White Cheddar Mac & Cheese. This product offers enhanced cooking convenience with five preparation methods: boil-in-bag, microwave, pizza oven/impinger, rapid-cook oven, and steamer

- In December 2023, Chef Anthony Mangieri of Una Pizza Napoletana introduced Genio Della Pizza, a new frozen pizza line. Featuring wood-fired crusts and natural Italian ingredients, the range caters to rising demand for Italian pizza with flavors such as plum tomatoes, buffalo mozzarella, basil, sea salt, flour, and oregano

- In May 2022, Plant-based meat company Redefined Meat expanded into the Italian market with the launch of its frozen meat products, strengthening its footprint in the European region due to its significant global market presence

- In April 2022, Prasuma, one of India’s top frozen meat brands, expanded its product line by introducing new frozen snacks, including chicken nuggets, vegetarian and chicken spring rolls, and other snack options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Frozen Ready Meals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Frozen Ready Meals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Frozen Ready Meals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.