Global Fruit Flavoured Syrups Market

Market Size in USD Billion

CAGR :

%

USD

27.52 Billion

USD

41.44 Billion

2024

2032

USD

27.52 Billion

USD

41.44 Billion

2024

2032

| 2025 –2032 | |

| USD 27.52 Billion | |

| USD 41.44 Billion | |

|

|

|

|

Fruit Flavoured Syrups Market Size

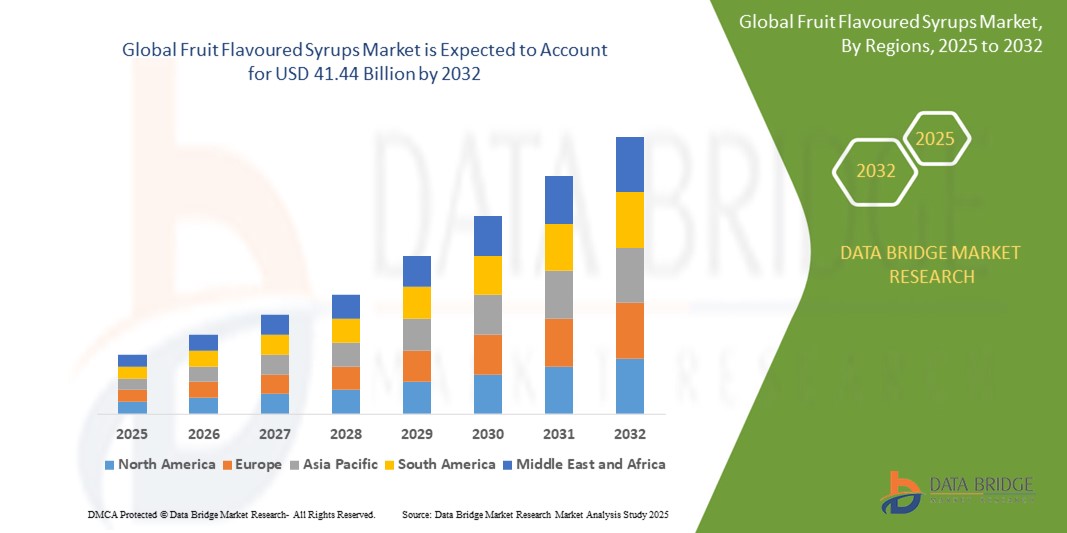

- The global fruit flavoured syrups market size was valued at USD 27.52 billion in 2024 and is expected to reach USD 41.44 billion by 2032, at a CAGR of 5.25% during the forecast period

- The market growth is largely fueled by increasing consumer demand for flavored and convenient food and beverage products, supported by shifting dietary preferences toward fruit-based ingredients across both developed and emerging economies

- Furthermore, rising application of fruit flavoured syrups in beverages, bakery, dairy, and desserts, along with the growing popularity of café culture, artisanal drinks, and ready-to-eat products, is driving widespread adoption across foodservice and retail sectors. These converging factors are accelerating the uptake of fruit flavoured syrups, thereby significantly boosting the industry's growth

Fruit Flavoured Syrups Market Analysis

- Fruit flavoured syrups, used to enhance the taste and appeal of beverages, desserts, and various food products, are increasingly vital components in the food and beverage industry due to their versatility, ease of use, and consumer preference for fruity, indulgent flavors across both household and commercial settings

- The escalating demand for fruit flavoured syrups is primarily fueled by the rising consumption of flavored beverages, the growth of café culture and dessert parlors, and a growing inclination toward natural, fruit-based, and clean-label ingredients in modern food formulations

- North America dominated the fruit flavoured syrups market with a share of 34.3% in 2024, due to strong consumer demand for flavored beverages, desserts, and convenience-based food products across both retail and foodservice sectors

- Asia-Pacific is expected to be the fastest growing region in the fruit flavoured syrups market during the forecast period due to rapid urbanization, rising disposable income, and increasing Western influence on dietary preferences in countries such as China, India, and Japan

- Sweet segment dominated the market with a market share of 48.7% in 2024, due to its dominant role in flavoring applications across a wide array of categories such as carbonated beverages, ice creams, yogurts, baked goods, and candies. Consumers across all age groups prefer sweet-tasting products, and fruit syrups with sweet flavor profiles—such as mango, strawberry, or peach—fit naturally into this preference. The consistent consumer demand for indulgent, sugary treats, along with their nostalgic and comfort-driven appeal, reinforces the growth of sweet syrups

Report Scope and Fruit Flavoured Syrups Market Segmentation

|

Attributes |

Fruit Flavoured Syrups Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fruit Flavoured Syrups Market Trends

“Expanding Bakery and Confectionery Sector”

- A significant and accelerating trend in the global fruit flavoured syrups market is the expanding bakery and confectionery sector, which is increasingly incorporating these syrups to enhance product variety, flavor profiles, and consumer appeal. The demand for unique, fruit-infused offerings in pastries, cakes, candies, and chocolates is growing steadily across retail and artisanal segments

- For instance, leading bakery chains and premium dessert brands are using strawberry, mango, and mixed berry syrups to innovate layered cakes, glazed toppings, and filled confections that cater to evolving taste preferences

- Fruit flavoured syrups provide consistent flavor, color, and aroma, making them a preferred ingredient in bakery and confectionery applications, especially as consumer interest rises in exotic, seasonal, and natural fruit flavors

- Moreover, syrups with clean-label claims and natural fruit extracts are aligning well with the growing trend toward healthier indulgence, driving their adoption among manufacturers aiming to meet consumer expectations without compromising on taste

- This trend is further reinforced by seasonal product launches and limited-edition flavor lines in both premium and mass-market segments, where fruit syrups serve as cost-effective yet impactful solutions for differentiation and customer engagement

- The widespread use of fruit flavoured syrups in bakery and confectionery is fundamentally reshaping product development strategies, encouraging continuous flavor innovation and contributing significantly to the growth of the global market

Fruit Flavoured Syrups Market Dynamics

Driver

“Growing Demand for Customizable Beverages and Foods”

- The growing demand for customizable beverages and foods is a significant driver for the rising consumption of fruit flavoured syrups across both foodservice and retail sectors

- For instance, major café chains and fast-casual restaurants are increasingly offering personalized drink and dessert options, allowing consumers to select from a wide range of fruit syrups to tailor flavors, sweetness levels, and combinations to their individual tastes. Brands such as Starbucks and Costa Coffee have expanded their use of syrups in seasonal and made-to-order beverages, boosting overall demand

- As consumers continue to seek unique, experiential, and personalized food and drink experiences, fruit flavoured syrups provide an easy-to-use, versatile solution that enhances menu diversity and customer satisfaction across smoothies, milkshakes, sodas, cocktails, and frozen desserts

- The ability of fruit flavoured syrups to deliver consistent flavor, color, and aroma across a wide variety of recipes makes them an ideal ingredient for brands and consumers looking to craft distinctive, made-to-order culinary creations

- This demand for personalization is pushing manufacturers to expand their portfolios with a broader range of fruit flavors, low-sugar or organic variants, and regionally inspired syrups, contributing significantly to the growth of the global fruit flavoured syrups market

Restraint/Challenge

“Health Concerns Over Sugar Content”

- Health concerns over sugar content present a significant challenge to the fruit flavoured syrups market, as consumers become increasingly aware of the negative health effects associated with excessive sugar intake, including obesity, diabetes, and cardiovascular diseases

- For instance, regulatory bodies in regions such as Europe and North America are implementing stricter labeling requirements and sugar taxes, which discourage the consumption of high-sugar products and push food manufacturers to reformulate or reduce sugar content in their offerings

- This shift in consumer preferences toward low-sugar, sugar-free, or naturally sweetened alternatives places pressure on syrup manufacturers to innovate without compromising on flavor, texture, or shelf life. Companies are now investing in R&D to develop syrups with natural sweeteners such as stevia or fruit concentrates, which may increase production costs and affect profit margins

- Moreover, the perception of syrups as indulgent or non-essential additives in health-conscious diets further limits their appeal among fitness-focused or wellness-oriented consumers

- Overcoming these challenges will require manufacturers to strike a balance between indulgence and health, improve labeling transparency, and diversify their product portfolios with low-sugar or functional syrup variants to remain competitive in an increasingly health-driven market landscape

Fruit Flavoured Syrups Market Scope

The market is segmented on the basis of product type, flavor type, application, and distribution channel.

• By Product Types

On the basis of product type, the fruit flavoured syrups market is segmented into strawberry, apple, grape, and others. The strawberry segment dominated the market with the largest revenue share in 2024, attributed to its broad consumer appeal, high familiarity, and compatibility across multiple product categories such as desserts, beverages, dairy, and bakery items. Strawberry syrups are frequently used by both household consumers and food manufacturers due to their bright red color, naturally sweet taste, and ability to enhance both visual and sensory aspects of food products. Furthermore, their strong association with indulgence and seasonal offerings such as milkshakes, pancakes, and sundaes strengthens their year-round demand.

The apple segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by growing consumer interest in healthier and natural fruit profiles. Apple syrups, especially those derived from green or red apples, provide a subtle and crisp flavor suited for a range of culinary applications from breakfast toppings to sauces and beverage concentrates. Increasing demand for reduced-sugar and organic variants of apple-based products is encouraging manufacturers to innovate and promote apple syrups as a clean-label, versatile alternative to artificial sweeteners.

• By Flavor Type

On the basis of flavor type, the market is segmented into salty, sour, mint, savoury, and sweet. The sweet segment accounted for the largest revenue share of 48.7% in 2024 due to its dominant role in flavoring applications across a wide array of categories such as carbonated beverages, ice creams, yogurts, baked goods, and candies. Consumers across all age groups prefer sweet-tasting products, and fruit syrups with sweet flavor profiles—such as mango, strawberry, or peach—fit naturally into this preference. The consistent consumer demand for indulgent, sugary treats, along with their nostalgic and comfort-driven appeal, reinforces the growth of sweet syrups.

The sour segment is expected to exhibit the highest CAGR from 2025 to 2032, supported by the rising popularity of bold, zesty, and tangy flavors, particularly among younger consumers and urban populations. Sour fruit syrups such as lemon, tamarind, and berry blends are being increasingly incorporated into functional beverages, sports drinks, and experimental desserts. As the health-conscious segment seeks alternatives with lower sweetness levels and a refreshing edge, sour syrups are being positioned as ideal choices for hydration-focused and taste-forward applications.

• By Application

On the basis of application, the fruit flavoured syrups market is segmented into bakery and confectionery, beverages, dairy and frozen desserts, food, pharmaceuticals, and others. The beverages segment led the market in 2024 in terms of revenue share, owing to the widespread use of fruit syrups in flavored water, carbonated drinks, cocktails, tea infusions, and smoothie bases. Foodservice establishments, including cafés and quick-service restaurants, are major contributors to this demand as they consistently introduce new fruit-flavored drink offerings. The rising trend of health-conscious drinks using natural flavoring agents also accelerates the use of fruit syrups in functional and ready-to-drink beverages.

The dairy and frozen desserts segment is forecasted to grow at the fastest rate from 2025 to 2032, propelled by increased consumption of flavored milk, yogurt, ice cream, and frozen treats in both developed and emerging markets. Fruit syrups offer convenient, consistent, and customizable options for producers to create a wide variety of taste profiles while maintaining texture and color. The evolving consumer preference for value-added dairy products and premium frozen desserts, often marketed with natural or real fruit content, continues to push innovation in this segment.

• By Distribution Channel

On the basis of distribution channel, the market is divided into online and offline. The offline segment held the largest revenue share in 2024, driven by the extensive reach of supermarkets, hypermarkets, departmental stores, and specialty food retailers. These outlets provide the advantage of physical inspection, immediate availability, and promotional discounts, influencing consumer buying decisions. Retail shelf placement also plays a crucial role in product visibility and brand competition. In developing regions, offline channels remain dominant due to limited digital infrastructure and consumer preference for traditional shopping experiences.

The online segment is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by the rapid expansion of e-commerce platforms, increased internet penetration, and changing consumer habits favoring convenience and doorstep delivery. Online platforms allow consumers to explore a broader variety of brands, including premium, organic, and artisanal syrups that may not be available in physical stores. The rise of food bloggers, recipe influencers, and D2C food brands has further amplified the demand for unique and niche fruit syrups sold online. Subscription models and digital promotions are also creating long-term brand-consumer engagement in the online space.

Fruit Flavoured Syrups Market Regional Analysis

- North America dominated the fruit flavoured syrups market with the largest revenue share of 34.3% in 2024, driven by strong consumer demand for flavored beverages, desserts, and convenience-based food products across both retail and foodservice sectors

- The popularity of flavored coffee, smoothies, and frozen desserts, along with an increased preference for natural and fruit-based sweeteners, contributes significantly to syrup consumption in the region

- The presence of leading food and beverage brands, a robust distribution network, and high consumer spending on premium and indulgent food products support sustained growth across multiple applications

U.S. Fruit Flavoured Syrups Market Insight

The U.S. fruit flavoured syrups market captured the largest revenue share in 2024 within North America, fueled by the widespread use of syrups in cafés, quick-service restaurants, and at-home gourmet cooking. The strong culture of flavored beverages, from bubble tea to craft sodas, continues to drive innovation and volume. In addition, the growing trend of clean-label and organic syrups, along with the expansion of health-conscious fruit blends, is reshaping consumer preference and spurring product diversification across both online and offline channels.

Europe Fruit Flavoured Syrups Market Insight

The Europe fruit flavoured syrups market is projected to grow at a steady CAGR throughout the forecast period, supported by increasing demand for fruit-based ingredients in bakery, dairy, and alcoholic beverages. Consumers are leaning toward premium, authentic fruit flavors with lower sugar content and natural origins. Regulatory support for clean-label products and a strong tradition of artisanal food preparation are encouraging syrup manufacturers to innovate with regionally inspired fruit blends and sustainable formulations.

U.K. Fruit Flavoured Syrups Market Insight

The U.K. market is expected to expand at a notable CAGR, driven by rising consumer interest in customizable beverages, flavored milk alternatives, and artisanal dessert toppings. The growing café culture, combined with increased demand for vegan and plant-based products, supports the use of fruit syrups in non-dairy applications. Digital grocery platforms and e-commerce penetration are also accelerating product availability and experimentation with diverse flavor profiles.

Germany Fruit Flavoured Syrups Market Insight

The Germany market is gaining momentum due to its high focus on food innovation, natural ingredient sourcing, and seasonal fruit use in culinary applications. The growing trend of low-calorie and functional food items is prompting manufacturers to offer syrups made with real fruit extracts and reduced sugar. Germany’s established food processing industry, emphasis on product quality, and strong retail infrastructure are instrumental in supporting steady market development.

Asia-Pacific Fruit Flavoured Syrups Market Insight

The Asia-Pacific market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, rising disposable income, and increasing Western influence on dietary preferences in countries such as China, India, and Japan. The expanding café and dessert chains, along with a growing preference for colorful, fruit-flavored toppings and beverages among younger consumers, are stimulating demand. Moreover, APAC's strength as a manufacturing hub ensures cost-effective production and accessibility of syrups across diverse price points.

Japan Fruit Flavoured Syrups Market Insight

The Japan market is witnessing robust growth due to a strong tradition of seasonal fruit usage, aesthetic food presentation, and high consumer demand for convenience. Syrups are increasingly being incorporated in traditional desserts, bubble tea, and frozen snacks. The aging population is also influencing the market, with increased interest in low-sugar, natural fruit syrup products that offer both flavor and nutritional benefits.

China Fruit Flavoured Syrups Market Insight

China accounted for the largest revenue share in the Asia-Pacific market in 2024, supported by a growing middle class, booming foodservice industry, and high penetration of flavored beverages. The popularity of fruit teas, milk-based drinks, and dessert cafés is fueling large-scale adoption of fruit flavoured syrups. Domestic production capabilities, a digitally driven retail environment, and increasing demand for premium and exotic fruit flavors are contributing to sustained market growth in the country.

Fruit Flavoured Syrups Market Share

The fruit flavoured syrups industry is primarily led by well-established companies, including:

- MONIN INCORPORATED (France)

- Torani (U.S.)

- THE HERSHEY COMPANY (U.S.)

- Kerry Inc. (Ireland)

- FDL Ltd (U.K.)

- Archer Daniels Midland Company (U.S.)

- The J.M. Smucker Company (U.S.)

- PANOS brands (U.S.)

- Sonoma Syrup Co. (U.S.)

- Sensient Technologies Corporation (U.S.)

- Toschi Vignola s.r.l (Italy)

Latest Developments in Global Fruit Flavoured Syrups Market

- In April 2024, Torani, a leader in the flavor industry for nearly a century, expanded its diverse portfolio by launching the Dragon Fruit Syrup. This product introduction reflects the growing market demand for exotic and tropical flavors, catering to evolving consumer preferences and supporting innovation across the beverage and dessert sectors

- In November 2022, MONIN launched its Le Crush de MONIN line featuring Strawberry, Pineapple, and Mango flavors, aimed at culinary professionals and mixologists. This expansion enhances the availability of premium, ready-to-use fruit syrup options, stimulating creativity in applications and driving growth in the high-end foodservice and hospitality segments

- In June 2022, Fuerst Day Lawson Ltd.'s acquisition of Quest Ingredients Ltd. marked a strategic move to expand its flavor and botanical extract capabilities. This acquisition strengthens FDL’s market presence in Europe and the U.S., enabling broader product offerings and accelerating its competitive positioning in the global fruit flavoured syrups market

- In May 2022, Kerry opened a new manufacturing facility in KwaZulu-Natal, South Africa, to support the production of nutritious food solutions across the continent. This development promotes regional manufacturing capacity and supports the availability of fruit syrups tailored to local tastes, contributing to the market’s geographic expansion in Africa

- In 2022, Singing Dog Vanilla introduced an organic vanilla syrup, targeting health-conscious consumers seeking clean-label and natural ingredient products. The launch aligns with rising demand for organic and sustainable syrup variants, boosting product diversification and appealing to the wellness-driven segment of the market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FRUIT FLAVOURED SYRUPS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FRUIT FLAVOURED SYRUPS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FRUIT FLAVOURED SYRUPS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, BY FRUIT SYRUP BASE INGREDIENT

11.1 OVERVIEW

11.2 MAPLE SYRUP

11.2.1 MAPLE SYRUP, BY FLAVOR

11.2.1.1. ORANGE

11.2.1.2. GRAPE

11.2.1.3. PLUM

11.2.1.4. POMEGRANTE

11.2.1.5. MELON

11.2.1.6. APPLE

11.2.1.7. MANGO

11.2.1.8. LEMON

11.2.1.9. PINEAPPLE

11.2.1.10. PEACH

11.2.1.11. KIWI

11.2.1.12. PASSION FRUIT

11.2.1.13. BANANA

11.2.1.14. CHERRY

11.2.1.15. BERRY

11.2.1.16. OTHERS

11.3 CANE SUGAR SYRUP

11.3.1 CANE SUGAR SYRUP, BY FLAVOR

11.3.1.1. ORANGE

11.3.1.2. GRAPE

11.3.1.3. PLUM

11.3.1.4. POMEGRANTE

11.3.1.5. MELON

11.3.1.6. APPLE

11.3.1.7. MANGO

11.3.1.8. LEMON

11.3.1.9. PINEAPPLE

11.3.1.10. PEACH

11.3.1.11. KIWI

11.3.1.12. PASSION FRUIT

11.3.1.13. BANANA

11.3.1.14. CHERRY

11.3.1.15. BERRY

11.3.1.16. OTHERS

11.4 SUCROSE SYRUP

11.4.1 SUCROSE SYRUP, BY FLAVOR

11.4.1.1. ORANGE

11.4.1.2. GRAPE

11.4.1.3. PLUM

11.4.1.4. POMEGRANTE

11.4.1.5. MELON

11.4.1.6. APPLE

11.4.1.7. MANGO

11.4.1.8. LEMON

11.4.1.9. PINEAPPLE

11.4.1.10. PEACH

11.4.1.11. KIWI

11.4.1.12. PASSION FRUIT

11.4.1.13. BANANA

11.4.1.14. CHERRY

11.4.1.15. BERRY

11.4.1.16. OTHERS

11.5 SYNTHETIC SUGAR SYRUP

11.5.1 SYNTHETIC SUGAR SYRUP, BY FLAVOR

11.5.1.1. ORANGE

11.5.1.2. GRAPE

11.5.1.3. PLUM

11.5.1.4. POMEGRANTE

11.5.1.5. MELON

11.5.1.6. APPLE

11.5.1.7. MANGO

11.5.1.8. LEMON

11.5.1.9. PINEAPPLE

11.5.1.10. PEACH

11.5.1.11. KIWI

11.5.1.12. PASSION FRUIT

11.5.1.13. BANANA

11.5.1.14. CHERRY

11.5.1.15. BERRY

11.5.1.16. OTHERS

11.6 CORN SYRUP

11.6.1 CORN SYRUP, BY FLAVOR

11.6.1.1. ORANGE

11.6.1.2. GRAPE

11.6.1.3. PLUM

11.6.1.4. POMEGRANTE

11.6.1.5. MELON

11.6.1.6. APPLE

11.6.1.7. MANGO

11.6.1.8. LEMON

11.6.1.9. PINEAPPLE

11.6.1.10. PEACH

11.6.1.11. KIWI

11.6.1.12. PASSION FRUIT

11.6.1.13. BANANA

11.6.1.14. CHERRY

11.6.1.15. BERRY

11.6.1.16. OTHERS

11.7 OTHERS

12 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, BY FRUIT FLAVOR

12.1 OVERVIEW

12.2 ORANGE

12.3 GRAPE

12.4 PLUM

12.5 POMEGRANTE

12.6 MELON

12.7 APPLE

12.8 MANGO

12.9 LEMON

12.1 PINEAPPLE

12.11 PEACH

12.12 KIWI

12.13 PASSION FRUIT

12.14 BANANA

12.15 CHERRY

12.16 BERRY

12.16.1 STRAWBERRY

12.16.2 BLUEBERRY

12.16.3 RASPBERRY

12.16.4 BLACKBERRY

12.16.5 OTHERS

12.17 OTHERS

13 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, BY SWEETNESS CATEGORY

13.1 OVERVIEW

13.2 SWEETENED (REGULAR/WITH SUGAR)

13.3 UNSWEETNED ( NO SUGAR ADDED)

13.4 REDUCED SUGAR (LOW SUGAR CONTENT)

14 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, BY CATEGORY

14.1 OVERVIEW

14.2 CONVENTIONAL

14.3 ORGANIC

15 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, BY BRAND

15.1 OVERVIEW

15.2 BRANDED

15.3 PRIVATE LABEL

16 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, BY PACKAGING TYPE

16.1 OVERVIEW

16.2 JAR

16.2.1 GLASS JAR

16.2.2 PLASTIC JARS

16.3 POUCHES

16.4 BOTTLES

16.4.1 PLASTIC BOTLLES

16.4.2 GLASS BOTTLES

16.5 OTHERS

17 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, BY PACKAGING SIZE

17.1 OVERVIEW

17.2 LESS THAN 100 ML

17.3 100-200 ML

17.4 201 – 300 ML

17.5 301 – 500 ML

17.6 501 – 700 ML

17.7 701 – 1000 ML

17.8 MORE THAN 1000 ML

18 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 DIRECT

18.3 INDIRECT

19 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 MERGERS & ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT & APPROVALS

19.7 EXPANSIONS & PARTNERSHIP

19.8 REGULATORY CHANGES

20 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, BY GEOGRAPHY

20.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

20.2 NORTH AMERICA

20.2.1 U.S.

20.2.2 CANADA

20.2.3 MEXICO

20.3 EUROPE

20.3.1 GERMANY

20.3.2 U.K.

20.3.3 ITALY

20.3.4 FRANCE

20.3.5 SPAIN

20.3.6 SWITZERLAND

20.3.7 NETHERLANDS

20.3.8 BELGIUM

20.3.9 RUSSIA

20.3.10 TURKEY

20.3.11 REST OF EUROPE

20.4 ASIA-PACIFIC

20.4.1 JAPAN

20.4.2 CHINA

20.4.3 SOUTH KOREA

20.4.4 INDIA

20.4.5 AUSTRALIA

20.4.6 SINGAPORE

20.4.7 THAILAND

20.4.8 INDONESIA

20.4.9 MALAYSIA

20.4.10 PHILIPPINES

20.4.11 REST OF ASIA-PACIFIC

20.5 SOUTH AMERICA

20.5.1 BRAZIL

20.5.2 ARGENTINA

20.5.3 REST OF SOUTH AMERICA

20.6 MIDDLE EAST AND AFRICA

20.6.1 SOUTH AFRICA

20.6.2 UAE

20.6.3 SAUDI ARABIA

20.6.4 KUWAIT

20.6.5 REST OF MIDDLE EAST AND AFRICA

21 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, SWOT & DBMR ANALYSIS

22 GLOBAL FRUIT FLAVOURED SYRUPS MARKET, COMPANY PROFILE

22.1 AMORETTI

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 GEOGRAPHICAL PRESENCE

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENTS

22.2 MONIN

22.2.1 COMPANY OVERVIEW

22.2.2 REVENUE ANALYSIS

22.2.3 GEOGRAPHICAL PRESENCE

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 SONOMA SYRUP CO.

22.3.1 COMPANY OVERVIEW

22.3.2 REVENUE ANALYSIS

22.3.3 GEOGRAPHICAL PRESENCE

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 R. TORRE & COMPANY & WORLDPANTRY, INC

22.4.1 COMPANY OVERVIEW

22.4.2 REVENUE ANALYSIS

22.4.3 GEOGRAPHICAL PRESENCE

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 DAVINCI GOURMET

22.5.1 COMPANY OVERVIEW

22.5.2 REVENUE ANALYSIS

22.5.3 GEOGRAPHICAL PRESENCE

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 SMALL HAND FOODS

22.6.1 COMPANY OVERVIEW

22.6.2 REVENUE ANALYSIS

22.6.3 GEOGRAPHICAL PRESENCE

22.6.4 PRODUCT PORTFOLIO

22.6.5 RECENT DEVELOPMENTS

22.7 TOP HAT PROVISIONS

22.7.1 COMPANY OVERVIEW

22.7.2 REVENUE ANALYSIS

22.7.3 GEOGRAPHICAL PRESENCE

22.7.4 PRODUCT PORTFOLIO

22.7.5 RECENT DEVELOPMENTS

22.8 SKINNY MIXES

22.8.1 COMPANY OVERVIEW

22.8.2 REVENUE ANALYSIS

22.8.3 GEOGRAPHICAL PRESENCE

22.8.4 PRODUCT PORTFOLIO

22.8.5 RECENT DEVELOPMENTS

22.9 SWEET TREE HOLDINGS, LLC

22.9.1 COMPANY OVERVIEW

22.9.2 REVENUE ANALYSIS

22.9.3 GEOGRAPHICAL PRESENCE

22.9.4 PRODUCT PORTFOLIO

22.9.5 RECENT DEVELOPMENTS

22.1 BRISTOL SYRUP COMPANY

22.10.1 COMPANY OVERVIEW

22.10.2 REVENUE ANALYSIS

22.10.3 GEOGRAPHICAL PRESENCE

22.10.4 PRODUCT PORTFOLIO

22.10.5 RECENT DEVELOPMENTS

22.11 BLOSSOMS SYRUP LTD

22.11.1 COMPANY OVERVIEW

22.11.2 REVENUE ANALYSIS

22.11.3 GEOGRAPHICAL PRESENCE

22.11.4 PRODUCT PORTFOLIO

22.11.5 RECENT DEVELOPMENTS

22.12 THE RAINBOW SYRUP COMPANY

22.12.1 COMPANY OVERVIEW

22.12.2 REVENUE ANALYSIS

22.12.3 GEOGRAPHICAL PRESENCE

22.12.4 PRODUCT PORTFOLIO

22.12.5 RECENT DEVELOPMENTS

22.13 ARKADIA BEVERAGES

22.13.1 COMPANY OVERVIEW

22.13.2 REVENUE ANALYSIS

22.13.3 GEOGRAPHICAL PRESENCE

22.13.4 PRODUCT PORTFOLIO

22.13.5 RECENT DEVELOPMENTS

22.14 CASHMERE SYRUPS

22.14.1 COMPANY OVERVIEW

22.14.2 REVENUE ANALYSIS

22.14.3 GEOGRAPHICAL PRESENCE

22.14.4 PRODUCT PORTFOLIO

22.14.5 RECENT DEVELOPMENTS

22.15 THE HERSHEY COMPANY

22.15.1 COMPANY OVERVIEW

22.15.2 REVENUE ANALYSIS

22.15.3 GEOGRAPHICAL PRESENCE

22.15.4 PRODUCT PORTFOLIO

22.15.5 RECENT DEVELOPMENTS

22.16 WALMART

22.16.1 COMPANY OVERVIEW

22.16.2 REVENUE ANALYSIS

22.16.3 GEOGRAPHICAL PRESENCE

22.16.4 PRODUCT PORTFOLIO

22.16.5 RECENT DEVELOPMENTS

22.17 MW POLAR

22.17.1 COMPANY OVERVIEW

22.17.2 REVENUE ANALYSIS

22.17.3 GEOGRAPHICAL PRESENCE

22.17.4 PRODUCT PORTFOLIO

22.17.5 RECENT DEVELOPMENTS

22.18 DOLE FOOD COMPANY

22.18.1 COMPANY OVERVIEW

22.18.2 REVENUE ANALYSIS

22.18.3 GEOGRAPHICAL PRESENCE

22.18.4 PRODUCT PORTFOLIO

22.18.5 RECENT DEVELOPMENTS

22.19 DEL MONTE FOODS

22.19.1 COMPANY OVERVIEW

22.19.2 REVENUE ANALYSIS

22.19.3 GEOGRAPHICAL PRESENCE

22.19.4 PRODUCT PORTFOLIO

22.19.5 RECENT DEVELOPMENTS

22.2 OREGON GROWERS

22.20.1 COMPANY OVERVIEW

22.20.2 REVENUE ANALYSIS

22.20.3 GEOGRAPHICAL PRESENCE

22.20.4 PRODUCT PORTFOLIO

22.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23 RELATED REPORTS

24 CONCLUSION

25 QUESTIONNAIRE

26 ABOUT DATA BRIDGE MARKET RESEARCH

Global Fruit Flavoured Syrups Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fruit Flavoured Syrups Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fruit Flavoured Syrups Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.