Global Fuel Tank Market

Market Size in USD Billion

CAGR :

%

USD

19.55 Billion

USD

29.33 Billion

2024

2032

USD

19.55 Billion

USD

29.33 Billion

2024

2032

| 2025 –2032 | |

| USD 19.55 Billion | |

| USD 29.33 Billion | |

|

|

|

|

Fuel Tank Market Size

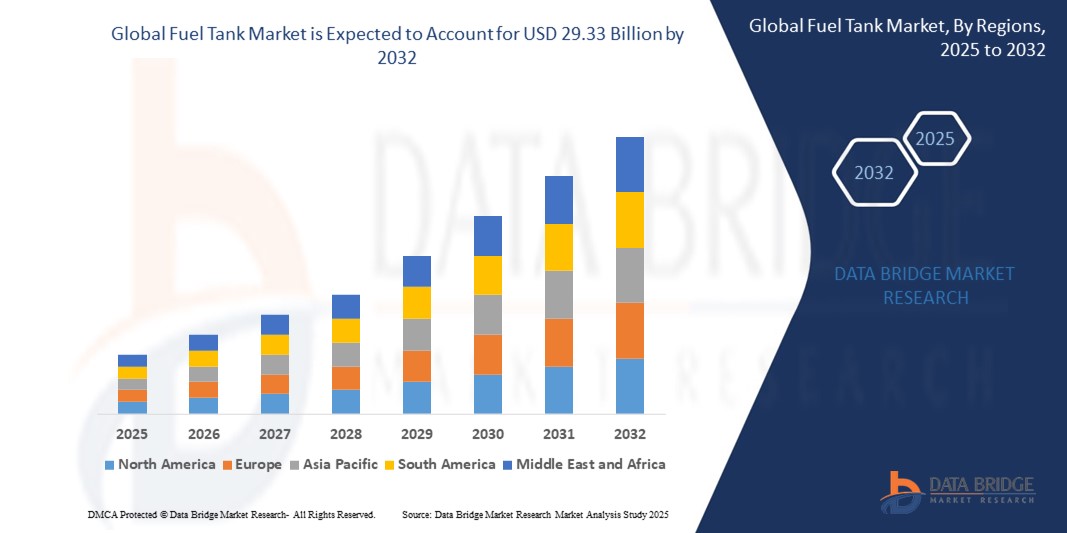

- The global fuel tank market size was valued at USD 19.55 billion in 2024 and is expected to reach USD 29.33 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market expansion is strongly driven by the increasing demand for lightweight, high-capacity, and durable storage solutions across automotive, aerospace, and industrial sectors, particularly in alignment with emission norms and fuel efficiency standards

- In addition, the growing adoption of electric and hydrogen-powered vehicles is creating new opportunities for innovative fuel tank designs, especially Type IV composite tanks, which are lightweight and corrosion-resistant. These trends are playing a crucial role in propelling market growth globally

Fuel Tank Market Analysis

- Fuel tanks, essential components for storing gasoline, diesel, or alternative fuels, are becoming increasingly critical for vehicle performance and emission compliance, particularly in passenger cars, commercial vehicles, and alternative energy vehicles

- The rising focus on sustainability, vehicle lightweighting, and the integration of advanced materials such as carbon fiber composites is driving innovations in fuel tank technologies, with OEMs and tier-one suppliers investing in R&D for next-generation solutions

- Moreover, regulatory mandates for zero-emission vehicles (ZEVs) and the transition to hydrogen and CNG vehicles in key markets such as the U.S., Germany, Japan, and South Korea are accelerating the demand for customized, high-pressure fuel tank solutions, boosting the overall market outlook through 2032

- Asia-Pacific (APAC) dominates the global fuel tank market with the largest revenue share of 39.54% in 2024. This dominance is fueled by the region's burgeoning automotive industry, particularly in countries such as China and India, which are experiencing rapid industrialization and a surge in vehicle production and demand

- Europe is projected to be the fastest-growing market for Fuel Tanks throughout the forecast period. This rapid expansion is driven by the stringent environmental regulations across the European Union, pushing for lighter and more efficient vehicle components, including advanced fuel tank systems

- The 45L–70L segment dominated the market with the largest revenue share of 41.8% in 2024, due to its widespread use in passenger cars and light commercial vehicles. This capacity range strikes a balance between fuel efficiency and space optimization, making it a preferred choice among automotive manufacturers globally

Report Scope and Fuel Tank Market Segmentation

|

Attributes |

Fuel Tank Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fuel Tank Market Trends

“Rising Innovation in Lightweight Composite Materials for Efficiency and Emission Reduction”

- A prominent trend in the global fuel tanks market is the growing use of lightweight composite materials, particularly carbon fiber and plastic composites, to meet stringent emission norms and enhance vehicle fuel efficiency. These materials help reduce vehicle weight without compromising structural integrity or fuel storage capacity

- For instance, in December 2023, Toyota Motor Corporation, in collaboration with UBE Corporation, introduced UBE NYLON 1218IU, a new type of polyamide 6 resin used in the plastic liner of hydrogen tanks in its Crown FCV. This resin is specifically designed to prevent hydrogen leakage while offering high durability

- The demand for Type IV high-pressure tanks, which use composite materials, is rising rapidly in the hydrogen mobility sector. These tanks are lighter than traditional steel tanks and are ideal for fuel cell vehicles (FCVs) and compressed natural gas (CNG) vehicles

- In June 2024, OPmobility announced the supply of 76 Type 4 hydrogen storage systems to CRRC for hydrogen-powered trams in Malaysia, highlighting a major commercial application of advanced fuel tank composites

- This trend is significantly transforming the industry landscape by supporting emission goals, enhancing range efficiency, and enabling alternative fuel adoption across vehicle segments

Fuel Tank Market Dynamics

Driver

“Expanding Alternative Fuel Adoption and Stringent Emission Regulations”

- A key driver for the Fuel Tanks market is the global shift toward alternative fuels such as CNG, LPG, and hydrogen, propelled by regulatory mandates for lower emissions and reduced carbon footprints. This transition necessitates specialized fuel storage solutions, which is driving the demand for advanced tank systems

- For instance, the European Union and China have introduced stricter emission targets for new vehicles, encouraging OEMs to adopt CNG and hydrogen fuel tanks to comply

- In November 2023, Robert Bosch GmbH launched its H2 Mobility technology, which includes a comprehensive hydrogen fuel injection and tank system for long-haul trucks, catering to the growing hydrogen transport segment

- Moreover, increasing investments in green mobility infrastructure, such as hydrogen refueling stations and public fleet conversions, are accelerating the adoption of lightweight, high-pressure fuel tanks

- This driver is set to fuel market expansion across automotive applications, particularly in commercial vehicles, buses, and trains

Restraint/Challenge

“High Manufacturing Costs and Infrastructure Limitations for Hydrogen Fuel Tanks”

- One of the primary challenges facing the Fuel Tanks market is the high production cost of composite fuel tanks, especially for hydrogen and CNG applications, which require precise engineering and advanced materials. These costs can deter adoption in cost-sensitive markets or among budget-conscious consumers

- For instance, Type IV composite hydrogen tanks, while offering significant weight savings and performance advantages, are significantly more expensive than traditional steel tanks

- In addition, the lack of sufficient hydrogen refueling infrastructure in many countries limits the practical deployment of hydrogen-powered vehicles, thereby restraining the demand for specialized hydrogen tanks

- In May 2024, Samvardhana Motherson International (SAMIL) acquired Yachiyo Industry’s four-wheeler business, aiming to expand fuel tank production. However, scaling these capabilities to meet hydrogen or CNG requirements still presents technological and cost-related hurdles

- Overcoming these barriers will require government incentives, technology standardization, and industry-wide efforts to expand alternative fuel infrastructure and reduce tank production costs through economies of scale

Fuel Tank Market Scope

The market is segmented on the basis of tank capacity, material type, weight, fuel type, propulsion type, sales channel, and vehicle type.

• By Tank Capacity

On the basis of tank capacity, the fuel tank market is segmented into less than 45L, 45L–70L, and more than 70L. The 45L–70L segment dominated the market with the largest revenue share of 41.8% in 2024, owing to its widespread use in passenger cars and light commercial vehicles. This capacity range strikes a balance between fuel efficiency and space optimization, making it a preferred choice among automotive manufacturers globally.

The more than 70L segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in heavy commercial vehicles and long-haul applications where extended driving range is critical.

• By Material Type

On the basis of material type, the fuel tank market is segmented into plastic, aluminum, steel, and others. The plastic segment held the dominant market share of 46.5% in 2024, favored for its lightweight, corrosion resistance, and design flexibility. Plastic tanks are increasingly being used in modern vehicles to reduce overall weight and enhance fuel efficiency.

The aluminum segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by its durability, strength-to-weight ratio, and eco-friendly recyclability, making it suitable for premium and electric vehicles.

• By Weight

On the basis of weight, the fuel tank market is segmented into less than 7KG, 7KG to 10KG, and more than 10KG. The 7KG to 10KG segment accounted for the highest market revenue share of 39.6% in 2024, due to its optimal balance between structural strength and vehicle load limits. This range is particularly suitable for compact and mid-sized passenger vehicles.

The less than 7KG segment is expected to witness the fastest growth, fueled by increasing efforts to reduce vehicle weight and improve fuel economy and emissions performance.

• By Fuel Type

On the basis of fuel type, the fuel tank market is segmented into LPG/CNG, diesel, and gasoline. The gasoline segment dominated the market with a market share of 48.3% in 2024, owing to the global dominance of gasoline-powered passenger cars. Widespread infrastructure availability and relatively lower vehicle costs support this segment.

The LPG/CNG segment is expected to register the fastest growth due to the growing preference for cleaner alternatives, government subsidies, and the expanding adoption of dual-fuel vehicles in urban centers.

• By Propulsion Type

On the basis of propulsion type, the fuel tank market is segmented into natural gas, hydrogen, internal combustion engine (ICE), and hybrid. The internal combustion engine (ICE) segment held the largest market share of 53.9% in 2024, driven by the dominant presence of ICE vehicles globally and established fueling infrastructure.

The hydrogen segment is anticipated to grow at the fastest CAGR during the forecast period, supported by rising investments in fuel cell electric vehicles (FCEVs) and government incentives promoting hydrogen mobility.

• By Sales Channel

On the basis of sales channel, the fuel tank market is segmented into OEM and aftermarket. The OEM segment led the market with a share of 67.4% in 2024, as most fuel tanks are installed during the original vehicle manufacturing process. OEMs benefit from integrated design, compliance assurance, and economies of scale.

The aftermarket segment is expected to grow rapidly due to the increasing need for replacement tanks and the rising average vehicle age, especially in emerging markets.

• By Vehicle Type

On the basis of vehicle type, the fuel tank market is segmented into passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and hybrid vehicles. The passenger cars segment held the largest market share of 49.7% in 2024, attributed to the massive global fleet size and consistent production volumes.

The hybrid vehicles segment is forecasted to register the fastest CAGR from 2025 to 2032, driven by increased consumer preference for fuel-efficient vehicles, stricter emissions regulations, and government incentives for hybrid adoption.

Fuel Tank Market Regional Analysis

- Asia-Pacific (APAC) dominates the global fuel tank market with the largest revenue share of 39.54% in 2024. This dominance is fueled by the region's burgeoning automotive industry, particularly in countries such as China and India, which are experiencing rapid industrialization and a surge in vehicle production and demand

- Stringent environmental regulations promoting fuel efficiency and the increasing affordability of vehicles due to the region's manufacturing prowess further solidify APAC's leading position

- The sheer volume of vehicle sales and production in APAC countries makes it the primary consumer and manufacturer of fuel tanks, establishing its supremacy in the global market

U.S. Fuel Tank Market Insight

The U.S. Fuel Tank market represents a substantial portion of the North American market. The country's vast transportation network and reliance on personal vehicles ensure a consistent demand for fuel tanks. Regulations focused on fuel efficiency and emissions control, along with the continuous production of a wide range of vehicles from compact cars to heavy-duty trucks, sustain the market volume. The presence of a mature automotive aftermarket also contributes significantly to the overall market size in the U.S.

Europe Fuel Tank Market Insight

Europe is projected to be the fastest-growing market for Fuel Tanks throughout the forecast period. This rapid expansion is driven by the stringent environmental regulations across the European Union, pushing for lighter and more efficient vehicle components, including advanced fuel tank systems. The increasing adoption of electric vehicles with auxiliary fuel tanks for hybrid models and the continuous innovation in fuel tank technology to meet these evolving demands contribute to Europe's high growth rate. Furthermore, government incentives and consumer preferences for eco-friendly vehicles are accelerating the demand for advanced fuel tank solutions.

U.K. Fuel Tank Market Insight

The U.K. fuel tank market experiences steady growth, aligning with the country's automotive sales and production trends. Factors such as government initiatives aimed at reducing carbon emissions and promoting fuel-efficient vehicles influence the type and technology of fuel tanks used in the UK. The market also benefits from a well-established aftermarket and ongoing demand for vehicles across various segments.

Germany Fuel Tank Market Insight

Germany, as a major hub for automotive manufacturing and innovation, plays a pivotal role in the European fuel tank market. The country's emphasis on high-performance vehicles and adherence to strict environmental standards drive the demand for technologically advanced and lightweight fuel tank solutions. Germany's strong automotive engineering sector ensures continuous development and adoption of cutting-edge fuel tank technologies.

Japan Fuel Tank Market Insight

The Japan fuel tank market is characterized by its focus on technological precision and high-quality manufacturing. The country's automotive industry is renowned for producing fuel-efficient and reliable vehicles, which necessitates advanced fuel tank systems. With a strong emphasis on environmental sustainability and safety, Japan's market demands innovative fuel tank designs and materials.

China Fuel Tank Market Insight

China's fuel tank market is the largest within the Asia-Pacific region and a significant contributor to global volumes. The country's massive automotive production and sales figures, driven by a rapidly growing economy and increasing vehicle ownership, make it a key player. While also being a manufacturing hub, the sheer domestic demand ensures China's dominance in the APAC fuel tank market.

Fuel Tank Market Share

The fuel tank industry is primarily led by well-established companies, including:

- TI Fluid Systems (U.K.)

- Yachiyo Industry Co., Ltd. (Japan)

- Magna International Inc. (Canada)

- Plastic Omnium (France)

- Kautex (Germany)

- Unipres Corporation (U.S.)

- ContiTech AG (Germany)

- SMA Serbatoi SpA (Italy)

- FTS CO., LTD. (Japan)

- Crefact Corporation (U.S.)

- Boyd Welding LLC (U.S.)

- Elkamet Kunststofftechnik GmbH (Germany)

- Salzburger Aluminium Group (Austria)

- Central Precision Limited (U.K.)

- Arrow Radiators (Melksham) Ltd (U.K.)

- A. KAYSER AUTOMOTIVE SYSTEMS GmbH (Germany)

- PIOLAX, Inc. (Japan)

Latest Developments in Global Fuel Tank Market

- In June 2024, OPmobility, through its PO-Rein joint venture, signed a breakthrough agreement with CRRC, the global leader in rail manufacturing, to supply hydrogen-powered trams in Malaysia. The deal involves the delivery of 76 Type 4 high-pressure storage systems, each fitted with four 175-liter hydrogen tanks, with delivery and commissioning expected by year-end. This strategic contract strengthens OPmobility’s position in the hydrogen mobility sector and expands its footprint in Asia

- In May 2024, Samvardhana Motherson International (SAMIL) finalized the acquisition of an 81% stake in Yachiyo Industry’s four-wheeler business, a subsidiary of Honda Motor, for USD 158.54 million. Following the acquisition, Yachiyo 4W is now supplying sunroofs and fuel tanks to SAMIL across all its production facilities. This acquisition significantly boosts SAMIL’s capabilities in fuel tank production and OEM integration

- In December 2023, Toyota Motor Corporation entered into a partnership with UBE Corporation to co-develop a new polyamide 6 resin, branded UBE NYLON 1218IU. This cutting-edge resin is applied as the plastic liner material in the high-pressure hydrogen tank of the Toyota Crown fuel-cell vehicle (FCV), effectively preventing hydrogen leakage under extreme conditions. The collaboration reinforces Toyota’s leadership in hydrogen vehicle innovation and material science

- In November 2023, Robert Bosch GmbH introduced H2 Mobility, a comprehensive hydrogen technology solution that includes a fuel injection system, tank system, sensors, controllers, and more. The offering is tailored for various vehicle segments, including SUVs, LCVs, coaches, and heavy-duty buses, marking a significant step in hydrogen infrastructure. This launch enhances Bosch’s competitive edge in the hydrogen mobility ecosystem

- In November 2023, Terra West, the parent company of Granby Industries, completed the acquisition of Highlands Tank to consolidate market share and expand product offerings. The two companies merged their products and services, aiming for greater operational diversification. This strategic acquisition strengthens Terra West’s market position in the fuel storage industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.