Global Fungicide Active Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

16.29 Billion

USD

24.25 Billion

2024

2032

USD

16.29 Billion

USD

24.25 Billion

2024

2032

| 2025 –2032 | |

| USD 16.29 Billion | |

| USD 24.25 Billion | |

|

|

|

|

Fungicide Active Ingredients Market Size

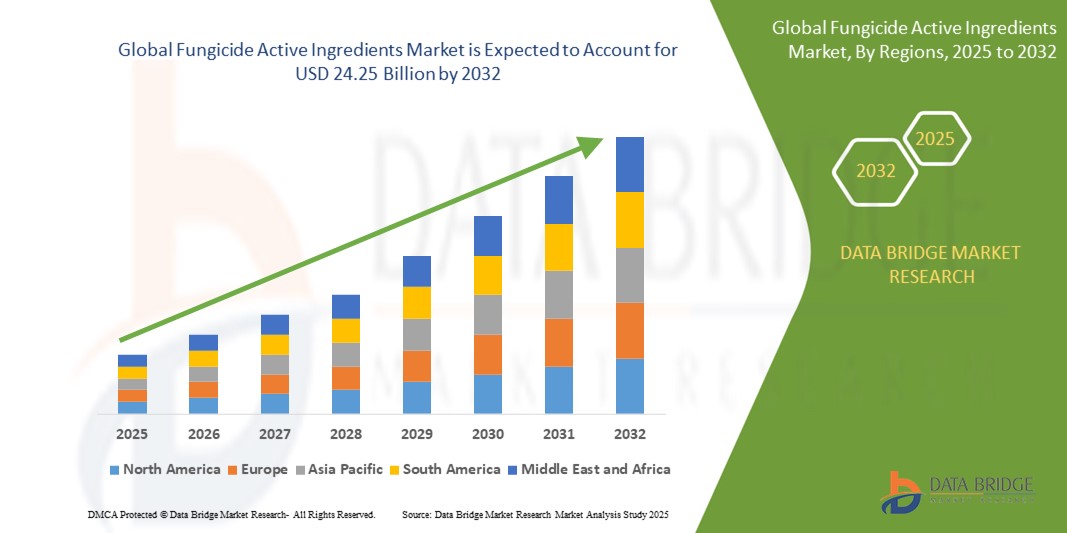

- The global fungicide active ingredients market size was valued at USD 16.29 billion in 2024 and is expected to reach USD 24.25 billion by 2032, at a CAGR of 5.1% during the forecast period

- The market growth is largely fuelled by the rising demand for crop protection chemicals to improve yield quality and quantity, the growing prevalence of fungal infections in agricultural crops, and increasing awareness among farmers regarding sustainable agricultural practices

- In addition, advancements in agricultural biotechnology and the introduction of broad-spectrum fungicide formulations are further accelerating market expansion across both developed and developing regions

Fungicide Active Ingredients Market Analysis

- The market is driven by the increasing need for efficient crop protection solutions due to a surge in global food demand and shrinking arable land

- The adoption of integrated pest management practices and favorable government support for advanced farming methods are contributing to the accelerated use of fungicides

- North America dominated the fungicide active ingredients market with the largest revenue share in 2024, fuelled by robust agricultural activity, advanced farming techniques, and the widespread use of high-efficiency fungicide formulations

- Asia-Pacific region is expected to witness the highest growth rate in the global fungicide active ingredients market, driven by rising agricultural activities, increased demand for food security, and growing awareness regarding crop protection, particularly in countries such as China, India, and Vietnam

- The azoxystrobin segment dominated the market with the largest market revenue share of 31.4% in 2024, driven by its broad-spectrum efficacy and widespread application across cereal crops, vegetables, and fruits. Azoxystrobin is highly preferred due to its systemic action, long-lasting protection, and low toxicity profile. It is extensively used in integrated pest management (IPM) programs and offers growers both preventive and curative control of various fungal pathogens

Report Scope and Fungicide Active Ingredients Market Segmentation

|

Attributes |

Fungicide Active Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Bio-Based Fungicide Active Ingredients • Expansion Of Agricultural Activities in Emerging Economies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fungicide Active Ingredients Market Trends

“Rising Adoption Of Bio-Based and Organic Fungicides”

- Increasing awareness about food safety and environmental impact has accelerated the demand for bio-based and organic fungicides

- Regulatory bodies such as the European Commission are limiting the use of synthetic fungicides, prompting a shift toward natural alternatives

- Farmers are increasingly using organic fungicides to qualify for organic certification and tap into premium market segments

- Companies are investing in plant-based active ingredients to meet regulatory and consumer expectations—BASF launched Revysol, an innovative fungicide with improved environmental profile

- Governments in countries such as India and the U.S. are offering incentives to promote organic farming and the adoption of natural crop protection products

Fungicide Active Ingredients Market Dynamics

Driver

“Expansion Of Global Agricultural Production and Crop Protection Needs”

- Global food demand is rising due to a growing population, pushing farmers to increase productivity and safeguard crops

- Fungal infections remain a major threat to crop yield and quality, necessitating the use of effective fungicide ingredients

- Adoption of high-value crops such as grapes, soybeans, and pulses requires consistent protection from fungal diseases

- Countries such as Brazil are investing heavily in expanding agricultural land and deploying crop protection technologies

- According to the FAO, countries with intensified farming practices, such as China, have significantly increased fungicide usage to mitigate risks from crop pathogens

Restraint/Challenge

“Stringent Regulatory Policies and Resistance Development”

- Government regulations, especially in Europe and North America, are imposing restrictions on the use of certain synthetic fungicides

- Continuous usage of similar fungicide compounds has led to increased resistance among fungal pathogens, reducing effectiveness

- Delays in product approvals due to extensive testing and environmental reviews hinder the timely launch of new active ingredients

- Companies must invest heavily in research and innovation to develop fungicides with new modes of action and resistance management strategies

- For instance, the European Union restricted the use of triazole-based fungicides due to their long-term environmental impact, compelling manufacturers to seek alternative solutions

Fungicide Active Ingredients Market Scope

The market is segmented on the basis of product, type, form, and end use.

• By Product

On the basis of product, the fungicide active ingredients market is segmented into azoxystrobin, boscalid, chlorothalonil, cyazofamid, etridiazole (ethazole), fenarimol, and others. The azoxystrobin segment dominated the market with the largest market revenue share of 31.4% in 2024, driven by its broad-spectrum efficacy and widespread application across cereal crops, vegetables, and fruits. Azoxystrobin is highly preferred due to its systemic action, long-lasting protection, and low toxicity profile. It is extensively used in integrated pest management (IPM) programs and offers growers both preventive and curative control of various fungal pathogens.

The cyazofamid segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its targeted action against oomycete fungi, especially in vegetable and ornamental crop protection. Its strong residual activity and low environmental impact make it increasingly popular among farmers aiming for sustainable disease management.

• By Type

On the basis of type, the market is segmented into powder and liquid. The liquid segment held the largest market revenue share in 2024 due to its ease of application, faster absorption, and better coverage. Liquid formulations are widely used in commercial agriculture, where efficiency and uniform application play a vital role in crop protection.

The powder segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in regions where manual application methods are prevalent. Powders offer longer shelf life and are easier to store, making them ideal for small and medium-scale farmers operating in developing regions.

• By Form

On the basis of form, the fungicide active ingredients market is segmented into systematic, contact, and translaminar. The systematic segment accounted for the largest revenue share in 2024, attributed to its ability to move within the plant and protect new growth from internal fungal infections. Systematic fungicides are often used in high-value crops such as grapes and apples due to their reliability and long-lasting control.

The translaminar segment is expected to witness the fastest growth rate from 2025 to 2032, as it offers the advantage of surface-to-tissue penetration, ensuring extended protection. This mode of action is gaining traction among horticulture farmers who seek efficient disease control with reduced frequency of application.

• By End Use

On the basis of end use, the market is segmented into food industry, medicinal, agriculture, chemical laboratory, and others. The agriculture segment dominated the market with the largest revenue share in 2024, driven by the rising need to protect crop yields and improve quality amidst changing climate conditions. Farmers across regions are increasingly using fungicides to combat diseases such as downy mildew, rusts, and blights.

The medicinal segment is expected to witness the fastest growth rate from 2025 to 2032, due to the rising demand for fungicides in pharmaceutical research and development. Active ingredients such as etridiazole and boscalid are being studied for their potential antimicrobial and antifungal properties beyond agriculture.

Fungicide Active Ingredients Market Regional Analysis

• North America dominated the fungicide active ingredients market with the largest revenue share in 2024, fuelled by robust agricultural activity, advanced farming techniques, and the widespread use of high-efficiency fungicide formulations

• The presence of major agrochemical manufacturers and rising demand for crop protection to ensure high yields contribute significantly to market expansion across the region

• Increased regulatory support for effective and sustainable crop protection solutions and the integration of digital agriculture practices also support market growth in the U.S. and Canada

U.S. Fungicide Active Ingredients Market Insight

The U.S. fungicide active ingredients market held the largest share in North America in 2024, driven by the country’s extensive agricultural output and the increasing adoption of integrated pest management (IPM) programs. The high demand for food crops such as wheat, corn, and soybeans has led to a surge in the use of advanced fungicide solutions. Moreover, U.S. farmers are increasingly adopting environmentally friendly and residue-free fungicides to comply with stringent food safety standards. The development of novel fungicide chemistries and collaborations between agricultural research institutes and chemical companies further boost innovation and product offerings in the country.

Europe Fungicide Active Ingredients Market Insight

The Europe fungicide active ingredients market is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing demand for organic and sustainable farming practices. Countries such as France, Germany, and Spain are emphasizing reduced pesticide usage and encouraging the development of biopesticides and targeted fungicide applications. This trend is supported by the European Union’s Green Deal and Farm to Fork Strategy, which promotes reduced chemical input in agriculture. The growing popularity of precision farming in the region is also enabling better fungicide application and improving market penetration.

U.K. Fungicide Active Ingredients Market Insight

The U.K. fungicide active ingredients market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's strong emphasis on sustainable agriculture and food safety. With regulatory pressure to reduce chemical residues in food, there is a growing demand for bio-based and systemic fungicides. Farmers are increasingly adopting precision farming techniques and integrated disease management approaches to improve efficiency and minimize environmental impact. The horticulture and cereal crop sectors are among the largest consumers of fungicide ingredients, and advancements in formulation technology are further supporting market expansion.

Germany Fungicide Active Ingredients Market Insight

The Germany fungicide active ingredients market is expected to witness the fastest growth rate from 2025 to 2032, driven by its strong agricultural sector and focus on quality crop protection. Germany’s push for sustainable agriculture and reduced pesticide residue in food is prompting a shift towards advanced formulations such as systemic and translaminar fungicides. The country also invests significantly in agricultural innovation, encouraging the development of high-performance, low-impact fungicide active ingredients. Market participants are aligning with regulatory standards, and demand from the fruit, vegetable, and viticulture segments continues to grow.

Asia-Pacific Fungicide Active Ingredients Market Insight

The Asia-Pacific fungicide active ingredients market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing agricultural production and rising awareness of crop protection technologies in emerging economies such as India, China, and Indonesia. Rapid urbanization and population growth have created a pressing need for higher agricultural productivity, leading to the increased adoption of fungicides. Government initiatives promoting modern farming techniques and subsidies on agrochemicals further enhance market growth.

Japan Fungicide Active Ingredients Market Insight

The Japan fungicide active ingredients market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s focus on high-value crops and its sophisticated agricultural infrastructure. Japanese farmers prioritize product quality and food safety, leading to consistent demand for targeted and low-toxicity fungicide solutions. Government support for sustainable farming practices and the adoption of advanced agri-tech solutions such as automated spraying and crop monitoring systems are enhancing fungicide usage efficiency. The market is also seeing increasing interest in imported, eco-certified, and residue-free fungicide ingredients aligned with consumer expectations and export requirements.

China Fungicide Active Ingredients Market Insight

China accounted for the largest revenue share in the Asia-Pacific fungicide active ingredients market in 2024, owing to the country’s intensive farming practices and significant demand for crop protection to combat plant diseases. With growing concerns around food security and the need for high-quality agricultural output, Chinese farmers are increasingly turning to advanced fungicide ingredients. In addition, local agrochemical manufacturers play a critical role in supplying cost-effective and innovative fungicide solutions to domestic and international markets. Government support for agricultural modernization and the rising penetration of e-commerce platforms for agrochemical distribution further strengthen market prospects in China.

Fungicide Active Ingredients Market Share

- BASF SE (Germany)

- Syngenta Group (ADAMA, Ltd.) (Switzerland)

- Certis USA LLC (U.S.)

- Bayer Crop Science (Germany)

- Nissan Chemical Corporation (Japan)

- ADAMA (Israel)

- Nufarm (Australia)

- Nutrichem Co Ltd. (China)

- Sumitomo Chemical Co. Ltd. (Japan)

- FMC Corporation (U.S.)

- Isagro S.P.A (Italy)

- DuPont (U.S.)

Latest Developments in Global Fungicide Active Ingredients Market

- In December 2024, ADAMA Ltd., part of the Syngenta Group, introduced a new fungicidal active ingredient called Gilboa in Europe. This product is designed to combat major cereal diseases while improving crop quality. The launch supports ADAMA's strategic focus on delivering innovative and sustainable disease management solutions tailored to modern farming challenges. It is expected to enhance growers’ productivity and strengthen the company's presence in the European crop protection market

- In January 2024, Certis Biologicals (Certis USA LLC) launched Convergence, a new biofungicide formulated for Soybean, Corn, and Peanuts. Utilizing naturally occurring microorganisms, the product offers an eco-friendly approach to controlling fungal diseases. This development aligns with the growing demand for sustainable agriculture solutions and reinforces Certis' role in advancing biological crop protection technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.