Global Gasoline Generator Market

Market Size in USD Million

CAGR :

%

USD

739.20 Million

USD

951.04 Million

2024

2032

USD

739.20 Million

USD

951.04 Million

2024

2032

| 2025 –2032 | |

| USD 739.20 Million | |

| USD 951.04 Million | |

|

|

|

|

Gasoline Generator Market Size

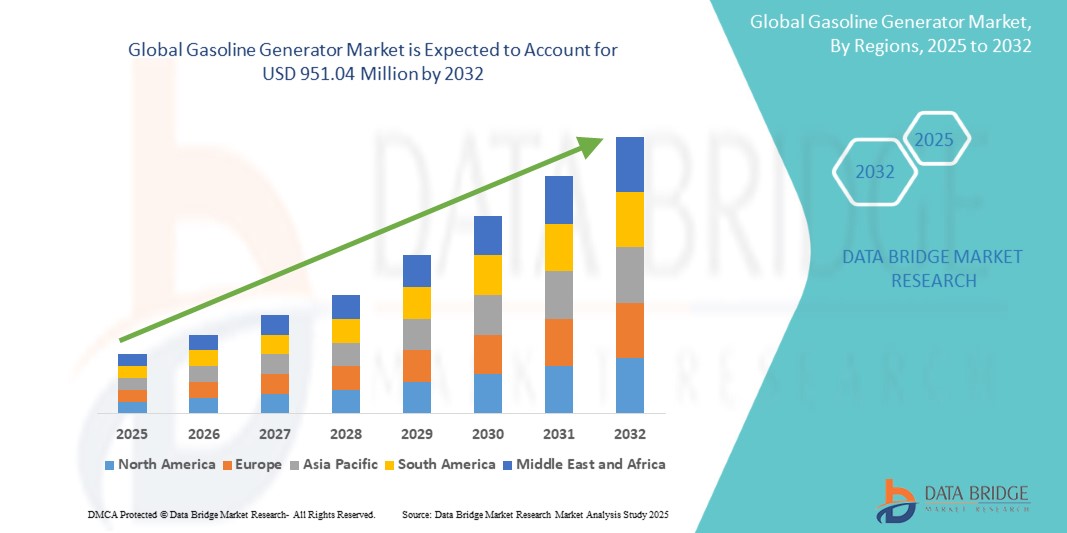

- The global gasoline generator market size was valued at USD 739.20 million in 2024 and is expected to reach USD 951.04 million by 2032, at a CAGR of 3.20% during the forecast period

- This growth is driven by rising residential construction activities

Gasoline Generator Market Analysis

- Gasoline generators are crucial for backup power, commonly used in residential, commercial, and industrial settings. Their portability, easy use, and ability to provide instant power during outages make them highly reliable, especially in off-grid or emergency situations

- The increasing frequency of extreme weather events, coupled with more power outages and the rising demand for affordable, portable energy solutions, is driving gasoline generator adoption. More individuals and businesses rely on them for backup power during emergencies or outdoor activities

- North America is projected to dominate the gasoline generator market with the largest market share of 41.01%, driven by strong residential infrastructure, increasing awareness of power backup, and consistent investments in portable energy solutions across the U.S. and Canada, ensuring reliable access to power during outages

- Asia-Pacific is expected to register the highest CAGR in the gasoline generator market due to rapid urbanization, expanding industrial sectors, and the growing demand for backup power. Countries such as India, China, and Southeast Asia are driving this growth with rising energy needs

- The portable generator segment is expected to dominate the market with market share of 68.21% in 2025 due to their exceptional versatility, ease of transport, and widespread use across residential, commercial, and recreational settings. Their compact and lightweight design enables users to conveniently provide power anytime and anywhere, without requiring complex installations or technical expertise

Report Scope and Gasoline Generator Market Segmentation

|

Attributes |

Gasoline Generator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand |

Gasoline Generator Market Trends

“Growing Demand for Portable and Compact Power Solutions”

- Portable gasoline generators are gaining popularity due to their compact size, lightweight design, and ability to provide backup power for outdoor activities, construction sites, and remote locations

- Urbanization and the need for mobile power solutions for small businesses and recreational activities are key drivers behind this demand

- Consumers increasingly prefer small, efficient gasoline generators that are easy to transport and use, enhancing convenience for short-term power needs

- For instance, in March 2025, Honda introduced a new line of portable gasoline generators that are 25% smaller and lighter than previous models, offering greater portability for outdoor enthusiasts

- This trend is expected to increase the adoption of portable gasoline generators as critical tools for emergency preparedness and on-the-go power

Gasoline Generator Market Dynamics

Driver

“Increasing Reliance on Gasoline Generators for Residential Backup Power”

- The rising frequency of power outages due to natural disasters and grid failures is boosting the demand for residential backup generators

- Gasoline-powered generators are being viewed as an affordable and reliable solution for homeowners who require emergency power to keep essential appliances running

- The growing awareness of the importance of emergency preparedness and self-sufficiency is further increasing the adoption of gasoline generators in residential settings

- For instance, in February 2025, Generac announced a surge in demand for residential gasoline generators, with a 20% increase in sales, driven by severe weather events in the U.S.

- This trend is expected to drive continued growth in the residential gasoline generator segment over the coming years

Opportunity

“Rising Use of Gasoline Generators in Off-Grid Applications”

- Gasoline generators are being increasingly deployed in remote locations, such as construction sites, campgrounds, and outdoor events, where grid electricity is unavailable

- As the demand for off-grid living and sustainable power solutions grows, gasoline generators are becoming essential for providing quick and reliable power in areas lacking infrastructure

- Their portability and ease of use make them ideal for temporary power solutions in areas where traditional grid access is limited

- For instance, in April 2024, Caterpillar launched a new range of mobile gasoline generators for construction projects in remote areas, offering a clean, affordable power solution

- The off-grid segment is expected to offer a significant growth opportunity as more industries seek portable and efficient power sources for temporary and emergency uses

Restraint/Challenge

“Environmental Concerns and Regulatory Challenges”

- Gasoline generators, while reliable, produce emissions that contribute to air pollution, limiting their adoption in regions with strict environmental regulations

- Governments are increasingly enforcing emission standards that impact the market for traditional gasoline-powered generators, pushing for cleaner energy alternatives

- High fuel consumption and noise pollution associated with gasoline generators pose environmental and social challenges that could hinder their market growth

- For instance, in January 2025, California introduced new regulations that limit the use of gasoline-powered generators in residential areas during wildfire seasons, creating barriers for market expansion

- To address these concerns, manufacturers are exploring eco-friendly innovations such as low-emission models and hybrid technologies to comply with environmental standards and maintain consumer trust

Gasoline Generator Market Scope

The market is segmented on the basis of power output, type, application, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Power Output |

|

|

By Type |

|

|

By Application |

|

|

By End Use

|

|

In 2025, the 1.0 to 3.0 KW is projected to dominate the market with a largest share in power output segment

The 1.0 to 3.0 KW segment is expected to dominate the gasoline generator market with the largest share of 39.11% in 2025 due to their versatility, portability, and widespread use across various end-user industries, making them ideal for home backup systems and essential for powering appliances such as refrigerators, lighting, and small electronic devices during outages.

The portable generator is expected to account for the largest share during the forecast period in type segment

In 2025, the portable generator segment is expected to dominate the market with the largest market share of 68.21% due to their exceptional versatility, ease of transport, and widespread use across residential, commercial, and recreational settings. Their compact and lightweight design enables users to conveniently provide power anytime and anywhere, without requiring complex installations or technical expertise.

Gasoline Generator Market Regional Analysis

“North America Holds the Largest Share in the Gasoline Generator Market”

- North America dominates the gasoline generator market with the market share of 41.01%, due to a high prevalence of power outages, strong demand for backup power systems, and widespread use in residential and commercial sectors

- The U.S. holds a significant market share, driven by frequent hurricanes, snowstorms, and aging power infrastructure that boosts the demand for portable and standby generators

- Increased adoption of home automation, remote work trends, and growing investment in emergency preparedness further contribute to the region’s leadership

- Strong distribution networks and the presence of major generator manufacturers bolster market strength across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Gasoline Generator Market”

- Asia-Pacific is expected to witness the fastest growth in the gasoline generator market, fueled by rapid urbanization, growing industrialization, and increasing demand for reliable backup power in emerging economies

- Countries such as India, China, and Indonesia are leading this growth due to frequent power outages, expanding infrastructure projects, and rising awareness about energy security

- The region’s booming construction sector, growing rural electrification initiatives, and increased adoption of portable generators for small businesses are key contributors

- As demand for affordable and dependable power solutions rises, Asia-Pacific’s gasoline generator market is poised for significant expansion over the coming years

Gasoline Generator Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- APR Energy (U.S.)

- Siemens (Germany)

- General Electric Company (U.S.)

- Aggreko (U.K.)

- Toshiba Corporation (Japan)

- Hyundai Heavy Industries Co. Ltd. (South Korea)

- Mitsubishi Electric Corporation (Japan)

- Generac Power Systems, Inc. (U.S.)

- GE Vernova (U.S.)

- MAHINDRA POWEROL (India)

- Atlas Copco AB (Sweden)

- Cummins Inc (U.S.)

- Caterpillar (U.S.)

- J C Bamford Excavators Ltd. (U.K.)

- Rolls-Royce plc (U.K.)

- Champion Power Equipment (U.S.)

- DuroMax Power Equipment (U.S.)

- Westinghouse Electric Company LLC (U.S.)

Latest Developments in Global Gasoline Generator Market

- In February 2023, Cummins Inc. introduced 175kW and 200kW natural gas standby generator sets tailored for North American markets, reinforcing its commitment to sustainable innovation under the “Destination Zero” initiative. These models deliver high power density and exceptional performance, ensuring dependable backup power for a range of applications

- In July 2022, Sterling Generators formed a strategic alliance with Moteurs Baudouin, a French manufacturer of diesel and gas engines, to blend Baudouin’s legacy of precision engineering with Sterling’s advanced, fuel-efficient power solutions. This partnership is expected to enhance product offerings in the auxiliary power market

- In January 2022, Caterpillar Inc. launched the Cat G3516 Fast Reaction generator set, expanding its natural-gas power lineup with a robust 1.5 MW model. This product boasts rapid load acceptance and transient response, making it ideal for mission-critical applications with EPA-certified reliability

- In August 2020, Caterpillar Inc. announced the release of a gas-powered generator set with a 500 kW rating, certified under the U.S. Environmental Protection Agency (EPA) for stationary emergency use in 60 Hz markets. This development underlines the company’s continued leadership in the production of high-performance gas and diesel generators

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.