Global Generative Ai In Healthcare Market

Market Size in USD Billion

CAGR :

%

USD

2.38 Billion

USD

22.81 Billion

2024

2032

USD

2.38 Billion

USD

22.81 Billion

2024

2032

| 2025 –2032 | |

| USD 2.38 Billion | |

| USD 22.81 Billion | |

|

|

|

|

Generative AI in Healthcare Market Size

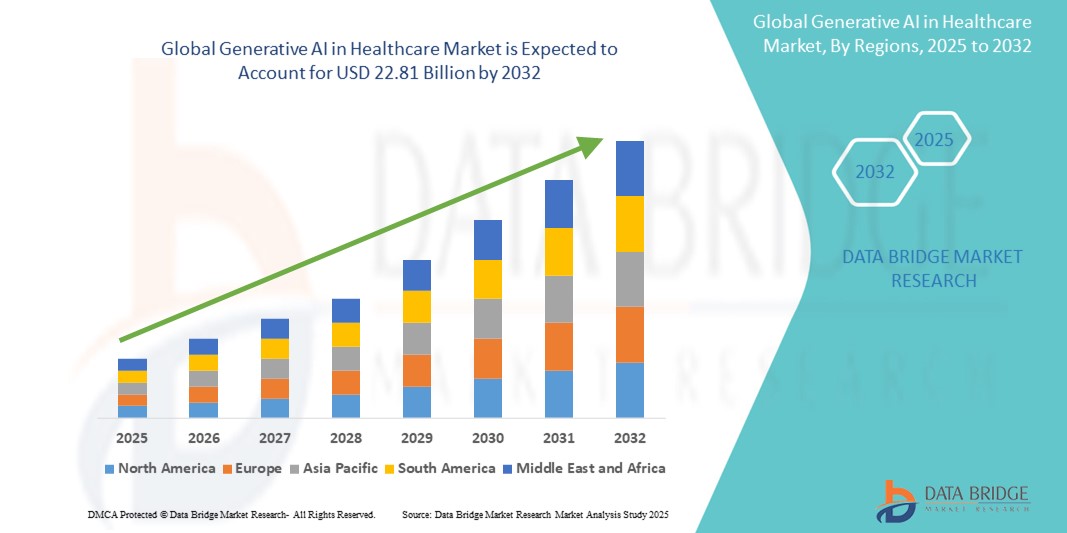

- The global generative AI in healthcare market size was valued at USD 2.38 billion in 2024 and is expected to reach USD 22.81 billion by 2032, at a CAGR of 32.60% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within artificial intelligence and machine learning, particularly in clinical decision support, drug discovery, and medical imaging, leading to increased digitalization in both healthcare delivery and administrative processes

- Furthermore, rising demand from healthcare providers for efficient, personalized, and data-driven solutions is establishing Generative AI as a transformative force in modern healthcare systems. These converging factors are accelerating the uptake of Generative AI in Healthcare solutions, thereby significantly boosting the industry's growth

Generative AI in Healthcare Market Analysis

- Generative AI in healthcare, which refers to AI systems that can generate medical content, support clinical decision-making, and accelerate drug discovery, is becoming a transformative force across diagnostics, treatment planning, and personalized medicine

- The growing demand for generative AI solutions is driven by rising healthcare data volumes, increasing adoption of digital health technologies, and the need to improve clinical efficiency and patient outcomes

- North America dominated the generative AI in healthcare market with the largest revenue share of 40.8% in 2024, attributed to early AI adoption, strong R&D infrastructure, significant investments from both public and private sectors, and the presence of leading tech companies and healthcare institutions. The U.S. in particular has seen rapid deployment of generative AI in clinical workflows, radiology, and genomics

- Asia-Pacific is expected to be the fastest-growing region in the generative AI in healthcare market during the forecast period, owing to growing healthcare digitization, supportive government policies, expanding medical tourism, and increasing investment in AI research, particularly in countries like China, India, and Japan

- The Drug Discovery and Development segment dominated the generative AI in healthcare market with the largest revenue share of 43.2% in 2024, driven by the ability of generative AI to streamline early-stage research, generate novel compounds, and reduce drug development timelines and costs. The segment benefits from growing investments in pharmaceutical R&D and AI-driven molecular modeling platforms

Report Scope and Generative AI in Healthcare Market Segmentation

|

Attributes |

Generative AI in Healthcare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Generative AI in Healthcare Market Trends

“Enhanced Convenience Through Generative AI-Powered Healthcare Solutions”

- A significant and accelerating trend in the global generative AI in healthcare market is the integration of AI-generated tools into clinical and operational workflows, enhancing provider efficiency and patient engagement. These tools support real-time decision-making, automate repetitive documentation, and personalize treatment approaches, leading to increased convenience for both practitioners and patients

- For instance, generative AI platforms such as Abridge and Nuance DAX automatically transcribe and summarize patient-physician conversations, enabling clinicians to spend more time on patient care rather than administrative tasks. This ease of use and automation is reshaping expectations across hospitals and private practices

- Generative AI systems are also being used to synthesize vast amounts of unstructured data—such as medical records, imaging results, and genomic data—to generate personalized diagnostics and treatment insights. These capabilities improve the speed and accuracy of care while reducing cognitive burden on healthcare professionals.

- Seamless integration of generative AI tools with electronic health record (EHR) systems enables centralized control of patient data, treatment planning, and clinical documentation. Physicians can access AI-generated summaries, alerts, and recommendations within their existing workflows, promoting streamlined care delivery

- This trend toward more intelligent, intuitive, and personalized healthcare systems is fundamentally reshaping user expectations, driving the need for dynamic, real-time AI-generated solutions. Consequently, companies such as Microsoft, Google Health, and Oracle are investing in generative AI platforms tailored for clinical support, documentation automation, and research acceleration

- The demand for generative AI healthcare solutions that offer seamless integration, real-time insights, and enhanced decision support is growing rapidly across hospitals, diagnostic labs, and life sciences companies, as the sector moves toward more value-based and patient-centric care models

Generative AI in Healthcare Market Dynamics

Driver

“Growing Need Due to Rising Demand for Personalized Healthcare and AI-Powered Solutions”

- The increasing need for personalized treatment, faster diagnosis, and improved patient outcomes, coupled with the rising integration of artificial intelligence in healthcare systems, is significantly driving the demand for generative AI in healthcare

- For instance, in April 2024, Google DeepMind announced advancements in its MedPaLM platform to support clinical decision-making by generating accurate medical responses from patient data, highlighting the expanding role of generative AI technologies in transforming clinical workflows

- As healthcare providers and institutions become more aware of the potential of AI to streamline processes, reduce workloads, and enhance precision, generative AI tools offer features such as personalized treatment plans, AI-generated diagnostic insights, and real-time patient monitoring, making them highly valuable in modern healthcare ecosystems

- Furthermore, the growing adoption of digital health records, telemedicine platforms, and AI-enabled medical imaging tools are making generative AI a core component of healthcare digital transformation, offering seamless integration across multiple systems and specialties

- The convenience of AI-driven drug discovery, predictive analytics for patient risk assessments, and decision support for clinicians are key factors propelling adoption across hospitals, research institutions, and specialty clinics. The growing accessibility and user-friendliness of generative AI healthcare platforms are also contributing to broader adoption among practitioners and organizations

Restraint/Challenge

“Concerns Regarding Data Privacy, Bias, and High Implementation Costs”

- Concerns surrounding data privacy, ethical use of patient data, and potential algorithmic bias pose significant challenges to the widespread adoption of generative AI in healthcare. Since these systems rely on vast datasets and complex neural networks, they may inadvertently reinforce existing biases or raise compliance issues under healthcare regulations such as HIPAA and GDPR

- For instance, studies highlighting racial or gender bias in AI-generated medical recommendations have sparked debates about the readiness of such technologies for clinical deployment, leading to hesitation among providers

- Addressing these concerns requires transparent algorithms, regulatory frameworks, and robust data governance models to ensure fairness, accuracy, and accountability. Companies such as IBM Watson Health and Microsoft Azure Health emphasize ethical AI development and regulatory compliance to build trust among stakeholders

- In addition, the high initial cost of implementing advanced generative AI systems—particularly those involving deep learning models for diagnostics or drug development—can be a barrier for small and mid-sized healthcare facilities, especially in emerging markets

- While cloud-based and subscription AI models are reducing some financial burdens, the perceived complexity and cost of adoption can still deter healthcare providers from fully embracing these solutions

- Overcoming these challenges through improved data transparency, equitable model training, cost-effective deployment strategies, and enhanced cybersecurity protocols will be critical for ensuring sustained growth in the generative AI in healthcare market

Generative AI in Healthcare Market Scope

The Generative AI in Healthcare market is segmented on the basis of application and end user.

- By Application

On the basis of application, the generative AI in healthcare market is segmented into personalized treatment, patient assistance, patient monitoring and predictive analytics, medical image analysis and diagnostics, and drug discovery and development. The drug discovery and development segment dominated the market with the largest revenue share of 43.2% in 2024, driven by the ability of generative AI to streamline early-stage research, generate novel compounds, and reduce drug development timelines and costs. The segment benefits from growing investments in pharmaceutical R&D and AI-driven molecular modeling platforms.

The medical image analysis and diagnostics segment is projected to witness the fastest CAGR of 24.8% from 2025 to 2032, supported by increasing adoption of AI tools in radiology, pathology, and dermatology. Generative AI applications in this domain improve diagnostic accuracy, automate image interpretation, and enable faster clinical decision-making.

- By End User

On the basis of end user, the generative AI in healthcare market is segmented into hospitals, specialty clinics, ambulatory surgical centers (ASCs), research and academic institutes, and others. The hospitals segment accounted for the largest market revenue share of 39.6% in 2024, due to high patient volumes, robust healthcare infrastructure, and greater investments in AI-driven solutions to enhance clinical efficiency and care delivery. Hospitals are integrating generative AI in diagnostics, documentation, and personalized medicine workflows.

The research and academic institutes segment is anticipated to witness the highest CAGR of 23.5% from 2025 to 2032, propelled by expanding AI research in biomedical fields, funding from public and private entities, and the development of AI algorithms for disease modeling and clinical trial optimization.

Generative AI in Healthcare Market Regional Analysis

- North America dominated the generative AI in healthcare market with the largest revenue share of 40.8% in 2024, driven by strong investments in digital health infrastructure

- Early AI adoption, and supportive regulatory frameworks

- The region is projected to grow at a CAGR of 21.3% from 2025 to 2032, supported by the integration of generative AI into clinical workflows, diagnostics, and personalized medicine initiatives

U.S. Generative AI in Healthcare Market Insight

The U.S. generative AI in healthcare market accounted for a dominant 61% share of the North American market in 2024, translating to 33.0% of the global revenue. This leadership position is driven by the widespread deployment of AI in electronic health records (EHRs), predictive analytics platforms, and AI-assisted diagnostics. The U.S. market is expected to grow at a CAGR of 21.8% during the forecast period due to increasing healthcare digitization and a high concentration of AI tech companies and healthcare providers.

Europe Generative AI in Healthcare Market Insight

The Europe generative AI in healthcare market held the second-largest share of the global market at 28.6% in 2024, fueled by strict healthcare data regulations, growing focus on automation, and increasing adoption of AI in diagnostics and imaging. The region is projected to expand, with notable growth in countries like Germany, the U.K., and France due to rising AI research investments and hospital modernization programs.

U.K. Generative AI in Healthcare Market Insight

The U.K. generative AI in healthcare market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by NHS-backed AI initiatives, funding for medtech startups, and a growing emphasis on reducing healthcare burden through automation. The market is projected to grow due to rising demand for AI-powered clinical decision-making and remote health management tools.

Germany Generative AI in Healthcare Market Insight

The Germany generative AI in healthcare market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s robust R&D infrastructure, digital health strategies, and increasing use of AI in pathology, radiology, and hospital administration. The market is expected to grow, fueled by ethical AI integration policies and growing deployment in public hospitals and academic institutions.

Asia-Pacific Generative AI in Healthcare Market Insight

The Asia-Pacific generative AI in healthcare market is poised to grow at the fastest CAGR of 24.0% from 2025 to 2032, and held a global market share of 18.3% in 2024. The region’s growth is attributed to increasing healthcare digitalization in China, Japan, and India, rising medical tourism, and expanding government funding for AI in healthcare.

Japan Generative AI in Healthcare Market Insight

The Japan generative AI in healthcare market contributed to around 5.2% of the global revenue share in 2024, driven by demand for AI in elderly care, precision medicine, and integrated smart hospital solutions. The market is expected to expand at a CAGR of 23.7%, as hospitals adopt AI for medical imaging, automated documentation, and remote patient monitoring.

China Generative AI in Healthcare Market Insight

The China generative AI in healthcare market led the Asia-Pacific market with a dominant 8.9% share of global revenue in 2024, driven by vast healthcare demand, rapid AI adoption, and strong domestic innovation in generative AI platforms. The market is projected to grow at a CAGR of 25.4% through 2032, driven by aggressive digital health infrastructure development, AI policy initiatives, and growing use in clinical research and pharmaceutical sectors.

Generative AI in Healthcare Market Share

The generative AI in healthcare industry is primarily led by well-established companies, including:

- Epic Systems Corporation (U.S.)

- DiagnaMed Holdings Corp. (U.S.)

- Syntegra (U.S.)

- Merative (U.S.)

- Google LLC (U.S.)

- Oracle (U.S.)

- Microsoft (U.S.)

- NVIDIA Corporation (U.S.)

- Insilico Medicine (U.S.)

- Abridge AI, Inc. (U.S.)

- ELEKS (Estonia)

- Persistent Systems (India)

Latest Developments in Global Generative AI in Healthcare Market

- In December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process

- In August 2023, Cognizant expanded collaboration with Google Cloud, utilizing generative AI to enhance administrative processes, aiming for cost optimization and improved user experiences. This collaborative partnership aimed to strengthen the healthcare solutions, improved business efficiencies, and enhanced user experiences

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.