Global Gin Market

Market Size in USD Billion

CAGR :

%

USD

25.64 Billion

USD

45.63 Billion

2024

2032

USD

25.64 Billion

USD

45.63 Billion

2024

2032

| 2025 –2032 | |

| USD 25.64 Billion | |

| USD 45.63 Billion | |

|

|

|

|

Gin Market Size

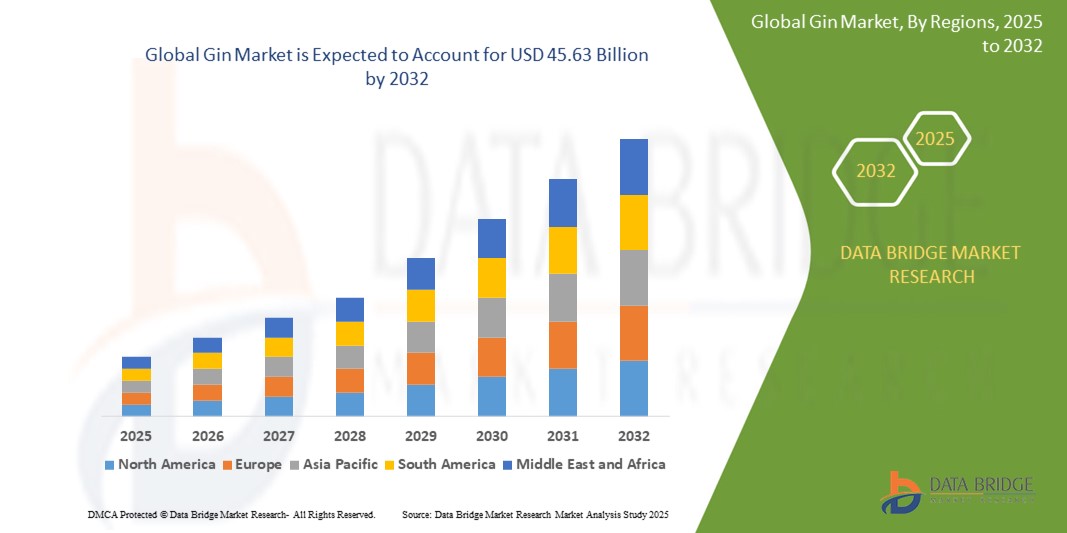

- The global gin market size was valued at USD 25.64 billion in 2024 and is expected to reach USD 45.63 billion by 2032, at a CAGR of 7.47% during the forecast period

- The market growth is largely fueled by rising consumer interest in premium and craft spirits, along with expanding innovation in botanical blends and flavor profiles, which is attracting a broader demographic, especially younger consumers

- Furthermore, increasing popularity of gin-based cocktails in bars, restaurants, and home settings is reinforcing demand across both on-trade and off-trade channels. These converging factors are significantly boosting the market’s expansion and diversification

Gin Market Analysis

- Gin is a distilled alcoholic beverage made primarily from juniper berries and various botanicals, known for its versatility in cocktails and its growing appeal among global consumers seeking unique flavor experiences

- The escalating demand for gin is driven by the global craft spirits movement, evolving taste preferences toward botanical-forward drinks, and increased marketing efforts by major players promoting heritage, artisanal production, and premium positioning

- Europe dominated the gin market with a share of 22.7% in 2024, due to deep-rooted gin culture, a strong presence of heritage and craft distilleries, and sustained consumer demand for premium and artisanal spirits

- North America is expected to be the fastest growing region in the gin market with a share of during the forecast period due to a rising preference for craft spirits, evolving cocktail culture, and increased availability of diverse gin varieties across retail and HoReCa channels

- 40-45%, segment dominated the market with a market share of 47.2% in 2024, due to its compliance with international regulatory standards and its balanced combination of strength and flavor. This ABV range is favored by distillers for preserving botanical integrity while ensuring a smooth consumer experience, making it the dominant choice across mainstream gin labels

Report Scope and Gin Market Segmentation

|

Attributes |

Gin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gin Market Trends

“Rising Demand for Craft and Premium Gin”

- A significant and accelerating trend in the global gin market is the rising demand for craft and premium gin, driven by consumers seeking unique flavors, artisanal production methods, and high-quality ingredients

- For instance, companies such as Bombay Sapphire and Hendrick’s are expanding their portfolios with small-batch, botanically diverse gins to attract discerning drinkers and cocktail enthusiasts

- The proliferation of craft distilleries has led to a surge in innovative gin varieties, including limited-edition releases, locally sourced botanicals, and experimental infusions, catering to evolving palates

- Premiumization is also evident in packaging, with brands investing in bespoke bottles, artistic labeling, and luxury gift sets to enhance the consumer experience and support premium pricing

- This trend toward craft and premium gin is fundamentally reshaping marketing and distribution strategies, as brands focus on storytelling, heritage, and authenticity to differentiate themselves in a crowded market

- The demand for craft and premium gin is growing rapidly across both established and emerging markets, as consumers increasingly prioritize quality, provenance, and new taste experiences in their spirits choices

Gin Market Dynamics

Driver

“Growing Cocktail Culture”

- The expanding global cocktail culture, fueled by the popularity of mixology, social drinking, and experiential dining, is a significant driver for the growth of the gin market

- For instance, brands such as Tanqueray and Beefeater are collaborating with bartenders and hospitality venues to promote signature gin cocktails, gin-and-tonic variations, and seasonal serves

- As consumers seek out new and creative drink options, gin’s versatility as a base spirit for classic and contemporary cocktails is enhancing its appeal among both younger and more mature audiences

- The rise of gin-focused bars, festivals, and tasting events is making gin a focal point for social gatherings and lifestyle experiences

- The convenience of ready-to-drink (RTD) gin cocktails and the growth of home bartending are further propelling gin consumption in both on-trade and off-trade channels. The influence of social media and cocktail influencers also contributes to the rising visibility and desirability of gin-based drinks

Restraint/Challenge

“Changing Consumer Preferences”

- Changing consumer preferences, including the shift toward low-alcohol, no-alcohol, and alternative spirits, pose a significant challenge to sustained growth in the gin market

- For instance, the emergence of alcohol-free gin alternatives and the growing popularity of other spirits such as tequila and rum are intensifying competition and fragmenting market share

- Addressing these challenges requires brands to innovate with new product formats, flavors, and health-conscious options, as well as to invest in consumer education and engagement

- The high level of competition and the need to continuously adapt to evolving tastes can be a barrier for smaller producers and new entrants

- Overcoming these challenges through diversification, marketing agility, and the development of low- and no-alcohol gin variants will be vital for maintaining relevance and capturing emerging consumer segments in the spirits industry

Gin Market Scope

The market is segmented on the basis of product type, production method, alcohol by volume, and distribution channel.

- By Product Type

On the basis of product type, the gin market is segmented into London Dry Gin, Plymouth Gin, Genever/Dutch Gin, Old Tom Gin, and New American Gin. The London Dry Gin segment dominated the largest market revenue share in 2024, owing to its global recognition, consistent flavor profile, and established use in classic cocktails. Its crisp, juniper-forward character appeals to both consumers and mixologists, ensuring its dominance across both on-trade and off-trade channels. Moreover, the popularity of premium and craft variants of London Dry Gin continues to reinforce its stronghold in mature markets.

The New American Gin segment is expected to witness the fastest growth from 2025 to 2032, driven by rising consumer interest in innovative botanical blends and the surge in craft distilling. These gins often emphasize non-juniper botanicals and creative flavor profiles, resonating well with younger, experimental drinkers. Their appeal is further enhanced by artisanal branding, local sourcing, and increasing availability across high-end bars and specialty liquor stores.

- By Production Method

On the basis of production method, the gin market is categorized into pot distilled gin, column distilled gin, and compound gin. The Pot Distilled Gin segment held the largest market revenue share in 2024, as it is widely favored among craft producers for allowing greater botanical expression and flavor complexity. The batch-distillation process preserves the nuanced character of botanicals, making these gins highly sought after in premium and ultra-premium segments.

The compound gin segment is projected to register the fastest growth through 2032, due to its cost-effectiveness, ease of production, and flexibility in flavor customization. Compound gins are increasingly used in ready-to-drink (RTD) and flavored gin products, responding to demand from budget-conscious and casual consumers seeking variety without premium pricing.

- By Alcohol by Volume

On the basis of alcohol content, the market is segmented into 36–40%, 40–45%, and 45–50%. The 40–45% ABV segment accounted for the highest revenue share of 47.2% in 2024, driven by its compliance with international regulatory standards and its balanced combination of strength and flavor. This ABV range is favored by distillers for preserving botanical integrity while ensuring a smooth consumer experience, making it the dominant choice across mainstream gin labels.

The 45–50% ABV segment is expected to grow at the highest CAGR from 2025 to 2032, spurred by increasing demand for high-strength gins among enthusiasts and mixologists who favor bolder, more pronounced flavor profiles. These gins are often positioned as premium offerings, suitable for sipping or use in high-proof cocktails, thereby gaining traction in craft and luxury segments.

- By Distribution Channel

On the basis of distribution channel, the market is divided into Hypermarkets and Supermarkets, Specialty Stores, Drug Stores, Online Channel, HoReCa, and Others. The HoReCa segment captured the largest market share in 2024, fueled by the rapid expansion of the global hospitality sector and the growing trend of premium gin consumption in bars, restaurants, and hotels. The rise in cocktail culture and gin-based signature drinks in urban centers significantly contributes to this channel’s dominance.

The Online Channel is poised to witness the fastest growth rate during the forecast period, supported by increasing consumer preference for convenient, home-based purchasing experiences. Digital platforms are being widely used for discovering new craft and imported gin brands, often supported by direct-to-consumer strategies, targeted promotions, and subscription models that enhance brand engagement and reach.

Gin Market Regional Analysis

- Europe dominated the gin market with the largest revenue share of 22.7% in 2024, driven by deep-rooted gin culture, a strong presence of heritage and craft distilleries, and sustained consumer demand for premium and artisanal spirits

- Consumers in Europe continue to favor traditional gin varieties such as London Dry, while also embracing new styles including contemporary and flavored gins, boosting product innovation and category expansion

- The region’s vibrant on-trade sector, led by bars and restaurants offering signature gin cocktails, along with well-established export networks and regulatory support for geographical indications, has firmly established Europe as the leading hub for gin production and consumption

U.K. Gin Market Insight

The U.K. gin market captured the largest revenue share in 2024 within Europe, fueled by the country's historic connection to gin and its dynamic craft distilling scene. The continued popularity of gin-based beverages, the introduction of new botanicals, and seasonal flavor launches are attracting a wide consumer base. Growth is further supported by domestic consumption as well as strong exports to international markets, with many distilleries leveraging digital sales channels to expand reach.

Germany Gin Market Insight

The Germany gin market is anticipated to grow steadily, driven by rising interest in premium beverages and the growth of local micro-distilleries. German consumers are increasingly drawn to high-quality, small-batch gins with unique botanical profiles. The market is also supported by evolving consumer preferences in favor of lower-sugar and low-ABV options, expanding the appeal of gin to a broader demographic.

North America Gin Market Insight

North America is projected to witness the fastest CAGR from 2025 to 2032, fueled by a rising preference for craft spirits, evolving cocktail culture, and increased availability of diverse gin varieties across retail and HoReCa channels. The region is experiencing growing interest in botanical-forward gins and premium labels, particularly among millennials and younger consumers seeking authenticity and flavor experimentation. The expanding presence of U.S.-based craft distilleries and their growing penetration across bars, restaurants, and direct-to-consumer platforms is significantly accelerating market growth in the region

U.S. Gin Market Insight

The U.S. gin market accounted for the largest share in North America in 2024, supported by strong growth in craft gin production and a flourishing cocktail scene. Consumers are showing increased interest in locally sourced, small-batch gins with novel botanical blends. The growth of e-commerce and direct-to-consumer models is also reshaping the market landscape, while bartenders and mixologists are playing a key role in educating consumers about the versatility of gin.

Canada Gin Market Insight

The Canada gin market is gaining momentum, driven by the rise of domestic craft distillers and heightened consumer interest in artisanal and flavored gins. Canadian consumers are exploring new gin experiences through tasting events and local distillery tours, which are strengthening brand loyalty and expanding category reach. Regulatory easing around alcohol retail and online purchasing is also contributing to increased gin accessibility.

Gin Market Share

The gin industry is primarily led by well-established companies, including:

- Bacardi Limited (Bermuda)

- Diageo (U.K.)

- Pernod Ricard (France)

- San Miguel Corporation (Philippines)

- SUNTORY HOLDINGS LIMITED (Japan)

- William Grant & Sons Ltd (U.K.)

- The Sustainable Spirit Co. (U.K.)

- Drinks&Co (Spain)

- Davide Campari-Milano S.p.A. (Italy)

- THE EAST INDIA COMPANY LTD (U.K.)

- Forest Spirits by La Hanoudière (France)

- Radico Khaitan Ltd. (India)

- The Whisky Exchange (U.K.)

- The Black Bottle Distillery (U.K.)

- Gwalior Distilleries Ltd. (India)

- Suffolk Distillery (U.K.)

- THE POSHMAKERS LTD. (U.K.)

- Mygin (U.K.)

- Dogra Distilleries (India)

- The Gin Guild (U.K.)

Latest Developments in Global Gin Market

- In May 2024, Portofino Dry Gin has unveiled 'La Penisola,' a limited edition gin that pays homage to the stunning landscape of Portofino's peninsula. This new release showcases a bright and aromatic profile, perfectly reflecting the lush surroundings and vibrant coastal ambiance. Housed in an elegantly designed bottle featuring Castello Brown, La Penisola symbolizes sophistication and the natural beauty of Portofino. It has already won accolades in the 'Negroni' and 'Design & Branding' categories at The Gin Guide Awards

- In April 2024, Ludlow Distillery in Shropshire has expanded its portfolio by launching four new fruit gins. The enticing flavors include Strawberry & Raspberry, Rhubarb & Apple, Elderflower & Quince, and Blood Orange & Pomelo. Each gin is crafted to provide a delightful tasting experience, appealing to both traditional gin lovers and those seeking innovative, fruity alternatives. This launch marks a significant addition to their diverse range

- In April 2022, Bombay Sapphire, owned by Bacardi, introduced Citron Presse gin, a refreshing lemon-flavored gin made with Mediterranean lemons. This innovative spirit is set to launch in key markets, including Australia, Germany, Ireland, Andorra, Belgium, France, Switzerland, Denmark, Austria, Spain, and Portugal. This strategic rollout aims to capture the growing demand for unique gin flavors and expand the brand's global presence in the competitive gin market

- In March 2022, Diageo India made a strategic investment in Nao Spirits, the creator of premium Indian gins such as "Greater Than" and "Hapusa." This move underscores Diageo India's commitment to tapping into India's flourishing premium gin sector, which is rapidly gaining popularity among consumers. The investment aims to bolster Nao Spirits’ growth and enhance Diageo's footprint in this dynamic market, reflecting changing drinking preferences in India

- In March 2022, William Grant & Sons launched Hendrick's Neptunia Gin, crafted by master distiller Lesley Gracie. This unique spirit incorporates distinctly Scottish coastal botanicals, presenting an innovative take on the beloved Hendrick's flavor profile. Neptunia Gin promises to delight fans of Hendrick's with its maritime essence, further enriching the brand's offerings. This launch exemplifies the brand's dedication to quality and creativity in the premium gin market

- In April 2021, Pernod Ricard S.A. introduced an exciting range of ready-to-drink (RTD) beverages in the UK, featuring Beefeater gin as the base. The newly launched RTDs include Beefeater London Dry Gin & Tonic, Beefeater Blood Orange & Tonic, and Beefeater Pink Strawberry Gin & Tonic. This introduction aims to meet the growing consumer demand for convenient, high-quality alcoholic beverages, making it easier for consumers to enjoy gin cocktails on the go

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.