Global Glamping Market

Market Size in USD Billion

CAGR :

%

USD

3.97 Billion

USD

10.40 Billion

2024

2032

USD

3.97 Billion

USD

10.40 Billion

2024

2032

| 2025 –2032 | |

| USD 3.97 Billion | |

| USD 10.40 Billion | |

|

|

|

|

Glamping Market Size

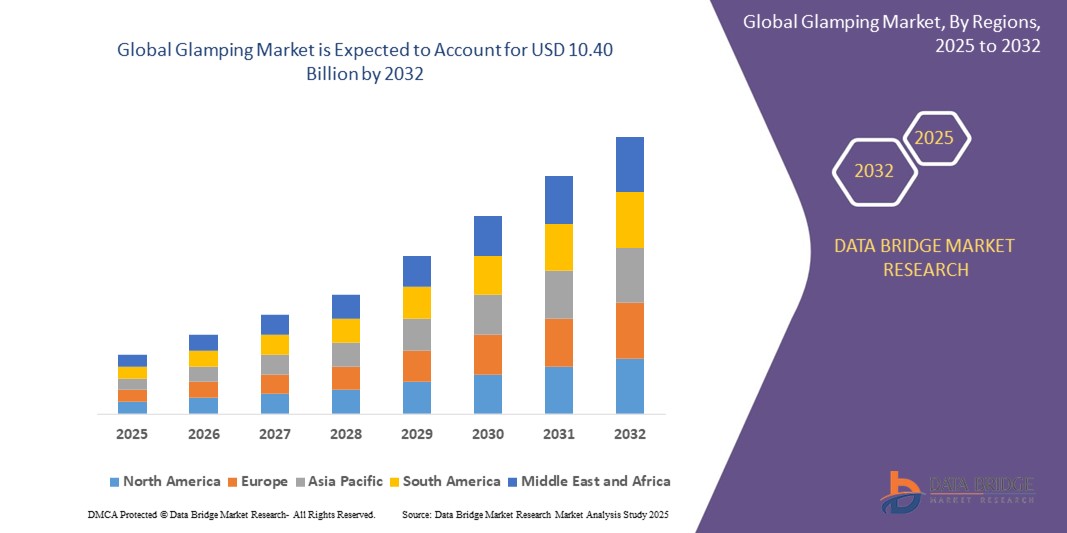

- The global glamping market was valued at USD 3.97 billion in 2024 and is expected to reach USD 10.40 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 12.80%, primarily driven by rising disposable incomes

- This growth is driven by factors such as higher spending on leisure travel and preference for luxury and comfort in nature

Glamping Market Analysis

- Glamping, short for "glamorous camping," refers to a form of camping that combines the outdoor adventure of traditional camping with luxurious amenities and accommodations. Unlike traditional camping, which often involves roughing it in tents or basic cabins, glamping offers more comfortable and upscale facilities, such as fully furnished tents, yurts, cabins, or even treehouses

- The market is witnessing robust growth driven by rising disposable incomes, increased demand for experiential travel, and a growing emphasis on wellness tourism. As consumers seek sustainable, nature-based getaways with modern comforts, glamping has emerged as an attractive alternative to conventional hospitality and camping models

- The glamping market is evolving with a strong focus on customization, sustainability, and integration of technology. Operators are enhancing their offerings with smart amenities, eco-friendly materials, and curated experiences tailored to different traveler demographics, including families, couples, and solo adventurers

- For instance, companies such as Under Canvas and AutoCamp are expanding their presence with innovative, eco-conscious designs that blend luxury, nature, and convenience to meet growing consumer expectations

- The glamping market is expected to continue its upward trajectory, supported by trends in digital nomadism, wellness retreats, and eco-tourism. Investments in infrastructure, tech-enabled services, and strategic partnerships with travel platforms are likely to further drive market expansion in the coming years

Report Scope and Glamping Market Segmentation

|

Attributes |

Glamping Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glamping Market Trends

“Increasing Emphasis on Wellness-Centric Experiences”

- One prominent trend in the global glamping market is the increasing emphasis on wellness-centric experiences

- This trend is driven by the growing demand for nature-based retreats that support mental well-being, stress reduction, and holistic health. Travelers are actively seeking escapes that offer relaxation, mindfulness, and a break from digital overload—prompting glamping operators to integrate wellness elements such as yoga platforms, spa facilities, forest bathing, and guided meditation sessions

- For instance, Huttopia and Sawday’s Canopy & Stars have expanded their offerings to include wellness-themed stays that blend natural immersion with activities such as outdoor saunas, slow food dining, and eco-conscious design

- The growing appeal of wellness tourism, especially among millennials and Gen Z, is accelerating the inclusion of curated health experiences within glamping sites. Operators are increasingly designing accommodations and packages that cater to self-care, detoxification, and rejuvenation in serene, eco-friendly settings

- As global interest in sustainable living and personal wellness continues to rise, the fusion of luxury camping with health-focused experiences is expected to shape innovation in the glamping industry, fueling investments in wellness amenities, eco-retreat models, and nature-integrated hospitality design

Glamping Market Dynamics

Driver

“Growing Popularity of Experiential Travel”

- The growing popularity of experiential travel is a key driver of growth in the global glamping market. Modern travelers, especially younger generations, are seeking immersive and memorable experiences over traditional vacation options, fueling demand for unique outdoor stays that offer both adventure and comfort

- This shift is particularly evident among millennials and Gen Z, who prioritize authentic travel encounters that connect them with nature, culture, and local environments—making glamping an ideal alternative to conventional hotels or resorts

- With a rising interest in personalized and story-worthy getaways, glamping accommodations such as treehouses, safari tents, and domes offer the perfect backdrop for experiential travel, combining scenic locations with curated activities such as stargazing, foraging, and guided hikes

- Features such as off-grid living, eco-conscious design, and on-site outdoor adventures are enabling glamping providers to attract experience-driven tourists looking for more than just a place to stay

- Companies are increasingly investing in thematic concepts, bespoke itineraries, and community-based tourism to meet evolving traveler expectations and tap into the emotional value of meaningful travel

For instance,

- Sawday’s Canopy & Stars and Long Valley Yurts are tailoring their offerings to provide immersive local experiences, from wild swimming to artisan workshops, enhancing the sense of discovery and connection with place

- Kudhva in the U.K. provides architecturally unique cabins with guided cliff hikes and cold-water therapy, attracting urban travelers seeking adventure and escape

- As the desire for experiential, sustainable, and wellness-integrated travel continues to rise, the glamping sector is well-positioned to capture this momentum, driving innovation in accommodation design, destination storytelling, and guest engagement strategies

Opportunity

“Increasing Accessibility Glamping Sites”

- Increasing accessibility of glamping sites presents a significant opportunity for growth in the glamping market. As demand for nature-based experiences continues to expand, the development of glamping accommodations in areas with better transport links and digital visibility is making it easier for travelers to access these destinations

- Glamping providers are strategically establishing sites closer to urban centers, popular tourist routes, and well-connected rural regions. This shift is enabling operators to attract a wider demographic including families, older travelers, and weekend explorers by offering outdoor stays without the need for extensive travel planning

- The growing integration of digital booking systems, travel apps, and location-based platforms is further improving the discoverability of glamping sites, supporting higher occupancy rates and market penetration

For instance,

- YALA luxury canvas lodges collaborates with global partners to install accessible, semi-permanent structures in scenic locations, enabling rapid site deployment with minimal environmental disruption

- Wigwam Holidays Ltd has expanded its footprint across the U.K. by targeting regions with strong domestic tourism traffic and road access, allowing easy weekend retreats for families and couples

- As national and local tourism authorities continue to invest in transport infrastructure, rural development, and promotional campaigns, glamping businesses are positioned to leverage improved accessibility to scale operations, enhance guest convenience, and unlock new revenue streams across untapped regions

Restraint/Challenge

“Seasonality and Weather Dependency”

- Seasonality and weather dependency pose a significant challenge for the glamping market. As demand for glamping experiences rises, operators face fluctuations in occupancy due to changing weather conditions, with colder or unpredictable weather often leading to a decline in bookings during off-peak seasons

- Glamping sites, especially those in outdoor or rural locations, require investments in weather-resistant accommodations and infrastructure. The need for upgrades to handle extreme weather conditions such as snow, rain, or storms adds to operational complexity and increases maintenance costs, putting pressure on the profitability of these businesses

- Operators often experience low occupancy rates during the off-season, such as in winter or rainy seasons, which impacts the overall revenue and sustainability of glamping sites

For instance,

- In regions with extreme weather, glamping providers are forced to seasonally close or reduce availability during challenging months, limiting their ability to operate year-round and affecting their bottom line

- As the demand for all-season glamping experiences increases, businesses that cannot afford weather-proofing or year-round accommodations may struggle to remain competitive, particularly in markets with heavy seasonal fluctuations

Glamping Market Scope

The market is segmented on the basis of accommodation type, area, size, land ownership, end user, age group, and application.

|

Segmentation |

Sub-Segmentation |

|

By Accommodation Type |

|

|

By Area |

|

|

By Size |

|

|

By Land Ownership

|

|

|

By End User |

|

|

By Age Group |

|

|

By Application |

|

Glamping Market Regional Analysis

“North America is the Dominant Region in the Glamping Market”

- North America dominates the glamping market, driven by increasing popularity among consumers and the rise in the number of tour operators and online glamping services in the region. The region has seen a significant shift towards outdoor leisure activities, with glamping offering the perfect blend of luxury and adventure

- The U.S. holds a significant share due to its strong tourism infrastructure, rising demand for unique travel experiences, and a growing glamping industry with both established and new providers

- The rise of eco-tourism, growing consumer interest in sustainable travel options, and improved accessibility to remote locations are all contributing to the growth of the market. In addition, advancements in technology, such as online booking platforms and travel apps, are making glamping more accessible and appealing to a broader audience

- With the growing trend of outdoor and luxury experiences, North America is expected to retain its dominant position in the global glamping market throughout the forecast period

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the glamping market, driven by rising disposable income, expanding middle-class populations, and increasing interest in outdoor luxury experiences across the region

- China and India are driving this growth, supported by a booming travel industry, increasing investments in tourism infrastructure, and a growing appreciation for eco-friendly and sustainable travel options

- Government initiatives aimed at boosting the tourism industry and fostering local tourism have further contributed to the expansion of glamping in the region

- With increased investments in both infrastructure and innovation, Asia-Pacific is poised to become the fastest-growing region in the global glamping market during the forecast period

Glamping Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bushtec Safari (South Africa)

- Sawday’s Canopy & Stars Ltd. (U.K.)

- Huttopia (France)

- Wigwam Holidays Ltd (U.K.)

- ArenaCampsites (Croatia)

- BIGHEAD glamping tents (Slovenia)

- Bond Fabrications Ltd (U.K.)

- Chateau Ramšak (Slovenia)

- Concierge Camping (U.K.)

- The Glamping Orchard (U.K.)

- Hidden Valley Camp & Resort (India)

- Killarney Glamping (Ireland)

- Kudhva Ltd. (U.K.)

- The Lazy Olive Villa (Italy)

- Long Valley Yurts (U.K.)

- Loose Reins (U.K.)

- YALA luxury canvas lodges (Netherlands)

- Glamping Olimia Adria village (Slovenia)

- Teapot Lane Glamping (Ireland)

- Yurtcamp Devon (U.K.)

Latest Developments in Global Glamping Market

- In January 2024, the Japanese camping brand Snow Peak revealed plans for its U.S. camping destination, Snow Peak Long Beach Campfield, set to launch in early 2024. Situated on a picturesque 25-acre site on the Long Beach peninsula in Washington state, the campfield is strategically located between Seattle and Portland, Oregon

- In September 2023, Luxeglamp EcoResorts, known for its bubble-glamping resort in Munnar, Kerala, introduced a new celestial-themed glamping experience in Kodaikanal, Tamil Nadu, a popular hill station. Branded as 'Luxeglamp Celestial Glamp,' this enchanting offering provides guests with a celestial ambiance, complete with twinkling stars and a moonlit setting inside the dome

- In November 2022, Under Canvas announced its expansion near the North Entrance of Yellowstone National Park, spanning 50 acres of Montana ranchland. Yellowstone National Park is renowned among outdoor enthusiasts, and this expansion is poised to drive growth in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.