Global Glossitis Market

Market Size in USD Million

CAGR :

%

USD

250.46 Million

USD

467.04 Million

2024

2032

USD

250.46 Million

USD

467.04 Million

2024

2032

| 2025 –2032 | |

| USD 250.46 Million | |

| USD 467.04 Million | |

|

|

|

|

Glossitis Market Size

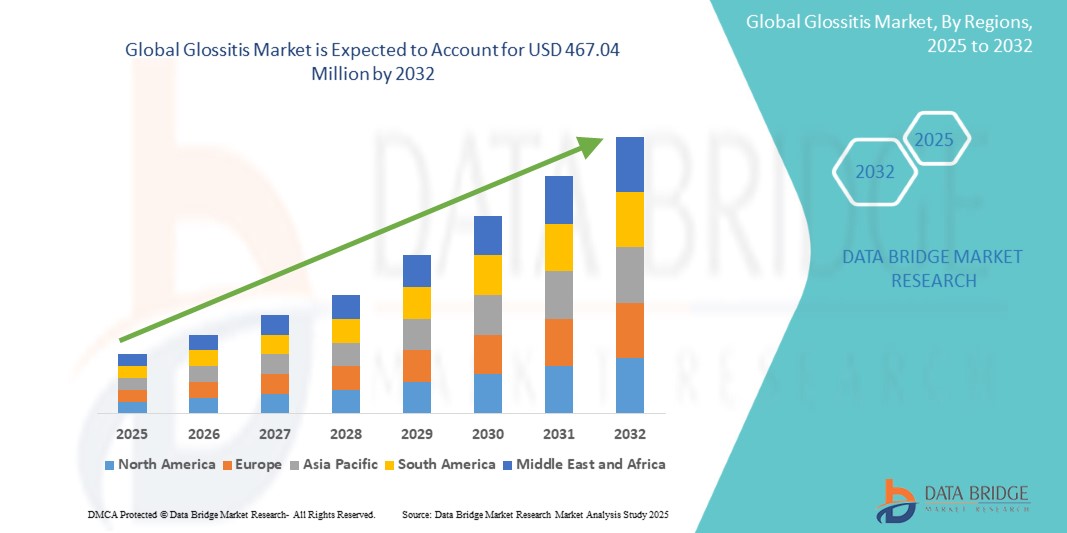

- The global glossitis market size was valued at USD 250.46 million in 2024 and is expected to reach USD 467.04 million by 2032, at a CAGR of 8.10% during the forecast period

- The market growth is largely driven by increasing awareness and diagnosis of oral health conditions, coupled with rising incidences of glossitis linked to nutritional deficiencies, allergic reactions, infections, and systemic diseases across global populations

- Furthermore, advancements in diagnostic tools and treatment options, along with growing healthcare infrastructure and spending, are creating favorable conditions for early intervention and management. These factors are collectively propelling the demand for glossitis therapies and expanding the market outlook globally

Glossitis Market Analysis

- Glossitis, characterized by inflammation of the tongue due to infections, allergic reactions, or underlying systemic conditions, is gaining clinical attention as a significant oral health concern, prompting increased demand for timely diagnosis and therapeutic interventions across both developed and emerging healthcare markets

- The growing prevalence of nutritional deficiencies, particularly vitamin B-complex and iron deficiencies, along with rising incidences of allergic and autoimmune conditions, is a primary driver of the increasing global burden of glossitis

- North America dominated the glossitis market with the largest revenue share of 39.5% in 2024, supported by well-established healthcare infrastructure, high awareness levels, and a strong presence of diagnostic and pharmaceutical players, with the U.S. showing increased patient visits for oral health symptoms and a rise in research efforts targeting oral inflammatory conditions

- Asia-Pacific is expected to be the fastest growing region in the glossitis market during the forecast period due to increasing healthcare access, growing awareness of oral hygiene, and higher incidence rates associated with dietary imbalances and infections

- The atrophic glossitis segment dominated the glossitis market with a market share of 42.1% in 2024, attributed to its strong association with iron-deficiency anemia and other systemic disorders, driving consistent clinical demand for targeted treatments and preventive care

Report Scope and Glossitis Market Segmentation

|

Attributes |

Glossitis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glossitis Market Trends

“Rising Emphasis on Nutritional Deficiency Management and Early Diagnosis”

- A significant and emerging trend in the global glossitis market is the increasing focus on addressing nutritional deficiencies particularly iron, folic acid, and vitamin B-complex—that are strongly linked to various types of glossitis, especially atrophic glossitis and Hunter’s glossitis

- For instance, healthcare providers are increasingly integrating micronutrient screening and supplementation protocols into general oral health assessments to detect and treat glossitis early. Products such as vitamin B12 supplements and iron formulations are now frequently recommended as part of standard glossitis management, particularly in primary care settings

- Advancements in diagnostic technologies, such as rapid oral screening tools and non-invasive nutrient deficiency tests, are enabling quicker identification of underlying causes, thereby allowing for more personalized and effective treatment pathways. In some regions, AI-powered symptom checkers integrated into telehealth platforms help flag glossitis-such as symptoms for timely referral

- Moreover, growing awareness campaigns about oral health and its link to systemic conditions are encouraging earlier consultations for tongue-related discomfort. As a result, pharmaceutical companies and nutraceutical brands are increasingly investing in developing specialized formulations targeting glossitis-causing deficiencies

- This shift toward proactive diagnosis and nutrition-driven management is redefining treatment approaches, especially in regions with high prevalence of anemia and dietary imbalance. It is also contributing to broader demand for targeted supplements and integrated care models in oral health

- The trend is expected to grow rapidly across both developed and emerging economies, as health systems adopt preventive healthcare approaches, further supported by consumer demand for accessible and non-invasive treatment solutions

Glossitis Market Dynamics

Driver

“Increased Prevalence Due to Nutritional Deficiencies and Autoimmune Conditions”

- The rising global prevalence of nutritional deficiencies, particularly iron, folic acid, and vitamin B12, remains a core driver for the growth of the glossitis market, as these deficiencies are major underlying causes of various forms of glossitis

- For instance, data from WHO and regional health agencies indicate persistent rates of iron-deficiency anemia in large populations across Asia and Africa, directly correlating with increased cases of glossitis. Similarly, autoimmune conditions such as pernicious anemia and Sjögren’s syndrome are being increasingly diagnosed, contributing to the demand for glossitis-specific therapies

- As awareness of oral health as an indicator of systemic diseases grows, more healthcare providers are focusing on tongue health as part of routine examinations. This is facilitating earlier identification of glossitis and associated disorders, increasing treatment demand

- The availability of effective over-the-counter and prescription supplements, combined with telemedicine consultations for oral health symptoms, is also supporting diagnosis and management, especially in rural and underserved areas

- In parallel, health-focused consumers are increasingly prioritizing preventive care, leading to higher use of multivitamins and dietary interventions to prevent recurrence. This is fueling pharmaceutical and nutraceutical product demand in the glossitis treatment landscape

Restraint/Challenge

“Misdiagnosis Risk and Limited Awareness in Low-Income Region”

- A key challenge hindering market expansion is the frequent misdiagnosis or underdiagnosis of glossitis, especially in low-resource settings where access to oral healthcare specialists is limited. Glossitis symptoms are often mistaken for generic oral irritation or minor infections, delaying appropriate treatment

- In addition, a lack of awareness among both consumers and frontline healthcare workers about the systemic implications of tongue inflammation limits timely detection. For instance, in several developing regions, glossitis is often dismissed until symptoms become severe or interfere with speech and eating

- Another constraint is the uneven distribution of diagnostic capabilities, such as blood testing for nutrient deficiencies and autoimmune screening. This hinders the adoption of personalized treatment approaches and limits therapeutic precision

- Furthermore, affordability remains a concern in lower-income regions, where nutritional supplements or immunological treatments may not be readily accessible. This economic barrier can prevent consistent treatment adherence or recurrence management

- Overcoming these challenges will require improved healthcare access, targeted educational campaigns, and the development of affordable, easy-to-administer nutritional solutions. In addition, enhancing training for primary care providers to recognize glossitis symptoms as part of systemic health monitoring could improve diagnosis and patient outcomes globally

Glossitis Market Scope

The market is segmented on the basis of type, treatment, diagnosis, dosage, route of administration, end user, and distribution channel.

- By Type

On the basis of type, the glossitis market is segmented into acute glossitis, chronic glossitis, atrophic glossitis, and median rhomboid glossitis. The atrophic glossitis segment dominated the market with the largest market revenue share of 42.1% in 2024 due to its strong association with nutritional deficiencies especially vitamin B12 and iron deficiencies and its increasing incidence across global populations. Patients frequently present with tongue discomfort, burning sensations, and smooth texture, prompting greater medical attention and sustained therapeutic demand.

The chronic glossitis segment is expected to witness the fastest growth from 2025 to 2032, driven by its linkage with underlying systemic conditions such as lichen planus, Sjögren’s syndrome, and allergic reactions. Recurrence in chronic cases necessitates long-term management strategies, fueling ongoing demand for tailored therapies and diagnostic services.

- By Treatment

On the basis of treatment, the glossitis market is segmented into antibiotics, topical corticosteroids, nonsteroidal anti-inflammatory drugs (NSAIDs), and others. The topical corticosteroids segment held the largest revenue share in 2024 due to their widespread use in managing inflammatory and autoimmune-related glossitis conditions. They offer localized relief with minimal systemic effects, making them the preferred choice for first-line therapy.

The NSAIDs segment is expected to witness the fastest CAGR from 2025 to 2032, particularly for symptomatic relief in mild to moderate inflammatory glossitis, especially when triggered by trauma or irritation.

- By Diagnosis

On the basis of diagnosis, the glossitis market is segmented into blood tests, laboratory tests, biopsy, and others. The blood tests segment led the market in 2024 due to the high diagnostic reliance on vitamin and iron level assessments for identifying deficiency-related glossitis. Increased awareness of the systemic nature of glossitis has promoted routine blood screening in clinical settings.

The biopsy segment is expected to witness the fastest CAGR from 2025 to 2032, primarily for chronic or suspicious glossitis presentations, enabling accurate differentiation from precancerous or malignant conditions.

- By Dosage

On the basis of dosage, the glossitis market is segmented into tablet, injection, mouthwash, and others. The tablet segment accounted for the largest share in 2024, owing to the dominance of oral supplements especially iron, folic acid, and vitamin B12—for nutritional glossitis management. Their accessibility, affordability, and ease of administration make them the primary choice in both hospital and retail settings.

The mouthwash segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its utility in managing symptom relief in mild inflammatory glossitis and growing popularity among patients seeking topical, non-invasive treatments.

- By Route of Administration

On the basis of route of administration, the glossitis market is segmented into oral, intramuscular, topical, and others. The oral route dominated in 2024, driven by the high prescription volume of oral supplements and systemic medications for treating glossitis.

The topical segment is expected to witness the fastest CAGR from 2025 to 2032, as corticosteroid and anesthetic gels become increasingly used for localized symptom relief in clinical and OTC settings.

- By End User

On the basis of end user, the glossitis market is segmented into clinics, hospitals, and others. Hospitals held the largest market share in 2024, as glossitis is often diagnosed and treated in hospital outpatient departments alongside broader systemic evaluations.

Clinics segment is expected to witness the fastest CAGR from 2025 to 2032, especially in urban and semi-urban regions, due to their accessibility and increased involvement in primary oral healthcare and nutritional screening.

- By Distribution Channel

On the basis of distribution channel, the glossitis market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Retail pharmacies led the market in 2024, driven by the over-the-counter availability of supplements, anti-inflammatory agents, and oral health products commonly used in glossitis management.

The online pharmacy segment is expected to grow at the fastest rate through 2032, supported by rising e-commerce penetration, direct-to-consumer supplement brands, and growing consumer preference for home delivery of healthcare products.

Glossitis Market Regional Analysis

- North America dominated the glossitis market with the largest revenue share of 39.5% in 2024, supported by well-established healthcare infrastructure, high awareness levels, and a strong presence of diagnostic and pharmaceutical players

- Consumers in the region prioritize preventive healthcare and readily seek treatment for oral discomfort, benefiting from widespread access to healthcare services and a strong presence of dental and medical professionals trained in identifying tongue-related conditions

- This regional dominance is further supported by high healthcare expenditure, availability of advanced diagnostic tools, and growing public awareness of the links between nutrition and oral inflammation, positioning North America as a leading market for glossitis diagnosis and treatment solutions

U.S. Glossitis Market Insight

The U.S. glossitis market captured the largest revenue share of 79% in 2024 within North America, fueled by heightened public awareness of oral health and widespread access to advanced healthcare services. Consumers increasingly seek early diagnosis and treatment for oral discomfort, especially glossitis linked to nutritional deficiencies and autoimmune conditions. The availability of specialized care, rising use of diagnostic blood testing, and the integration of glossitis screening into routine healthcare contribute significantly to market expansion. Moreover, strong healthcare infrastructure and growing attention to preventive care support continued growth.

Europe Glossitis Market Insight

The Europe glossitis market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing attention to oral health and rising incidence of vitamin and iron deficiencies. Public health initiatives promoting better nutritional habits and regular health checkups are facilitating early detection and treatment. European consumers, particularly in urban areas, are more aware of systemic diseases reflected through oral symptoms, encouraging demand for glossitis diagnostics and therapies. Growth is evident across general practice, dental care, and specialist clinics, especially in aging populations.

U.K. Glossitis Market Insight

The U.K. glossitis market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness of nutritional health and oral inflammation. The increasing prevalence of iron-deficiency anemia and autoimmune-related glossitis is encouraging both general practitioners and dental professionals to prioritize tongue-related symptoms. Government-backed nutrition campaigns and access to advanced diagnostics support early intervention, while growing public interest in holistic health is such asly to sustain demand for targeted treatment solutions.

Germany Glossitis Market Insight

The Germany glossitis market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing healthcare access and a focus on preventive diagnosis of systemic deficiencies manifesting in oral conditions. With a well-organized healthcare infrastructure, German practitioners actively screen for glossitis during general checkups, especially in elderly and chronically ill patients. Nutritional supplement usage and integration of oral health into overall well-being programs further drive market growth, aligned with the population's strong interest in medical precision and sustainability.

Asia-Pacific Glossitis Market Insight

The Asia-Pacific glossitis market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2025 to 2032, driven by increasing nutritional deficiencies, urbanization, and expanding healthcare access in countries such as India, China, and Southeast Asian nations. Government health programs promoting anemia prevention and oral health education are raising awareness. As diagnostic services and affordable treatments become more accessible, the adoption of glossitis-related therapies is expanding across both urban and rural areas, supporting overall market growth

Japan Glossitis Market Insight

The Japan glossitis market is gaining momentum due to the country’s focus on preventive healthcare and nutritional management. An aging population, high health literacy, and a robust healthcare system are driving early diagnosis of glossitis linked to systemic issues. Consumers in Japan value rapid, minimally invasive solutions, leading to strong demand for supplements, oral treatments, and clinical care. Integration of glossitis assessment into dental and general health exams supports market expansion, especially in managing chronic and deficiency-based forms.

India Glossitis Market Insight

The India glossitis market is expanding rapidly, driven by rising public awareness of nutritional health and increasing access to basic healthcare services. High prevalence of iron-deficiency anemia, especially among women and children, contributes to the widespread occurrence of glossitis. Government-led nutrition programs and community health initiatives are improving diagnosis and treatment rates. As more consumers seek care for oral discomfort and systemic symptoms, the market is expected to grow significantly, supported by affordable supplement availability and expanded rural healthcare outreach.

Glossitis Market Share

The Glossitis industry is primarily led by well-established companies, including:

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Paratek Pharmaceuticals, Inc. (U.S.)

- Nabriva Therapeutics plc (Ireland)

- Spero Therapeutics (U.S.)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Novartis AG (Switzerland)

- Bayer AG (Germany)

- Sun Pharmaceutical Industries Ltd. (India)

- Lilly (U.S.)

- Aurobindo Pharma (India)

- Lupin (India)

- Shionogi & Co., Ltd. (Japan)

- AbbVie Inc. (U.S.)

- Cipla (India)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Zydus Group (India)

What are the Recent Developments in Global Glossitis Market?

- In April 2023, GlaxoSmithKline plc (GSK) launched a targeted oral health awareness campaign in Southeast Asia to address rising cases of glossitis linked to nutritional deficiencies. The initiative included the distribution of educational materials and free vitamin B12 supplements in underserved communities, highlighting GSK’s commitment to preventive healthcare and its focus on mitigating micronutrient-related oral health issues through public health outreach and early intervention strategies

- In March 2023, Pfizer Inc. initiated a clinical study evaluating the efficacy of a new multivitamin formulation specifically designed to treat atrophic glossitis in elderly populations. The study, conducted across multiple geriatric centers in the U.S. and Europe, aims to develop tailored therapeutic options for age-related oral inflammatory conditions. This research effort reinforces Pfizer’s investment in specialized treatments addressing nutritional and autoimmune causes of glossitis

- In March 2023, the Indian Council of Medical Research (ICMR), in collaboration with the Ministry of Health, launched a nationwide program to identify and manage glossitis caused by iron and folate deficiencies among women and children. The program includes community health worker training, mobile diagnostic units, and free supplement distribution, emphasizing the role of early diagnosis in preventing complications. This initiative underscores the growing recognition of glossitis as a public health indicator for nutritional health in developing regions

- In February 2023, Colgate-Palmolive introduced a new medicated oral rinse in Latin America formulated to relieve symptoms of glossitis and improve tongue hygiene. The product, enriched with natural anti-inflammatory agents and mild antiseptics, supports Colgate’s strategy of expanding its therapeutic oral care portfolio while addressing region-specific oral health concerns. The launch reflects increasing consumer demand for OTC solutions tailored to inflammatory oral condition

- In January 2023, Nestlé Health Science announced the development of a new line of medical nutrition products targeting oral mucosal health, including formulations beneficial for glossitis management. These supplements are designed to support individuals with vitamin B complex and iron deficiencies and will be marketed through both clinical channels and retail outlets. This innovation aligns with Nestlé’s mission to offer science-backed nutritional therapies for improving quality of life and managing deficiency-related disorders globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.