Global Glp 1 Receptor Agonists Obesity Drugs Market

Market Size in USD Billion

CAGR :

%

USD

9.96 Billion

USD

33.12 Billion

2024

2032

USD

9.96 Billion

USD

33.12 Billion

2024

2032

| 2025 –2032 | |

| USD 9.96 Billion | |

| USD 33.12 Billion | |

|

|

|

|

GLP-1 Receptor Agonists Obesity Drugs Market Size

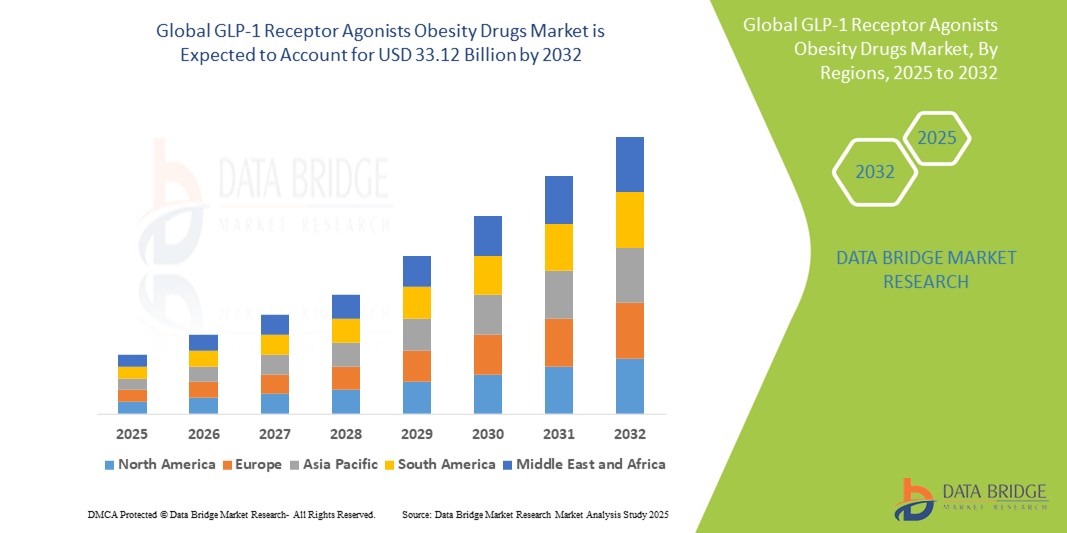

- The global GLP-1 receptor agonists obesity drugs market size was valued at USD 9.96 billion in 2024 and is expected to reach USD 33.12 billion by 2032, at a CAGR of 16.21% during the forecast period

- The market growth is primarily driven by the increasing need for secure, transparent, and tamper-proof systems to manage sensitive healthcare data, billing processes, and patient records across diverse stakeholders

- In addition, the rising adoption of blockchain technology by healthcare providers, insurers, and pharmaceutical companies to streamline operations, enhance data integrity, and mitigate fraud is propelling market expansion. These evolving requirements are fostering a digitally secure infrastructure, significantly elevating the demand for blockchain solutions in the healthcare sector

GLP-1 Receptor Agonists Obesity Drugs Market Analysis

- GLP-1 receptor agonists, a class of drugs that mimic the glucagon-such as peptide-1 hormone, are increasingly recognized as powerful therapeutic options for obesity management due to their dual benefits in appetite regulation and blood glucose control, making them essential tools in both endocrinology and weight-loss medicine

- The accelerating demand for GLP-1 receptor agonists is primarily driven by the global surge in obesity and type 2 diabetes cases, strong clinical outcomes demonstrating significant weight reduction, and growing medical and consumer acceptance of pharmacological obesity treatment

- North America dominated the GLP-1 receptor agonists obesity drugs market with the largest revenue share of 55.56% in 2024, characterized by high obesity prevalence, favorable reimbursement policies, and early adoption of innovative therapies such as semaglutide and tirzepatide, with the U.S. showing robust prescription growth driven by expanding indications and direct-to-consumer pharmaceutical marketing.

- Asia-Pacific is expected to be the fastest growing region in the GLP-1 receptor agonists obesity drugs market during the forecast period due to increasing obesity rates, rising healthcare awareness, and expanding access to advanced diabetes and obesity care

- Long-acting GLP-1 Receptor Agonists segment dominated the GLP-1 receptor agonists obesity drugs market with a market share of 55.5% in 2024, driven by its superior weight loss efficacy, once-weekly dosing convenience, and broad adoption of drugs such as semaglutide and tirzepatide

Report Scope and GLP-1 Receptor Agonists Obesity Drugs Market Segmentation

|

Attributes |

GLP-1 Receptor Agonists Obesity Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

GLP-1 Receptor Agonists Obesity Drugs Market Trends

“Expansion Beyond Diabetes Through Multi-Indication Approvals”

- A significant and accelerating trend in the global GLP-1 receptor agonists obesity drugs market is the expansion of these therapies beyond type 2 diabetes into broader indications such as chronic obesity, cardiovascular risk reduction, and potentially even conditions such as sleep apnea and nonalcoholic steatohepatitis (NASH). This multi-dimensional therapeutic potential is reshaping the positioning of GLP-1 drugs as comprehensive metabolic treatments rather than just glucose-lowering agents

- For instance, Novo Nordisk’s semaglutide is now marketed as Wegovy specifically for chronic weight management, while Eli Lilly’s tirzepatide has received FDA approval under the brand name Zepbound for obesity treatment, independent of diabetic status. These milestones highlight the growing regulatory and clinical momentum supporting expanded uses

- Ongoing trials are also exploring the impact of GLP-1 agonists on cardiovascular outcomes, liver health, and even neurodegenerative diseases, reinforcing their value in treating systemic metabolic disorders. This pipeline diversification is expected to significantly boost long-term market demand and widen the patient base

- The integration of GLP-1 therapies into primary care and obesity management clinics is being accelerated by improved reimbursement models and increasing medical acceptance of pharmacologic obesity treatments. These factors are creating a strong foundation for mainstream adoption

- This shift toward multi-indication GLP-1 therapies is redefining treatment protocols and broadening healthcare strategies aimed at chronic disease management. Consequently, companies such as Novo Nordisk and Eli Lilly are investing heavily in next-generation formulations, including oral small-molecule GLP-1 receptor agonists such as orforglipron, which aim to expand patient accessibility and therapeutic scope

- The demand for GLP-1 drugs that address a wider array of metabolic conditions is growing rapidly across global markets, as patients and healthcare providers increasingly seek holistic and effective long-term treatment options for obesity and its comorbidities

GLP-1 Receptor Agonists Obesity Drugs Market Dynamics

Driver

“Surging Demand Due to Rising Obesity Prevalence and Enhanced Clinical Outcomes”

- The global surge in obesity rates and associated comorbidities such as type 2 diabetes and cardiovascular diseases is significantly driving demand for GLP-1 receptor agonist drugs as effective medical weight loss therapies

- For instance, in May 2024, Novo Nordisk announced a USD 4.1 billion expansion in its U.S. manufacturing capacity for GLP-1 drugs such as Wegovy and Ozempic, underscoring the overwhelming demand and global supply challenges in addressing obesity at scale.

- GLP-1 receptor agonists are increasingly favored for their ability to promote sustained weight reduction, improve glycemic control, and deliver cardiovascular benefits—making them superior to many legacy obesity treatments.

- The growing body of clinical evidence supporting the long-term efficacy and safety of agents such as semaglutide and tirzepatide has strengthened physician confidence and expanded reimbursement coverage in key markets

- Moreover, the rising interest from younger demographics, increased public awareness through social media, and celebrity endorsements are normalizing the use of obesity drugs, further accelerating consumer demand. The shift toward chronic disease prevention and improved metabolic health is positioning GLP-1 receptor agonists as a cornerstone of modern obesity treatment strategies

Restraint/Challenge

“Side Effects and High Treatment Costs Pose Adoption Barrier”

- Concerns surrounding the side effects and high cost of GLP-1 receptor agonist therapies pose significant challenges to broader market adoption. While these drugs are highly effective for weight loss and glycemic control, they are associated with gastrointestinal issues such as nausea, vomiting, and diarrhea, which can lead to treatment discontinuation among some patients

- For instance, clinical data and patient reports have shown that adverse events are particularly common during the early stages of treatment with drugs such as semaglutide and tirzepatide, prompting careful dose titration and medical supervision, which may not be feasible for all patients or healthcare settings

- Addressing these side effect concerns through better patient education, physician training, and next-generation formulations with reduced tolerability issues is crucial to improving long-term adherence and treatment outcomes. In addition, the high cost of GLP-1 therapies remains a barrier, especially in markets with limited insurance coverage or constrained healthcare budgets

- The annual cost of treatment with drugs such as Wegovy or Zepbound can exceed several thousand dollars, which may limit accessibility for patients without comprehensive health coverage. In developing regions, this financial barrier is even more pronounced, slowing market penetration despite growing obesity prevalence

- While efforts are underway to improve affordability—including the introduction of generic formulations and price negotiations in certain markets—the perception of GLP-1 therapies as premium, high-cost treatments can deter both patients and providers from widespread adoption

- Overcoming these challenges through the development of cost-effective alternatives, enhanced insurance support, and patient assistance programs will be vital for ensuring sustained and inclusive market growth in the GLP-1 receptor agonists obesity drugs market

GLP-1 Receptor Agonists Obesity Drugs Market Scope

The market is segmented on the basis of drug type, route of administration, application, and distribution channel.

- By Drug Type

On the basis of drug type, the GLP-1 receptor agonists obesity drugs market is segmented into short-acting and long-acting GLP-1 receptor agonists. The long-acting GLP-1 receptor agonists segment dominated the market with the largest revenue share of 55.5% in 2024, driven by their superior efficacy in sustained weight loss, cardiovascular benefits, and the convenience of once-weekly dosing. Key drugs such as semaglutide (Wegovy/Ozempic) and tirzepatide (Zepbound) are widely adopted due to their robust clinical outcomes and expanding global approvals.

The long-acting GLP-1 receptor agonists segment is also expected to be the fastest-growing during forecast period, supported by strong demand, clinical success, and ongoing development of next-generation formulations, including oral versions. The short-acting segment, while still used in specific patient populations, is experiencing slower growth due to lower compliance rates and less favorable weight loss results compared to long-acting alternatives.

- By Route Of Administration

On the basis of route of administration, the market is segmented into injectable and oral. The injectable segment held the largest market share in 2024, supported by the early introduction and widespread use of injectable formulations such as liraglutide, semaglutide, and tirzepatide. Injectable drugs remain the standard due to their proven efficacy and existing patient familiarity in both diabetes and obesity management.

The oral segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the growing demand for needle-free alternatives and the launch of oral GLP-1 receptor agonists such as Rybelsus (oral semaglutide) and future pipeline products such as orforglipron. These offer enhanced patient convenience, potentially improving adherence in primary care and emerging markets.

- By Application

On the basis of application, the market is segmented into type 2 diabetes and obesity. The type 2 diabetes segment dominated the market in 2024, owing to the longstanding clinical use of GLP-1 drugs in glycemic control and the growing emphasis on cardiovascular and renal benefits.

The obesity segment is the fastest-growing application during forecast period, fueled by increasing global obesity prevalence and expanding FDA and EMA approvals of GLP-1 drugs specifically for weight loss. The success of brands such as Wegovy and Zepbound has spurred demand beyond diabetic populations, positioning GLP-1 therapies as central to chronic weight management protocols.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment led the market in 2024, owing to their role in dispensing specialty and high-cost drugs under medical supervision, especially for newly initiated treatments and titration monitoring.

The online pharmacies segment is expected to grow at the fastest CAGR from 2025 to 2032, propelled by increased digital adoption, convenience of home delivery, and telemedicine integration. Growing consumer comfort with online healthcare services and direct-to-consumer models are supporting the rapid expansion of this channel, particularly in developed regions.

GLP-1 Receptor Agonists Obesity Drugs Market Regional Analysis

- North America dominated the GLP-1 receptor agonists obesity drugs market with the largest revenue share of 55.56% in 2024, driven by high obesity prevalence, favorable reimbursement policies, and early adoption of innovative therapies such as semaglutide and tirzepatide

- Patients and providers in the region increasingly value the superior weight loss efficacy, cardiovascular benefits, and convenience of long-acting GLP-1 drugs such as semaglutide (Wegovy) and tirzepatide (Zepbound), which have become key components in chronic weight and metabolic disorder management

- This widespread use is further supported by favorable reimbursement policies, high healthcare spending, and a proactive medical community, positioning North America as the leading hub for innovation and growth in the GLP-1 obesity drugs space

U.S. GLP-1 Receptor Agonists Obesity Drugs Market Insight

The U.S. GLP-1 receptor agonists obesity drugs market captured the largest revenue share of 81% in 2024 within North America, driven by high obesity prevalence, early drug approvals, and robust healthcare infrastructure. Consumers and physicians are increasingly favoring advanced therapies such as semaglutide (Wegovy) and tirzepatide (Zepbound) for their proven weight loss efficacy and cardiovascular benefits. The expanding role of telehealth, direct-to-consumer marketing, and widespread insurance coverage for obesity medications continue to accelerate adoption across diverse patient populations.

Europe GLP-1 Receptor Agonists Obesity Drugs Market Insight

The Europe GLP-1 receptor agonists obesity drugs market is projected to grow at a substantial CAGR during the forecast period, fueled by the rising incidence of obesity, expanding reimbursement frameworks, and broader acceptance of pharmacological weight management. Regulatory bodies are increasingly approving GLP-1 therapies for obesity-specific indications. Growth is supported by urbanization, public health initiatives targeting metabolic diseases, and growing demand for effective, long-term weight loss solutions in both primary and specialist care settings.

U.K. GLP-1 Receptor Agonists Obesity Drugs Market Insight

The U.K. GLP-1 receptor agonists obesity drugs market is expected to grow at a noteworthy CAGR, driven by the National Health Service (NHS)'s expanding access to obesity treatments and rising public awareness of GLP-1 therapy benefits. With obesity being a key health concern, increasing adoption of Wegovy and similar treatments is being observed in clinical practice. The U.K.’s evolving digital healthcare infrastructure and data-driven patient management support the efficient rollout of GLP-1-based treatments.

Germany GLP-1 Receptor Agonists Obesity Drugs Market Insight

The Germany GLP-1 receptor agonists obesity drugs market is anticipated to expand at a considerable CAGR, underpinned by strong clinical guidelines, a well-established insurance system, and high healthcare spending. The country’s focus on innovative, evidence-based treatments supports broad physician adoption of GLP-1 therapies for obesity. German patients show increasing preference for once-weekly injectables and emerging oral alternatives, aligned with the nation’s emphasis on long-term therapeutic compliance and cost-effectiveness.

Asia-Pacific GLP-1 Receptor Agonists Obesity Drugs Market Insight

The Asia-Pacific GLP-1 receptor agonists obesity drugs market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising obesity rates, growing middle-class populations, and increasing healthcare investments across countries such as China, Japan, and India. Government initiatives promoting chronic disease management and greater access to GLP-1 therapies are strengthening market potential. Local manufacturing and competitive pricing are also improving affordability, expanding access across urban and semi-urban areas.

Japan GLP-1 Receptor Agonists Obesity Drugs Market Insight

The Japan GLP-1 receptor agonists obesity drugs is gaining traction due to its rapidly aging population, rising obesity-related health issues, and preference for high-precision, minimally invasive treatments. Strong clinical outcomes and government approval of semaglutide for weight management are supporting market expansion. The integration of GLP-1 drugs into personalized care models and connected health systems is further advancing adoption, particularly among tech-savvy and elderly populations.

India GLP-1 Receptor Agonists Obesity Drugs Market Insight

The India GLP-1 receptor agonists obesity drugs accounted for the largest revenue share in Asia Pacific in 2024, driven by a growing obesity burden, increasing healthcare awareness, and the rapid expansion of urban healthcare infrastructure. With a large diabetic and pre-diabetic population, GLP-1 therapies are gaining acceptance as dual-purpose treatments. Government-led health campaigns, rising insurance coverage, and local production of cost-effective GLP-1 drugs are propelling growth, especially in metro and tier-2 cities.

GLP-1 Receptor Agonists Obesity Drugs Market Share

The GLP-1 receptor agonists obesity drugs industry is primarily led by well-established companies, including:

- Novo Nordisk A/S (Denmark)

- Lilly (U.S.)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- AstraZeneca (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Hanmi Pharmaceutical Co., Ltd. (South Korea)

- Amgen Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Merck & Co., Inc. (U.S.)

- Johnson & Johnson Services Inc. (U.S.)

- GSK plc (U.K.)

- Lupin Limited (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Ipsen S.A. (France)

- Oramed Pharmaceuticals Inc. (U.S.)

- Zealand Pharma A/S (Denmark)

- Takeda Pharmaceutical Company Limited (Japan)

- Structure Therapeutics Inc. (U.S.)

- Innovent Biologics, Inc. (China)

What are the Recent Developments in Global GLP-1 Receptor Agonists Obesity Drugs Market?

- In May 2024, Novo Nordisk announced plans to expand production capacity for Wegovy and Ozempic by investing over USD 4.1 billion in manufacturing facilities in Denmark and the U.S. This move aims to address growing global demand and reduce supply constraints for GLP-1 receptor agonists used in obesity and diabetes treatment. The investment reflects the company's strategic commitment to scaling operations in response to increasing therapeutic uptake

- In April 2024, Eli Lilly and Company launched Zepbound (tirzepatide) in several European markets following regulatory approval for obesity management. The dual GIP/GLP-1 receptor agonist has shown superior efficacy in weight reduction and metabolic improvement, and its European rollout marks a significant milestone in expanding the availability of next-generation obesity drugs beyond the U.S. market

- In March 2024, Pfizer Inc. resumed clinical development of its once-daily oral GLP-1 receptor agonist after earlier trials were paused due to gastrointestinal side effects. The company has reformulated the drug to improve tolerability, reflecting the industry's broader effort to develop more patient-friendly alternatives to injectable therapies. If successful, this could significantly improve compliance and expand access

- In February 2024, Amgen Inc. initiated a Phase 3 clinical trial for its investigational GLP-1 agonist compound MariTide, targeting obesity and cardiometabolic comorbidities. The candidate previously demonstrated promising weight loss outcomes in Phase 2 trials, and its progression into late-stage testing underscores the competitive momentum building in this high-growth therapeutic category

- In January 2024, Zealand Pharma and Boehringer Ingelheim announced positive Phase 2 results for BI 456906, a long-acting GLP-1/glucagon dual agonist, in obese individuals. The data showed significant body weight reduction and favorable tolerability, paving the way for Phase 3 development. This reflects the evolving focus on combination therapies to enhance efficacy and broaden treatment options in obesity care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.