Global Golf Apparel Footwear And Accessories Market

Market Size in USD Billion

CAGR :

%

USD

11.14 Billion

USD

15.49 Billion

2024

2032

USD

11.14 Billion

USD

15.49 Billion

2024

2032

| 2025 –2032 | |

| USD 11.14 Billion | |

| USD 15.49 Billion | |

|

|

|

|

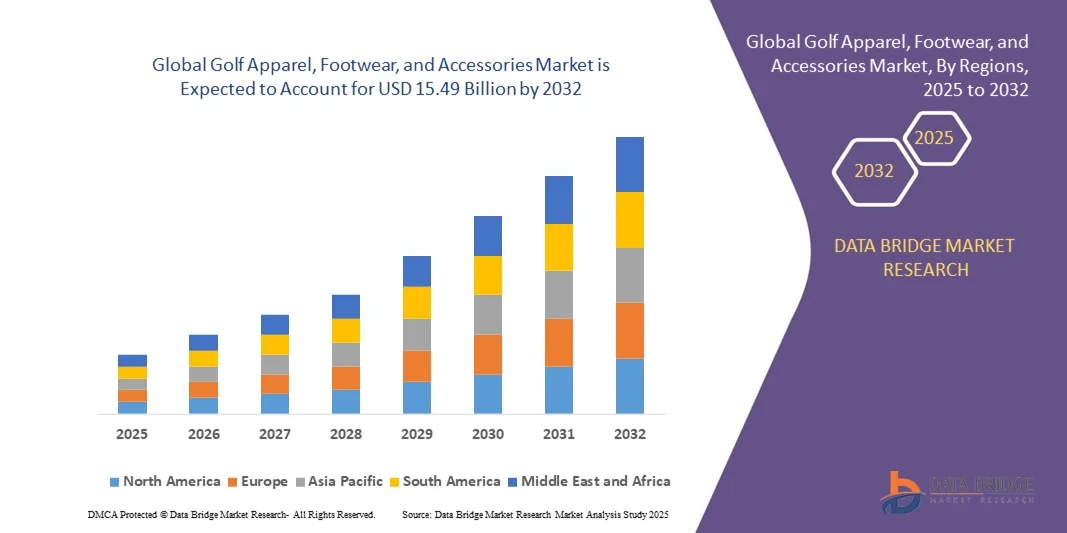

What is the Global Golf Apparel, Footwear, and Accessories Market Size and Growth Rate?

- The global golf apparel, footwear, and accessories market size was valued at USD 11.14 billion in 2024 and is expected to reach USD 15.49 billion by 2032, at a CAGR of 4.20% during the forecast period

- The presence of companies produces the best golf apparel and accessories products for users at regional and international levels. These manufacturers and suppliers of golf apparel, footwear, and accessories offer products for all budget ranges with various characteristics

- Development and rise in third-party logistics globally are expected to drive the Global golf apparel, footwear, and accessories market. In addition, the rise of e-commerce and other online platforms fuels global golf apparel, footwear, and accessories growth

What are the Major Takeaways of Golf Apparel, Footwear, and Accessories Market?

- Ecommerce continued to be a rapidly growing third-party logistics (3PL) segment as retailers rely on Amazon and third-party logistics providers to help manage Omni channel and e-commerce operations

- Both e-Commerce and ride hailing, which include food delivery services, are experiencing a burst of demand due to rapid adoption and fundamental shifts in consumer behaviour. In a few years, e-Commerce and ride hailing have become an integral part of daily life for millions of Southeast Asians, especially those living in big cities

- North America dominated the golf apparel, footwear, and accessories market with the largest revenue share of 36.48% in 2024, driven by the strong popularity of golf, a well-established golfing infrastructure, and high consumer spending on premium sportswear

- The Asia-Pacific (APAC) golf apparel, footwear, and accessories market is projected to grow at the fastest CAGR of 7.98% from 2025 to 2032, driven by the rising popularity of golf, expanding middle-class populations, and growing brand awareness in countries such as China, Japan, South Korea, and India

- The Men Apparel segment dominated the market with the largest revenue share of 41.8% in 2024, driven by high male participation in golf and consistent demand for performance-oriented clothing such as polo shirts, trousers, and outerwear

Report Scope and Golf Apparel, Footwear, and Accessories Market Segmentation

|

Attributes |

Golf Apparel, Footwear, and Accessories Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Golf Apparel, Footwear, and Accessories Market?

Integration of Sustainable Materials and Smart Fabric Technology

- A major emerging trend in the Golf Apparel, Footwear, and Accessories market is the rising integration of sustainable materials and smart fabric technologies aimed at enhancing both performance and environmental responsibility

- Manufacturers are increasingly adopting recycled polyester, organic cotton, and plant-based fibers to align with growing consumer demand for eco-friendly and ethical products.

- For instance, Adidas AG introduced golf apparel and shoes made from recycled ocean plastics under its “End Plastic Waste” initiative, emphasizing sustainability without compromising performance

- Smart fabrics embedded with moisture-wicking, temperature control, and UV-protection technologies are gaining traction, particularly among professional and recreational golfers seeking comfort and durability. Moreover, connected wearables such as GPS-enabled gloves and AI-integrated footwear enhance performance analytics and training feedback

- This convergence of technology and sustainability is reshaping consumer expectations, driving brands to innovate responsibly and appeal to the eco-conscious golfer worldwide

What are the Key Drivers of Golf Apparel, Footwear, and Accessories Market?

- The increasing popularity of golf as a lifestyle sport, coupled with the rising influence of social media and celebrity endorsements, is significantly driving the demand for stylish and performance-oriented golf apparel and accessories. The expanding participation of women and younger demographics has also boosted product diversification

- For instance, in February 2024, Nike Inc. launched its new “Nike Tour Collection,” designed with advanced moisture management and stretchable fabrics to enhance comfort and flexibility on the golf course. This initiative highlights the brand’s focus on combining innovation with athletic fashion

- Furthermore, growing awareness of fitness and outdoor activities, combined with the increasing availability of golf courses and resorts globally, is propelling market growth. Golf apparel and footwear that offer breathability, durability, and weather resistance are becoming essential for players across all skill levels

- The expansion of e-commerce platforms and personalized shopping experiences has also contributed to the market’s growth, offering consumers easy access to premium golf products with global reach and brand variety

Which Factor is Challenging the Growth of the Golf Apparel, Footwear, and Accessories Market?

- One of the major challenges restraining market growth is the high price of premium golf apparel and accessories, which limits adoption among casual and price-sensitive players. High production costs of advanced materials, coupled with fluctuating raw material prices, increase retail prices for consumers

- For instance, limited-edition products from luxury brands such as KERING (France) and RALPH LAUREN (U.S.) often cater to niche audiences, creating a gap between aspirational demand and actual purchase power

- Another significant challenge lies in the seasonal dependency of golf, as unfavorable weather conditions in several regions reduce participation rates and product demand during off-seasons. Moreover, counterfeit and low-quality replicas in online marketplaces dilute brand reputation and impact profitability

- To overcome these challenges, companies are focusing on price diversification, offering mid-range collections, and expanding into all-weather and multipurpose golfwear to ensure consistent revenue streams throughout the year

How is the Golf Apparel, Footwear, and Accessories Market Segmented?

The market is segmented on the basis of product, distribution channel, demographics, and price range.

- By Product

On the basis of product, the Golf Apparel, Footwear, and Accessories market is segmented into Men Apparel, Women Apparel, Footwear, and Accessories. The Men Apparel segment dominated the market with the largest revenue share of 41.8% in 2024, driven by high male participation in golf and consistent demand for performance-oriented clothing such as polo shirts, trousers, and outerwear. Brands are increasingly focusing on stylish yet functional men’s golf wear designed for moisture control and flexibility.

The Women Apparel segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the growing number of female golfers and the expansion of women-focused golf tournaments globally. Rising fashion consciousness and the introduction of vibrant, performance-enhancing designs have significantly boosted product appeal. The growing inclusivity and athletic participation of women are expected to strengthen this segment’s future market position.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Store-Based Retail and Online Retail. The Store-Based Retail segment held the largest market revenue share of 58.5% in 2024, attributed to the tangible product experience, personalized fitting, and brand-specific outlets that provide customers with a premium shopping environment. Physical stores also benefit from impulse purchases and exclusive in-store offers.

The Online Retail segment is expected to register the fastest CAGR from 2025 to 2032, driven by the rapid digitalization of commerce and growing consumer preference for convenience, variety, and discounts offered by e-commerce platforms. The increasing adoption of virtual try-on technologies and direct-to-consumer strategies by leading brands such as Nike Inc. and Adidas AG are further propelling this segment’s growth.

- By Demographics

Based on demographics, the market is divided into Men, Women, and Kids. The Men segment accounted for the largest market share of 63.7% in 2024, owing to higher male participation rates in golf, frequent purchases of apparel, and increasing engagement in professional and recreational tournaments. The segment’s dominance is also supported by premium product launches targeting male golfers who value both performance and aesthetics.

The Women segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by initiatives to promote women’s golf worldwide and a rising number of golf academies encouraging female participation. Leading brands are expanding female-centric collections featuring comfortable fits, UV protection, and lightweight materials. In addition, social media influence and celebrity collaborations are accelerating women’s adoption of fashionable golf wear.

- By Price Range

On the basis of price range, the market is segmented into Economy, Mid-Range, Premium, and Super Premium. The Mid-Range segment dominated the market with the largest revenue share of 39.4% in 2024, as it offers a balance between affordability and quality. Golfers in this segment seek durable, functional, and aesthetically appealing products without paying luxury prices.

The Premium segment is expected to experience the fastest CAGR from 2025 to 2032, driven by the rising preference for branded, high-performance golf wear and accessories among professional and semi-professional golfers. Brands such as PUMA Golf and Adidas AG are introducing premium lines with advanced moisture-wicking fabrics, ergonomic designs, and sustainability-driven materials, aligning with consumer expectations for innovation and exclusivity.

Which Region Holds the Largest Share of the Golf Apparel, Footwear, and Accessories Market?

- North America dominated the golf apparel, footwear, and accessories market with the largest revenue share of 36.48% in 2024, driven by the strong popularity of golf, a well-established golfing infrastructure, and high consumer spending on premium sportswear. The region benefits from a large base of professional golfers, prestigious tournaments such as the PGA Tour, and the presence of leading brands including Nike Inc. and Adidas AG

- Consumers in North America prioritize comfort, innovation, and brand reputation when purchasing golf apparel and footwear. The increasing trend of athleisure and the adoption of sustainable, performance-oriented fabrics further boost regional demand

- Moreover, golf’s cultural significance, rising participation among younger demographics, and growing women’s golf segment have solidified North America’s position as the leading regional market

U.S. Golf Apparel, Footwear, and Accessories Market Insight

The U.S. accounted for the largest market share within North America in 2024, primarily driven by the country’s robust golf culture, high household incomes, and growing awareness of sports fashion. The U.S. market witnesses consistent product launches from global and domestic brands, integrating advanced technologies such as moisture-wicking and UV-protective materials. The expanding popularity of recreational golf and celebrity endorsements have further fueled apparel and footwear sales. Moreover, the rise of online retail platforms and customized product offerings have enhanced accessibility for consumers. The growing focus on eco-friendly materials and sustainable fashion practices is expected to strengthen the country’s leadership in the golf apparel and accessories sector.

Europe Golf Apparel, Footwear, and Accessories Market Insight

The Europe golf apparel, footwear, and accessories market is projected to grow steadily during the forecast period, supported by the rising adoption of golf as a leisure activity and the expansion of golf tourism across countries such as the U.K., Germany, and France. Increasing fashion consciousness and the preference for high-quality branded sportswear are boosting market demand. The region’s established golf clubs and associations play a vital role in driving apparel and footwear sales, particularly among professional and amateur players. In addition, European consumers are showing greater interest in sustainable and ethically produced products, encouraging brands to innovate eco-friendly collections. Golf’s growing appeal among younger and female participants is such asly to sustain long-term market expansion in the region.

U.K. Golf Apparel, Footwear, and Accessories Market Insight

The U.K. golf apparel, footwear, and accessories market is anticipated to grow at a notable CAGR during the forecast period, driven by increasing golf participation rates and a strong preference for premium and fashionable sportswear. The U.K. is home to several prestigious golf courses, attracting both domestic and international players. Consumers in the country are gravitating toward versatile, weather-resistant clothing suitable for local climate conditions. Moreover, a surge in e-commerce platforms and brand-owned retail stores has made high-end golf apparel more accessible. With sustainability and functionality at the forefront, the U.K. continues to witness rising interest from younger golfers and women’s categories, reinforcing its growth trajectory.

Germany Golf Apparel, Footwear, and Accessories Market Insight

The Germany golf apparel, footwear, and accessories market is expected to expand at a consistent CAGR during the forecast period, supported by growing golf club memberships and the adoption of environmentally responsible manufacturing practices. German consumers prioritize premium quality, comfort, and innovation in sportswear products. Leading international and regional brands are investing in research and design to create eco-friendly, high-performance materials that cater to local consumer expectations. In addition, the popularity of golf as a recreational sport among middle-aged professionals contributes to steady apparel and footwear demand. The focus on luxury golf accessories and functional designs aligns with Germany’s reputation for precision and quality.

Which Region is the Fastest Growing Region in the Golf Apparel, Footwear, and Accessories Market?

The Asia-Pacific (APAC) golf apparel, footwear, and accessories market is projected to grow at the fastest CAGR of 7.98% from 2025 to 2032, driven by the rising popularity of golf, expanding middle-class populations, and growing brand awareness in countries such as China, Japan, South Korea, and India. Increasing participation in golf tournaments and government efforts to develop golf courses are strengthening regional market growth. Moreover, the influence of Western fashion, celebrity endorsements, and premium lifestyle trends are fueling the demand for branded golf apparel and accessories. The availability of affordable local products, combined with the rise of online retail channels, has made golf fashion more accessible to a wider consumer base, positioning APAC as a key growth hub for the industry.

Japan Golf Apparel, Footwear, and Accessories Market Insight

The Japan golf apparel, footwear, and accessories market is witnessing significant growth, propelled by the nation’s affinity for high-quality products, advanced textile technology, and active golf culture. Japanese consumers value innovation, comfort, and elegant design, leading to high adoption of performance-oriented apparel and footwear. The increasing popularity of indoor golf facilities and simulation-based training is also contributing to market expansion. Furthermore, collaborations between international and local brands to introduce limited-edition collections have enhanced brand loyalty. With golf being viewed as both a sport and a lifestyle activity, Japan remains one of the most dynamic markets in the Asia-Pacific region.

China Golf Apparel, Footwear, and Accessories Market Insight

The China golf apparel, footwear, and accessories market accounted for the largest share in the Asia-Pacific region in 2024, supported by rapid urbanization, rising disposable incomes, and growing interest in luxury sportswear. China’s expanding base of golf courses and driving ranges has created strong demand for apparel and accessories among both amateurs and professionals. The growing influence of Western golf brands, coupled with the emergence of domestic manufacturers, has made high-quality products widely available. In addition, online retail platforms such as Tmall and JD.com have made premium golf apparel more accessible to middle-income consumers. The country’s rising sports enthusiasm and lifestyle shift toward health and recreation are expected to continue fueling market growth.

Which are the Top Companies in Golf Apparel, Footwear, and Accessories Market?

The golf apparel, footwear, and accessories industry is primarily led by well-established companies, including:

- TaylorMade Golf Co. (U.S.)

- Acushnet Holdings Corp (U.S.)

- KERING (France)

- RALPH LAUREN (U.S.)

- Decathlon (France)

- FILA HOLDING CORP (South Korea)

- YONEX CO., LTD. (Japan)

- DUCA DEL COSMA (Netherlands)

- Nike Inc. (U.S.)

- Under Armour Inc. (U.S.)

- ASICS Corporation (Japan)

- Amer Sports (Finland)

- Mizuno Corporation (Japan)

- Adidas AG (Germany)

- Sumitomo Rubber Industries Ltd. (Japan)

- Bridgestone Golf Inc. (U.S.)

- PING (U.S.)

- COBRA GOLF (PUMA GOLF) (U.S.)

What are the Recent Developments in Global Golf Apparel, Footwear, and Accessories Market?

- In May 2024, Sun Day Red, a lifestyle brand founded by Tiger Woods in collaboration with TaylorMade Golf Co., launched its debut golf wear collection titled The Hunt. The collection reflects Woods’ vision of combining performance and style, catering to both professional golfers and fashion-conscious consumers. This launch marks an important step in redefining premium golf apparel with a focus on authenticity and functionality, reinforcing TaylorMade’s position in the global golf lifestyle segment

- In May 2024, Stuburt, a U.K.-based golf footwear and apparel company, announced a multi-team partnership deal with Fireballs G.C., Torque G.C., and Stinger G.C.. As part of this collaboration, Stuburt introduced team-specific men’s polos, pants, rain gear, and lifestyle apparel. The partnership highlights Stuburt’s growing commitment to professional golf and its strategy to enhance global brand recognition through innovative, athlete-driven collections

- In May 2023, Adidas signed a multi-year endorsement deal with Rose Zhang, a leading American professional golfer. Under this agreement, Zhang will wear Adidas’ range of golf apparel, footwear, and accessories during tournaments. This collaboration strengthens Adidas’ association with elite athletes and reflects the company’s ongoing focus on expanding its influence in women’s golf fashion

- In March 2023, Adidas introduced its Our [Fair]Way Floral Collection, featuring a skort, sleeve and sleeveless polo, and dress. The collection was designed to combine sustainability with elegance, appealing to environmentally conscious golfers. Through this launch, Adidas reinforced its dedication to innovation and eco-friendly materials, further enhancing its reputation as a leader in sustainable golf apparel

- In March 2021, Callaway Golf Company, a California, U.S.-based golf equipment and accessories manufacturer, unveiled its Summer/Spring 2021 Collection for men and women. The collection included ventilated heather jacquard, fine line stripe polos, TrueSculpt skorts, and short-sleeved color block dresses. This product line demonstrated Callaway’s commitment to blending performance, comfort, and modern aesthetics, strengthening its position in the global golf fashion market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.