Global Grain Mill Grinder Market

Market Size in USD Billion

CAGR :

%

USD

11.75 Billion

USD

18.45 Billion

2024

2032

USD

11.75 Billion

USD

18.45 Billion

2024

2032

| 2025 –2032 | |

| USD 11.75 Billion | |

| USD 18.45 Billion | |

|

|

|

|

Grain Mill Grinder Market Size

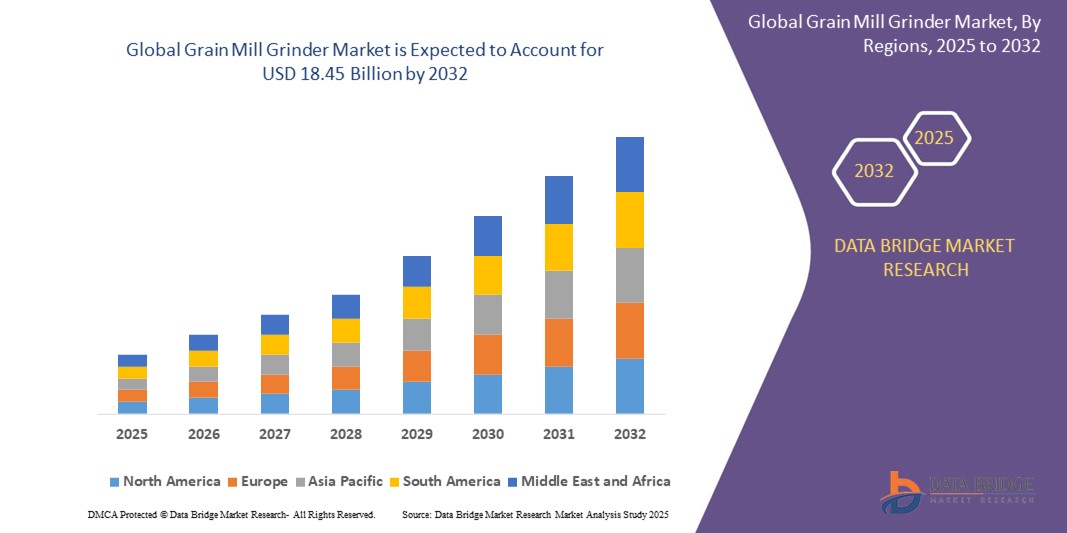

- The global grain mill grinder market was valued at USD 11.75 billion in 2024 and is expected to reach USD 18.45 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.80%, primarily driven by the increasing demand for home-based food processing appliances

- This growth is driven by factors such as the rising interest in organic and whole grain diets, growing health consciousness among consumers, and the expansion of small-scale and artisanal food production

Grain Mill Grinder Market Analysis

- Grain mill grinders are essential equipment used to grind cereals, seeds, and grains into flour or meal, catering to both household and commercial food preparation needs. These machines are vital in food processing industries, bakeries, and increasingly, in home kitchens promoting healthy and organic eating habits

- The demand for grain mill grinders is significantly driven by the rising preference for freshly ground, preservative-free flour, and the growing popularity of whole grain and gluten-free diets. Urban consumers and health-conscious individuals are increasingly investing in these machines for personal use

- The Asia Pacific region stands out as one of the dominant markets for grain mill grinders, driven by a large base of traditional grain-based food consumption and increasing adoption of electric grinders in developing economies such as India and China

- For instance, the rise of small-scale flour mills and organic food startups in India and China is contributing to increased demand for efficient and compact grain milling solutions. These businesses often rely on semi-automatic or automatic grain grinders to meet growing consumer needs.

- Globally, grain mill grinders are among the most frequently purchased kitchen appliances in the small-scale food processing segment, following mixers and blenders. Their role is pivotal in supporting sustainable and homemade food trends that emphasize freshness, nutrition, and local production

Report Scope and Grain Mill Grinder Market Segmentation

|

Attributes |

Grain Mill Grinder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Grain Mill Grinder Market Trends

“Integration of Smart Features and Compact, User-Friendly Designs”

- One prominent trend in the global grain mill grinder market is the increasing integration of smart features and the shift toward compact, user-friendly designs for domestic and small-scale commercial use

- These modern grain grinders come equipped with features such as programmable grinding settings, overload protection, and digital displays, offering greater convenience and customization for user

- For instance, recent product lines from brands like WonderMill and NutriMill now include variable speed controls, noise-reduction technology, and detachable parts for easier cleaning—catering to the growing demand for functional yet compact kitchen appliances

- The move toward digital control panels and smart timers not only enhances precision in grinding various grain types but also appeals to tech-savvy consumers looking for more automation in kitchen devices

- This trend is redefining the home appliance and small food production segment, boosting adoption among health-conscious individuals and artisan food producers, and expanding the global grain mill grinder market beyond traditional industrial applications

Grain Mill Grinder Market Dynamics

Driver

“Growing Demand Driven by Health-Conscious Eating and Dietary Preferences”

- The increasing consumer shift toward health-conscious eating habits, including the preference for whole grains, gluten-free products, and freshly ground flour, is significantly contributing to the rising demand for grain mill grinders

- As awareness of nutritional benefits grows, more individuals are seeking to avoid commercially processed flours containing additives and preservatives by grinding their own grains at home or in small-scale businesses

- Whole grains are rich in fiber, vitamins, and antioxidants, making them a staple in diets promoting digestive health, weight management, and chronic disease prevention—fueling the adoption of home-based or small commercial grinding solutions

- Technological advancements in grinder design—such as adjustable grinding settings for different textures, quieter operation, and compact sizes—have made these machines more appealing and accessible to a broader range of consumers

- As healthy eating trends continue to rise across both developed and emerging markets, the demand for grain mill grinders is expected to grow steadily, driven by lifestyle choices and dietary awareness

For instance,

- In August 2023, KoMo GmbH reported a significant uptick in sales of their electric home grain mills across Europe and North America, driven by increased consumer interest in organic and whole grain diets, especially following global food supply disruptions and rising gluten sensitivities

- In February 2024, NutriMill announced the expansion of its grain grinder product line, integrating smart digital controls and customizable texture options, targeting health-conscious users and boutique bakeries

- As more consumers prioritize fresh and nutrient-rich food options, grain mill grinders are becoming an essential tool in modern kitchens and small-scale food enterprises, pushing the market forward

Opportunity

“Expanding Capabilities through Smart Automation and IoT Integration”

- Smart grain mill grinders with IoT connectivity and automated features present a growing opportunity to transform both home and commercial grain processing by improving efficiency, consistency, and ease of use

- IoT-enabled grinders can monitor performance, track usage patterns, and provide maintenance alerts, reducing downtime and enhancing the lifespan of the equipment

- Automated features such as programmable settings for different grain types, texture customization, overload protection, and real-time feedback help users optimize grinding processes and achieve precise results

- These advancements are especially beneficial in small-scale food manufacturing units and home kitchens where consistent quality, hygiene, and productivity are critical

- Integration with mobile apps and smart home ecosystems also adds convenience, enabling users to control grinders remotely, track grain consumption, and receive maintenance reminders

For instance,

- In September 2023, Mockmill introduced a new line of smart grain mills equipped with digital interfaces and app connectivity, allowing users to monitor grain type, flour texture, and machine performance via smartphones—catering to the growing segment of tech-savvy home bakers and food startups

- In March 2024, L’Chef/NutriMill announced a collaboration with a food tech firm to develop AI-powered grinders capable of recommending grind settings based on grain moisture levels and desired coarseness, aimed at improving quality control in boutique bakeries and organic food production units

- The integration of smart technologies in grain mill grinders not only improves user experience and product quality but also opens new avenues for innovation in the global market, particularly in health-focused and tech-driven consumer segments

Restraint/Challenge

“High Initial Costs Limiting Adoption in Emerging Markets”

- The relatively high upfront cost of quality grain mill grinders presents a significant challenge to market expansion, particularly in low-income and emerging regions where affordability is a key factor in consumer purchasing decisions

- Industrial and semi-automatic grain grinders, which are essential for consistent and large-scale flour production, can range from several hundred to several thousand dollars, depending on features and capacity

- This price barrier often prevents small-scale businesses, local bakeries, and home-based entrepreneurs from adopting advanced grinders, pushing them to rely on manual or outdated equipment that compromises efficiency and output qu

For instance,

- In October 2024, according to a product pricing overview by Pleasant Hill Grain, commercial-grade electric grain grinders suitable for continuous operation were priced upwards of USD 1,000–2,500, limiting accessibility for rural micro-enterprises and small food producers in developing countries

- In May 2023, a report by India’s Ministry of Micro, Small and Medium Enterprises (MSME) noted that high equipment costs in the food processing sector remain a critical obstacle for technology adoption, especially among traditional grain-processing units in rural India that operate on slim margins

- Consequently, the high cost of modern grain mill grinders restricts their market penetration in price-sensitive regions, contributing to uneven adoption rates and slowing the growth potential of the global grain mill grinder market

Grain Mill Grinder Market Scope

The market is segmented on the basis of type, application, grain type, power source, end users, and sales channels.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Grain Type |

|

|

By Power Source |

|

|

By End Users |

|

|

By Sales Channel |

|

Grain Mill Grinder Market Regional Analysis

“North America is the Dominant Region in the Grain Mill Grinder Market”

- North America dominates the global grain mill grinder market, driven by a strong culture of home-based food preparation, rising demand for healthy eating options, and a well-established presence of premium kitchen appliance brands

- The U.S. holds a substantial market share due to increasing consumer interest in organic and whole grain diets, the popularity of home baking, and the growing number of boutique bakeries and small-scale food enterprises

- The region’s robust distribution network—both online and offline—facilitates widespread availability of grain mill grinders, while brand recognition and customer loyalty further fuel product uptake

- In addition, continuous innovation by U.S.-based manufacturers, including the introduction of smart grinders and customizable grinding options, has significantly elevated product appeal among tech-savvy and health-conscious consumers

- Government programs promoting small food businesses and sustainable food practices, along with a rise in gluten-free and specialty diets, have also contributed to the expansion of the market in North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the grain mill grinder market, driven by increasing demand for traditional and healthy diets, rising disposable incomes, and the rapid growth of small-scale food businesses

- Countries such as India, China, and Japan are emerging as key markets due to the growing popularity of home-ground flour, millet-based diets, and whole grain consumption, particularly among urban and health-conscious populations

- India and China, with their vast rural populations and deep-rooted use of grains like wheat, rice, millet, and maize, are seeing increased demand for small, efficient grain grinders, especially as micro-entrepreneurship and cottage food industries expand

- Government initiatives supporting rural food processing units and the growing presence of global kitchen appliance brands in the region are further boosting accessibility and product adoption across urban and semi-urban areas

Grain Mill Grinder Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bühler Group (Switzerland)

- Miller Milling Company (U.S.)

- Cargill, Incorporated (U.S.)

- Satake Corporation(Japan)

- Grain Milling Technology (GMT) (South Africa)

- Zhengzhou Double-lion Grain & Oil Machinery Co., Ltd. (China)

- Kice Industries, Inc. (U.S.)

- Alapala Machine Industry & Trade Inc. (Turkey)

- Ocrim S.p.A. ( Italy)

- Rheon Automatic Machinery Co., Ltd. (Japan)

- Akyurek Technology (Turkey)

- Pavan Group (Italy),

- MUKUL ENTERPRISES(India)

- The Schuitemaker Group (Netherlands)

- CTGRAIN(China)

Latest Developments in Global Grain Mill Grinder Market

- In February 2025, the Sana Grain Mill was launched as a compact, user-friendly appliance designed for home use. It features ceramic and corundum millstones along with a powerful 360-watt motor, capable of grinding 6.5 cups of flour in just five minutes. The mill efficiently processes a variety of grains, including wheat, corn, beans, and lentils, ensuring freshly milled, nutrient-rich flour that enhances the flavor of baked goods. Its solid beechwood construction and adjustable grinding settings make it a durable and versatile kitchen tool

- In August 2024, GrainTech India 2024 took place at the Bangalore International Exhibition Centre, bringing together industry leaders from over 25 countries. The event showcased cutting-edge innovations in grain milling technology, emphasizing automation, sustainability, and value addition. Key discussions focused on the future of flour milling and the integration of smart technologies in modern milling equipment. The exhibition provided a platform for networking, knowledge exchange, and business opportunities within the grain processing sector

- In September 2023, Renewal Mill introduced upcycled white corn flour, expanding its portfolio of sustainable ingredients. This flour is derived from the byproduct of the cornmeal milling process, transforming what would be waste into a nutritious, eco-friendly alternative. The company, known for its commitment to upcycled food solutions, aims to reduce food waste while providing high-quality, plant-based ingredients. The new flour is ideal for baking, snacks, tortillas, and crackers, offering a versatile option for food manufacturers

- In June 2023, Ardent Mills introduced Egg Replace and Ancient Grains Plus Baking Flour Blend, responding to the rising demand for plant-based and specialty baking ingredients. Egg Replace serves as a 1:1 substitute for dried and liquid eggs, offering cost efficiency and supply stability. Ancient Grains Plus is crafted from whole-food ancient grains and chickpeas, delivering higher protein content than traditional flours. Both products are gluten-free, vegan, and free from major allergens, ensuring accessibility for diverse dietary needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.