Global Grasshoppers Protein Market

Market Size in USD Million

CAGR :

%

USD

157.03 Million

USD

721.56 Million

2024

2032

USD

157.03 Million

USD

721.56 Million

2024

2032

| 2025 –2032 | |

| USD 157.03 Million | |

| USD 721.56 Million | |

|

|

|

|

Grasshoppers Protein Market Size

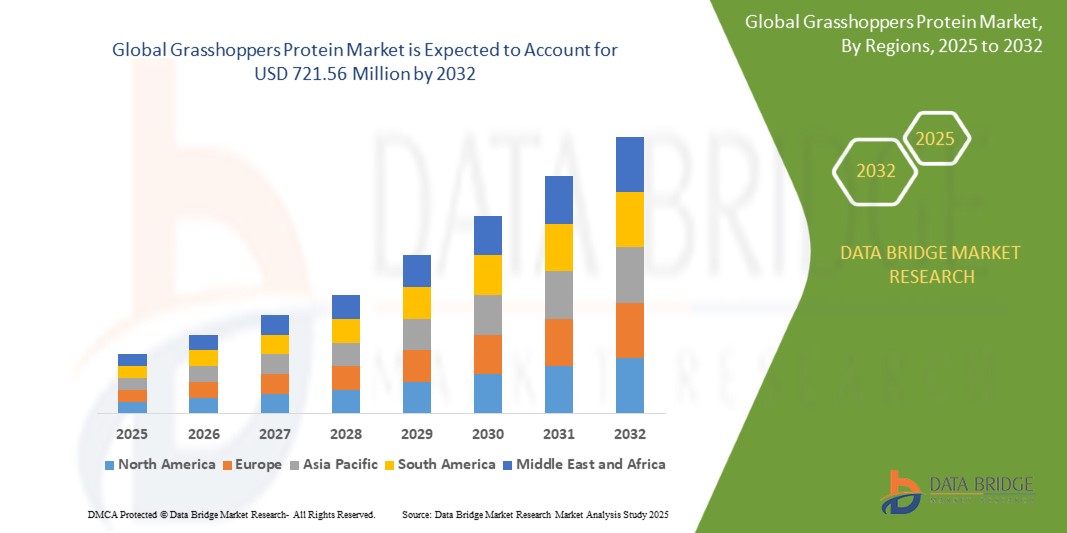

- The global grasshoppers protein market size was valued at USD 157.03 million in 2024 and is expected to reach USD 721.56 million by 2032, at a CAGR of 21.00% during the forecast period

- The market growth is largely fuelled by the rising consumer demand for sustainable and high-protein food alternatives, driven by growing environmental concerns, population growth, and increased awareness of insect-based nutrition

- The increasing use of grasshopper protein in sports nutrition, dietary supplements, and functional food sectors is contributing significantly to market expansion

Grasshoppers Protein Market Analysis

- The market is witnessing robust development due to increasing investments in edible insect farming technologies and processing innovations

- Key players are actively exploring new product formats, such as protein powders, bars, and snacks, to appeal to a broader consumer base

- North America dominated the grasshoppers protein market with the largest revenue share of 39.8% in 2024, driven by growing consumer awareness about sustainable protein alternatives and the rising demand for high-nutrition food products

- Asia-Pacific region is expected to witness the highest growth rate in the global grasshoppers protein market, driven by increasing consumer acceptance of insect-based foods, government-backed initiatives promoting alternative proteins, and the growing demand for sustainable and high-protein food sources across countries such as China, Thailand, and Vietnam

- The flour segment accounted for the largest revenue share in 2024, driven by its versatility and increasing incorporation into baked goods, pasta, and health-focused meal replacements. Flour made from grasshoppers is gaining traction as a high-protein, low-carb alternative to conventional flours, appealing to both fitness enthusiasts and sustainability-conscious consumers

Report Scope and Grasshoppers Protein Market Segmentation

|

Attributes |

Grasshoppers Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Grasshoppers Protein Market Trends

“Rising Adoption of Grasshopper Protein in Functional Food and Beverage Products”

- Consumers are increasingly prioritizing functional foods that offer both nutritional benefits and sustainability, which is boosting interest in grasshopper protein

- Grasshopper protein is rich in essential amino acids, micronutrients such as iron and zinc, and bioavailable vitamins, making it suitable for health-centric formulations targeting active lifestyles

- Food and beverage manufacturers are actively incorporating grasshopper protein into bars, protein powders, baked goods, and meal replacements to appeal to fitness-conscious consumers

- This trend is aligned with growing clean-label and eco-conscious preferences, especially among millennials and Gen Z who are more open to alternative proteins

- The rise in plant-based and insect-based innovations is broadening the protein ingredient market, supporting product diversification across both sports nutrition and convenience food categories

- For instance, Seek Food launched grasshopper-based energy bars with minimal ingredients, specifically designed for wellness enthusiasts seeking ethical and functional protein sources

Grasshoppers Protein Market Dynamics

Driver

“Environmental Sustainability and High Feed Conversion Efficiency”

- Grasshoppers require substantially fewer natural resources—such as feed, land, and water—compared to traditional livestock, making them an environmentally superior protein option

- Their feed conversion ratio (FCR) is among the most efficient in the insect kingdom, converting 1.7 kg of feed into 1 kg of insect mass, reducing production input costs

- Greenhouse gas emissions from grasshopper farming are negligible, which supports climate-conscious food production systems and aligns with global carbon-reduction goals

- Rearing grasshoppers can also be scaled vertically in urban settings, offering a localized, low-impact protein solution with minimal waste output

- Global initiatives such as the UN’s Sustainable Development Goals (SDGs) and efforts to reduce meat consumption are further encouraging the shift toward insect protein adoption

- For instance, The Food and Agriculture Organization (FAO) has publicly recognized edible insects, including grasshoppers, as viable and sustainable alternatives to conventional animal protein, especially in addressing food insecurity

Restraint/Challenge

“Consumer Acceptance and Cultural Barriers”

- Despite the nutritional value and environmental benefits, many Western consumers are reluctant to accept insects as food due to long-standing cultural stigma and psychological aversion

- The “yuck factor” significantly limits product uptake, even in health-aware markets, with insects often perceived as unclean or unsafe for human consumption

- Limited exposure and lack of consumer education around flavor, preparation methods, and safety standards result in hesitation and misconceptions regarding edible insects

- Branding, packaging, and marketing strategies must overcome deep-rooted cultural barriers through transparency, culinary creativity, and nutritional communication

- In addition, mainstream retail penetration remains limited due to low consumer demand, causing most insect protein products to remain in niche or specialty health stores

- For instance, although brands such as Chapul and Exo have introduced insect protein snacks in the U.S., these products still face slow growth and are confined to online platforms or select natural food retailers due to low mainstream appeal

Grasshoppers Protein Market Scope

The market is segmented on the basis of usage, application, and distribution channels.

• By Usage

On the basis of usage, the grasshoppers protein market is segmented into flour, protein bars, snacks, and others. The flour segment accounted for the largest revenue share in 2024, driven by its versatility and increasing incorporation into baked goods, pasta, and health-focused meal replacements. Flour made from grasshoppers is gaining traction as a high-protein, low-carb alternative to conventional flours, appealing to both fitness enthusiasts and sustainability-conscious consumers.

The protein bars segment is expected to witness a fastest growth rate from 2025 to 2032, fuelled by rising demand for functional snacks and convenient nutrition options. Grasshopper protein bars are being increasingly adopted in the sports nutrition and meal-on-the-go categories, with several start-ups and established brands launching innovative formulations that highlight eco-friendliness and clean label credentials.

• By Application

On the basis of application, the market is segmented into food and beverage, animal nutrition, pharmaceuticals, and cosmetics. The food and beverage segment held the largest market share in 2024, supported by the global shift toward alternative proteins and sustainable food sources. Grasshopper protein is being used in bakery items, smoothies, sauces, and even alcoholic beverages.

In animal nutrition is expected to witness a fastest growth rate from 2025 to 2032, as a cost-effective and high-protein alternative to fishmeal, especially in poultry and aquaculture. For instance, several pilot projects in Europe have explored insect-based feed for improving livestock efficiency and reducing environmental impact.

• By Distribution Channels

On the basis of distribution channels, the grasshoppers protein market is segmented into direct and indirect. The indirect segment dominated the market in 2024, driven by the widespread availability of grasshopper protein products in health stores, online platforms, and specialty food retailers. Consumers are increasingly discovering insect-based products via e-commerce due to better access to niche brands and detailed product descriptions.

The direct segment is expected to witness a fastest growth rate from 2025 to 2032, as manufacturers build brand loyalty through their own websites and establish B2B relationships with food processing companies and institutional buyers.

Grasshoppers Protein Market Regional Analysis

- North America dominated the grasshoppers protein market with the largest revenue share of 39.8% in 2024, driven by growing consumer awareness about sustainable protein alternatives and the rising demand for high-nutrition food products

- Consumers in the region are increasingly shifting toward entomophagy due to environmental concerns and a preference for functional foods that support fitness and wellness goals

- This rising adoption is further supported by the presence of established insect protein producers, a favorable regulatory outlook, and growing interest in incorporating grasshopper protein into processed food and animal feed formulations

U.S. Grasshoppers Protein Market Insight

The U.S. grasshoppers protein market captured the largest revenue share of 83% in 2024 within North America, driven by a sharp rise in demand for sustainable protein sources. The market is benefitting from heightened interest in alternative diets, particularly among health-focused and environmentally aware consumers. Numerous startups and food-tech firms in the U.S. are launching protein bars, powders, and meat analogs using grasshopper protein. The FDA’s evolving stance on insect-based food also contributes to expanding market access, with increased R&D investments aimed at improving product taste, texture, and acceptance among mainstream consumers.

Europe Grasshoppers Protein Market Insight

The Europe grasshoppers protein market is expected to witness a fastest growth rate from 2025 to 2032, supported by progressive regulations and growing cultural acceptance of edible insects. The European Food Safety Authority’s approvals for insect-based products have paved the way for new market entrants and product innovations. Countries such as the Netherlands, France, and Germany are seeing a rise in insect-based startups producing snack items, flour blends, and pet food. The growing trend of plant-forward and flexitarian diets is also propelling interest in grasshopper protein as a nutritious, eco-friendly option.

U.K. Grasshoppers Protein Market Insight

The U.K. grasshoppers protein market is expected to witness a fastest growth rate from 2025 to 2032, driven by increasing adoption of alternative proteins and consumer preferences for ethical and low-impact food production. The presence of a well-established vegan and flexitarian consumer base has encouraged retailers and food producers to experiment with insect protein-based snacks, protein bars, and fortified baked goods. With rising awareness of the protein’s nutritional profile, including high levels of iron and amino acids, the U.K. is emerging as a key player in the European insect protein landscape.

Germany Grasshoppers Protein Market Insight

The Germany grasshoppers protein market is expected to witness a fastest growth rate from 2025 to 2032, driven by strong consumer demand for functional and novel food products. Germany’s progressive food innovation ecosystem, coupled with government-backed sustainability initiatives, is enabling widespread product development and experimentation with grasshopper protein. The country is also seeing increased interest in using grasshopper protein in sports nutrition, pet food, and supplements, supported by rising health consciousness and environmental responsibility among consumers.

Asia-Pacific Grasshoppers Protein Market Insight

The Asia-Pacific grasshoppers protein market is expected to witness a fastest growth rate from 2025 to 2032, led by rising population, traditional familiarity with entomophagy, and expanding applications in food, feed, and cosmetics. Countries such as Thailand, China, and Vietnam have long consumed grasshoppers, creating a culturally receptive base for commercial expansion. Government initiatives supporting insect farming and the emergence of regional protein processing startups are increasing the accessibility of grasshopper protein. The growing middle-class demand for affordable, high-protein foods further accelerates market growth across APAC.

Japan Grasshoppers Protein Market Insight

The Japan grasshoppers protein market is expected to witness a fastest growth rate from 2025 to 2032 a resurgence as the country focuses on food security and sustainable protein innovation. With a cultural history of consuming insects, particularly grasshoppers (known locally as inago), modern Japanese consumers are embracing this traditional food in new formats. Japanese startups and food companies are exploring the incorporation of grasshopper protein into energy bars, noodles, and dietary supplements. The market is also benefiting from academic research partnerships and government funding for sustainable food technologies.

China Grasshoppers Protein Market Insight

The China grasshoppers protein market held the largest revenue share in Asia-Pacific in 2024, driven by high demand for alternative protein sources amid growing health and environmental concerns. China’s large-scale insect farming infrastructure and its strategic focus on food innovation provide fertile ground for the expansion of grasshopper-based products. Key applications include food ingredients, animal feed, and traditional medicine. Domestic brands are increasingly marketing grasshopper protein to urban millennials seeking healthy, natural, and high-protein food options, further strengthening the country’s market position.

Grasshoppers Protein Market Share

The Grasshoppers Protein industry is primarily led by well-established companies, including:

- Ÿnsect (SAS) (France)

- Protix B.V. (Netherlands)

- Enterra Feed Corporation (Canada)

- InnovaFeed (France)

- Enviroflight (U.S.)

- Nutrition Technologies (Singapore)

- Entomo Farms (Canada)

- Hargol FoodTech (Israel)

- Aspire Food Group (U.S.)

- All Things Bugs LLC (U.S.)

- Beta Hatch (U.S.)

- EntoCube Ltd. (Finland)

- Armstrong Crickets (U.S.)

- Global Bugs Asia (Thailand)

- JR Unique Foods Ltd.(Thailand)

- BioflyTech (Spain)

- TEBRIO (Spain)

- nextProtein (France)

- Hexafly (Ireland)

- HiProMine S.A. (Poland)

- Protenga (Singapore)

Latest Developments in Global Grasshoppers Protein Market

- In March 2020, Thai Union Group of Thailand announced plans to allocate $30 million towards advancing alternative proteins and other FoodTech innovations, signaling a strategic shift towards diversification. Concurrently, the company made an undisclosed investment in Flying Spark, an Israeli start-up specializing in insect protein. This move aligns with Thai Union's ambition to bolster its position in the growing insect protein market, foreseeing substantial growth opportunities in the sector

- In March 2020, Protix BV, a prominent insect farming enterprise based in the Netherlands, secured funding from Rabo Corporate to fortify its black soldier fly larvae production facility. The investment, the exact amount of which remains undisclosed, underscores Protix's commitment to expanding its capacity for rearing and processing insect-derived ingredients such as proteins and lipids. This strategic move aims to capitalize on the increasing demand for sustainable protein sources, positioning Protix as a key player in the emerging insect-based food industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Grasshoppers Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Grasshoppers Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Grasshoppers Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.