Global Gum Arabic Market

Market Size in USD Million

CAGR :

%

USD

950.95 Million

USD

1,496.34 Million

2024

2032

USD

950.95 Million

USD

1,496.34 Million

2024

2032

| 2025 –2032 | |

| USD 950.95 Million | |

| USD 1,496.34 Million | |

|

|

|

|

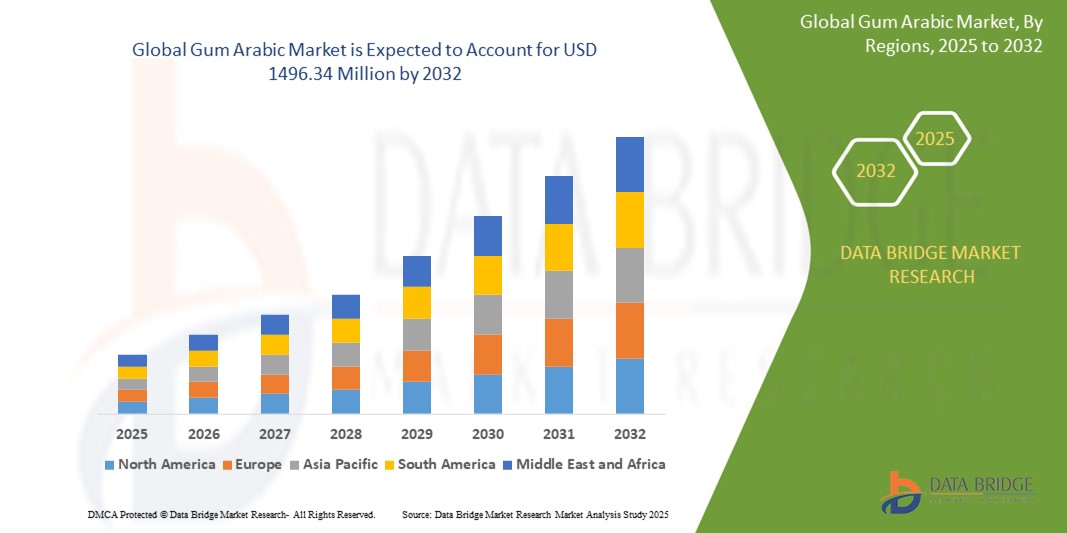

What is the Global Gum Arabic Market Size and Growth Rate?

- The global gum arabic market size was valued at USD 950.95 million in 2024 and is expected to reach USD 1496.34 million by 2032, at a CAGR of 5.83% during the

- The global gum arabic market is seeing a surge in innovative applications and methods. From encapsulating flavors in food to enhancing drug delivery systems, its versatility expands.

- Nanotechnology introduces novel extraction techniques, promising higher purity and yield. This evolution revitalizes industries, offering sustainable solutions and boosting economic prospects.

What are the Major Takeaways of Gum Arabic Market?

- The gum arabic market thrives on its pivotal role as a stabilizer, thickening agent, and emulsifier in the food and beverage sector. Its application enhances texture and stability in popular products such as soft drinks, confectionery, and baked goods, driving substantial demand within the industry

- North America dominated the gum arabic market with the largest revenue share of 38.2% in 2024, driven by the rising demand for natural food additives and clean-label ingredients in the food and beverage industry

- Asia-Pacific gum arabic market is projected to expand at the fastest CAGR of 22.6% from 2025 to 2032, driven by rising health awareness, a shift toward natural food additives, and rapid expansion of the food processing industry

- The Senegalia Senegal segment dominated the Gum Arabic market with the largest revenue share of 64.8% in 2024, due to its superior solubility, high fiber content, and widespread use in food and beverage applications

Report Scope and Gum Arabic Market Segmentation

|

Attributes |

Gum Arabic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Gum Arabic Market?

“Clean Label Demand and Traceable Sourcing in Natural Hydrocolloids”

- A major trend shaping the gum arabic market is the growing preference for clean-label ingredients in food, beverage, and nutraceutical applications. Consumers are seeking products that are natural, minimally processed, and sustainably sourced

- Manufacturers are increasingly focusing on traceable sourcing and ethical harvesting, especially from key producing regions such as Sudan, Chad, and Nigeria, to ensure transparency and build consumer trust

- For instance, in 2022, Nexira launched Inavea, an organic and carbon-neutral acacia fiber product, highlighting its commitment to clean-label positioning and traceability

- Companies are also integrating digital tools such as blockchain and QR codes to communicate supply chain transparency to consumers

- This trend reflects a broader industry movement towards sustainable, plant-based ingredients that align with both health and environmental values

- As clean-label standards become central to product development, Gum Arabic is gaining traction as a versatile, natural, and traceable functional ingredient

What are the Key Drivers of Gum Arabic Market?

- Increasing demand for natural emulsifiers, stabilizers, and dietary fibers across food, beverage, and personal care sectors is a major driver for the gum arabic market

- Gum Arabic is valued for its multi-functionality it acts as a thickener, emulsifier, and texturant—making it ideal for clean-label and allergen-free formulations

- The rise in plant-based diets, sugar reduction efforts, and prebiotic product launches is further fueling its use in confectionery, soft drinks, and supplements

- Regulatory approval as a safe food additive (E414) in major markets such as the U.S., E.U., and Japan supports its widespread application

- Moreover, the growing popularity of functional beverages and natural fiber supplements is accelerating its adoption due to its high solubility and low viscosity

- As demand for sustainable and natural ingredients surges globally, Gum Arabic is positioned as a high-value component in next-generation product innovation

Which Factor is challenging the Growth of the Gum Arabic Market?

- A key challenge for the gum arabic market is the unstable supply chain caused by political unrest, climate change, and limited infrastructure in producing countries such as Sudan and Chad

- These issues often result in supply disruptions and price volatility, affecting the consistency and reliability needed by global manufacturers

- Furthermore, dependence on manual harvesting and lack of mechanized processing limit scalability and global competitiveness

- Market penetration is also hindered by the availability of cheaper alternatives such as guar gum, xanthan gum, and synthetic emulsifiers with more consistent properties

- Concerns around product standardization, such as varying gum grades and contamination risks, further impact its acceptance in high-precision industries such as pharmaceuticals

- Unless sourcing reliability, price stability, and quality control improve, these factors may restrain the market’s long-term growth potential

How is the Gum Arabic Market Segmented?

The market is segmented on the basis of type, function, functionality, and application.

• By Type

On the basis of type, the gum arabic market is segmented into Senegalia Senegal and Vachellia Seyal. The Senegalia Senegal segment dominated the Gum Arabic market with the largest revenue share of 64.8% in 2024, due to its superior solubility, high fiber content, and widespread use in food and beverage applications. Its high emulsification capacity makes it the preferred choice among manufacturers for clean-label formulations.

The Vachellia Seyal segment is projected to witness the fastest CAGR from 2025 to 2032, attributed to its increasing use in cost-sensitive applications and the rising demand for industrial-grade gum in pharmaceuticals and adhesives.

• By Function

On the basis of function, the gum arabic market is segmented into Thickener, Fat Replacer, Stabilizer, Gelling Agent, Coating Agent, Texturant, and Others. The Stabilizer segment held the largest market share of 27.5% in 2024, owing to Gum Arabic’s effectiveness in stabilizing emulsions, beverages, and confections. Its film-forming and moisture-retention capabilities are key to extending shelf life in food products.

The Fat Replacer segment is expected to register the highest growth during 2025–2032, driven by increasing demand for low-calorie and reduced-fat products in snacks, dairy alternatives, and functional foods.

• By Functionality

On the basis of functionality, the gum arabic market is segmented into Viscosity, Solubility, Emulsifier, Film Forming, Fat Substitute, Fiber, and Stabilizer. The Solubility segment dominated the market with the highest revenue share of 31.2% in 2024, as manufacturers favor Gum Arabic’s exceptional water solubility, which enhances its usability across beverages and encapsulated flavors.

The Fiber segment is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by rising demand for digestive health products and natural soluble fiber sources in dietary supplements and functional foods.

• By Application

On the basis of application, the gum arabic market is segmented into Confectionery, Beverage Products, Bakery Products, Dairy Products, Sauces and Dressings, and Others. The Confectionery segment led the market with the largest share of 36.4% in 2024, due to Gum Arabic’s superior film-forming and glazing properties used in gummies, candies, and lozenges. It also offers improved texture and shelf-life extension in sugar confections.

The Beverage Products segment is forecasted to experience the highest growth rate from 2025 to 2032, propelled by the rising use of Gum Arabic as a stabilizer in plant-based drinks, juices, and emulsified concentrates.

Which Region Holds the Largest Share of the Gum Arabic Market?

- North America dominated the gum arabic market with the largest revenue share of 38.2% in 2024, driven by the rising demand for natural food additives and clean-label ingredients in the food and beverage industry

- Consumers in the region are increasingly opting for natural emulsifiers, thickeners, and stabilizers, particularly in health-conscious food products, including plant-based beverages, confectionery, and dietary supplements

- The region’s strong regulatory framework, along with heightened consumer awareness of the health and functional benefits of gum arabic, continues to support its widespread adoption across various end-use industries

U.S. Gum Arabic Market Insight

The U.S. gum arabic market captured a dominant share in North America in 2024, attributed to robust food and beverage processing industries, increased demand for dietary fibers, and the growing trend of natural and organic ingredients. Key sectors such as bakery, beverages, nutraceuticals, and pharmaceuticals are actively integrating Gum Arabic for its multifunctional properties and natural origin. The U.S. also benefits from established supply chains and the rising popularity of functional and fortified food products, further driving market growth.

Europe Gum Arabic Market Insight

The Europe gum arabic market is expected to witness steady growth during the forecast period, fueled by the region’s strong regulatory emphasis on natural food ingredients and sustainability. Increased health consciousness, rising vegan and organic food trends, and demand for plant-based stabilizers are fostering the use of Gum Arabic in various formulations. Countries such as Germany, France, and the U.K. are leading the adoption, especially in premium food and cosmetic applications where ingredient transparency is a key consumer requirement.

Germany Gum Arabic Market Insight

The Germany gum arabic market is poised to grow at a notable CAGR, driven by the nation’s strong focus on eco-friendly solutions, clean-label product innovation, and dietary supplements. Germany’s advanced manufacturing and food processing sectors are embracing Gum Arabic for its solubility, emulsifying capability, and fiber content, with increased applications in functional beverages and organic products. The market is also supported by a strong distribution network and heightened interest in ethical sourcing of ingredients.

Which Region is the Fastest Growing in the Gum Arabic Market?

Asia-Pacific gum arabic market is projected to expand at the fastest CAGR of 22.6% from 2025 to 2032, driven by rising health awareness, a shift toward natural food additives, and rapid expansion of the food processing industry. Countries such as China, India, and Japan are witnessing increasing demand for plant-based and clean-label ingredients, supported by government initiatives promoting safe and sustainable food production. The availability of affordable gum arabic imports, expansion of confectionery and beverage industries, and a growing middle-class population are accelerating market growth across the region.

China Gum Arabic Market Insight

The China gum arabic market held the largest revenue share in Asia Pacific in 2024, owing to its robust food and beverage manufacturing base and strong demand for functional additives. China’s increasing adoption of natural ingredients in both packaged foods and health supplements, alongside growing e-commerce channels, supports the proliferation of Gum Arabic across end-user verticals. Rising demand from personal care, pharmaceutical, and nutraceutical sectors is also playing a critical role in market development.

India Gum Arabic Market Insight

The India gum arabic market is experiencing rapid growth due to rising demand for natural binders and stabilizers in Ayurvedic formulations, functional foods, and health beverages. Government support for clean-label product manufacturing, a growing health-conscious population, and increased foreign investment in the F&B sector are key contributing factors. Gum Arabic is gaining popularity among domestic manufacturers due to its versatility and alignment with traditional dietary preferences.

Which are the Top Companies in Gum Arabic Market?

The gum arabic industry is primarily led by well-established companies, including:

- Kerry Group plc (Ireland)

- The Clorox Company (U.S.)

- Softigel (U.S.)

- Nature's Way Products, LLC (U.S.)

- Zanonvitamec (U.S.)

- OLLY Vitamins & Supplements (U.S.)

- HERBALAND USA (Canada)

- Hero Nutritionals, Inc. (U.S.)

- SmartyPants Inc. (U.S.)

- The Nature's Bounty (U.S.)

- IM Healthcare (India)

- Nutra Solutions (U.S.)

- Makers Nutrition, LLC (U.S.)

- Vitakem Nutraceutical Inc. (U.S.)

- Bayer AG (Germany)

- Ernest Jackson (U.K.)

- Boscogen, Inc. (U.S.)

- SCN BestCo. (U.S.)

What are the Recent Developments in Global Gum Arabic Market?

- In August 2022, ADM launched ScaleUp Bio, Singapore’s first contract development and manufacturing organization focused on precision fermentation for food applications. This initiative is set to advance sustainable food innovation across Asia, driving demand for alternative ingredients such as Gum Arabic in novel food formulations. This development boosts the gum arabic market by encouraging its use in next-generation sustainable food solutions

- In May 2022, Kerry unveiled Africa’s largest taste manufacturing facility in South Africa, aimed at delivering sustainable nutrition solutions. This expansion strengthens the company's capabilities across the continent and supports the growing demand for natural ingredients such as Gum Arabic in food and beverage manufacturing. This move significantly broadens Gum Arabic’s market presence throughout the African region

- In July 2021, Polygal AG partnered with Clariant to create natural tara gum-based rheology modifiers for the personal care sector. Combining Polygal’s plant-based hydrocolloid expertise with Clariant’s formulation strength, this collaboration expands the scope of Gum Arabic applications beyond food into skincare and cosmetics. This collaboration fosters gum arabic’s diversification into the personal care industry

- In March 2020, Farbest Brands entered a strategic partnership with CARAGUM International, a specialist in stabilizer systems for liquid food products such as beverages. This collaboration enhances product stability and expands formulation possibilities within the Gum Arabic segment. This alliance strengthens gum arabic’s position in beverage stabilization and functional innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gum Arabic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gum Arabic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gum Arabic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.